QUOTE(tehoice @ Mar 16 2020, 09:15 AM)

I meant it probably won't help much in pushing the market up but it will help cushioning the fallFind the cause and cure it. In the case, covid19, crude oil price war and trump administration

Just my opinion.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Mar 16 2020, 09:36 AM Mar 16 2020, 09:36 AM

Return to original view | Post

#81

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(tehoice @ Mar 16 2020, 09:15 AM) I meant it probably won't help much in pushing the market up but it will help cushioning the fallFind the cause and cure it. In the case, covid19, crude oil price war and trump administration Just my opinion. |

|

|

|

|

|

Mar 18 2020, 10:19 AM Mar 18 2020, 10:19 AM

Return to original view | IPv6 | Post

#82

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(messi.78 @ Mar 18 2020, 09:42 AM) From Stash Away's Freddy "Right now, the data suggests that we are in a market crash, not a bear market. This means that we expect the market underperformance to be short-lived, not lasting more than a few months. As such, we’re managing your portfolios through the crash by keeping your asset allocations unchanged. However, we’re continuously monitoring the incoming economic data and the valuation gaps of asset classes. If the data suggest a shift in the long-term economic environment that's not fully priced by the assets’ valuation gap, we will re-optimise your asset allocations accordingly." https://www.stashaway.my/r/markets-turbulen...fights-pandemic |

|

|

Mar 19 2020, 10:51 PM Mar 19 2020, 10:51 PM

Return to original view | IPv6 | Post

#83

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

Mar 20 2020, 12:22 PM Mar 20 2020, 12:22 PM

Return to original view | IPv6 | Post

#84

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(yklooi @ Mar 20 2020, 11:43 AM) OT... many ppl/investor/institution/fund house are hoarding cash, specifically USDthanks good ness, my family is not planning to US this year... most probably to Thailand & Spore.... how is the movement of the currencies of that 2 countries? is about the same YTD? hence strengthening of the USD and that's why most of the market is tanking despite gov stimulus they are waiting to enter the market imo |

|

|

Mar 25 2020, 10:28 PM Mar 25 2020, 10:28 PM

Return to original view | Post

#85

|

Senior Member

2,649 posts Joined: Nov 2010 |

VinaCapital shuts down Singapore-based robo-advisor Smartly

https://www.dealstreetasia.com/stories/vina...artly-2-181473/ Singapore-based robo-advisor Smartly is winding down its operations, a move it attributed to “intense” competition in the digital investment advisory space Founded in 2015, Smartly was acquired by Vietnam-based asset management firm VinaCapital in 2019. In a notice on its website, the startup said its decision to wind down operations was guided by its parent company’s strategic considerations. Smartly’s portfolio includes more than 20 exchange-traded funds (ETFs), and the startup charges its customers annual management fees of 0.5-1 per cent, and the underlying ETF fee charged by the ETF providers (0.1-0.25 per cent per year). Smartly’s Singapore rivals StashAway and Kristal had raised $12 million and $6 million, respectively, in their latest rounds. i wonder how well is stashaway doing |

|

|

Mar 26 2020, 10:30 AM Mar 26 2020, 10:30 AM

Return to original view | IPv6 | Post

#86

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(sewjin @ Mar 26 2020, 09:46 AM) oh wow thanks for sharing. honestly, it's reasons like these why i'm still quite heavily invested into mutual funds compared to stashaway. i really do want to take advantage of the much lower fees by stashaway but got this fear that it may wind up (like Smartly). main reason coz the founder (Michael) gives me a very "serial entrepreneur" kind of vibe. same as me.. initially wanted to put in more but cant find any financial report, the total user and total amount invested in stashawayQUOTE(tadashi987 @ Mar 26 2020, 10:24 AM) according to the article, smartly are in discussion with other robo, including stashaway for investor to move their account with other robo at 50% offThis post has been edited by xcxa23: Mar 26 2020, 10:31 AM |

|

|

|

|

|

Mar 26 2020, 11:12 AM Mar 26 2020, 11:12 AM

Return to original view | IPv6 | Post

#87

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(MGM @ Mar 26 2020, 11:05 AM) sorry about thatAll Smartly customers will enjoy a 50% management discount for the first six months, up to the first S$50,000. https://blog.seedly.sg/singapore-robo-advis...ent-comparison/ |

|

|

Mar 26 2020, 09:59 PM Mar 26 2020, 09:59 PM

Return to original view | IPv6 | Post

#88

|

Senior Member

2,649 posts Joined: Nov 2010 |

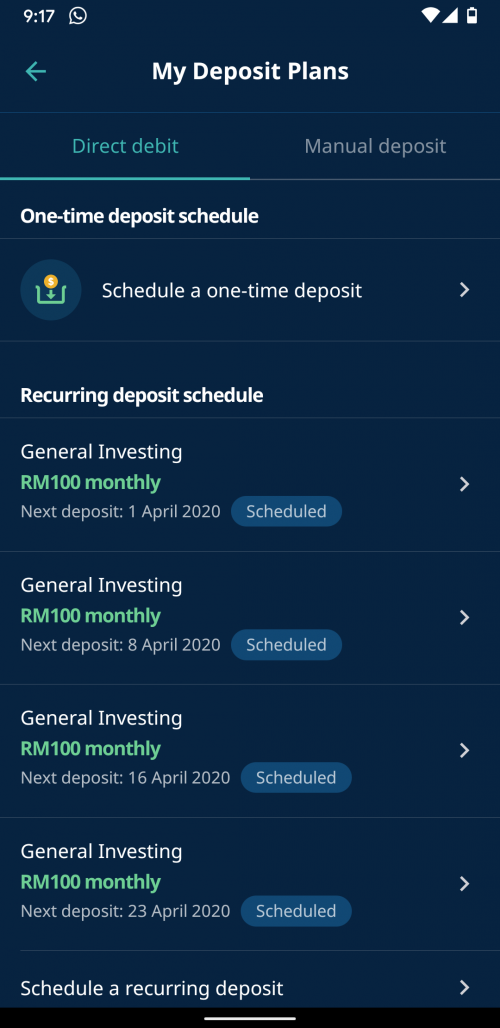

QUOTE(svchia78 @ Mar 26 2020, 09:24 PM) StashAway didn't have/ removed the option for weekly DCA. im doing manual weekly DCANow using this method to create a 'weekly' DCA automatically: -  Create 4 monthly auto deposit into the same portfolio. since sometimes will get dividend from stock might as well bump up the amount using the dividend |

|

|

Mar 28 2020, 05:58 PM Mar 28 2020, 05:58 PM

Return to original view | IPv6 | Post

#89

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(GrumpyNooby @ Mar 28 2020, 02:04 PM) Not sure how credible this article? actually what the article meant to say is investor attitude/reaction can affect the effectiveness/purpose of DCA5 Disadvantages Of Using Dollar-Cost Averaging Into A Downward Market (That Many Investors Don’t Realise) https://dollarsandsense.sg/disadvantages-us...2DNUnJt8PRPST3s dca are meant to be carry out regardless of the market condition and regardless of your personal view. but some ppl here including me will say ''i will DCA more frequently/more amount during this downturn or i will wait for the bottom only continue dca'' from the point of view DCA, that's the wrong decision/course of action as that defeat the purpose of DCA. personally, i dont think dca more or wait bottom is wrong, as long as you stay in the market and emotionally stable/unaffected. most of the time, the amount for dca are not significant enough to make a dent on the average purchasing price especially when you already in the market for a long time hence ppl argue its pointless and worthless to waste time and emotion on it. if investor are getting anxiety attack, stress, unable to sleep and any form of uneasiness due to market downturn, such investor are better off playing it safe, like FD or set up recurring DCA automatically and check on it once awhile for SA i just continue DCA weekly with higher amount, not much, only approximately 5% than normal. since its robo ai and its practically useless to time it since there's specific time frame for its buying procedure like unit trust for unit trust i am willing to sacrifice my unnecessary budget for investment, plus profit in trading stock, also price money from DMC 2nd price yo.. |

|

|

Mar 28 2020, 11:12 PM Mar 28 2020, 11:12 PM

Return to original view | IPv6 | Post

#90

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

Mar 31 2020, 01:33 PM Mar 31 2020, 01:33 PM

Return to original view | IPv6 | Post

#91

|

Senior Member

2,649 posts Joined: Nov 2010 |

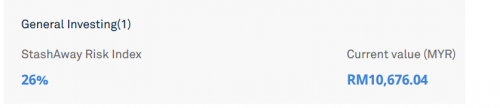

QUOTE(QQHTJ @ Mar 31 2020, 12:07 PM) speaking from 36% which highly consist of etf with no bondsif you join before the ''crash'', high chance you will in the red now. me included if you join in now, high chances are you will see the green much faster than me this is assuming that the ''crash'' are over if you join now, assuming the ''crash'' continue, high chances the red you see is lower than me we cant see the future, only prediction based on available information. invest with the money you afford to lose |

|

|

Mar 31 2020, 02:28 PM Mar 31 2020, 02:28 PM

Return to original view | IPv6 | Post

#92

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(GrumpyNooby @ Mar 31 2020, 01:37 PM) yup.. that is energythere's forummer mention it is due to the crude oil price war luckily its not huge allocation for it the saudi said they will wage another price war on april |

|

|

Mar 31 2020, 04:42 PM Mar 31 2020, 04:42 PM

Return to original view | IPv6 | Post

#93

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

|

|

|

Mar 31 2020, 10:49 PM Mar 31 2020, 10:49 PM

Return to original view | IPv6 | Post

#94

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(QQHTJ @ Mar 31 2020, 10:12 PM) bro yours insights really help me alot. thanks personally i prefer DCA for SAthere's no right or wrong, as long as you profit from it, able to sleep soundly, no stress, no panic say your strategy invest max 100k in SA. say you have 100k now and if you predict/believe the market is rock bottom now, you dont want to miss it, lump sum all in. or if you predict/believe the market will drop more and you want to catch the fall, wait or say your strategy max invest 100k in SA but you dont have 100k cash in hand now so you have no choice but to DCA monthly/weekly/quarterly until it reach 100k whichever method is up to you. its your money and you alone will need to deal with your emotion. |

|

|

Apr 1 2020, 08:49 PM Apr 1 2020, 08:49 PM

Return to original view | IPv6 | Post

#95

|

Senior Member

2,649 posts Joined: Nov 2010 |

With turmoil continuing in corporate financing markets, the Fed expanded the scope of its asset purchases under its quantitative easing program and announced four new measures to grease the commercial paper, corporate bond, and even ETF markets.

https://finance.yahoo.com/news/fed-calls-th...-120121252.html old news, approximately a week ah yes, and unlimited QE makes me wonder if the support for S&P500 will stand strong at 2.2k This post has been edited by xcxa23: Apr 1 2020, 08:52 PM |

|

|

Apr 1 2020, 10:28 PM Apr 1 2020, 10:28 PM

Return to original view | IPv6 | Post

#96

|

Senior Member

2,649 posts Joined: Nov 2010 |

https://www.facebook.com/groups/22492128117.../?flyingspaghettimonster=bookmarks

for those who are worry, join the stashaway fb group. the member consist SG and MSIA although the admin is not associate with SA but sometimes SA staff will reply in the group |

|

|

Apr 3 2020, 12:16 PM Apr 3 2020, 12:16 PM

Return to original view | IPv6 | Post

#97

|

Senior Member

2,649 posts Joined: Nov 2010 |

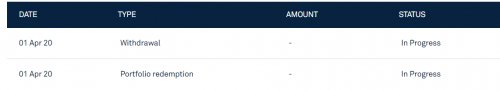

QUOTE(furious and fast @ Apr 3 2020, 09:20 AM) with the benefit of hindsight, anyone who had been doing DCA over the past few months or past few years would be in a LOSS position now. you are bravelet me give example of doing the opposite of DCA 1. i had been saving money in FD since 2019. guarantee 4% per annum. zero risk 2. i deposit 10k in stashaway on 18 march 3. i exit on 1 April. REALIZED quick n easy profit 6%.  . .  . .  SA dont have fixed procedure/processing date sometimes it took them 1 working day, sometime 2 to complete the purchase how long did they took to complete the sell? |

|

|

Apr 5 2020, 10:44 AM Apr 5 2020, 10:44 AM

Return to original view | IPv6 | Post

#98

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(stormseeker92 @ Apr 5 2020, 02:09 AM) I am wondering at what range sum of money you guys deposit and DCA monthly. For me sometimes RM200, RM250, RM500 or RM1000 (if im rich lol) tbh, im still sceptical about SA operation. no financial/sustainability report available for public, apart from their series B usd12m but thats it. how they handle it, operation cost, operating cost, earning from investor, total investor. Perfectly fine if everyone wants to keep it personal. nothing sure, our capital is hold by trustee but if SA does close down, how easy/hard to get back our capital, how long it will take. so, for now i only allocating small portion in SA. 2k-3k montly |

|

|

Apr 5 2020, 03:34 PM Apr 5 2020, 03:34 PM

Return to original view | IPv6 | Post

#99

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(MNet @ Apr 5 2020, 12:52 PM) u r right afaik, for smartly case, those investor are being absorbed by other company, including SA. not liquidate afaik.That why AUM figure is important here. If they r running on low AUM, I doubt they can survive long run. If SA closed down, its shouldn't be problem in getting back the money But I need u to think about what if SA portfolio is liquidate in a bad economy shape which mean our portfolio is in red? I suggest u take a look at SG Smartly case, they closed down during this time which mean those investor portfolio in red will not be able to recover their loss. Mind u SG Smartly is backup by vietnam deep pocket group VinaCap https://e27.co/vietnams-vinacapital-acquire...artly-20190717/ https://e27.co/company/vinacapital/ Even with the backer of VinaCap, smartly also faced the consequent of closed shop. Thing to think at, who is behind SA? Does their backer have the necessary resources to keep SA a float? ya. true enough. low AUM = low earning thru management fee |

|

|

Apr 5 2020, 04:46 PM Apr 5 2020, 04:46 PM

Return to original view | IPv6 | Post

#100

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(MNet @ Apr 5 2020, 04:31 PM) dont be so naive ah i see.. thanks for the infodo u think that the etf from smartly can be transfer to SA or syfe? answer is no way. https://invest.syfe.com/freshstart/ SA or syfe just offer the smartly client to sell their smartly portfolio and take the proceed to invest with SA or syfe. Get $10 bonus for minimum $500 invested with Syfe. Get $50 bonus for deposits above $10,000. Maximum bonus of $100 for deposits above $20,000. Valid for first deposit only. i thought it was transfer of portfolio between robo, did not know it is literally ''force selling'' damn.. need to rethink my strategy |

| Change to: |  0.4528sec 0.4528sec

0.07 0.07

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 04:01 AM |