Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

xander2k8

|

Jan 26 2023, 04:10 PM Jan 26 2023, 04:10 PM

|

|

QUOTE(whycanot323 @ Jan 26 2023, 03:48 PM) i have invested during 2019 till now for 30k... the app showing 30%.... but the 30% is totally misleading calc.. i did a calculation in excel , comparing if i placing FD with average promo rate of 12-18months each year. for 2019 Jan to 2022 Jan... basically past 4years FD can earn more than stashaway... PLUS no risk if go for FD i have just decided to withdraw all my 30k from stashaway today for new user that thinking to going in stashaway, my sugesstion is a big no, please dont Question is did you get out with a profit? If yes by all means go ahead as they are not consistent with AA hence you can see the lower performing and mid range is performing is stable while higher risks is bearing the brunt This year AA is much more resilient as compared to past 3 years as I believe the new CIO is much convincing than the previous one 🤦♀️ |

|

|

|

|

|

xander2k8

|

Jan 27 2023, 03:41 PM Jan 27 2023, 03:41 PM

|

|

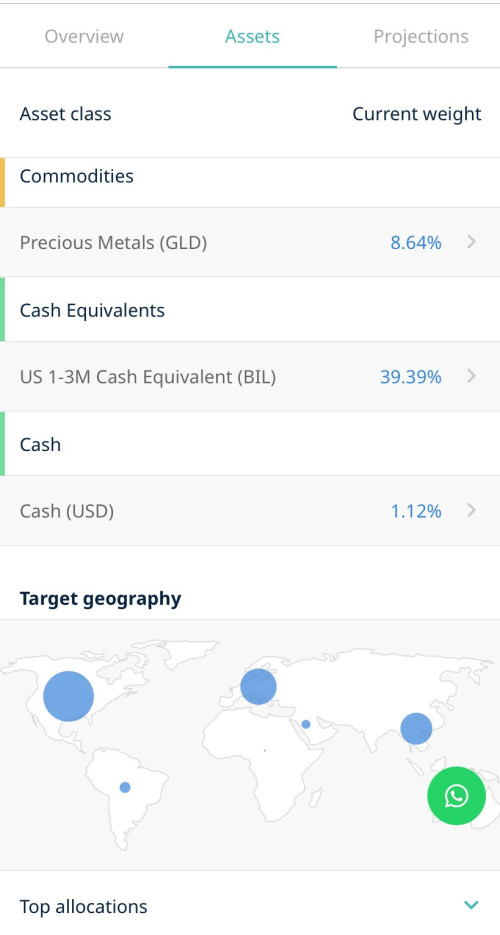

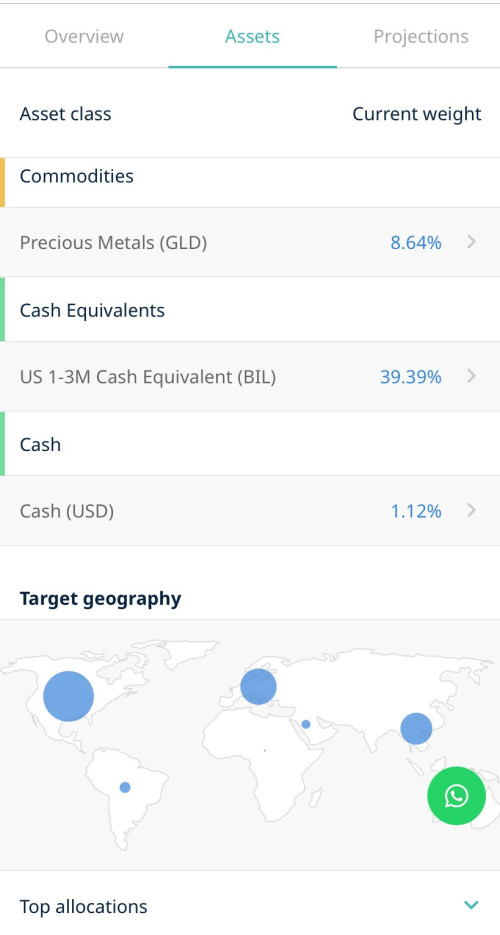

QUOTE(bcombat @ Jan 27 2023, 12:07 PM)  why place so much of our funds in cash equivalent? they should have done so early/ mid of last year. Cash because they are uncertain on what to allocate for those lower SRI as they are trying preserve your portfolio and moving into recession regime now For any Asset Allocation last year you should ask the previous underperform CIO instead 🤦♀️ This year SA should not lose a lot in % otherwise you will see more leaving and smaller AUM in the future |

|

|

|

|

|

xander2k8

|

Jan 28 2023, 03:05 AM Jan 28 2023, 03:05 AM

|

|

QUOTE(bcombat @ Jan 28 2023, 12:43 AM)   Putting substantial of funds in the cash equivalent assets may not be safer option when the dollar is weakened. Can see MWR for USD has improved but MYR in ringgit were headed to different direction. Selective unit trust has set aside 1x% to 2x% into cash/ money market funds since mid of last year. SA only adopt defensive stance at end of last year. Remember that SA bought Bonds in place cash equivalent hence they adopt the posture just that wrong asset allocation 🤦♀️ Markets and them got it wrong with bonds as they figures it will hold instead |

|

|

|

|

|

xander2k8

|

Jan 30 2023, 02:43 PM Jan 30 2023, 02:43 PM

|

|

QUOTE(RoosterGold @ Jan 30 2023, 11:19 AM) CAGR (Compound Annual Grwoth Rate) is the yardstick across my various investments. FD is relatively "safer" than investing equity since one's capital is protected with a fixed return but equity/stocks has more potential to grow over the medium to long term. I would suggest doing an analysis for the broad market like the S&P500 vs FD over a 10, 20 & 30 year period. Factor in as well if there is dividend given out to be reinvested as well 👏 |

|

|

|

|

|

xander2k8

|

Jan 31 2023, 01:22 PM Jan 31 2023, 01:22 PM

|

|

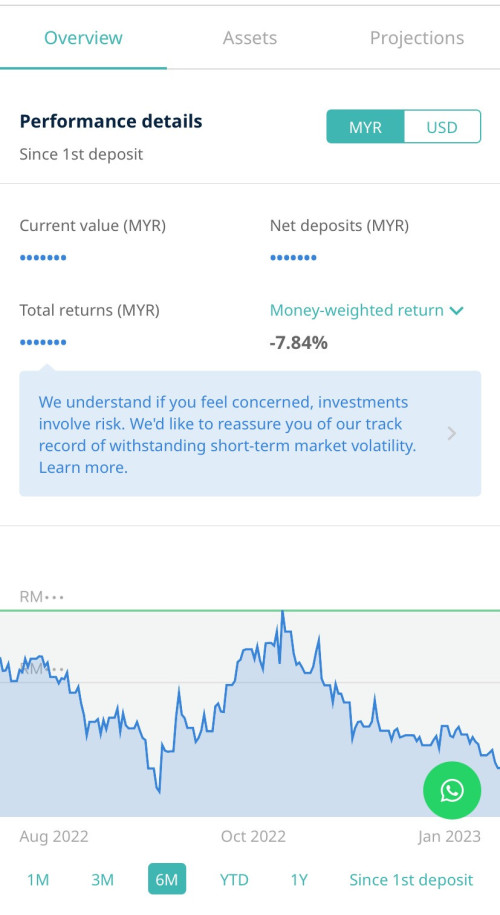

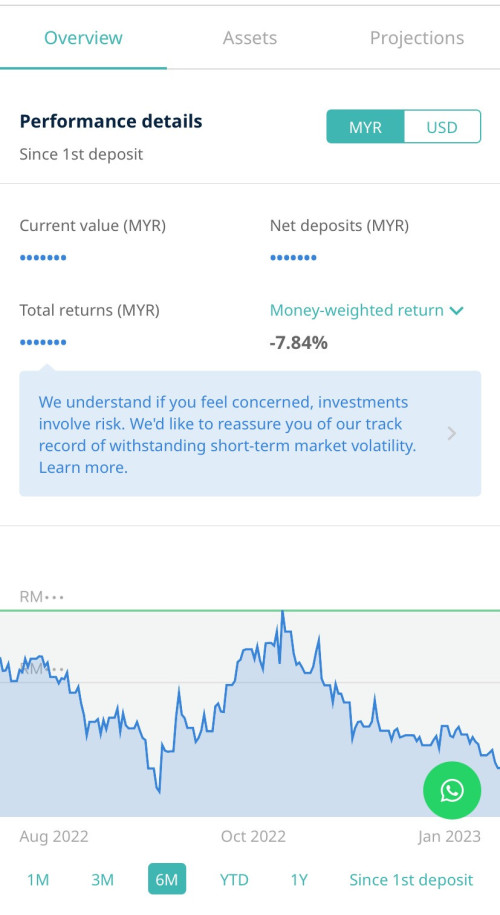

QUOTE(akhito @ Jan 31 2023, 12:45 PM) -13.87% TWR as of 31/1/2023 22% RI As long don’t reach more than -20% then you are alright |

|

|

|

|

|

xander2k8

|

Jan 31 2023, 01:43 PM Jan 31 2023, 01:43 PM

|

|

QUOTE(whycanot323 @ Jan 31 2023, 01:33 PM) understood, maybe i miss out the 2017 ? those from 2017, what are your CAGR ? i believe 2019 to 2023 are not too short in term of investment period i even top up during 2020 march to june during sharp fall... still not much "earn" in true % compared to FD dont follow the app return % shown, it is misleading calc.... again, im here to learn and share my view guys... dont shoot me if my thinking is different You need to factor the exchange rate The best is for you take their USD value and compared CAGR is the right way because of your underlying assets value Then factor in the management fees if any being paid during the period You can’t compare side by side with FD firstly because there is fees involved 🤦♀️ |

|

|

|

|

|

xander2k8

|

Feb 8 2023, 09:55 PM Feb 8 2023, 09:55 PM

|

|

QUOTE(lolabunny123 @ Feb 8 2023, 07:31 PM) Their BlackRock portfolios were re-optimised again effective today. Seems like the reoptimisation is quite frequent compared to the SA’s original portfolio. Is rebalancing by % or add or remove new ETFs because it is seems minor reopt only? Their reopt is frequent because the allocation is minor % as compared to Stashaway General |

|

|

|

|

|

xander2k8

|

Feb 9 2023, 05:55 PM Feb 9 2023, 05:55 PM

|

|

QUOTE(eternity4av @ Feb 9 2023, 09:20 AM) Hi fellow seniors, I did invest in SA in return for my marriage savings, till to date, it's accrueing lost at RM570, with SRI 22% initially to SRI 6.5%, and I would need to use the money for my marriage in October, should I remain or moved to Simple, which I able to get RM30, or cut my losses and withdraw all the money? Thanks a lot in advance for your advises. I suggest you to hold since the loss is bearable because you lower the risks Unless you really need the money then you sell QUOTE(RoosterGold @ Feb 9 2023, 10:25 AM) Am also concerned about these re-optimisation exercises carried out by StashAway. Not too sure if this has been done under StashAway's ERAA indicating a transition into another economic cycle perhaps? ERAA and Blackrock are seperate reoptimisation cycle 🤦♀️ Blackrock will be quite frequent and monthly due to many holdings they have in a portfolio |

|

|

|

|

|

xander2k8

|

Feb 9 2023, 08:37 PM Feb 9 2023, 08:37 PM

|

|

QUOTE(lolabunny123 @ Feb 9 2023, 07:36 PM) A bit of both. I didn’t keep track of everything but I noticed some bonds like FLOT is missing from my portfolio. Increased % in certain bonds and gold. That was done earlier on reoptimisation at end of last year hence you might missed out on it Allocation to gold is higher because of it is a balancing tool by SA while Bonds were to allocate to other ETFs |

|

|

|

|

|

xander2k8

|

Feb 10 2023, 11:06 PM Feb 10 2023, 11:06 PM

|

|

QUOTE(zstan @ Feb 10 2023, 10:40 PM) This DJI. Break 34k for just a bit. Then go back down to 33.5k again 🥴🥴🥴 That was yesterday news 🤦♀️ Today totally different story |

|

|

|

|

|

xander2k8

|

Feb 13 2023, 03:59 PM Feb 13 2023, 03:59 PM

|

|

QUOTE(RoosterGold @ Feb 13 2023, 02:21 PM) Will the DJI dip further? It is trading sideways but skewed towards downside so you can make your conclusion there |

|

|

|

|

|

xander2k8

|

Feb 13 2023, 04:44 PM Feb 13 2023, 04:44 PM

|

|

QUOTE(RoosterGold @ Feb 13 2023, 04:30 PM) Good point and shall definitely be taken into consideration! You should take the bottom during Oct 2022 as your baseline and chart from there if you trading short term And also monitor earnings from q2 from Dow biggest 30 companies Definitely there is an opportunity for upside on Q3 onwards if you are patience enough |

|

|

|

|

|

xander2k8

|

Feb 14 2023, 03:25 AM Feb 14 2023, 03:25 AM

|

|

QUOTE(RoosterGold @ Feb 13 2023, 05:16 PM) Always look forward while basing on the past 👏 Btw my SA portfolio turn green now after 2 years of a lump sum 🤦♀️ |

|

|

|

|

|

xander2k8

|

Feb 15 2023, 09:13 PM Feb 15 2023, 09:13 PM

|

|

QUOTE(zstan @ Feb 15 2023, 08:31 PM) The latest inflation data is worrying though. Not sure if US gonna be aggressive again on the hikes. What to be worried It is already expected as it happened before back in the early 80s but the markets doesn’t accept the reality 🤦♀️ |

|

|

|

|

|

xander2k8

|

Feb 16 2023, 12:15 PM Feb 16 2023, 12:15 PM

|

|

QUOTE(RoosterGold @ Feb 16 2023, 09:42 AM) Likely The Fed will continue to be hawkish, raising interest rates applying downward pressure on the markets overall. QUOTE(zstan @ Feb 16 2023, 09:52 AM) Yeah but the Fed had reduced the rate of its hike in the last round from 0.5 to 0.25. Not sure if they will go back up to 0.5 after this. But this also means a stronger USD and weaker ringgit Wait for blockbuster March meeting after jobs report data is out then we know rate If jobs report spring a very good suprise of negative then we are back at 25bps Anything 50bps is now suicidal from the Fed as it means that there is no more soft landing in place 🤦♀️ I already expect at least 4 rate rises this year which is not suprising anyhow because the data is not convincing enough 🤦♀️ |

|

|

|

|

|

xander2k8

|

Feb 17 2023, 02:43 PM Feb 17 2023, 02:43 PM

|

|

QUOTE(RoosterGold @ Feb 17 2023, 11:14 AM) 4 rate hikes this year does not seem unreasonable looking at macro trends & economics. As you said, it is now a matter of how much the interest rates will be raised this year. Market only pricing in 2 another this year which means 3 total but the only will break the market next month is another 50bps but for sure 25bps will be another 3 to go until summer The pause started should be longer now most likely end of the year |

|

|

|

|

|

xander2k8

|

Feb 18 2023, 11:44 PM Feb 18 2023, 11:44 PM

|

|

QUOTE(RoosterGold @ Feb 18 2023, 09:13 PM) I guess it will still depends on inflation as well along with other key economic indicators. If inflation you just need to look at CPI, Core CPI, PPI and Consumer Confidence Index Jobs and Unemployment claims are also in the Fed radar while housing is not so at the moment Wait for March as tide will turn then |

|

|

|

|

|

xander2k8

|

Feb 19 2023, 05:23 PM Feb 19 2023, 05:23 PM

|

|

QUOTE(honsiong @ Feb 19 2023, 03:38 PM) Only EPF and PRS dunno why kena nominate, cant just write them into a will. Almost all other assets can be passed on with a will. Govt doesn’t wanna deal with probates and trustee of the will 🤦♀️ They prefer direct approach to the hence nomination of the person |

|

|

|

|

|

xander2k8

|

Feb 21 2023, 02:59 PM Feb 21 2023, 02:59 PM

|

|

QUOTE(RoosterGold @ Feb 21 2023, 02:17 PM) Expect another 5% swing this year if BNM doesn’t start to increase OPR this year 🤦♀️ Inflation will start biting once subsidies will reduced come mid year |

|

|

|

|

|

xander2k8

|

Feb 21 2023, 05:36 PM Feb 21 2023, 05:36 PM

|

|

QUOTE(zstan @ Feb 21 2023, 04:31 PM) big mistake by BNM didnt increase OPR the last round   Already big mistake by keeping it below 3% when inflation is higher than that now BNM already bite themselves in the back because recession is already in sight and they do not have ammunition to cut rates to stimulate economy so all the legwork has to be done by PMX policies 🤦♀️ The Governor has to be fired and replaced with the younger deputies instead |

|

|

|

|

Jan 26 2023, 04:10 PM

Jan 26 2023, 04:10 PM

Quote

Quote

0.0477sec

0.0477sec

0.82

0.82

7 queries

7 queries

GZIP Disabled

GZIP Disabled