Hmm..

Simply cannot do that...

I'm sure the units from somewhere

But where? No one shared that part of information

Only shared got 1 billion offering start 1st August

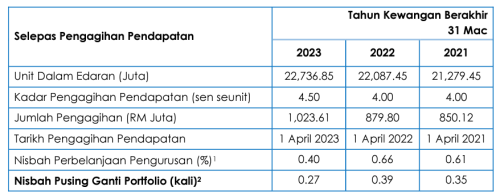

Maybe they are doing pretty well recently, need to pull NAV back to RM 1 per unit. KLCI has done quite well in the past 6 months and 1 year, recording gains of 7% and 11%, respectively.

Err. Ok.

ASMx funds are nothing more than unit trusts. Barring counterparty risk with ASNB/PNB, i.e., the fund management company itself, the risk nature of a UT can be derived from the fund's underlying. In Finance, we care about exposure, that's where the risk/payoff etc. come from.

Here're ASM 1, ASM 2, ASM 3 full list of investment portfolio from FY 2020 to FY 2022. The analysis are more detailed in FY 2021 and FY 2022 (I added country, GICS industry classification etc. in the later years' excel files). But overall, you can observe that risk-free/near risk-free assets accounted for around 10%ish of the total NAV.

[attachmentid=11466816]

ASMx funds have always been heavy on the equity side, with some bond exposure. Save for risk-free treasuries like MGS or GII, equities and corporate bonds are obviously not risk-free.

---------------------

So, newbies will ask: Maybank shares are obviously not fixed, nor are many other equities and bonds. We see stock prices go up and down after all.

How does ASNB achieve a constant NAV of RM 1 on a daily basis then?

If you look at the the formula for NAV, i.e., NAV = net asset value per unit of share, there are 2 ways this can be done:

» Click to show Spoiler - click again to hide... «

1. Change/modify the denominator, i.e., the number of units issued/in circulation.

Suppose NAV = RM 1 yesterday. If today the total asset value goes up, NAV should exceed RM 1. To "pull back" the unit price to RM 1, ASNB/PNB will have to issue more units. How much more? As much as needed to pull the NAV back to RM 1 at the close of business day (usually 5pm on weekday). This is usually easy to do as new units will be snapped up pretty quickly by investors.

Conversely, if the total asset value goes down, NAV will drop below RM 1. To bring back NAV to RM 1, ASNB/PNB will have to reduce the number of units. Reduce by how much? As much as needed to bring back NAV to RM 1. But this is more difficult to achieve in reality. It's only possible if someone else withdraws from ASMx funds. Easier said than done, especially with so many long-term non-bumi investors... "die die" holding onto their units (I learnt this phrase "die die" when studying A-levels in KL

, really impressed by you guys' "Manglish".) Also, PNB/ASNB has no mandate to do any "share buyback" from unit holders. You don't see your units decline unless you sell your ASMx holdings. So, how does ASMx account for declining NAV then?

----------------------

2. Change/modify the numerator, i.e., the net asset value.

Again let's suppose NAV = RM 1 yesterday. If today the total asset value goes up, NAV should exceed RM 1. To "pull back" the unit price to RM 1, ASNB/PNB can issue more units. But they also have another choice. They can

pretend the NAV still says at RM 1 and book the extra returns in a separate account. These returns (if realized) can then be distributed as part of subsequent years' dividends.

Conversely, if the total asset value goes down, NAV will drop below RM 1. To bring back NAV to RM 1, ASNB/PNB can elect to value the assets at the same value as previous day's. The unrealized losses are booked in a separate account. These loses are then marked down when realized in later years (as a form of reduced dividends).

Newbies may also ask: Which method(s), 1 or 2, is/are ASNB using? I can confirm that method no. 2 is definitely being used. You can observe that in ASMx fund's annual report in the "income source" section (

sumber pengagihan), where you will see the line "

Keuntungan ternyata daripada tahun-tahun sebelumnya" (or in English, realized profit from previous years). This is where ASNB will draw down realized profits from previous years to pay out as dividends in the current financial year. I could not confirm if method 1 is used, as the number of units in circulation is dependent on many factors ("dividends" are reinvested, forming many new units every financial year, complicating the analysis).

It begs to ask: so what's the big deal? Well obviously, if NAV far exceeds RM 1 and ASNB undervalues it every day by booking profits, all is good. The issue is what if NAV is below RM 1 and ASNB has booked huge unrealized losses, waiting to be realized in later years, or perhaps

choosing when to realize those losses. These choices are subject to manipulations. It may well be that losses are not realized over many years... If you scrutinize ASMx fund's annual reports vs other private sector UTs like those of Kenanga's, AHAM's, Eastspring's etc., you will notice that the private sector UTs will mark to market their assets (i.e., recognized at fair value through profit/lost, FVTPL) in their P&L statement, this line does not exist in ASMx funds' P&L statements.

Long story short, the "magic" of NAV holding at RM 1 is just an accounting gimmick. It's a choice of when and how often you wish to mark your asset to the market value and when/how often you wish to realize the profits/losses. Nothing fancier than that. I am not suggesting that something has gone terribly wrong at ASNB or PNB. But for newbies, such "accounting" risk is best understood when you start investing at ASMx funds.

ASNB does have the advantage of starting pretty early in the 90s when Malaysia's economy was pretty strong, so they may be sitting on quite a large pile of realized profits, at least that's the case many years ago. In recent years, they have been distributing realized returns pretty often from their glory days.

That said, I am no accountant. Just a "finance" student. For more details, I refer to our friend

ikanbilis, an ACCA accountant in SG. He should be able to give newbies further guidance, whenever appropriate.

E. & O. E.

ASNB_FP_Funds_Holdings.zip ( 1.77mb )

Number of downloads: 154

ASNB_FP_Funds_Holdings.zip ( 1.77mb )

Number of downloads: 154

Mar 7 2024, 10:43 PM

Mar 7 2024, 10:43 PM

Quote

Quote

0.0425sec

0.0425sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled