Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

stormseeker92

|

Mar 28 2020, 02:12 PM Mar 28 2020, 02:12 PM

|

|

QUOTE(GrumpyNooby @ Mar 28 2020, 02:04 PM) Not sure how eligibility this article? 5 Disadvantages Of Using Dollar-Cost Averaging Into A Downward Market (That Many Investors Don’t Realise)https://dollarsandsense.sg/disadvantages-us...2DNUnJt8PRPST3sWell the article mentions mostly DCAing into non-performing stocks (which is always a bad idea) and DCA vs Lump sump (timing the market). Not really a good indicator that DCAing is bad. Correct me if I am wrong. |

|

|

|

|

|

stormseeker92

|

Mar 28 2020, 10:08 PM Mar 28 2020, 10:08 PM

|

|

QUOTE(kelvinfixx @ Mar 28 2020, 09:33 PM) If you invested in stashaway, don't treat it like share market. Well majority of my assets are invested in US market so US stock market would definitely affect it. No harm in following the stock markets right |

|

|

|

|

|

stormseeker92

|

Mar 28 2020, 11:26 PM Mar 28 2020, 11:26 PM

|

|

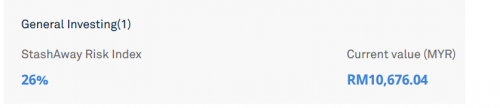

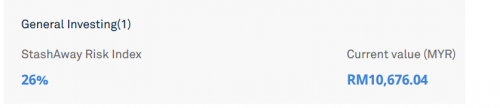

QUOTE(xcxa23 @ Mar 28 2020, 11:12 PM) afaik, 36% eft are mostly tracking the s&p500 index, apart from the europe etf Based on the asset categories; US Equities : 45%International Equities: 18.5% Gov Bonds: 20.50% Commodities (Gold): 15% USD: 1% Risk: 22% Big chunk is tracking US markets. So definitely it affects my portfolio. |

|

|

|

|

|

stormseeker92

|

Mar 29 2020, 01:17 PM Mar 29 2020, 01:17 PM

|

|

QUOTE(kelvinfixx @ Mar 29 2020, 10:25 AM) #5 Able To Generate Much Higher Returns If You Can Accurately Spot Investment Themes Who is able to spot it? No one. lol. even billionaires cannot time the market. |

|

|

|

|

|

stormseeker92

|

Mar 29 2020, 05:36 PM Mar 29 2020, 05:36 PM

|

|

QUOTE(tadashi987 @ Mar 29 2020, 04:41 PM) somehow feel SA should announce their past year performance that would be great as a indicative performance reference to others hehe Did they share the 2018 performance in 2019? |

|

|

|

|

|

stormseeker92

|

Mar 29 2020, 08:39 PM Mar 29 2020, 08:39 PM

|

|

QUOTE(kelvinfixx @ Mar 29 2020, 08:29 PM) I think this year, it won't perform as good as last 2 years. Obviously. No significant issues for the past two years. and this year? you got covid, you got covid everyone got covid. *insert oprah meme* |

|

|

|

|

|

stormseeker92

|

Mar 30 2020, 06:22 PM Mar 30 2020, 06:22 PM

|

|

QUOTE(!@#$%^ @ Mar 29 2020, 08:59 PM) may affect our currency strength since we are converting money here We want MYR to go stronger against USD so we can buy more shares per MYR. |

|

|

|

|

|

stormseeker92

|

Mar 30 2020, 10:40 PM Mar 30 2020, 10:40 PM

|

|

QUOTE(!@#$%^ @ Mar 30 2020, 06:30 PM) Hello everyone. let say if you have 1000. Would it be better to DCA every month once (RM1000), every two weeks (RM500x2), or every week (RM250x4)? What's your DCA strategy? How many percent of your monthly earning goes to Investments? |

|

|

|

|

|

stormseeker92

|

Mar 31 2020, 12:33 AM Mar 31 2020, 12:33 AM

|

|

QUOTE(watabakiu @ Mar 31 2020, 12:00 AM) How to cancel scheduled deposit? i accidentally put more zero ahahah Guys look at the rich boi here. lol |

|

|

|

|

|

stormseeker92

|

Mar 31 2020, 01:26 AM Mar 31 2020, 01:26 AM

|

|

QUOTE(victorian @ Mar 31 2020, 12:52 AM) I DCA RM300 monthly, just started two months ago, not sure if I should increase the amount since the market is in the red now. But I think more importantly I should have the bullet to hold for long. I am planning to continue DCA same amount each week/month but the cheap prices are making me crazy lol |

|

|

|

|

|

stormseeker92

|

Mar 31 2020, 04:05 PM Mar 31 2020, 04:05 PM

|

|

QUOTE(d-realm @ Mar 31 2020, 01:44 PM) must be XLE  Yeap. oil prices damn cheap now. LOL Im interested in XLK but my 22% risk portfolio doesnt have that.  This post has been edited by stormseeker92: Mar 31 2020, 04:11 PM This post has been edited by stormseeker92: Mar 31 2020, 04:11 PM |

|

|

|

|

|

stormseeker92

|

Mar 31 2020, 04:47 PM Mar 31 2020, 04:47 PM

|

|

It would be wonderful if we can customize our own stocks and allocation or at least remove and add 1/2 ETFs we want and don't want.

|

|

|

|

|

|

stormseeker92

|

Mar 31 2020, 10:35 PM Mar 31 2020, 10:35 PM

|

|

QUOTE(QQHTJ @ Mar 31 2020, 10:12 PM) bro yours insights really help me alot. thanks  so the community of stashaway here prefers one time deposit or DCA basics? any differences if for long term investment? And how long you guys will stick with SA? DCA is the way to go since nobody can time the market. But for me I'll pump a bit extra when the stock is quite cheap now. When it recovers will continue DCA fixed amount. Plan to stay for 3-5 years. |

|

|

|

|

|

stormseeker92

|

Apr 1 2020, 02:14 PM Apr 1 2020, 02:14 PM

|

|

QUOTE(furious and fast @ Apr 1 2020, 11:36 AM) i put in 10k on 18 march. 6% return on paper.  Damn rich boi. My total investment is only RM2.5k so far lol |

|

|

|

|

|

stormseeker92

|

Apr 1 2020, 03:29 PM Apr 1 2020, 03:29 PM

|

|

QUOTE(Leo the Lion @ Apr 1 2020, 03:07 PM) World Bank reduce Malaysia GDP growth target, IMF said we're in recession. So better stop inmho Investment is preferably using money you can afford to lose. If you dont have cash to support your daily lives, then stop. If you have more than enough, this time is a good time to buy I guess..  This post has been edited by stormseeker92: Apr 1 2020, 03:41 PM This post has been edited by stormseeker92: Apr 1 2020, 03:41 PM |

|

|

|

|

|

stormseeker92

|

Apr 1 2020, 04:52 PM Apr 1 2020, 04:52 PM

|

|

QUOTE(kelvinfixx @ Apr 1 2020, 03:48 PM) I already have a 6months contingency savings put aside for now. How much of my disposable money would you suggest me to put in savings and SA? 1:1? or 1:2 or all in investment? I don't really worry about the next 6 months since I already have enough to get by plus my monthly income. |

|

|

|

|

|

stormseeker92

|

Apr 1 2020, 05:05 PM Apr 1 2020, 05:05 PM

|

|

QUOTE(QQHTJ @ Apr 1 2020, 05:03 PM) I just deposit and plan to continue DCA bi weekly basics...why stop? Market seems lower compare to back few months. Is right timing right? And what I understood SA is not about timing, it’s long term investment. True but make sure you have at least 6 months savings first, so you dont choke if your investment go south. |

|

|

|

|

|

stormseeker92

|

Apr 1 2020, 06:39 PM Apr 1 2020, 06:39 PM

|

|

QUOTE(infrasonic @ Apr 1 2020, 06:34 PM) Just curious, how legit is Stashaway in terms of long term investment? I don't mind losing some of my investment but what actually happens if the company goes bankrupt or it is a scam from the start? If this is legit thing like a mutual fund where the only risk is them making bad investment and losing some of the money I might put most of my FD savings into Stashaway as I won't be needing the money in at least 5 years time. We just discussed this a few days back. actually Stashaway has a trustee account with Saxo Capital Markets. So if they go under, our money stays with the trustee and there should be some arrangement for them to sell our stocks and return back the money to us. Stashaway cant touch our money in the trustee account. Correct me if I'm wrong.  |

|

|

|

|

|

stormseeker92

|

Apr 2 2020, 02:10 PM Apr 2 2020, 02:10 PM

|

|

DCA is the opposite of timing the market. If you dont follow the market news closely, hence you will not know when the market is in the tough spot (timing the market), so DCA erases the need to time the market by separating the time you purchase the stocks regardless of price which in the end averages out the price when you bought during low or high prices.

Lump sump is good if you are confident that the market is at it's low that if you go all in you can still make money.

Anyways, either one is a good strategy but if you dont know when is the best time to buy, DCA is the way.

|

|

|

|

|

|

stormseeker92

|

Apr 2 2020, 02:15 PM Apr 2 2020, 02:15 PM

|

|

QUOTE(honsiong @ Apr 2 2020, 02:03 PM) I am doing B. Reason is it smoothes out the DCA a lot better than A, coz it triggers rebalancing enough to make sure your portfolio stays close to the intended allocation. However in long run it probably doesn’t matter as long as you don’t panic sell or stop buying. Those who are easily spooked into panic selling is the ones who always loses money imho. Didn't take advantage of dividend and also didnt let the investment grow. |

|

|

|

|

Mar 28 2020, 02:12 PM

Mar 28 2020, 02:12 PM

Quote

Quote

0.2809sec

0.2809sec

1.48

1.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled