I still think I am a fundamental guy... Charts and resistances... head and shoulders patterns all seem like aliens to me lol

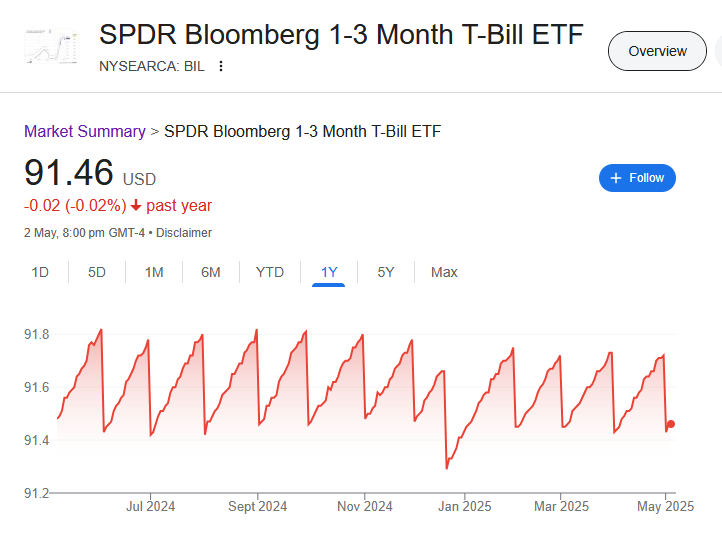

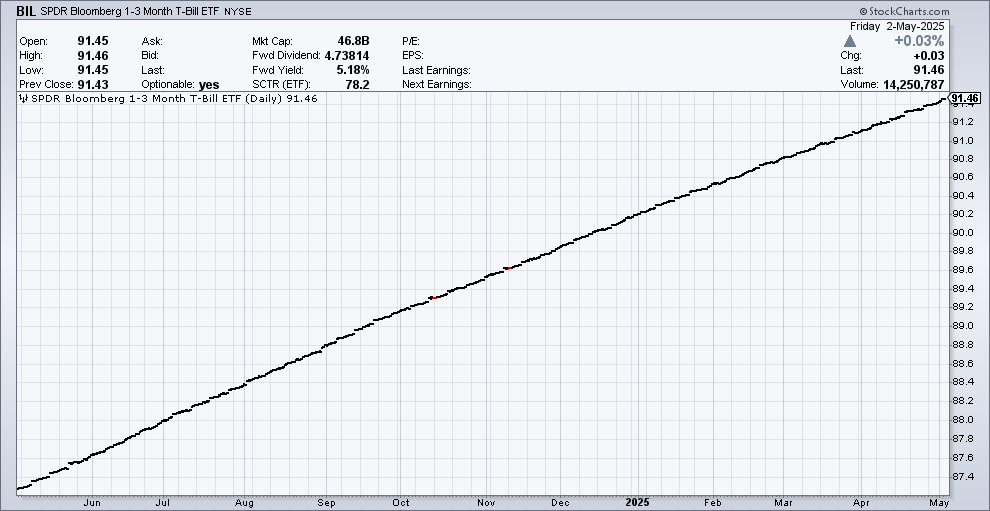

I make 2-3 USD a day every 3 days or so trading the bid-ask spread of BIL ETF... passive income for a start...

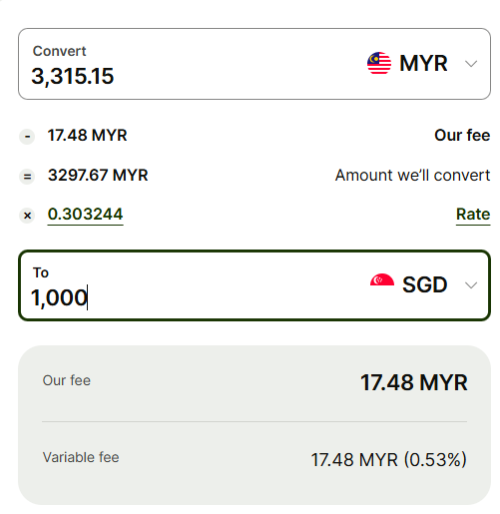

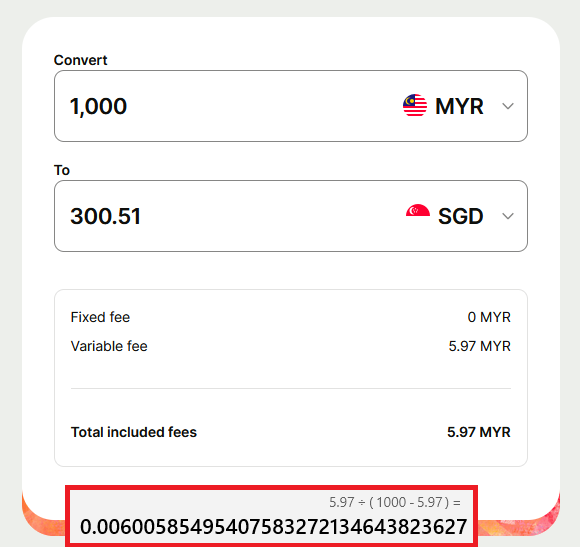

Quantitative researcher/analyst is a more suitable job for me. I heard the pay is 15k SGD - 20k SGD a month for PhD graduates in quant firms like Citadel, Jane Street etc. but I guess the trading desks people bring home more money lah..

You can help check for me the pay for Physics PhD working as quant analyst/researcher in Malaysia banks/funds?

As for your OT question, no I am just starting my 2nd year PhD at NTU Singapore... Will graduate in August 2027. See if I can land an intern at one of the market makers out there. PhDs and Masters' quants are in high demand in Singapore...

High Frequency Trading. A good book to read is 'Flash Boys" by Michael Lewis.

https://en.wikipedia.org/wiki/Flash_BoysYou can find the e-book for free online, given the book's popularity (PM me if you have difficulty looking for one.)

A very common HFT tactic is known as SIP latency arbitrage:

https://www.law.berkeley.edu/wp-content/upl...latency2017.pdfIn essence these traders program computers so that they can seek arbitrage profits in a very short period of time. The NMS regulation by the SEC requires a common pricing to be known to the public, but the problem is NMS regulation does not specify the time (or time delay) for the information to be known. The SIP systems are often delayed by milliseconds, but stocks tick every nanoseconds or so.

So in that short instance, a trader can buy from one exchange and sell to the order to make money.

That's a simplified version of the HFT story, books will tell you more.

---------------------

Yes, you can do HFT with IBKR although theoretically, you will always lose out to the traders whose servers and PCs are right next to the exchange's matching engine in say Mahwah, New Jersey (for NYSE).

But even if you are located physically in the US, there may be requirements to fulfill before you can start trading like a pro... Some license or something... Can check out on IBKR's website.

-----------------------

I think IBKR connects to the exchanges' matching engines directly, but I am not sure how close IBKR's servers are to the data centers of NYSE, NASDAQ etc...

What I can share with you from my previous attendance in Citadel, Point72, QRT etc.'s campus recruitment talk in NTU Singapore is that they are using short waves to relay signals all the way to the US as the underground fibre optic cables are congested and slow. The signal bounces along the ionosphere of Earth... from Singapore all the way to the US...

https://panoradio-sdr.de/the-world-of-short...ck%20to%20earth.

------------------------

Ans lastly, this info is from my HK finance professor who knows people working in Citadel Hong Kong. A lot of these non-bank trading firms, hedge/quant funds do not have solid footing in traditional hardcore finance unlike people who work at investment banks like Goldman, Morgan Stanley or Deutsche. Their backgrounds are somewhat diverse, with people coming in as long as they have a Masters/PhDs and can think/analyze...

My prof confirms that Citadel makes money by taking positions against its counterparties, albeit for a short period of time (e.g. in low-latency HFT trades). Pure "vanilla" market-making will never be profitable...

(A joke from him: He himself applied for a job at Citadel HK and the HR asked him his research field. He said Capital Asset Pricing Model, CAPM. The HR asked him what is "CAPM"

)

Hope that helps.

Crazy how those tiny NMS time-delay gaps still slip past the SEC, trading moves faster than rule-making, I guess. If you’re lining up a private raise for a hedge or quant desk, grab a lawyer who lives and breathes Reg D.

This quick JD Supra read on choosing a private-placement attorney keeps it simple and might save you a fortune in cleanup later:

May 5 2025, 10:45 PM

May 5 2025, 10:45 PM

Quote

Quote

0.0194sec

0.0194sec

0.88

0.88

6 queries

6 queries

GZIP Disabled

GZIP Disabled