Outline ·

[ Standard ] ·

Linear+

Opus Touch, Self-Service UT Platform

|

TStan_aniki

|

May 15 2020, 05:41 PM May 15 2020, 05:41 PM

|

|

QUOTE(funboy555 @ May 15 2020, 05:39 PM) Ya man. I think has to be fair, be it afternoon get or at night get, it is T+1. I think they are doing the best effort. I never see anyone in the market can do this. Last time I invest in those others, 5-6 days to get my money back. Even those so called Robo Adviser also takes 5-6 days. It is not easy, first the funds need to be liquid and also the way the process our applications is crazily smooth and fast. Really give credit to them. CS team also responsive. that's why people like to invest with them, even boost don't want partner with them anymore i will still support them with fpx hopefully they come out with cc as well |

|

|

|

|

|

epie

|

May 15 2020, 07:39 PM May 15 2020, 07:39 PM

|

|

QUOTE(epie @ May 15 2020, 05:22 PM) i used maybank...5 figures redemption...redeemed before 10 a.m but my wife account still not in yet...also maybank Received my wife's redemption via maybank Agree with u guys... Opus is really doing a very good job Superbly fast service ever |

|

|

|

|

|

choco_ice

|

May 15 2020, 09:13 PM May 15 2020, 09:13 PM

|

Getting Started

|

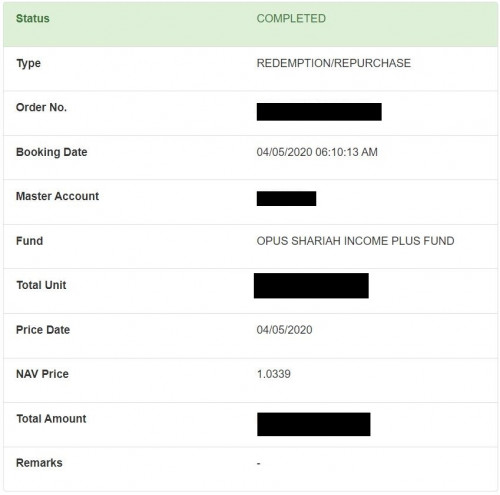

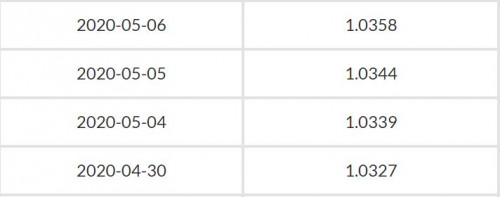

I redeemed on 14/5 at 10.30am, received report that my redemption is based on NAV of 14/5 instead of 13/5, anybody facing the same?

|

|

|

|

|

|

GrumpyNooby

|

May 15 2020, 09:15 PM May 15 2020, 09:15 PM

|

|

QUOTE(choco_ice @ May 15 2020, 09:13 PM) I redeemed on 14/5 at 10.30am, received report that my redemption is based on NAV of 14/5 instead of 13/5, anybody facing the same? Anything wrong? Redeemed which fund? This post has been edited by GrumpyNooby: May 15 2020, 09:15 PM |

|

|

|

|

|

choco_ice

|

May 15 2020, 09:16 PM May 15 2020, 09:16 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ May 15 2020, 09:15 PM) Anything wrong? Redeemed which fund? IPF, should based on NAV of 13/5 isn't it? |

|

|

|

|

|

GrumpyNooby

|

May 15 2020, 09:17 PM May 15 2020, 09:17 PM

|

|

QUOTE(choco_ice @ May 15 2020, 09:16 PM) IPF, should based on NAV of 13/5 isn't it? Why so? This is a bond fund; not a cash management fund like FSM CMF. |

|

|

|

|

|

choco_ice

|

May 15 2020, 09:41 PM May 15 2020, 09:41 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ May 15 2020, 09:17 PM) Why so? This is a bond fund; not a cash management fund like FSM CMF. I see, thanks! I thought IPF redemption same like SIPF as SIPF same time redemption follow previous day NAV. |

