QUOTE(backspace66 @ Apr 10 2021, 06:21 AM)

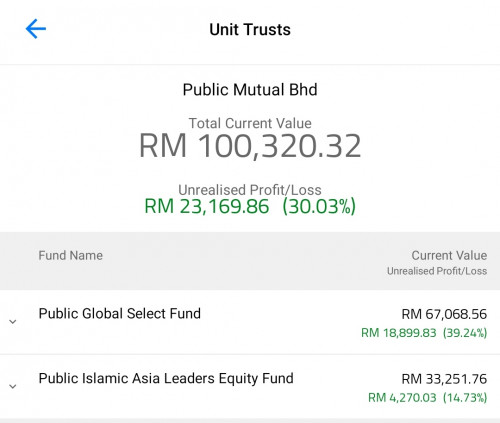

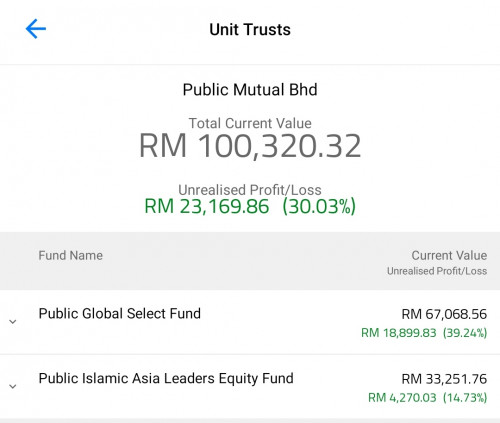

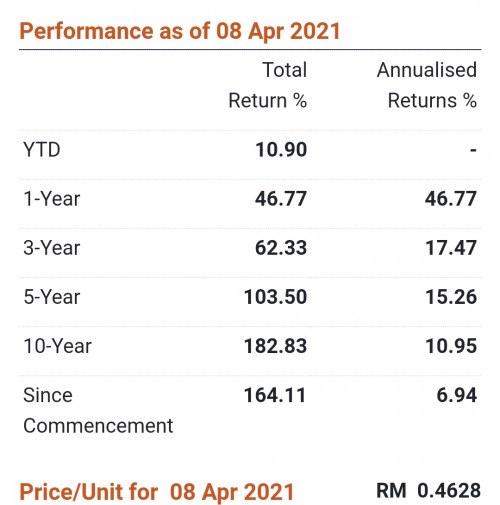

I can sense a lot of people always recommend fsm and ask newbie to completely ignore public mutual. This is the performance so far for my publiv mutual fund. Consider both and judge yourself. Some people dont really know what they are talking about.

PGSF - one year old from the start of investment , additional investment during DIP only, lol my way of DCA. When i start investing i was charged 0.5% sales charge since the promo havent started back then.

PIALF- 6 month from the start, invest during dip only, the value shown on the screenshot is around 10% below the peak. This one 0% sales charge as promo already started.

Both FSM and public mutual service is top notch. I always receive answer/response on the same day.

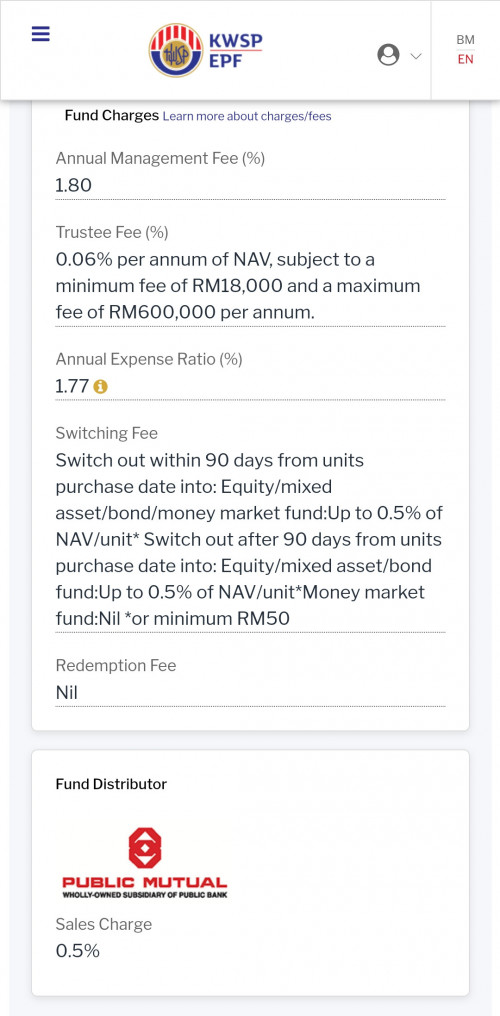

People who say ignore public mutual usually see the sales charge n get turn off from it without actually researching the funds PGSF - one year old from the start of investment , additional investment during DIP only, lol my way of DCA. When i start investing i was charged 0.5% sales charge since the promo havent started back then.

PIALF- 6 month from the start, invest during dip only, the value shown on the screenshot is around 10% below the peak. This one 0% sales charge as promo already started.

Both FSM and public mutual service is top notch. I always receive answer/response on the same day.

I'm biased because I'm a long time public mutual investor, but I would say "public mutual can't perform" is a very underinformed mentality. Not as high as some famous funds like those in Kenanga and Affin but their growth is generally steady. PM's "weakness" is also a strength if investor is risk adverse.

Apr 10 2021, 10:45 AM

Apr 10 2021, 10:45 AM

Quote

Quote

0.0307sec

0.0307sec

0.36

0.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled