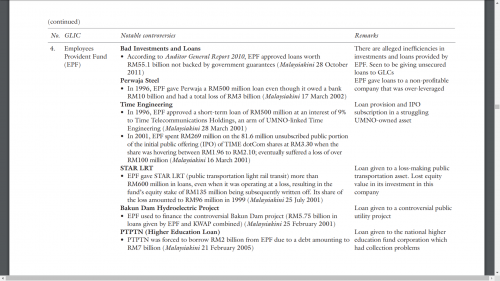

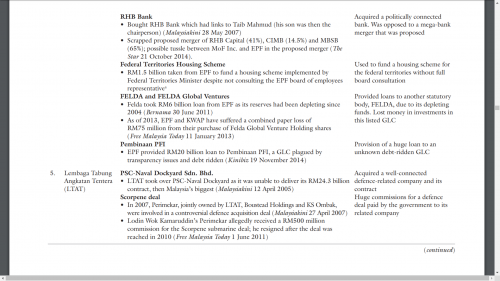

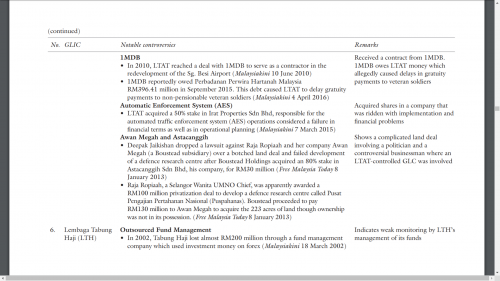

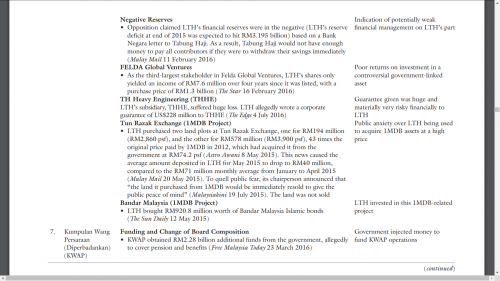

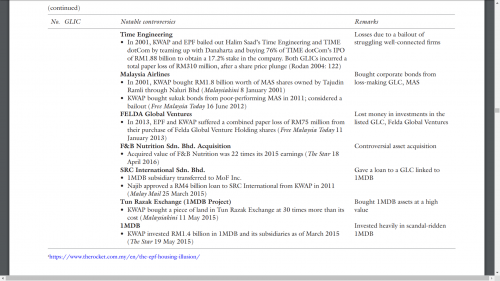

Not that I want to go into politics, the above are just to serve as a reminder for investors in EPF and PNB (for non-bumi, in particular) and for Malaysians (Khazanah Nasional) and bumi investors, all the 7 GLICs, that you need to be alert and aware of potential misuse of your hard-earned money.

I think you know what I mean.

QUOTE(MNet @ Jun 16 2020, 11:16 AM)

What is the credibility of the writer?

I think many people know about him and IDEAS. Further research can be done online or even in person, if you are in Klang Valley.

Dr. Gomez tends to be neutral, in my view. When Tun M moved to bring Khazanah and PNB under Azmin's control (Minister of Economic Affairs) when he's in power, Prof. Gomez voiced out about concentration of powers issue because back then, LGE was the Minister of Finance and Tun supposedly foresaw the power MOF controlled.

He's not leaning towards either side. Clearly sticking to his view that political abuse was an issue which warrants closer scrutiny in GLIC to safeguard investors, and the public's interest.

You may disagree, that's fine. I am not interested in Malaysia politics anyway, looking forward to Singapore instead.

QUOTE(Unkerpanjang @ Jun 16 2020, 11:17 AM)

Got scandal or not... Die, Die also... Embrace ASM123.

Forumers in this thread, ain't got much choice apart from ASNB FP. Worst case, low dividends but principal protected.

PN Gomen street-smarr, won't dare make investors angry.... Just Rob from someplace, etc to fund gaps.

The real losers are those that's not vested.

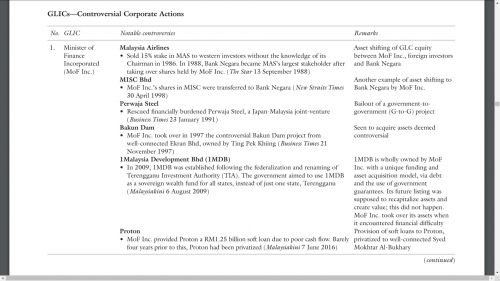

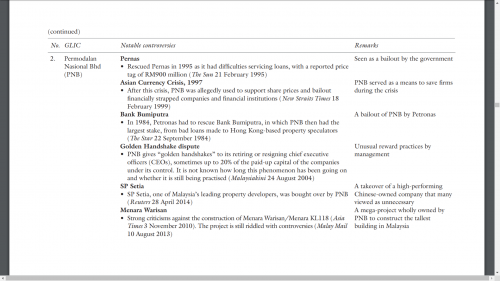

Principal protected only if the money goes into well-managed blue chips. From the list, there have been instances where money is borrowed among funds, GLICs themselves and sometimes in opaque structure and arrangements, not immediately understood by the public. (Think 1MDB). The ebook has more to say about the GLICs themselves.

I have exercised my right to query ASNB on the detailed list of ASM, ASM2 and ASM3 investment portfolio, as stipulated in the annual report. However, a few weeks later, the report only includes about 75% of the fund's holding. I asked for further details of the other 25%, and had not received any replies to date.

Most likely the other 25% are fixed-income securities and cash/near-cash items. Keep you fingers crossed that the money does not go into some kind of loans again...

One thing Prof. Gomez made clear is that since 2014/2015, the GLICs, especially EPF and PNB, had improved a lot and are managed by professionals. So, you would notice a substantial drop in "scandals" after 2014/2015. But there is no guarantee that what happened in the late 1990s won't repeat.

This post has been edited by TOS: Jun 16 2020, 02:45 PM

Jun 5 2020, 10:23 AM

Jun 5 2020, 10:23 AM

Quote

Quote

0.0328sec

0.0328sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled