Background:

I was a non-believer in insurance, mostly due to the aggressive way it's sold, up until I was 30 years old. Then a friend became a Prudential agent and I bought a medical card to support him, which also included life and critical illness protection, and very minimal investment.

Then I started freelancing and also bought a house and a car, so I thought of increasing my insurance - in case something happened to me, the insurance would pay off the loans. Still having doubts about the ethics of insurance companies, I decided to buy extra life and critical illness protection from Great Eastern this time to "diversify the risk".

Over the years, I increased my insurance protection and also bought insurance, including a 15-year education savings which I regret, for my 2 sons. I also started a company that grew to almost 100 people and have been buying company group insurance from Great Eastern - paying a premium of about MYR 70,000 a year.

Critical Illness:

Last year, I was diagnosed with a heart condition that was covered under the critical illness insurance. Due to my fitness level, I was able to undergo non-invasive keyhole surgery (more advanced, less painful, recover faster, smaller scar) to repair my heart, instead of the conventional open-heart surgery where they saw your chest bone and open up your chest.

Claims:

Upon discharge, I submitted all the neccessary reports and documents to both agents and on the SAME DAY. This was what happened:

Prudential

- the agent told me Prudential will respond within 14 working days.

- within that period, Prudential sent me an SMS saying the claim was successful.

- the money was paid into my bank account 2 days later.

Great Eastern

- the agent said don't know how long the process will take.

- a week later GE asked for "certified" docs, which were copied and submitted by their own agent.

- a week later, I was asked to complete a questionnnaire, including which other insurance company I bought from.

- then my claim got rejected.

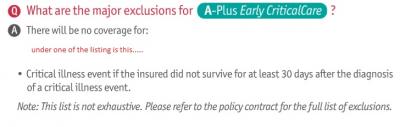

- GE says based on the policy, I MUST undergo an open-chest surgery to qualify.

My agent was stunned and my cardiologist literally said "what the fuck?". My agent appealed and got rejected - twice. Finally, I wrote a long email to express my disappointment and detailed my entire journey with GE, comparing it with Prudential. My email was escalated two levels up ...and then NO REPLY for a whole month.

Then my surgeon wrote another report and appealed to them. Finally, my claim was approved but GE proudly emphasized that they were ONLY doing it out of goodwill.

I promptly terminated and switched my company group insurance to Prudential. I also did the same with my son's insurance.

Buyer Beware:

It's companies like GE the reason why I never trusted insurance companies. Even my insurance agent who had been selling GE for 13 years was unaware of such a clause, hidden in the fine print.

The insurance policies are supposed to cover us until 100 years old. So between now and then, if there's a new and more advanced medical treatment, we still can't use it because it's not covered under GE's archaic policy?

Over the 13 years, my insurance agent has sold over 500 policies. But including mine, he has only made 3 CLAIMS for critical illness/life to date!

Other issues that I had with GE, was with their online access which didn't work and customer support which takes a minimum of 3 business days to respond, e.g. "we will transfer your request to the relevant department". Seriously? In this day and age of Internet speed? In my last interaction with them, they took 1.5 MONTHS to reply "due to sudden surge of volumes of email" (I wonder why), by which time I'd totally given up.

Conclusion:

Be careful when buying insurance - it's easy to buy but difficult to claim. Based on my personal experience, I would highly recommend Prudential instead (for now). The PruWaiver that I bought meant my son's premium will now be borne by Prudential. My premium will also be borne by them and paid towards my cash value until my policy expires at 100 years old.

Prudential vs Great Eastern: My Experience, Not all insurance companies are the same

Sep 5 2019, 09:32 AM, updated 7y ago

Sep 5 2019, 09:32 AM, updated 7y ago

Quote

Quote

0.0956sec

0.0956sec

0.38

0.38

6 queries

6 queries

GZIP Disabled

GZIP Disabled