QUOTE(TOS @ May 30 2024, 11:14 PM)

Hello, you should ask in the IBKR thread over here https://forum.lowyat.net/topic/4843925/+7700

With the T+1 settlement in US onshore market and thus the mismatch with UK/Europe's T+2 settlement, it's best to stick to onshore US market ETFs like VOO, QQQ etc. for peace of mind...

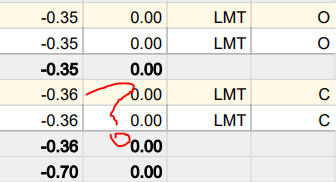

I don't buy using the app so can't comment. But if you use the Trader Workstation software, you get to choose which exchange to route your orders to. It's generally advised to choose ECNs like Turquoise, CHI-X or BATS Europe as their charges are cheaper compared to the original electronic boards/exchanges whose stocks are listed.

DCA-wise, let me ping Medufsaid.

Wait what.With the T+1 settlement in US onshore market and thus the mismatch with UK/Europe's T+2 settlement, it's best to stick to onshore US market ETFs like VOO, QQQ etc. for peace of mind...

I don't buy using the app so can't comment. But if you use the Trader Workstation software, you get to choose which exchange to route your orders to. It's generally advised to choose ECNs like Turquoise, CHI-X or BATS Europe as their charges are cheaper compared to the original electronic boards/exchanges whose stocks are listed.

DCA-wise, let me ping Medufsaid.

I can choose for a cheaper routing?

Puts on sherlock homes hat

This post has been edited by AthrunIJ: May 30 2024, 11:28 PM

May 30 2024, 11:27 PM

May 30 2024, 11:27 PM

Quote

Quote

0.0245sec

0.0245sec

0.21

0.21

6 queries

6 queries

GZIP Disabled

GZIP Disabled