QUOTE(torres09 @ Jun 27 2024, 11:27 PM)

Hi sifu's here. I have a few questions here regarding my investments with Public Mutual from my EPF account 1.

1. How do you know if the returns from PM is lower or higher than what you would've got if you had kept the money in EPF account 1?

2. My way of calculation is (since I didn't touch my EPF account 2), I take my current account 2 balance as 30%, and assume how much should my EPF account 1 70% should be. For example, if I have 30k in my account 2 now, my account 1 should have 70k, if I did not withdraw to EPF. Is this method correct?

3. I am very confused with how PM show the fund performance in PMO app. The returns are shown as total unrealised P/L from the total investments into the fund. For example, I might see a return of 70% which seems great, but considering it has been more than 10 years without top up, it actually isn't that great. In 10 years considering an average of 5% EPF dividend, my money would've doubled! Isn't this misleading?

Hopefully someone can enlighten me as I am not invested in other unit trust funds except PM.

Thanks.

1. How do you know if the returns from PM is lower or higher than what you would've got if you had kept the money in EPF account 1?

2. My way of calculation is (since I didn't touch my EPF account 2), I take my current account 2 balance as 30%, and assume how much should my EPF account 1 70% should be. For example, if I have 30k in my account 2 now, my account 1 should have 70k, if I did not withdraw to EPF. Is this method correct?

3. I am very confused with how PM show the fund performance in PMO app. The returns are shown as total unrealised P/L from the total investments into the fund. For example, I might see a return of 70% which seems great, but considering it has been more than 10 years without top up, it actually isn't that great. In 10 years considering an average of 5% EPF dividend, my money would've doubled! Isn't this misleading?

Hopefully someone can enlighten me as I am not invested in other unit trust funds except PM.

Thanks.

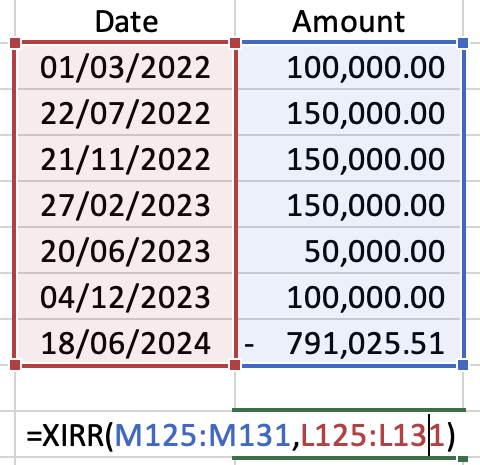

Date: Base on withdrawal date

Amount: Capital injected

You will then be able to determine the annualised return of your investment and conclude if your investments have outperformed EPF.

In your example of 70% return in 10 years (assume), you're looking at an annualised return of 5.44%, just about EPF return. The questions will be if it's worth the risk you're taking. If it's more than 10 years like what you mentioned, you probably want to reassess your investments.

Hope this helps.

This post has been edited by Holocene: Jun 28 2024, 11:08 AM

Jun 28 2024, 10:59 AM

Jun 28 2024, 10:59 AM

Quote

Quote

0.0225sec

0.0225sec

0.86

0.86

6 queries

6 queries

GZIP Disabled

GZIP Disabled