Where Is Alibaba Founder Jack Ma? What the Saga of One of the World's Richest Men Reveals About China Under Xi Jinping

https://time.com/5926062/jack-ma/

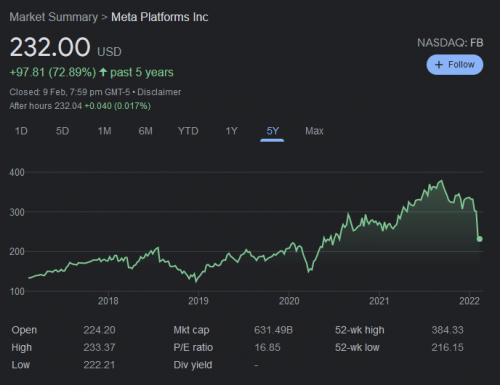

explains why Alibaba stocks went down so much also.

if I find more about China I will share..

I suspect China or KWEB or someone pulled some string to make Stashway list KWEB as its top investment for General Investing. Maybe Stashaway receive something behind close doors.. we'll never know.

ESG new portfolio now seems like damage control before more ppl pull out of Stashaway

They could put it as another Thematic portfolio, but how come put it under General Investing? hmmm that's the question..

This post has been edited by Davidtcf: Jan 27 2022, 03:53 PM

Jan 27 2022, 03:48 PM

Jan 27 2022, 03:48 PM

Quote

Quote

0.4370sec

0.4370sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled