QUOTE(mapeyeo1 @ Jun 19 2024, 11:39 AM)

Mind sharing which bloggers you following? want to read up on what they blog as well, tyty

Me tako escape (his blog disappeared already)

Joseph Carlson

Joseph Carlson after hours

Dividend guy

Brian feroldi

Mr fired up wealth

Chip stock investor

Dividendology

QUOTE(!@#$%^ @ Jun 19 2024, 11:43 AM)

once in a about 10 years. is it time soon?

Who knows.

QUOTE(SeniorCitizen @ Jun 19 2024, 04:32 PM)

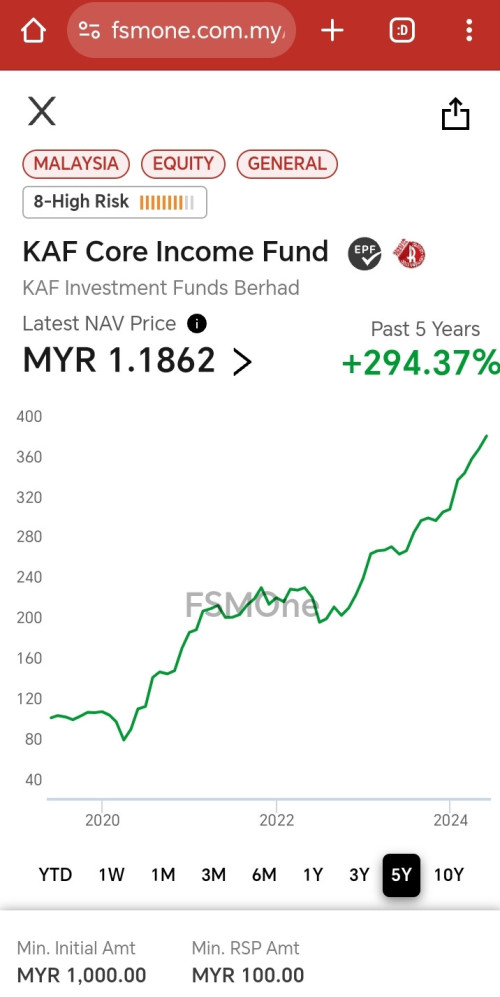

This is no good. For 8 years 43.88% is just around 5%pa.

I am also reading here looking for UT with more than 8%pa return.

Agreed.

QUOTE(kennykong85 @ Jun 19 2024, 05:06 PM)

to me consider ok la since that day1 i bought consider quite a high price

If you are using EPF money you better be damn sure it beats EPF money or match it. If it cannot beat it match EPF, don't bother. That's why I set my target at 10%p.a

QUOTE(MGM @ Jun 19 2024, 05:48 PM)

Where n what product u use to park your money while waiting?

EPF, interactive broker. I am using my RM100k to buy sg banks over putting money into EPF.

Jun 17 2024, 10:21 PM

Jun 17 2024, 10:21 PM

Quote

Quote

0.0268sec

0.0268sec

0.76

0.76

6 queries

6 queries

GZIP Disabled

GZIP Disabled