Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

stormseeker92

|

Apr 2 2020, 08:42 PM Apr 2 2020, 08:42 PM

|

|

QUOTE(honsiong @ Apr 2 2020, 07:37 PM) Wah last time they never asked for salary + tax return. Good luck man, I had -23% in 2018 on risk 36% Expect it to be lower this year thanks to the coronavirus. Haha |

|

|

|

|

|

stormseeker92

|

Apr 2 2020, 10:37 PM Apr 2 2020, 10:37 PM

|

|

QUOTE(nickcct @ Apr 2 2020, 09:15 PM) I think this round also quite steep. Peak to bottom if not mistaken 26% but now recovered a bit. Got some potential to go even lower now that unemployment in US reached 6.6 million. DCA is the way. |

|

|

|

|

|

stormseeker92

|

Apr 3 2020, 03:33 PM Apr 3 2020, 03:33 PM

|

|

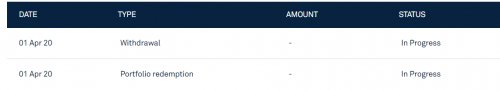

QUOTE(furious and fast @ Apr 3 2020, 09:20 AM) with the benefit of hindsight, anyone who had been doing DCA over the past few months or past few years would be in a LOSS position now. let me give example of doing the opposite of DCA 1. i had been saving money in FD since 2019. guarantee 4% per annum. zero risk 2. i deposit 10k in stashaway on 18 march 3. i exit on 1 April. REALIZED quick n easy profit 6%.  . .  . .  As far as I'm concerned you sold all on 1st of April but the stock started to plummet from 1st of March. If you still making money, good for you I guess. For us who kept on buying while it's low, and continue DCA, might see similar or higher return than 6% I guess. Whichever makes you happy man ! You still manage to make money and that's a good thing. |

|

|

|

|

|

stormseeker92

|

Apr 4 2020, 02:58 AM Apr 4 2020, 02:58 AM

|

|

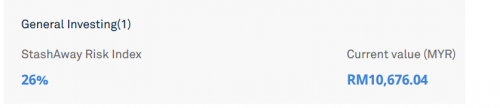

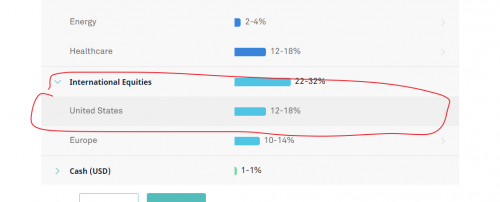

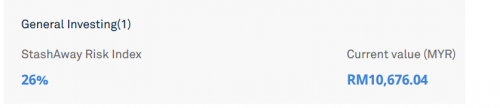

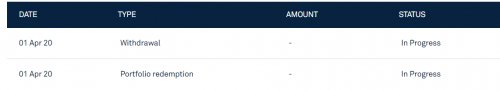

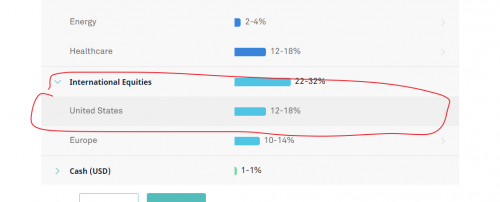

QUOTE(tadashi987 @ Apr 4 2020, 02:19 AM) I am not sure about portfolio risk 22% but maybe 22% risk profile don't have IVV. for 36% risk profile does has IVV [iShares Core S&P 500 ETF] which is variant of SPY S&P500. Try check under international equities, then click on the United States  you can learn more here on the EPF selection of SA StashAway's Fund Selection22% risk here. We have IVV with target weight of 7.5% |

|

|

|

|

|

stormseeker92

|

Apr 4 2020, 09:52 PM Apr 4 2020, 09:52 PM

|

|

QUOTE(MNet @ Apr 4 2020, 09:29 PM) my concern is low AUM then it will faced the same problem with smartly which is closed shop Do the funding announcement helps in keeping the company afloat? They release their funding amount for July 2019, not sure why so late to announce and what's the figure for 2020. |

|

|

|

|

|

stormseeker92

|

Apr 5 2020, 01:09 AM Apr 5 2020, 01:09 AM

|

|

QUOTE(xXwasabiXx @ Apr 4 2020, 11:29 PM) i just started today with risk 36 appetite. all the best. Great time to start. Im unlucky my first dump is before the market crash . sad  |

|

|

|

|

|

stormseeker92

|

Apr 5 2020, 02:09 AM Apr 5 2020, 02:09 AM

|

|

QUOTE(QQHTJ @ Apr 5 2020, 01:21 AM) I just joined back to few days ago. Hope it’s great time now since it’s very low for the moment! I am wondering at what range sum of money you guys deposit and DCA monthly. For me sometimes RM200, RM250, RM500 or RM1000 (if im rich lol) Perfectly fine if everyone wants to keep it personal. |

|

|

|

|

|

stormseeker92

|

Apr 5 2020, 03:06 PM Apr 5 2020, 03:06 PM

|

|

QUOTE(MNet @ Apr 5 2020, 12:52 PM) u r right That why AUM figure is important here. If they r running on low AUM, I doubt they can survive long run. If SA closed down, its shouldn't be problem in getting back the money But I need u to think about what if SA portfolio is liquidate in a bad economy shape which mean our portfolio is in red? I suggest u take a look at SG Smartly case, they closed down during this time which mean those investor portfolio in red will not be able to recover their loss. Mind u SG Smartly is backup by vietnam deep pocket group VinaCap https://e27.co/vietnams-vinacapital-acquire...artly-20190717/https://e27.co/company/vinacapital/Even with the backer of VinaCap, smartly also faced the consequent of closed shop. Thing to think at, who is behind SA? Does their backer have the necessary resources to keep SA a float? Anyone tried to ask abt their latest funding round and AUM? I see they release videos on advises and Q&A sessions w Freddy constantly so that's a good sign I guess? |

|

|

|

|

|

stormseeker92

|

Apr 5 2020, 03:09 PM Apr 5 2020, 03:09 PM

|

|

I'll try to ask them via whatsapp and share their response here.

|

|

|

|

|

|

stormseeker92

|

Apr 5 2020, 03:54 PM Apr 5 2020, 03:54 PM

|

|

QUOTE(xcxa23 @ Apr 5 2020, 03:34 PM) afaik, for smartly case, those investor are being absorbed by other company, including SA. not liquidate afaik. ya. true enough. low AUM = low earning thru management fee I think it's a bad sign if they do not disclose the funding and AUM numbers. Very concerning |

|

|

|

|

|

stormseeker92

|

Apr 5 2020, 06:49 PM Apr 5 2020, 06:49 PM

|

|

At least we're better off from Wahed I guess. everybody's cashing in and running away from them edi. lol

|

|

|

|

|

|

stormseeker92

|

Apr 5 2020, 07:49 PM Apr 5 2020, 07:49 PM

|

|

QUOTE(honsiong @ Apr 5 2020, 07:46 PM) Given their past positions, it's likely they have 7 figures saved up somewhere ady, usually startup founders do not draw much salaries, if any, from early stage startups unless it makes certain revenue. You only worry when people stop talking about SA on forums and in telegram channels, I have plenty of friends investing regularly with SAMY now. If they really close shop, they likely won't take your money and cabut, I have faith in Singapore rule of law. You got telegram forum for SAMY? Can I join |

|

|

|

|

|

stormseeker92

|

Apr 6 2020, 11:37 AM Apr 6 2020, 11:37 AM

|

|

Hi xxxx! Thank you for reaching out to us. For the latest funding round numbers, you can take a look at it here: https://www.stashaway.my/r/stashaway-raises...on-usd-series-b. As for our AUM, we are keeping private our AUM because by itself, it is not an indicator of whether or not we are meeting our business plan targets. We understand that it’s a business of scale, which is why our marketing strategy reflects that. It’s important to note that we have very strong, seasoned investors who have vetted the business plan, and who are comfortable with our marketing strategy and our international expansion timeline. Hope this gives you better clarity!  FYI respond from SAMY regarding funding and AUM. |

|

|

|

|

|

stormseeker92

|

Apr 6 2020, 11:40 AM Apr 6 2020, 11:40 AM

|

|

QUOTE(tehoice @ Apr 6 2020, 10:53 AM) what happened to wahed? previously i wanted to invest and so many members pm me and give me their referral code even i didnt ask for one (just speak of the possibility of joining), i wonder why. i thought it performed better than SAMY? I read they say no market movement for one whole week in the app. Plus it's getting red since Malaysia started MCO so market declines since everyone stays at home similar to other countries. Plus the withdrawal takes almost 1 week or more. People scared edi cz they think it's skim cepat kaya lol |

|

|

|

|

|

stormseeker92

|

Apr 6 2020, 11:45 AM Apr 6 2020, 11:45 AM

|

|

QUOTE(GrumpyNooby @ Apr 6 2020, 11:38 AM) So what is the conclusion? Safe? If I recalled correctly they have the Fidelity Eight Road investor joined their board of directors or advising committee in 2019. Maybe that's a good sign everything is ok for at least 1-3 years? |

|

|

|

|

|

stormseeker92

|

Apr 6 2020, 11:59 AM Apr 6 2020, 11:59 AM

|

|

QUOTE(B500 @ Apr 6 2020, 11:56 AM) Haha for those who are paranoid about this and that, and about SA closing shop, like mentioned above, no single investment vehicle is risk free. If you want totally risk free, then just keep your money under your pillow.. 😂 Your money under pillow is safe? Mine also have risk people steal lol |

|

|

|

|

|

stormseeker92

|

Apr 6 2020, 12:47 PM Apr 6 2020, 12:47 PM

|

|

I expect US & Europe market will go even lower for the next few weeks. Only in end of May or June can see market rebound

|

|

|

|

|

|

stormseeker92

|

Apr 6 2020, 12:58 PM Apr 6 2020, 12:58 PM

|

|

QUOTE(GrumpyNooby @ Apr 6 2020, 11:24 AM) I made a deposit via JomPay on last Thursday morning. The deposit just converted to USD this morning.  Depends on what time you transferred the money. The CS told me it gonna take 3-5hrs to reach their account. Then have to convert to USD and then send to their broker. And their broker will buy the ETF. Gonna take around 3-4 business days i guess. |

|

|

|

|

|

stormseeker92

|

Apr 6 2020, 01:25 PM Apr 6 2020, 01:25 PM

|

|

QUOTE(skeith @ Apr 6 2020, 01:24 PM) My uncle keep his hard earn money under bed, pure cash, n few hundreds thousands. At least 20% ate by ants and bank dont wan exchange due to number dah incomplete. Can PM me his address so I can help him protect the cash from unwanted people haha jk jk |

|

|

|

|

|

stormseeker92

|

Apr 7 2020, 12:02 AM Apr 7 2020, 12:02 AM

|

|

QUOTE(seiluen @ Apr 6 2020, 08:52 PM) please share with us after get the answer  Already asked their CS thru Whatsapp or email? |

|

|

|

|

Apr 2 2020, 08:42 PM

Apr 2 2020, 08:42 PM

Quote

Quote

0.0438sec

0.0438sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled