QUOTE(xander83 @ Apr 1 2021, 05:25 PM)

Don't get bluff by 0% promo. There's platform fees. You want real 0%, use webull where everyday is zero.Money in EPF vs Unit Trusts

Money in EPF vs Unit Trusts

|

|

Apr 1 2021, 05:46 PM Apr 1 2021, 05:46 PM

Show posts by this member only | IPv6 | Post

#81

|

All Stars

24,417 posts Joined: Feb 2011 |

|

|

|

|

|

|

Apr 1 2021, 07:55 PM Apr 1 2021, 07:55 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Apr 1 2021, 08:11 PM Apr 1 2021, 08:11 PM

Show posts by this member only | IPv6 | Post

#83

|

All Stars

24,417 posts Joined: Feb 2011 |

QUOTE(xander83 @ Apr 1 2021, 07:55 PM) QUOTE SGD 2 per stock up to a max. of SGD 150 per quarter (7% GST applies) Monthly charges are automatically waived if there are at least (a) two trades in your trading account in the same calendar month, regardless of trade size in local or foreign shares OR (b) six trades in your trading account in the same calendar quarter, regardless of trade size in local or foreign shares OR © SGD 132 of paid brokerages in the same calendar quarter https://globalmarkets.poems.com.sg/faq/fees...ges-settlement/ |

|

|

Apr 2 2021, 02:57 AM Apr 2 2021, 02:57 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Ramjade @ Apr 1 2021, 08:11 PM) Settlement fees it looks like it Super confusing especially Asian brokerages |

|

|

Apr 2 2021, 08:23 AM Apr 2 2021, 08:23 AM

|

Junior Member

64 posts Joined: Aug 2019 |

Wow, so many platform wants to be like EPF. Look at characteristic

EPF - Every month 21% deducted from your salary to EPF for investment. - EPF build porfolio using SAA (strategic asset allocation) just a fancy name means, 50% fixed income, 40% equity (local/foreign), 6% property, 4% money market - 0 fees Unit trust, mutual, stashaway, whatever - Every month you decide pump in how many - depend on type above u choose, and porfolio they build, be it by robo by fund manager, choose their own SAA style - annual fees (1-2%), transaction fees ( 0.x - 1.x%) no free lunch, initial buying fees, some could cut into 5% first etc... The way they make money is the the more u transact...the more fees. So, your investment, please take into account such thing, every month u depost RM1000 to whatever type, could be 1% charges or 10 ringgit whatever depend %, so your RM1000 is actuall 990 only, plus yearly come, fund manager wants to take a cut. |

|

|

Apr 2 2021, 08:49 AM Apr 2 2021, 08:49 AM

Show posts by this member only | IPv6 | Post

#86

|

Senior Member

8,188 posts Joined: Apr 2013 |

At the e nd of the day, it is the returns that matters to each individuals at the investment platform or products that suits the risk appetite n returns expectations of that individuals... Fees are just secondary.... It will have to be the consistency of "net" returns that matters most in their mind initally. After some times, if the returns are consistent, then they will think abt the fees variance..... To try to get more for the same amount of risk taken This post has been edited by yklooi: Apr 2 2021, 08:53 AM real55555 liked this post

|

|

|

|

|

|

Apr 2 2021, 12:21 PM Apr 2 2021, 12:21 PM

|

Senior Member

779 posts Joined: May 2006 |

Definitely a lot of irresponsible agents out there. I have seen some actually got their clients to park EPF money into Public Mutual bond funds with 4% 10 year annualized returns, which is lower than EPF 6% 10y. The excuse was so that they can reoptimize the portfolio when equity markets are underperforming. Completely ridiculous - why not reoptimize into the EPF fund itself then? This is in addition to parking in equity fund with only 7% 10y annualized performance. Why risk your EPF money for extra 1% outperformance? romuluz777 liked this post

|

|

|

Apr 2 2021, 12:36 PM Apr 2 2021, 12:36 PM

|

Senior Member

3,182 posts Joined: Nov 2008 From: KL |

QUOTE(blackchides @ Apr 2 2021, 12:21 PM) Definitely a lot of irresponsible agents out there. I have seen some actually got their clients to park EPF money into Public Mutual bond funds with 4% 10 year annualized returns, which is lower than EPF 6% 10y. EPF already put 50% in fixed income and 3% in money market iirc. Agents really got huge conflicts of interest.The excuse was so that they can reoptimize the portfolio when equity markets are underperforming. Completely ridiculous - why not reoptimize into the EPF fund itself then? This is in addition to parking in equity fund with only 7% 10y annualized performance. Why risk your EPF money for extra 1% outperformance? |

|

|

Apr 6 2021, 11:33 PM Apr 6 2021, 11:33 PM

Show posts by this member only | IPv6 | Post

#89

|

Junior Member

182 posts Joined: Apr 2020 |

Better EPF because:- 1. less risk 2. compunded dividen every year 3. Every month deduct salary 11% and Employer contribute 13% and go into your EPF. 4. 50 years old age can take out 1/3 and at 55 years old can take out all. However below 50 years old also can take out if more than a million in your EPF account. You can take out the balance at anytime. Minimum cannot take out is RM1 million. Cookie101 and blackchides liked this post

|

|

|

Apr 6 2021, 11:49 PM Apr 6 2021, 11:49 PM

|

Junior Member

103 posts Joined: Nov 2014 |

You don't always have to flex to prove a point you know. Just saying. asdfgvbnqw and hedfi liked this post

|

|

|

Apr 7 2021, 12:39 AM Apr 7 2021, 12:39 AM

Show posts by this member only | IPv6 | Post

#91

|

Junior Member

132 posts Joined: Aug 2019 |

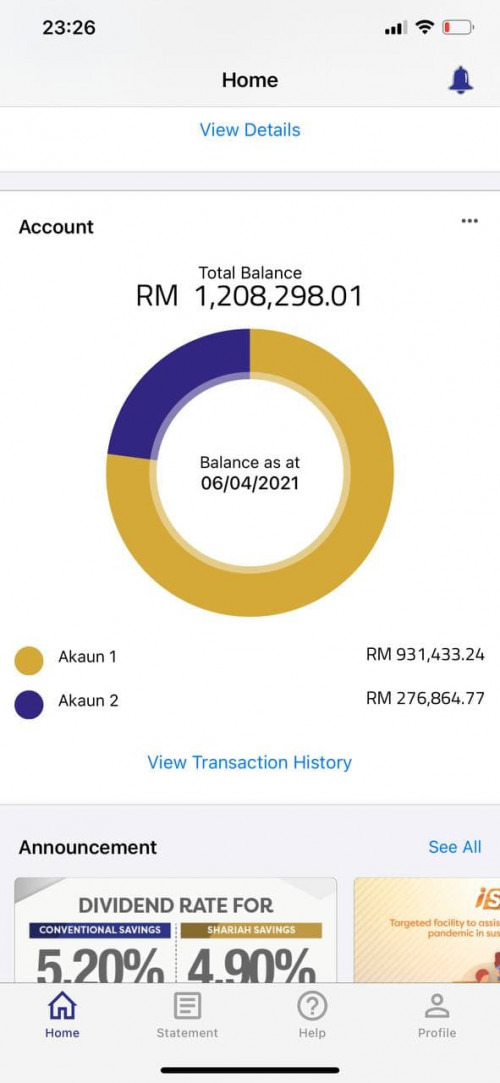

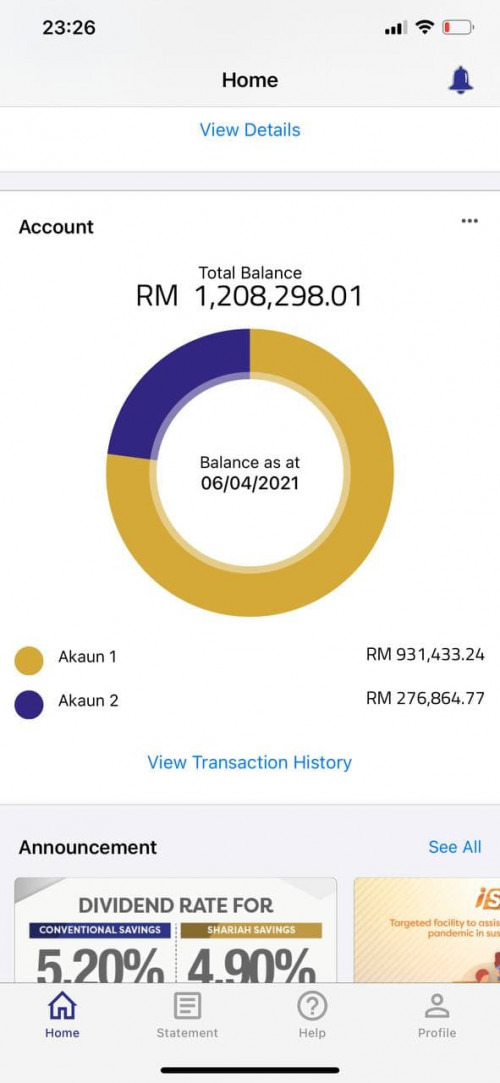

Just gonna leave this here. I cincai throw into one UT during the 0% sales charge sometime Oct last year, gonna sell back and put into EPF balik.

buffa and blackchides liked this post

|

|

|

Apr 7 2021, 09:40 AM Apr 7 2021, 09:40 AM

Show posts by this member only | IPv6 | Post

#92

|

All Stars

14,949 posts Joined: Mar 2015 |

QUOTE(NorAzdanNordin @ Apr 7 2021, 12:39 AM) Just gonna leave this here. I cincai throw into one UT during the 0% sales charge sometime Oct last year, gonna sell back and put into EPF balik.

if those that had previously entered and cabut during these indicated periods, they would have cursed about this fund at that time of their exit....their reasons are valid too.... Attached thumbnail(s)

blackchides liked this post

|

|

|

Apr 7 2021, 09:53 AM Apr 7 2021, 09:53 AM

Show posts by this member only | IPv6 | Post

#93

|

All Stars

14,949 posts Joined: Mar 2015 |

QUOTE(farizmalek @ Apr 6 2021, 11:33 PM)  Better EPF because:- 1. less risk 2. compunded dividen every year 3. Every month deduct salary 11% and Employer contribute 13% and go into your EPF. 4. 50 years old age can take out 1/3 and at 55 years old can take out all. However below 50 years old also can take out if more than a million in your EPF account. You can take out the balance at anytime. Minimum cannot take out is RM1 million. as per 2018 article.... A net worth of $93,170 U.S. (abt RM400k) is enough to make you richer than 90 percent of people around the world, Credit Suisse reports. The institute defines net worth, or “wealth,” as “the value of financial assets plus real assets (principally housing) owned by households, minus their debts.” https://www.cnbc.com/2018/11/07/how-much-mo...-worldwide.html in 2019 report, 3.7% Malaysians was placed in the US$100,000 to US$1 million wealth band. https://themalaysianreserve.com/2019/10/22/...wealth-bracket/ |

|

|

|

|

|

Apr 7 2021, 10:12 AM Apr 7 2021, 10:12 AM

|

Senior Member

779 posts Joined: May 2006 |

QUOTE(MUM @ Apr 7 2021, 09:40 AM) if those that had previously entered and cabut during these indicated periods, they would have cursed about this fund at that time of their exit....their reasons are valid too.... Whereas EPF returns are almost linear every year like clockwork, so you may feel tempted to switch out from UT in those years when returns are below EPF dividends. |

|

|

Apr 7 2021, 10:24 AM Apr 7 2021, 10:24 AM

Show posts by this member only | IPv6 | Post

#95

|

All Stars

14,949 posts Joined: Mar 2015 |

QUOTE(blackchides @ Apr 7 2021, 10:12 AM) Good chart. This just shows that you can outperform EPF with UT, but must be prepared mentally to handle the volatility and you must be in for the long haul to ride any multi-year dips. Whereas EPF returns are almost linear every year like clockwork, so you may feel tempted to switch out from UT in those years when returns are below EPF dividends. This post has been edited by MUM: Apr 7 2021, 10:29 AM Attached thumbnail(s)

|

|

|

Apr 7 2021, 10:27 AM Apr 7 2021, 10:27 AM

|

Senior Member

2,012 posts Joined: Dec 2007 From: Malaysia |

Diversify MUM liked this post

|

|

|

Apr 7 2021, 10:36 AM Apr 7 2021, 10:36 AM

|

Senior Member

779 posts Joined: May 2006 |

QUOTE(MUM @ Apr 7 2021, 10:24 AM) There are plenty of really crappy underperforming funds out there pushed by irresponsible agents. As usual, whoever wants to take this route must do sufficient research, look at the usual metrics - annualized returns, annual performance, beta, Sharpe ratio, benchmarks. DragonReine liked this post

|

|

|

Apr 7 2021, 10:40 AM Apr 7 2021, 10:40 AM

|

Senior Member

4,482 posts Joined: Jul 2005 |

QUOTE(l4nunm4l4y4 @ May 15 2020, 01:07 PM) 2020 was the best time buying UT. nearly all portfolios went up approx 30%. Even the few portfolio's i invested in now 2020 shown 22% for their conservation 24% for their balance and 32% for their moderate aggressive portfolios.How come you lose money? something must be wrong. This post has been edited by kidmad: Apr 7 2021, 10:41 AM |

|

|

Apr 7 2021, 10:43 AM Apr 7 2021, 10:43 AM

|

Senior Member

779 posts Joined: May 2006 |

QUOTE(kidmad @ Apr 7 2021, 10:40 AM) 2020 was the best time buying UT. nearly all portfolios went up approx 30%. Even the few portfolio's i invested in now 2020 shown 22% for their conservation 24% for their balance and 32% for their moderate aggressive portfolios. Old post. May 2020. He must be celebrating that he didnt sell now How come you lose money? something must be wrong. This post has been edited by blackchides: Apr 7 2021, 10:43 AM |

|

|

Apr 7 2021, 10:46 AM Apr 7 2021, 10:46 AM

|

Senior Member

4,482 posts Joined: Jul 2005 |

|

| Change to: |  0.0391sec 0.0391sec

0.60 0.60

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 03:17 PM |