Hi, I just want to explain my scenario quickly and ask for advice on what I can do in this situation.

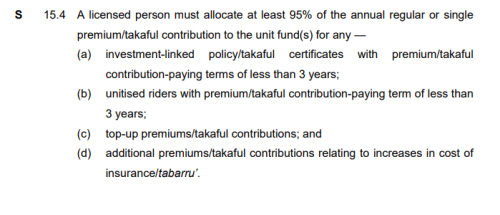

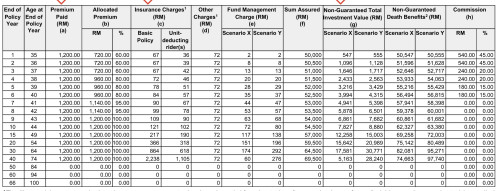

7 years ago, I bought an ILP plan from GE (Insurance + Medical), and there has been an increase in the premium of the existing policy.

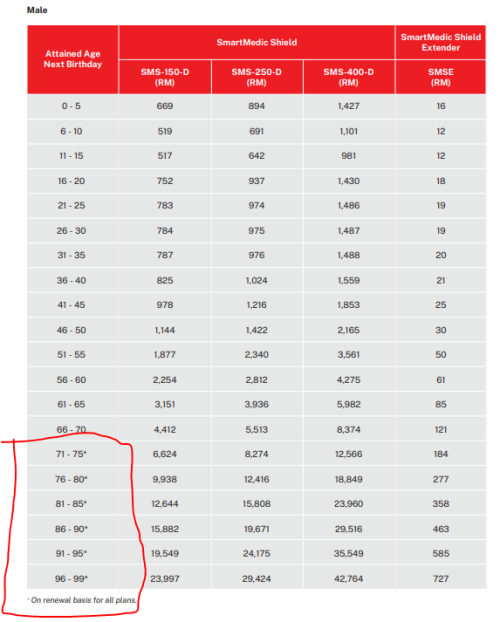

Then, a new GE agent offered me a new ILP policy. He proposed canceling the existing medical card in the current plan and adjusting the policy of the existing plan. This way, the overall cost of the Existing ILP policy (Insurance only) and the New ILP policy (Insurance + Medical Card) would be similar to the increase in premium.

After the new policy free look period expired, My old agent receive the letter of adjustment of old policy, and informed me that the investment fund in the existing policy would be affected, as the agent would no longer be taking commission from it. Thus, the money would go to the policy and investment fund.

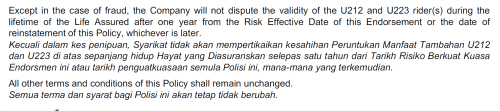

Currently, I am planning to reverse the changes by sending an email to GE to appeal (cancel the New policy and reinstate whatever changes have been made in the existing policy).

If this fails, since the investment fund in the existing policy has been affected, I am planning to keep whatever is in the old policy and update the new policy to a standalone policy with Medical Card instead of ILP.

Can any expert (sifu) offer advice on any other steps I might not be aware of to fix this?

Oh my how can people be so naive. Why restart a new ILP, bugger just change the medical rider for the existing policy. You wasted so much money as the allocation rate will reset!

If I was you I will report the new agent for engaging in dishonest practice.

Jul 21 2023, 11:55 PM

Jul 21 2023, 11:55 PM

Quote

Quote

0.0332sec

0.0332sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled