Alright I know what is going on FINALLY! Now I feel like a forensic accountant, one Sherlock Holmes detective

Let's start from the beginning, one day prior to the deposit of HKD from my Mox Bank account and my purchase of BIL ETF. That would be

10 June 2024.

On 10 June 2024, here're my FX positions:

| Currency | Amount |

| CHF | 118.56 |

| EUR | 28 |

| HKD | 70.24 |

| SGD | 73.84 |

| USD | 679.27 |

--------------------------------------

On the morning of

11th June 2024 around 11.30 a.m., I deposited 781.45 HKD from my Mox Bank account. Let's assume instant settlement for now (we will deal with T+1 later), my account balance would look like:

| Currency | Amount |

| CHF | 118.56 |

| EUR | 28 |

| HKD | 70.24+781.45 = 851.69 |

| SGD | 73.84 |

| USD | 679.27 |

Then I decided to purchase BIL ETF and placed a limit order for 10 shares of BIL at 91.54 USD. The first order went through at precisely 7:54:15 am US Eastern, and I got 1 unit of BIL ETF, commission's 0.35 USD, so now the cash account is:

| Currency | Amount |

| CHF | 118.56 |

| EUR | 28 |

| HKD | 70.24+781.45 = 851.69 |

| SGD | 73.84 |

| USD | 679.27-91.54-0.35=587.38 |

Then, 3 minutes and 23 seconds later, on 7:57:38 Eastern, the next 9 orders went through, I got another 9 units of BIL ETF and this time NYSE rebated me 0.02 USD. So, at 7:57:38 Eastern, the account balance looks like:

| Currency | Amount |

| CHF | 118.56 |

| EUR | 28 |

| HKD | 70.24+781.45 = 851.69 |

| SGD | 73.84 |

| USD | (679.27-91.54-0.35)-(91.54*9)+0.02=-236.46 |

With negative cash balance, IBKR will now have to convert the money from my other currency accounts. Based on my guess, they started by deducting my CHF, HKD and SGD accounts (because the timestamp of those trades in the trade confirmation report were exactly 1 second after my BIL execution, i.e., 7:57:49 eastern).

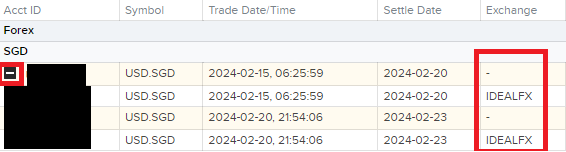

Let's see how the money was deducted, based on the trade confirmation report. 3 FX trades were recorded:

1. Sold 118.51 CHF at CHF.USD = 0.89675 to get 132.16 USD. No commissions (at least direct commissions...)

2. Sold 388.90 HKD at USD.HKD = 7.8109 to get 49.79 USD. No commissions.

3. Sold 73.80 SGD at USD.SGD = 1.35365 to get 54.52 USD. No commissions.

In tabulated format, at 7:57:39 US Eastern:

| Currency | Amount |

| CHF | 118.56-118.51 = 0.05 |

| EUR | 28 |

| HKD | 70.24+781.45-388.90 = 462.79 |

| SGD | 73.84-73.80 = 0.04 |

| USD | (679.27-91.54-0.35)-(91.54*9)+0.02+(132.16+49.79+54.52)=0.01 |

So, the 3 FX trades above pretty much brought back the USD account balance to almost 0.

The next few transaction records were seen around 5pm US eastern. Let's proceed to understand what IBKR did at 5pm US Eastern. 3 transactions were recorded:

1. Sold 0.04 CHF at CHF.USD = 0.89787213 to get 0.04814124 USD. No commissions (at least direct commissions...)

2. Sold 0.04814124 USD at USD.SGD = 1.35285165 to get 0.07 SGD. No commissions.

3. Sold 0.00487447 USD at USD.SGD = 1.35264869 to get 0.01 SGD. No commissions.

In tabulated format, at 5 pm US Eastern:

| Currency | Amount |

| CHF | 118.56-118.51-0.04 = 0.01 |

| EUR | 28 |

| HKD | 70.24+781.45-388.90 = 462.79 |

| SGD | 73.84-73.80+(0.07+0.01) = 0.12 |

| USD | (679.27-91.54-0.35)-(91.54*9)+0.02+(132.16+49.79+54.52)+0.04814124-0.04814124-0.00487447=0.005 |

Now it becomes pretty clear what IBKR was trying to do. The CHF cash balance was too low, so they closed it by selling CHF and converting it to USD. But then the USD account balance was too low as well, so they convert everything in USD to my base currency SGD. By 5 pm US Eastern, my CHF and USD balance were 0 and closed. (I have no more USD and CHF cash at IBKR). So, adjusted for rounding error, at 5 pm US Eastern, my currency balance was actually as follow:

| Currency | Amount |

| CHF | 0 (closed) |

| EUR | 28 (no change from the start) |

| HKD | 462.78 (rounded down from 472.79) |

| SGD | 0.11 (rounded down from 0.12) |

| USD | 0 (closed) |

--------------------------------------------------

Now we can "switch on" the T+1 settlement for currencies. By 12th June 2024, this was the account balance:

Notice CHF and USD account balances no longer exist.

------------------------------------------------------

Ok, so far so good. So, what was with the funny transaction I raised earlier on the 13th of June?

Well, on 13th of June MSFT paid a dividend of 0.75 USD a share to my brokerage account. IBKR deducted 30% withholding tax (0.23 USD) and passed on 0.52 USD to me. It turned out that since my USD balance was now zero and closed permanently, IBKR would not reopen my USD balance and deposit 0.52 USD into it. Instead, IBKR would auto-convert 0.52 USD into SGD (my base currency).

On 5pm US Eastern, 0.52 USD was converted to SGD at USD.SGD = 1.35092174 to obtain 0.70 SGD. And funnily enough the settlement period for this dividend auto-conversion is T+0, the same day!

That explains the last piece of the puzzle:

So, on the 13th of June 5pm US Eastern, my currency balance looked like:

| Currency | Amount |

| EUR | 28 |

| HKD | 462.78 |

| SGD | 0.11+0.70 = 0.81 |

Which remains the case until today:

------------------------------------

In short, nothing mysterious here. Firstly the CHF and USD account balances were too low so IBKR "forcefully" converted the remaining balance to SGD (my base currency). And with no more USD cash balance, all subsequent USD cash dividends will be auto-converted to my base currency (SGD) automatically.

This post has been edited by TOS: Jun 19 2024, 09:20 AM

Jun 17 2024, 02:31 PM

Jun 17 2024, 02:31 PM

Quote

Quote

0.0203sec

0.0203sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled