QUOTE(T231H @ Feb 27 2020, 04:33 PM)

Just refer to Yr earlier post..... It did mention percentage of fund' assets...

Bcos you mentioned MER is a concern without taking consideration of comparison of fund size

I myself think differently...

I don't mind paying higher fees if the returns is corresponding higher too.

Return is by comparing the navs over a certain period... This navs is nett value.. Which I did not see

QUOTE(xcxa23 @ Feb 27 2020, 10:31 AM)

hence its important to find

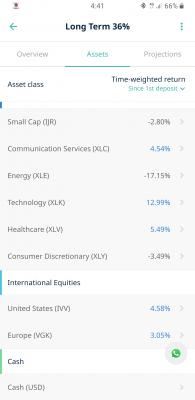

low expense ratio [B]yet high annualised return [/B]for UT

not all UT have 1.5 expense ratio

i saw lowest <0.2% to >2%

indeed i did not take fund size into consideration because i notice some UT despite having small fund size, their expense ratio is higher and their annualised return are lower comparing to those bigger fund size that have much lower expense ratio and much better annualised return

if you notice my earliest post

i did not solely mention lowest expense ratio is a must

lowest expense ratio YET with highest annualised return.

like you said,

i also dont mind paying 2% or 3% heck even 5% if the annualised return is >20% consistently

side note

remember that investor will have to pay those fee every year even if the fund have 0% growth

hence the importance of finding lowest possible expense ratio yet highest annualised return to minimise such risk

https://www.investopedia.com/ask/answers/07...es-deducted.aspThis post has been edited by xcxa23: Feb 27 2020, 08:44 PM

Feb 26 2020, 08:37 AM

Feb 26 2020, 08:37 AM

Quote

Quote

0.0413sec

0.0413sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled