Outline ·

[ Standard ] ·

Linear+

Money in EPF vs Unit Trusts

|

coolguy_0925

|

Apr 15 2024, 10:30 PM Apr 15 2024, 10:30 PM

|

|

QUOTE(Ramjade @ Apr 15 2024, 09:18 AM) Of course. See if you willing to click extra and see good funds available. Er buy from FSM, it's free. You only pay annual fees. Rather than pay EPF to manage your money and get like 5%, by you doing a little work can earn minimum 10%p.a Just to seek clarification as you mentioned that FSM is free Yet the website is stating that equity, balanced, alternative investment and mixed assets funds is charging 1.50% of sales charge |

|

|

|

|

|

Ramjade

|

Apr 15 2024, 10:32 PM Apr 15 2024, 10:32 PM

|

|

QUOTE(coolguy_0925 @ Apr 15 2024, 10:30 PM) Just to seek clarification as you mentioned that FSM is free Yet the website is stating that equity, balanced, alternative investment and mixed assets funds is charging 1.50% of sales charge My mistake. Sorry. I thought was free. https://www.fsmone.com.my/support/frequentl...tUniqueKey=2362This post has been edited by Ramjade: Apr 15 2024, 10:33 PM |

|

|

|

|

|

coolguy_0925

|

Apr 15 2024, 10:38 PM Apr 15 2024, 10:38 PM

|

|

QUOTE(Ramjade @ Apr 15 2024, 10:32 PM) No issue, just to clarify Yet 1.5% is acceptable as some charge even higher I suppose opening and maintaining an account @ fsmone is FOC This post has been edited by coolguy_0925: Apr 15 2024, 10:39 PM |

|

|

|

|

|

Ramjade

|

Apr 15 2024, 11:07 PM Apr 15 2024, 11:07 PM

|

|

QUOTE(coolguy_0925 @ Apr 15 2024, 10:38 PM) No issue, just to clarify Yet 1.5% is acceptable as some charge even higher I suppose opening and maintaining an account @ fsmone is FOC It's always free. |

|

|

|

|

|

Holocene

|

Apr 16 2024, 08:18 AM Apr 16 2024, 08:18 AM

|

|

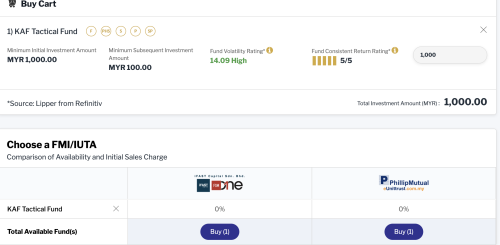

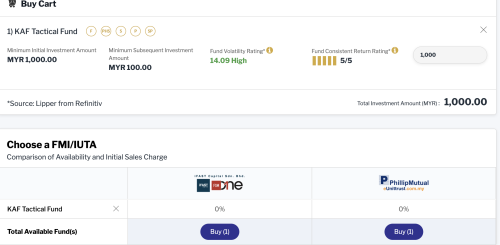

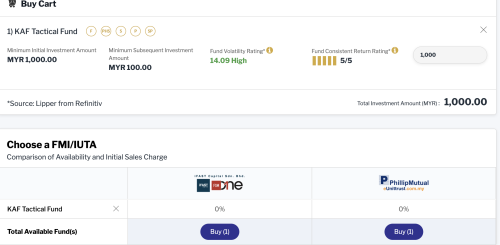

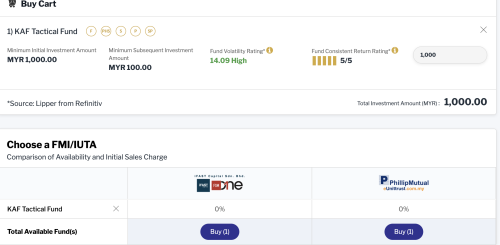

QUOTE(coolguy_0925 @ Apr 15 2024, 10:30 PM) Just to seek clarification as you mentioned that FSM is free Yet the website is stating that equity, balanced, alternative investment and mixed assets funds is charging 1.50% of sales charge I think what Ramjade meant was if you go through i-invest, the EPF approved funds available on FSM will be free.  |

|

|

|

|

|

dwRK

|

Apr 16 2024, 08:37 AM Apr 16 2024, 08:37 AM

|

|

QUOTE 9. What is the sales charge for EPF investment?

Effective from 1 May 2020, for a duration of one year, EPF has imposed a maximum sales charge of 1.5% on subscription via EPF form submission (ePPA). As such, your EPF sales charge will be stamped with 1.5% sales charge. |

|

|

|

|

|

markedestiny

|

Apr 16 2024, 09:24 AM Apr 16 2024, 09:24 AM

|

|

QUOTE(dwRK @ Apr 16 2024, 08:37 AM) The max sales charge is now capped to 0.5% if you directly invest via i-invest in your EPF account. Most of the funds with the exception of PB Mutual do not charge this 0.5%, so usually no sales charge 0%. Besides FSM, there is also Philip Mutual fundhouse which you can buy from with 0%. |

|

|

|

|

|

togekiss

|

Apr 16 2024, 09:26 AM Apr 16 2024, 09:26 AM

|

|

i have 4 funds through i-invest EPF. all 4 are in the negative. once it goes positive, i would park it back into EPF and will not take it out for unit trust purposes anymore.

|

|

|

|

|

|

markedestiny

|

Apr 16 2024, 09:30 AM Apr 16 2024, 09:30 AM

|

|

QUOTE(togekiss @ Apr 16 2024, 09:26 AM) i have 4 funds through i-invest EPF. all 4 are in the negative. once it goes positive, i would park it back into EPF and will not take it out for unit trust purposes anymore. See my earlier comments, you need to research what funds to buy and hold. If you don't or new to investment, then it's wiser to leave it as it is in the EPF and let it roll as EPF has very good fund managers |

|

|

|

|

|

togekiss

|

Apr 17 2024, 09:28 AM Apr 17 2024, 09:28 AM

|

|

QUOTE(markedestiny @ Apr 16 2024, 09:30 AM) See my earlier comments, you need to research what funds to buy and hold. If you don't or new to investment, then it's wiser to leave it as it is in the EPF and let it roll as EPF has very good fund managers i agree. |

|

|

|

|

|

Ramjade

|

Apr 17 2024, 09:42 AM Apr 17 2024, 09:42 AM

|

|

QUOTE(Holocene @ Apr 16 2024, 08:18 AM) I think what Ramjade meant was if you go through i-invest, the EPF approved funds available on FSM will be free.  I don't know if I am charged 0% or 1.5%. If charge 1.5% so be it. It's worth paying them 1.5% to get average minimum of 10%p.a and only one time charge. QUOTE(togekiss @ Apr 16 2024, 09:26 AM) i have 4 funds through i-invest EPF. all 4 are in the negative. once it goes positive, i would park it back into EPF and will not take it out for unit trust purposes anymore. Pick one. No need so many fund. Pick the best. |

|

|

|

|

|

Ramjade

|

Apr 17 2024, 11:34 PM Apr 17 2024, 11:34 PM

|

|

QUOTE(coolguy_0925 @ Apr 15 2024, 10:38 PM) No issue, just to clarify Yet 1.5% is acceptable as some charge even higher I suppose opening and maintaining an account @ fsmone is FOC QUOTE(Holocene @ Apr 16 2024, 08:18 AM) I think what Ramjade meant was if you go through i-invest, the EPF approved funds available on FSM will be free.  QUOTE(dwRK @ Apr 16 2024, 08:37 AM) I just checked my transactions on FSM bought via i-invest 0% service charge  This post has been edited by Ramjade: Apr 17 2024, 11:35 PM This post has been edited by Ramjade: Apr 17 2024, 11:35 PM |

|

|

|

|

|

togekiss

|

Apr 18 2024, 09:25 AM Apr 18 2024, 09:25 AM

|

|

QUOTE(Ramjade @ Apr 17 2024, 09:42 AM) Pick one. No need so many fund. Pick the best. thanks for the advice. |

|

|

|

|

|

Ramjade

|

Apr 18 2024, 09:34 AM Apr 18 2024, 09:34 AM

|

|

QUOTE(togekiss @ Apr 18 2024, 09:25 AM) For me if somehow principal global titans is open back up, I will put my money with them. Since EPF suspended them, my only choice left is KAF core income. Others all sucks. Not sure about public mutual. |

|

|

|

|

|

dwRK

|

Apr 18 2024, 10:55 AM Apr 18 2024, 10:55 AM

|

|

QUOTE(Ramjade @ Apr 17 2024, 11:34 PM) I just checked my transactions on FSM bought via i-invest 0% service charge  is a fsm problem.... on one faq page it says 1.5%... on another, the page i posted, says 1.5% for one year only which has now pass... |

|

|

|

|

|

Ramjade

|

Apr 18 2024, 11:04 AM Apr 18 2024, 11:04 AM

|

|

QUOTE(dwRK @ Apr 18 2024, 10:55 AM) is a fsm problem.... on one faq page it says 1.5%... on another, the page i posted, says 1.5% for one year only which has now pass... Only way is test it out yourself and it will generate a report from FSM side. Report shows zero service charge. I didn't go and count. |

|

|

|

|

|

mapeyeo1

|

Apr 18 2024, 02:59 PM Apr 18 2024, 02:59 PM

|

Getting Started

|

Decided to put some money in KAF Core Income Fund, wish me luck haha

|

|

|

|

|

|

Ramjade

|

Apr 18 2024, 08:01 PM Apr 18 2024, 08:01 PM

|

|

QUOTE(mapeyeo1 @ Apr 18 2024, 02:59 PM) Decided to put some money in KAF Core Income Fund, wish me luck haha Don't worry. Wish me luck too. I got like 20% of my EPF inside there. Lol. |

|

|

|

|

|

acrylic_26

|

May 13 2024, 03:56 PM May 13 2024, 03:56 PM

|

Getting Started

|

mine from 2022 - 2024 got increase 20% consider not bad right?

This post has been edited by acrylic_26: May 13 2024, 03:58 PM

|

|

|

|

|

|

mapeyeo1

|

Jun 15 2024, 10:31 PM Jun 15 2024, 10:31 PM

|

Getting Started

|

QUOTE(Ramjade @ Apr 18 2024, 08:01 PM) Don't worry. Wish me luck too. I got like 20% of my EPF inside there. Lol. Good fund recommendation, now up11% since purchase on April24, huat. |

|

|

|

|

Apr 15 2024, 10:30 PM

Apr 15 2024, 10:30 PM

Quote

Quote

0.0242sec

0.0242sec

1.20

1.20

6 queries

6 queries

GZIP Disabled

GZIP Disabled