QUOTE(encikbuta @ Jul 25 2020, 08:43 AM)

looking at the snapshot, the 20% GLD weightage in our 36% portfolio managed to cushion the drop yesterday.

that said tho i am still a gold hater, haha! GLD is an awesome asset to hold now when the economy is so unsure of itself. but once this all blows over, GLD will just go back to being stagnant and other EQ will begin to rise at a higher rate.

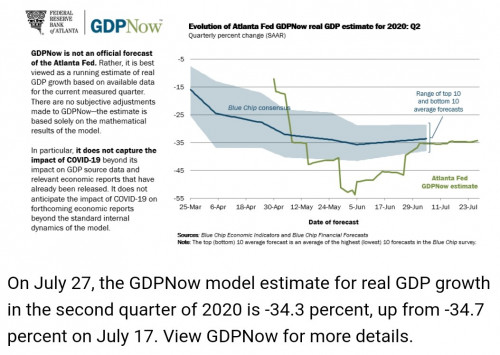

however, maybe it makes sense for a dynamic model like STASHAWAY to hold GLD right now. later when the economy recovers, STASHAWAY would pandai pandai switch back to full EQ portfolio. so we're kinda depending on their system to time the market.

Being stagnant might not be too bad, but what if the money put into gold right now is mirroring the event at mid-end 2011, anyone catching the gold train during that time would have been bleeding for quite some time before recovering it back this eyar. that said tho i am still a gold hater, haha! GLD is an awesome asset to hold now when the economy is so unsure of itself. but once this all blows over, GLD will just go back to being stagnant and other EQ will begin to rise at a higher rate.

however, maybe it makes sense for a dynamic model like STASHAWAY to hold GLD right now. later when the economy recovers, STASHAWAY would pandai pandai switch back to full EQ portfolio. so we're kinda depending on their system to time the market.

For the gold lover, none of the equity stay depressed for such a period, even great depression has it own bull run within the great crisis. Of course there are exception such as nikkei

Jul 25 2020, 09:00 AM

Jul 25 2020, 09:00 AM

Quote

Quote

0.0432sec

0.0432sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled