QUOTE(hc7840 @ Aug 28 2020, 01:16 AM)

Why everyone keep saying international is good leh? They familiar with local market, they can manipulate the local market because of their big fund size. Go international become kecil miao player and their fund manager don’t know good to handle oversea portfolio bo?

Think about this, how long can they manipulate local market? The informed and educated local player like you and me know that this local exchange is from day one, an unfair playground. 40% of equities controlled by just 7 GLICs, another 10% by JP Morgan and its associates. PNB + ASNB alone already controlled 10% ++.

Sooner rather than later, your counterparty will realize this (in fact they had) and they will just stand aside. Your equities won't fetch good valuations, won't be liquid. You will just be playing among yourselves (funds vs funds). Foreigner's participation has already dropped to new low in the local exchange, retailers focused on catching the latest tips and prop up penny stocks. Who else is left to play with you?

Become small miao player may not be a bad thing. It gives you the ability to trade securities without significant distortion to the securities' price. You don't want to be the next Buffet and buy into Barrick Gold assuming that the return is happening over the next few months only to see the shares jump 10% the next day after the positions are disclosed, disrupting all your investment plan.

As for how good they are in handling overseas portfolio, I can point you to a few sources:

1. Aware of the Battersea Power Station redevelopment project?

https://www.spsetia.com/getattachment/5444c...ef04f1a6c0/2020See from slide 21 onwards.

2. Not sure if you know the Guthrie Dawn Raid? Guthrie eventually merged with Golden Hope and Sime Darby to become the large plantation counter sime darby, but then PNB decided that the conglomerate has too many businesses inside it and so the palm oil plantation business was demerged to become sime darby plantation.

Nothing surprising here, but the dawn raid was a big news in LSE back then. Exchange rules were modified thereafter and now you can no longer "steal" a British listed company that easy anymore.

Sime Darby, the listed company (without plantation business) has substantial revenue source from overseas business, mostly inherited from its British parent.

Can have a look at its latest result presentation, just released yesterday:

http://www.simedarby.com/sites/default/fil...web_revised.pdf3. PNB has properties in UK for a long time, they do have some experience in managing those, although the portfolio is small.

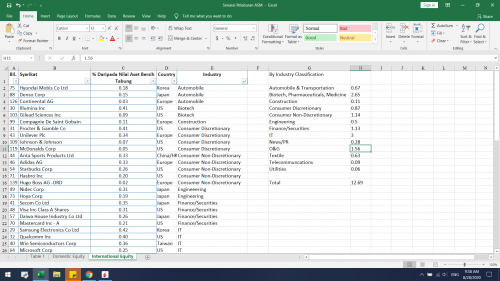

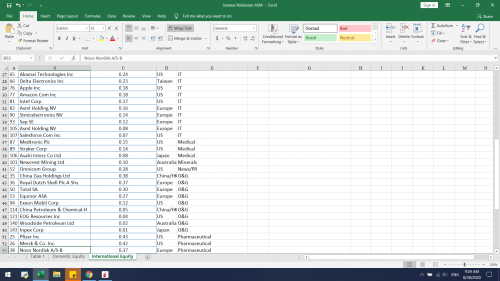

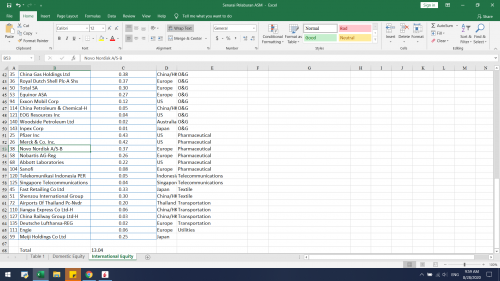

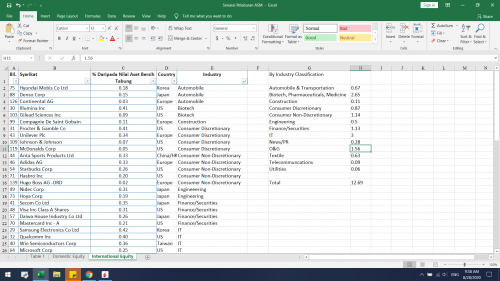

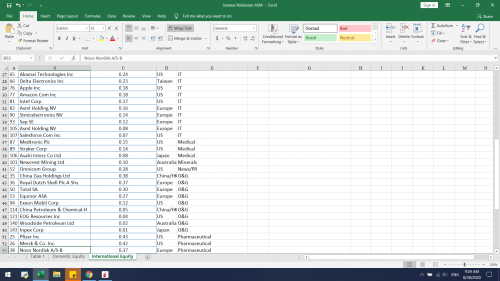

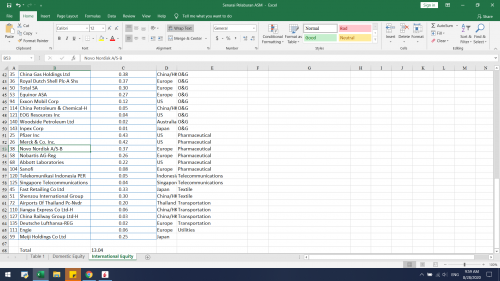

https://www.pnb.com.my/03_4Property_EN.php4. The above are their real estate portfolio, for international equity portfolio, here is a screenshot of international equity portfolio for ASM from the 2020 annual report (my own analysis in excel). I can't send you the whole file for privacy/security reason and I am not supposed to share this without notifying ASNB. You may request for a complete list of ASNB FP fund's portfolio by emailing them yourself.

Note: The industry classifications are my own addition. The original copy of PDF file provided by them only has company name and company holding's as a percentage of NAV data provided.

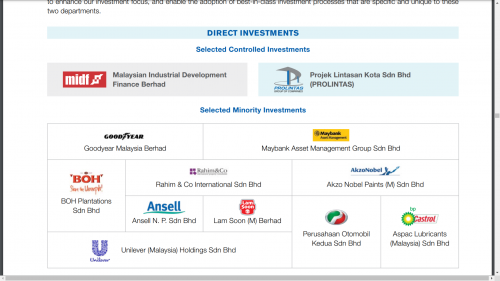

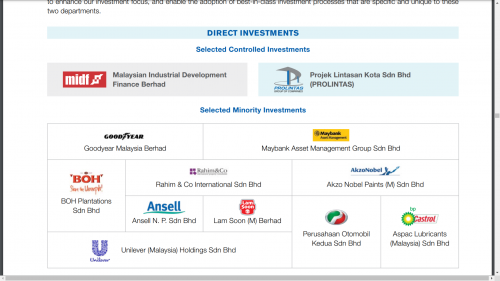

5. As for fixed-income and private equity portfolio, I do not have any information on this as PNB/ASNB never disclose this information in their annual report (including fund's report), but from the PNB annual report, they seem to have collaborations with some international partners like Unilever and Akzo Nobel.

Edit: Added Sime Darby 4Q FY 20 result presentation to reflect international business result. Also added more info on fixed income portfolio.

This post has been edited by TOS: Aug 28 2020, 01:08 PM

Jul 23 2020, 04:19 PM

Jul 23 2020, 04:19 PM

Quote

Quote

0.0404sec

0.0404sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled