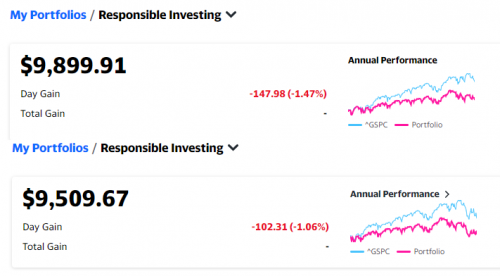

QUOTE(MUM @ Mar 9 2022, 01:01 PM)

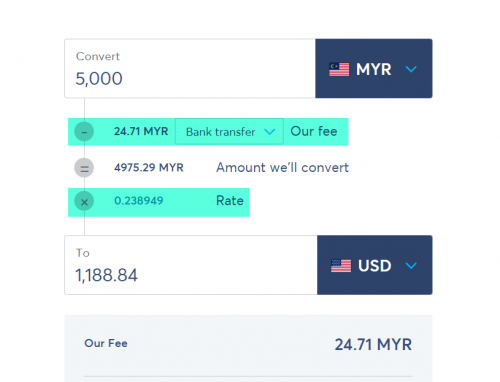

if wanna know which is more worth it. Calculate fees by Stashaway a year based on your total investment. Then compare with Wise:

https://www.stashaway.my/pricingFor Wise Fees they transparent also for both FX rate and transfer fee:

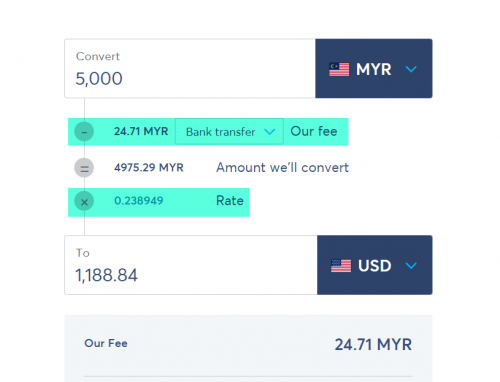

https://wise.com/my/send-money/Did an example below via Wise:

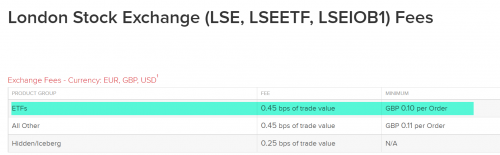

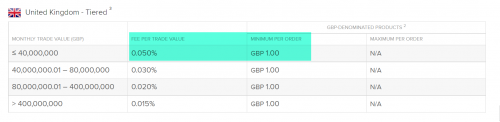

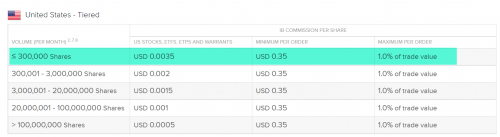

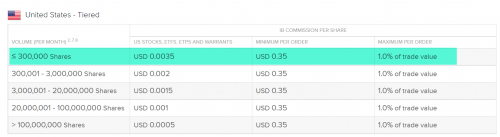

Then in IBKR got some minor fees. But all these fees only paid during buy or sell orders:

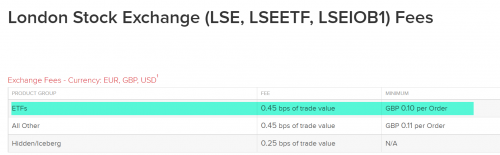

UK fees (if buy Irish Domiciled ETFs these will apply):

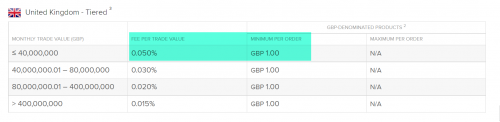

US fees (scroll down got some other fees but all are super low):

But of course DIY more steps and some people find it confusing or lazy to do it.

If you really push yourself to do it, once use to it will find it easy since all the account and transfer information already saved in your favorites. Wise will save your IBKR details after the first transfer.

Then they will give excuse they lazy monitor.. if you invest DIY long term, you don't need monitor much the first place if you pick the good stocks / ETFs. Just read news once a while to ensure you know what's going on in the world. If buy individual stocks then more work as you need to keep up to date as to how the company doing (example later CEO die affected company). Check portfolio once a month also ok. Hardworking will give you more edge in investing laa.. wanna earn money ma.

Keep checking and kanchiong not a good thing also as it might trigger you to sell and make losses. When investing need to keep your emotions in check.

Stashway pros also is got roboadvisor/fund manager help u do rebalance.. but some apps like Stashaway you have no control over what they choose to invest in, just need to follow the flow (this is why if can choose which ETFs might attract some people).

Also if use Wise transfer to IBKR, need to keep receipts also in case IBKR auditor ask, since you're using Wise which is a 3rd party to send money to IBKR. Need to prove to them that it is your savings and not illegal funds. I save all my receipts using Dropbox cloud, so phone can access anytime if they ask.

TLDR; DIY invest via IBKR cheaper, but more steps and higher learning curve, wanna buy/sell everything ownself control. Stashaway fees more expensive if compounded yearly over many years, but easy to execute buy/sell. Also Stashaway help you rebalance once a while.

oh and if you're buying ETFs, do note that ETFs also got fund managers, they will rebalance for that particular are that the ETF invests in. Example S&P500 they will rebalance between those 500 US companies in S&P depending on their performance. Imo I feel this is good enough if you choose the good ETFs.

This post has been edited by Davidtcf: Mar 9 2022, 03:01 PM

This post has been edited by Davidtcf: Mar 9 2022, 03:01 PM

Feb 10 2022, 08:28 PM

Feb 10 2022, 08:28 PM

Quote

Quote

0.4775sec

0.4775sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled