This thread will mainly discuss about these 2 cards (Maybank x Shopee) & (Maybank x Grab).

PLEASE REFER POST# 3 for MAYBANK X GRAB CC.

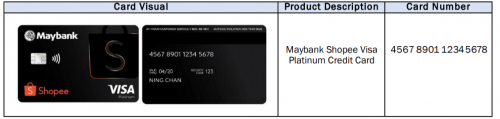

MAYBANK X SHOPEE CREDIT CARD - MAYBANK SHOPEE VISA PLATINUM CREDIT CARD

Card Site

[LAUNCH DATE - 30th JUNE 2020]

Card Look:

Benefits:

- Get up to 5% effective cashback, given in terms of Shopee's coins.

*Points crediting timeline*

1. Transaction is posted to CC.

2. Transaction date + (3 to 5 working days) after posting date = update to MBB Server

3. Update to MBB server + 1 working day = Updates reflected in Shopee app

4. Statement will reflect how much points earned in a statement cycle

[SPECIAL DAYS] - every 28th of each month, 9.9, 11.11, 12.12, 1-day CNY & Raya Campaign

- Shopee Spend = 5x shopee coins

- Dining/PayWave/Entertainment = 4x Shopee coins

- Other spend = 1x Shopee coins

~roughly up to 5% cashback~

[NORMAL DAYS] - Normal Days (remainder of the calendar year)

- Shopee Spend = 2x shopee coins

- Dining/PayWave/Entertainment = 2x Shopee coins

- Other spend = 1x Shopee coins

~roughly up to 2% cashback~

[Things to Note]

- RM1 spend = Shopee coins (x multiplier based on the dates)

- *First 5,000 points will be rewarded in Shopee Coins;

- *Subsequent points will be rewarded in Treatpoints.

*PER STATEMENT CYCLE

- No Shopee Coins and TreatsPoints will be rewarded for all transactions go through “Deals, Top-ups & Bills” and “Food & Services Vouchers” under Shopee app.

- You could dip it another round via cashback sites (i.e. Shopback / RebateMango depending on availability) / third party wallets (FavePay / SamsungPay) to earn a little extra cashback / reward points as well.

- Should the card is lost / encounter fraud / etc once the Shopee coins are credited, cardmember is required to reach out to Shopee for further assistance.

- Update as per 10/07/2020: Current Shopee (RM10) coupon can't be claimed by CC holders (known issue) - Possible workaround (shared by @jhleo1, post# 213): Add CC to shopee, set as default card. Done in App as per Screenshot.

- Update as per 17/08/2020: multiple members mentioned that there are delays in points crediting, no workaround / direction for this issue at the moment from MBB/Shopee.

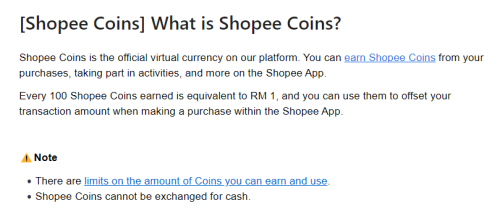

Shopee Coin Calculation based on MBB Site

- 5,000 shopee coins = RM50

- 100 shopee coins = RM1

Fees:

- No annual fee (lifetime waiver).

Requirements:

- Age: Principal Cardholder - 21 to 65 y.o.

- Age: Supplementary Cardholder - 18 to 65 y.o.

- Annual Salary > RM24,000 per annum

- Monthly Salary > RM2,000 per month

- Shopee account *THIS NEEDS TO BE LINKED, SAME SHOPEE ACC PHONE NUMBER AS CC REGISTERED PHONE NUMBER*

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

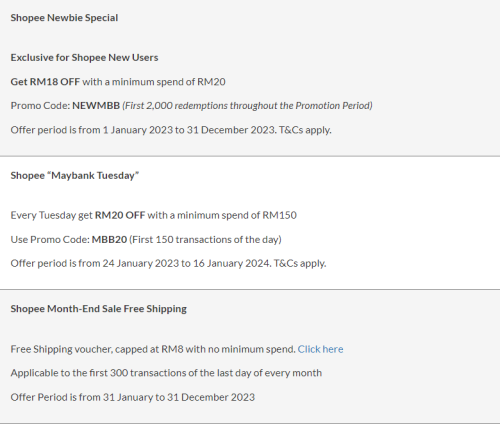

Signup bonus (updated as off 06/09/2023)

ALL PREVIOUS ENDED CAMPAIGNS has been removed (unless there are any special call outs)

- 5,000 Shopee coins worth RM50 (TO BE CREDITED TO LINKED SHOPEE ACC UPON RM300 SPENT WITHIN 60 DAYS) >> Override by other ongoing campaign

- CURRENT:

ALL YEAR LONG PROMO

ALL YEAR LONG PROMO

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

NOTE: EWALLET Transactions are NOT considered as 'Retail' Spending as per Post# 290.

Campaign FAQs

APPLY FOR THE CARD HERE

FAQ

Source 1

Source 2

[b]GENERAL CC DISPUTE INFO / FLOW:

1. CC Holder files for dispute with respective Issuing Bank (Card Issuing Bank i.e. Maybank)

2. Issuing Bank handles a case and issues a dispute statement to Acquiring Bank (Merchant Bank i.e. Public Bank) / Payment Gateway (iPay88 / RazerPay / GHL / MolPay) depending on the Merchant MID provider / umbrella.

3. Acquiring Bank / Payment Gateway liaises with merchant to defend the dispute (asks merchants for supporting document i.e. Invoice / Delivery Note / Any proof to demonstrate product delivered / service has been rendered.)

4. Acquiring Bank reverts to Issuing Bank with supporting documents, to mediate whether the dispute (cardholder) / chargeback (merchant) is valid.

5. Once decision is reached, outcome will be published / informed by the Acquiring + Issuing banks.

6. Each party will be informed of the outcome (dispute success = chargeback for merchant, refund for cardholder; dispute fail = cardholder signs dispute cancellation form or dispute not valid)

*Does not take into account of further dispute / pre-arbitration.

*As per last advice by CS, MBB recommends dispute to be filed ASAP after transaction posting date for more accurate case presentation. However, the duration could be longer / has been known to be different from banks to banks depending on their policies, some may accept a much longer period i.e. Up to 9 months in some banks.

Source: Work experience / CS / Case handling / Own disputes / Other feedbacks.

edit series 1(a) - Adjusted details and did some house cleaning.

edit series 1(b) - Minor Revamp to include Maybank x Grab CC details in next post.

edit series 1© - Updated details / house cleaning.

edit post - Updated with recent information.

This post has been edited by sadukarzz: Sep 6 2023, 03:43 PM

Jun 30 2020, 03:40 PM, updated 3y ago

Jun 30 2020, 03:40 PM, updated 3y ago

Quote

Quote

0.0382sec

0.0382sec

1.03

1.03

6 queries

6 queries

GZIP Disabled

GZIP Disabled