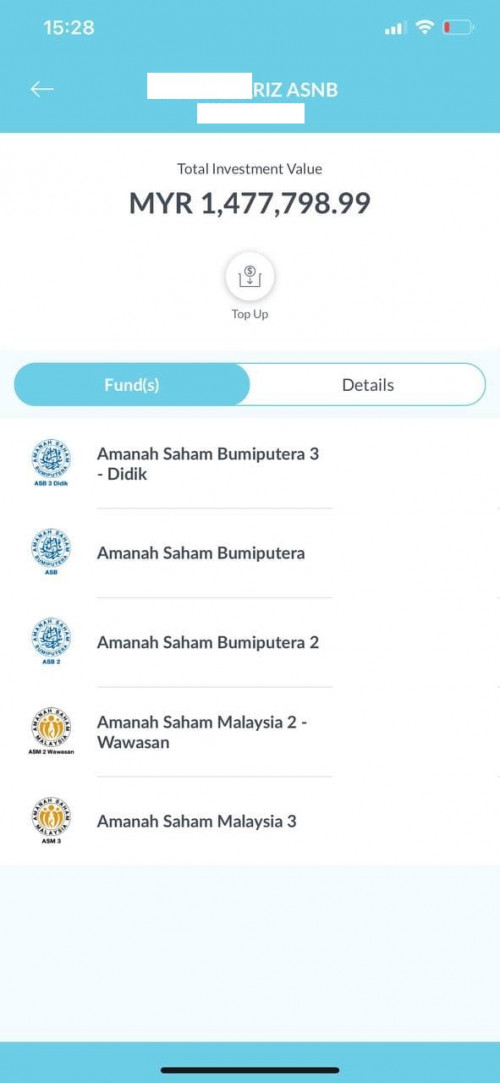

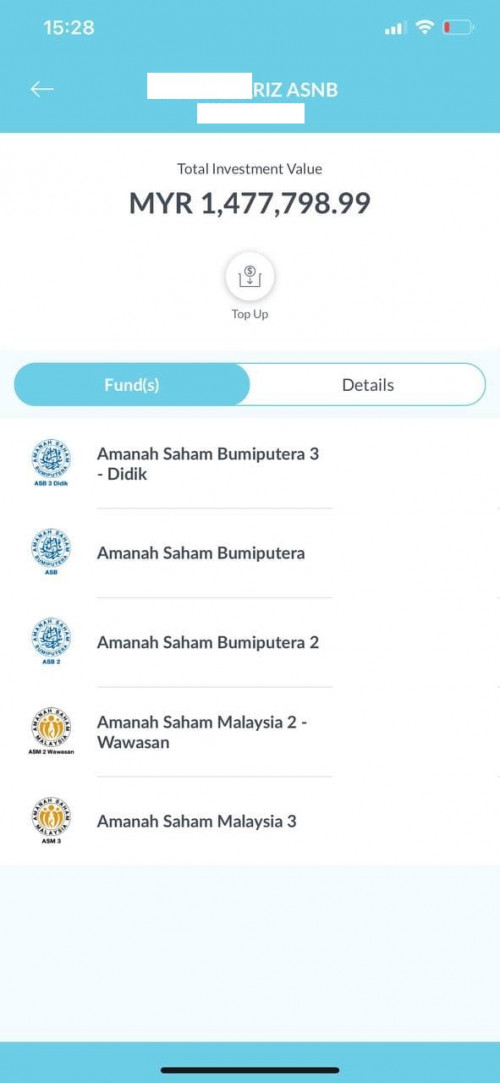

No need to be at 50s to be a millionaires. With careful plan and disciplines at 41 also can. Makan gaji also can. Just work smart and pray.

Money in EPF vs Unit Trusts

|

|

Apr 8 2021, 10:50 PM Apr 8 2021, 10:50 PM

Show posts by this member only | IPv6 | Post

#121

|

Junior Member

182 posts Joined: Apr 2020 |

|

|

|

|

|

|

Apr 9 2021, 12:03 PM Apr 9 2021, 12:03 PM

|

Senior Member

2,354 posts Joined: Apr 2009 |

This is my result, invested around 3-4 years ago, deposit once awhile, the result is pretty good so far DragonReine liked this post

|

|

|

Apr 9 2021, 12:05 PM Apr 9 2021, 12:05 PM

|

Junior Member

438 posts Joined: Apr 2007 |

QUOTE(farizmalek @ Apr 8 2021, 10:50 PM)   No need to be at 50s to be a millionaires. With careful plan and disciplines at 41 also can. Makan gaji also can. Just work smart and pray. that's why non-bumi sometimes not so happy with all these bumi perks, like bumi housing discounts, bumi uni quota, etc. Just stating the $$ facts, don't get into racial topic. This post has been edited by klangboy83: Apr 9 2021, 12:06 PM |

|

|

Apr 9 2021, 12:10 PM Apr 9 2021, 12:10 PM

Show posts by this member only | IPv6 | Post

#124

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(farizmalek @ Apr 8 2021, 10:50 PM)   No need to be at 50s to be a millionaires. With careful plan and disciplines at 41 also can. Makan gaji also can. Just work smart and pray. Not to say that bumi don't have own cchallenges like discrimination, but when it comes to things where gahmen got incentives like ASNB, education, bumi has substantial advantage on starting point for savings. MaJYun, KingArthurVI, and 3 others liked this post

|

|

|

Apr 9 2021, 12:29 PM Apr 9 2021, 12:29 PM

Show posts by this member only | IPv6 | Post

#125

|

Junior Member

309 posts Joined: Jul 2010 |

Actually in the end is best to educate yourself with some financial knowledge, know how UT works and what is the expected returns for each type of UT. Like insurance, there are good and bad agents out there. With equipping yourself knowledge, you can filter out those bad agents when they try to sell you certain UT and unable to answer your questions or give unconvincing answers.

EPF at 5-6% p.a. is decent return should you choose not to invest in UT using EPF fund, nothing wrong with that. But nowadays most people who know how to invest will invest through FSM or online, bypassing the agent commission. But I must say the sales charge is not a big thing to me, most important is fund selection. A performing fund can earn back the sales charge easily, while a non-performing fund will give you greater headache even if you get cheaper sales charge. |

|

|

Apr 9 2021, 12:43 PM Apr 9 2021, 12:43 PM

Show posts by this member only | IPv6 | Post

#126

|

Newbie

21 posts Joined: Nov 2018 |

QUOTE(DragonReine @ Apr 9 2021, 12:10 PM) A lot harder for non-bumi, won't have assess to ASB funds and other economical incentives like house price discounts, easier access to public universities etc. Correct. As a bumi myself I definitely agree with you.Not to say that bumi don't have own cchallenges like discrimination, but when it comes to things where gahmen got incentives like ASNB, education, bumi has substantial advantage on starting point for savings. |

|

|

|

|

|

Apr 9 2021, 03:05 PM Apr 9 2021, 03:05 PM

Show posts by this member only | IPv6 | Post

#127

|

Senior Member

2,139 posts Joined: Nov 2007 |

Funny popeye the sailorman. I didnt know you need a million in epf to be a millionaire. This is new knowledge. Glad i learn new thing from popeye.

Net asset at least for me is a few multiple the one in epf, targeting at least 3 or 4 times by the time i retire. Not anyone can be popeye and enjoy not paying tax. This post has been edited by backspace66: Apr 9 2021, 03:08 PM |

|

|

Apr 9 2021, 04:20 PM Apr 9 2021, 04:20 PM

|

Junior Member

427 posts Joined: Oct 2010 |

|

|

|

Apr 9 2021, 04:54 PM Apr 9 2021, 04:54 PM

Show posts by this member only | IPv6 | Post

#129

|

Senior Member

2,610 posts Joined: Aug 2011 |

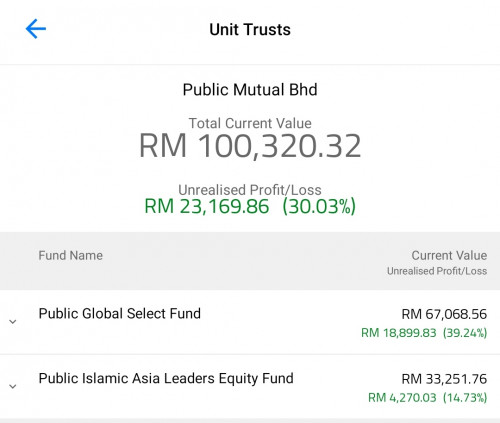

QUOTE(no6 @ Apr 9 2021, 04:20 PM) Public's funds that invest in East Asian markets have been doing well, and last year they rocketed up Personally I can say Global Select in particular has been doing very good and consistent return, been only growing upwards since I first invested in 2012 |

|

|

Apr 9 2021, 07:35 PM Apr 9 2021, 07:35 PM

|

Junior Member

103 posts Joined: Nov 2014 |

QUOTE(farizmalek @ Apr 8 2021, 10:50 PM)   No need to be at 50s to be a millionaires. With careful plan and disciplines at 41 also can. Makan gaji also can. Just work smart and pray. Well I also makan gaji and was already a millionaire at 32, of course I keep reminding myself what I was taught before I started working which is = 'if you think that you are smart, a lot of people are smarter than you. If you think that you are rich, a lot of people are richer than you'. I will leave the showing off to you, a pro. Kinda ironic when you mention about praying, just remember dengan sikap takabur,ujub dan riak, anytime Tuhan boleh tarik balik nikmat tu. QUOTE(DragonReine @ Apr 9 2021, 12:10 PM) A lot harder for non-bumi, won't have assess to ASB funds and other economical incentives like house price discounts, easier access to public universities etc. As a bumi, I too agree.Not to say that bumi don't have own cchallenges like discrimination, but when it comes to things where gahmen got incentives like ASNB, education, bumi has substantial advantage on starting point for savings. QUOTE(backspace66 @ Apr 9 2021, 03:05 PM) Funny popeye the sailorman. I didnt know you need a million in epf to be a millionaire. This is new knowledge. Glad i learn new thing from popeye. LOL. You know what they say about guys with big cars right? Trying to compensate for something else lolNet asset at least for me is a few multiple the one in epf, targeting at least 3 or 4 times by the time i retire. Not anyone can be popeye and enjoy not paying tax. Okay now back to the topic. asdfgvbnqw liked this post

|

|

|

Apr 9 2021, 07:45 PM Apr 9 2021, 07:45 PM

|

Junior Member

103 posts Joined: Nov 2014 |

QUOTE(ragk @ Apr 9 2021, 12:03 PM)  This is my result, invested around 3-4 years ago, deposit once awhile, the result is pretty good so far |

|

|

Apr 9 2021, 08:09 PM Apr 9 2021, 08:09 PM

|

Senior Member

2,354 posts Joined: Apr 2009 |

QUOTE(afif737 @ Apr 9 2021, 07:45 PM) That is impressive. Don't mind me asking, if I'm not mistaken someone made a calculation in this thread comparing if you take out money from epf to invest in UT with a return of 8% , with just leaving the money in epf for the compounded dividend, it's not that worthwhile taking into account the risk etc. But in your case just by looking at the returns, it is worthwhile right? Have you done a calculation on how much you would end up with, if you were to have left the money in epf? because i deposit multiple times within the 4 years, so that's average cost down factor here, its abit hard to calculate as i dint record when i do the transaction and how much it isbut if i do a no brain calculation comparison, follow previous 4 years of dividend history record from EPF, that's 25% profit with compound interest, on my EPF fund dashboard today, its showing overal 35% profit since my first deposit Ofcoz we cant say EPF fund is always better thn EPF, u can say im lucky that my fund manager do their homework. And in bad economic year, the market wont cause your capital to decrease in EPF, but fund will This post has been edited by ragk: Apr 9 2021, 08:11 PM afif737 liked this post

|

|

|

Apr 9 2021, 08:15 PM Apr 9 2021, 08:15 PM

Show posts by this member only | IPv6 | Post

#133

|

All Stars

24,407 posts Joined: Feb 2011 |

QUOTE(afif737 @ Apr 9 2021, 07:45 PM) That is impressive. Don't mind me asking, if I'm not mistaken someone made a calculation in this thread comparing if you take out money from epf to invest in UT with a return of 8% , with just leaving the money in epf for the compounded dividend, it's not that worthwhile taking into account the risk etc. But in your case just by looking at the returns, it is worthwhile right? Have you done a calculation on how much you would end up with, if you were to have left the money in epf? You have to pick good fund. To pick good fund you need to know which are the good funds to pick and there are some work involved. Unfortunately if you rely on agent you most likely will be worse off than EPF.My unit trust have been outperforming unit trust for don't know how many donkey years. afif737 and blackchides liked this post

|

|

|

|

|

|

Apr 9 2021, 08:29 PM Apr 9 2021, 08:29 PM

|

Senior Member

1,267 posts Joined: Oct 2009 |

only 2 kind of thinking i cant afford it or how can i afford it

mostly thinking profession is your income do it asset pay all your liability and expense yet your profession income pay for your hobby and other investment dont keep thinking i need few job cover blah at the end rich getting richer poor getting poorer i dont even finish my primary school using broken english hahahaha no issue at all as long my life until dead nothing to worry |

|

|

Apr 9 2021, 08:56 PM Apr 9 2021, 08:56 PM

Show posts by this member only | IPv6 | Post

#135

|

Junior Member

182 posts Joined: Apr 2020 |

From Khazanah http://www.krinstitute.org/The_State_of_Ho...INEQUALITY.aspx "Although the average investment in ASB increased from RM14,096 in 2012 toRM15,928 in 2014, the distribution remains skewed. In 2012, the bottom 73.7% of unit-holders of ASB had an average savings of RM611 in their accounts. By 2014, the average savings for the bottom 71.5% of unit-holders had fallen to RM536." Eventhough ASB is for the Malays but not all afford to have a savings. Or mabe some prefer to invest in UT for higher returns. Yup I riak to myself and only God can judge me. What is important is I don't attack or condem people. Err. sentap ke? blackchides liked this post

|

|

|

Apr 10 2021, 02:33 AM Apr 10 2021, 02:33 AM

|

Junior Member

103 posts Joined: Nov 2014 |

QUOTE(farizmalek @ Apr 9 2021, 08:56 PM) From Khazanah You : I riak to myself and only God can judge me.http://www.krinstitute.org/The_State_of_Ho...INEQUALITY.aspx "Although the average investment in ASB increased from RM14,096 in 2012 toRM15,928 in 2014, the distribution remains skewed. In 2012, the bottom 73.7% of unit-holders of ASB had an average savings of RM611 in their accounts. By 2014, the average savings for the bottom 71.5% of unit-holders had fallen to RM536." Eventhough ASB is for the Malays but not all afford to have a savings. Or mabe some prefer to invest in UT for higher returns. Yup I riak to myself and only God can judge me. What is important is I don't attack or condem people. Err. sentap ke? Also you : Yup I am showing off. *and posts screenshots of epf and asb in almost every thread you are in Me : staring at the wall for 10mins. Confused kejap. LOL Sentap? lol. You are hilarious. Hard to believe you are a 40+ year old. Xpe xpe. Saya bagi. Betul betul saya sgt sgt sentap. lol. I hope that will help you sleep well at night. This post has been edited by afif737: Apr 10 2021, 04:42 AM |

|

|

Apr 10 2021, 02:36 AM Apr 10 2021, 02:36 AM

|

Junior Member

103 posts Joined: Nov 2014 |

QUOTE(ragk @ Apr 9 2021, 08:09 PM) because i deposit multiple times within the 4 years, so that's average cost down factor here, its abit hard to calculate as i dint record when i do the transaction and how much it is I totally understand. Thank you for your reply though. Glad that it's working out for you.but if i do a no brain calculation comparison, follow previous 4 years of dividend history record from EPF, that's 25% profit with compound interest, on my EPF fund dashboard today, its showing overal 35% profit since my first deposit Ofcoz we cant say EPF fund is always better thn EPF, u can say im lucky that my fund manager do their homework. And in bad economic year, the market wont cause your capital to decrease in EPF, but fund will QUOTE(Ramjade @ Apr 9 2021, 08:15 PM) You have to pick good fund. To pick good fund you need to know which are the good funds to pick and there are some work involved. Unfortunately if you rely on agent you most likely will be worse off than EPF. Thanks for the tips.My unit trust have been outperforming unit trust for don't know how many donkey years. |

|

|

Apr 10 2021, 06:21 AM Apr 10 2021, 06:21 AM

Show posts by this member only | IPv6 | Post

#138

|

Senior Member

2,139 posts Joined: Nov 2007 |

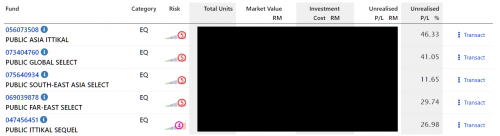

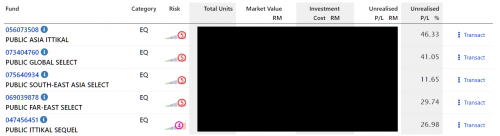

I can sense a lot of people always recommend fsm and ask newbie to completely ignore public mutual. This is the performance so far for my publiv mutual fund. Consider both and judge yourself. Some people dont really know what they are talking about. PGSF - one year old from the start of investment , additional investment during DIP only, lol my way of DCA. When i start investing i was charged 0.5% sales charge since the promo havent started back then. PIALF- 6 month from the start, invest during dip only, the value shown on the screenshot is around 10% below the peak. This one 0% sales charge as promo already started.  Both FSM and public mutual service is top notch. I always receive answer/response on the same day. This post has been edited by backspace66: Apr 10 2021, 06:30 AM DragonReine liked this post

|

|

|

Apr 10 2021, 07:33 AM Apr 10 2021, 07:33 AM

|

Senior Member

1,013 posts Joined: Sep 2014 |

QUOTE(hedfi @ Apr 7 2021, 10:45 PM) Ouch lol. I bet this one hurts a lot. He can only show off here coz he knows in the proper rich world 1m is nothing to show off about afif737 and asdfgvbnqw liked this post

|

|

|

Apr 10 2021, 09:32 AM Apr 10 2021, 09:32 AM

Show posts by this member only | IPv6 | Post

#140

|

Newbie

21 posts Joined: Nov 2018 |

QUOTE(debonairs91 @ Apr 10 2021, 07:33 AM) Ouch lol. I bet this one hurts a lot. He can only show off here coz he knows in the proper rich world 1m is nothing to show off about Ya lor hahaha afif737 liked this post

|

| Change to: |  0.0230sec 0.0230sec

1.20 1.20

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 11:03 AM |