|

|

|

|

|

GrumpyNooby

|

May 15 2020, 09:50 PM May 15 2020, 09:50 PM

|

|

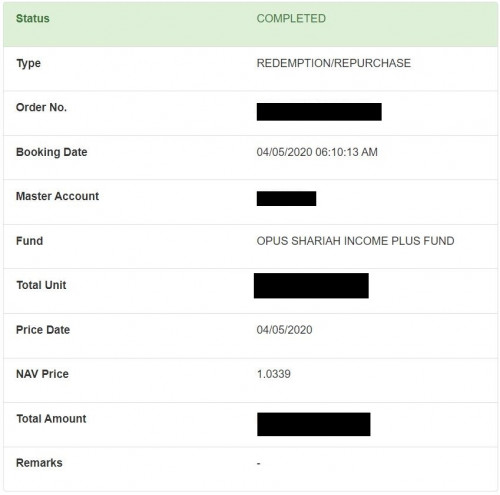

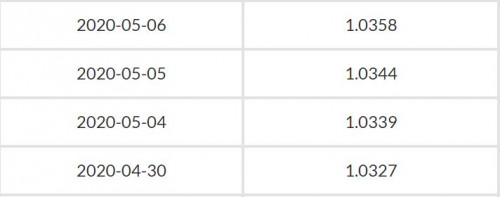

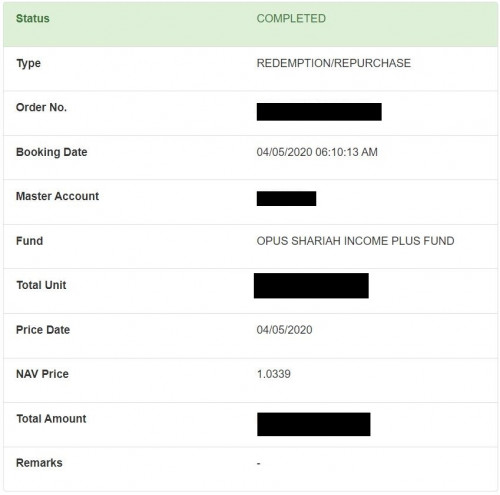

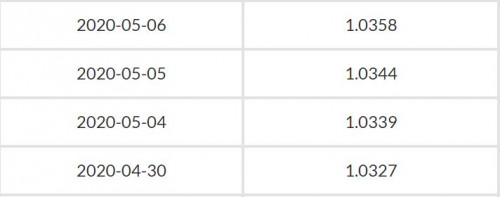

QUOTE(choco_ice @ May 15 2020, 09:41 PM) I see, thanks! I thought IPF redemption same like SIPF as SIPF same time redemption follow previous day NAV. Are you sure?   |

|

|

|

|

|

choco_ice

|

May 15 2020, 10:00 PM May 15 2020, 10:00 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ May 15 2020, 09:50 PM) Are you sure?   Oops, my mistake, just double confirm against my statement, thanks! This post has been edited by choco_ice: May 15 2020, 10:01 PM |

|

|

|

|

|

TStan_aniki

|

May 15 2020, 10:03 PM May 15 2020, 10:03 PM

|

|

QUOTE(choco_ice @ May 15 2020, 09:41 PM) I see, thanks! I thought IPF redemption same like SIPF as SIPF same time redemption follow previous day NAV. all fund redeem before 4pm on that day follow the NAV after 6pm on that day, not previous NAV opus just roughly let u know how much your units worth based on previous day NAV, but the next day you will get the actual value following the NAV of the day u redeem This post has been edited by tan_aniki: May 15 2020, 10:04 PM |

|

|

|

|

|

choco_ice

|

May 15 2020, 10:11 PM May 15 2020, 10:11 PM

|

Getting Started

|

QUOTE(tan_aniki @ May 15 2020, 10:03 PM) all fund redeem before 4pm on that day follow the NAV after 6pm on that day, not previous NAV opus just roughly let u know how much your units worth based on previous day NAV, but the next day you will get the actual value following the NAV of the day u redeem Okay got it, thanks! |

|

|

|

|

|

apathen

|

May 15 2020, 10:15 PM May 15 2020, 10:15 PM

|

|

QUOTE(choco_ice @ May 15 2020, 09:41 PM) I see, thanks! I thought IPF redemption same like SIPF as SIPF same time redemption follow previous day NAV. doesn't make sense to follow previous day nav . Let say if today market collapse everyone redeem then how they pay the different of higher yesterday price with today's lower price? |

|

|

|

|

|

choco_ice

|

May 15 2020, 10:21 PM May 15 2020, 10:21 PM

|

Getting Started

|

QUOTE(apathen @ May 15 2020, 10:15 PM) doesn't make sense to follow previous day nav . Let say if today market collapse everyone redeem then how they pay the different of higher yesterday price with today's lower price? Yes this is so true! |

|

|

|

|

|

abcn1n

|

May 16 2020, 04:15 AM May 16 2020, 04:15 AM

|

|

QUOTE(funboy555 @ May 15 2020, 05:12 PM) I think you can find the info from their latest fund fact sheet. For IPF, https://www.opusasset.com/wp-content/upload...v=1589533560223I think the coupon rate that you are mentioned is something like the portfolio yield they mentioned in the fact sheet. Now 1 month FD on board rate 1.90% and 12 month is only 2.10%, I would rather save my money in Opus bond funds. so far i made redemption and it is really super fast, the next day get my money and all with all the daily price earning. Love it!  I did not really go in and out la. I see it not much difference unless it is a huge drop like end of March. or else if withdraw today, tomorrow if the price go up again, you enter at high price again. Short term price movement should not be a concern. and I saw earlier some big big posted that it is unit trust, it is not a trading accounts, and it is not a stock, so I think for medium and long term investment or I treat this as my savings with great interest earn, I wont bother to do the in and out. just a personal opinion. Thanks. As I suspected the coupon rate is certainly lower than the 7-8% base on the top 5 holdings in the fund fact sheet. That means about 2-4% are from capital appreciation. |

|

|

|

|

|

coo|dude

|

May 16 2020, 01:19 PM May 16 2020, 01:19 PM

|

|

Who has the distribution dates for all the funds? I want to plot them to my calendar. TIA!

|

|

|

|

|

|

TStan_aniki

|

May 16 2020, 01:23 PM May 16 2020, 01:23 PM

|

|

QUOTE(coo|dude @ May 16 2020, 01:19 PM) Who has the distribution dates for all the funds? I want to plot them to my calendar. TIA! already got all the graph why wanna do double work? |

|

|

|

|

|

coo|dude

|

May 16 2020, 01:42 PM May 16 2020, 01:42 PM

|

|

QUOTE(tan_aniki @ May 16 2020, 01:23 PM) When is the next one after 25 March? I know it's quarterly, but doesn't seems to be exact 90 days. This post has been edited by coo|dude: May 16 2020, 01:48 PM |

|

|

|

|

|

TStan_aniki

|

May 16 2020, 01:50 PM May 16 2020, 01:50 PM

|

|

QUOTE(coo|dude @ May 16 2020, 01:42 PM) When is the next one after 25 March? I know it's quarterly, but doesn't seems to be exact 90 days. The distribution is up to them, not a fixed 3 months distribution, as u can observed from their past history |

|

|

|

|

|

GrumpyNooby

|

May 16 2020, 02:38 PM May 16 2020, 02:38 PM

|

|

Only MPF has monthly distribution.

IPF and SIPF are NOT committed for qaurterly distribution and it is up to them if they want to declare. In the PHS, the distribution policy is at least once a year.

Distribution Policy The Fund intends to distribute income, if any, at least once a year.

This post has been edited by GrumpyNooby: May 16 2020, 02:39 PM

|

|

|

|

|

|

TStan_aniki

|

May 16 2020, 03:35 PM May 16 2020, 03:35 PM

|

|

QUOTE(GrumpyNooby @ May 16 2020, 02:38 PM) Only MPF has monthly distribution. IPF and SIPF are NOT committed for qaurterly distribution and it is up to them if they want to declare. In the PHS, the distribution policy is at least once a year. Distribution Policy The Fund intends to distribute income, if any, at least once a year. err... MPF also didn't commit to monthly distribution, you can see from the past history as well |

|

|

|

|

May 15 2020, 05:41 PM

May 15 2020, 05:41 PM

Quote

Quote

0.0288sec

0.0288sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled