Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

backspace66

|

Jun 17 2020, 05:06 PM Jun 17 2020, 05:06 PM

|

|

QUOTE(honsiong @ Jun 17 2020, 11:48 AM) You can reject them? I gonna wait and see if they will eventually force you to switch over, coz its costly for them to trade for minorities that stay behind. Yes, i did reject the reoptimization. If they intend to switch me over they will not invest based on these allocation for fresh fund |

|

|

|

|

|

backspace66

|

Jun 17 2020, 08:12 PM Jun 17 2020, 08:12 PM

|

|

QUOTE(xcxa23 @ Jun 17 2020, 06:26 PM) looks like 36%? SA did bought back what some of what they sold the last time they re-optimised https://forum.lowyat.net/index.php?showtopi...&#entry97077706Yes 36% risk, the allocation prior to recommended reoptimization few month ago i guess |

|

|

|

|

|

backspace66

|

Jun 20 2020, 02:38 AM Jun 20 2020, 02:38 AM

|

|

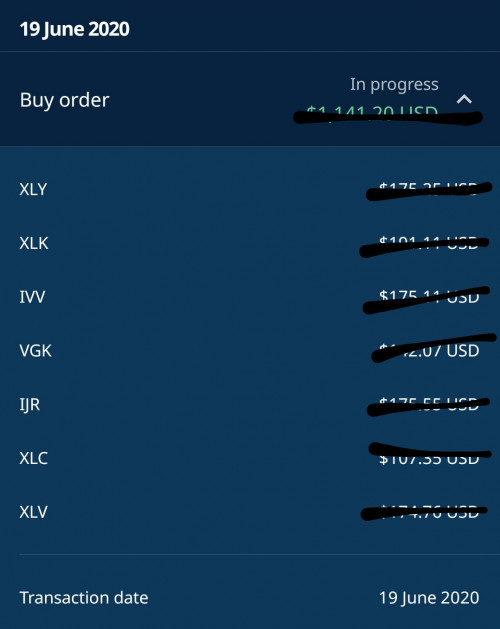

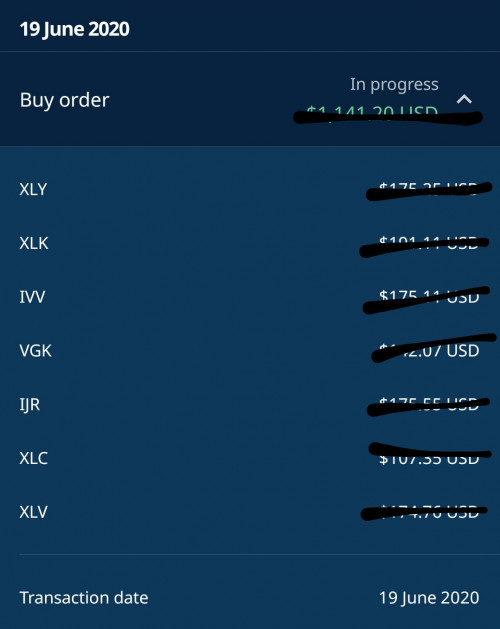

QUOTE(abcn1n @ Jun 19 2020, 10:52 PM) You are lucky then. I read from here that ultimately you have to accept because it makes no economical sense for SA to maintain the 'old' settings/portfolio'. That's why I accepted the optimisation. Sigh! Should have wrote to SA and asked for confirmation. I see no problem for XLY, XLV and IJR since those are part of the bulk of other portfolio. What i can see as well , they are no longer executing any buy for XLE(at least for my case), and almost 20% of fresh fund was not allocated to any investment (in cash) for 2-3days after confirmation on the deposit. Although 80% of the fresh fund is executed on day 1 itself. Btw, this is latest deposit. 80++% allocated to US market.  This post has been edited by backspace66: Jun 20 2020, 08:22 AM This post has been edited by backspace66: Jun 20 2020, 08:22 AM |

|

|

|

|

|

backspace66

|

Jun 20 2020, 11:24 AM Jun 20 2020, 11:24 AM

|

|

QUOTE(woonsc @ Jun 20 2020, 10:49 AM) China allocation is good thou, don't you want to switch? And woah haha I can see 5k lump sum.. That is for my second portfolio which is at 36% risk as well, i am trying to adjust my exposure to certain market, since we are not allowed to do so as the target weightage is fixed by SA. So my workaround is multiple portfolio. |

|

|

|

|

|

backspace66

|

Jun 21 2020, 04:49 AM Jun 21 2020, 04:49 AM

|

|

QUOTE(abcn1n @ Jun 20 2020, 11:36 PM) I see. Your 2nd portfolio is it with optimization? If no optimization, then if both portfolios at 36% risk, wouldn't they be investing in exactly the same things? I thought all portfolios either have to be with optimization or both without optimization? This is how i workaround the systrn; no auto optimization, whenever there is a reoptimization suggested by SA, i will review and if i dont like it, then reject it. Afterward create another portfolio ,if u create another new portofolio after the recommendation of reoptimization,then it will follow the new one(again only for the new portofolio). The original portfolio stays the same. And then if you want to adjust exposure to this newer portfolio you can just transfer between the portfolio, basically transfer within SA. |

|

|

|

|

|

backspace66

|

Jun 23 2020, 01:20 PM Jun 23 2020, 01:20 PM

|

|

Divident entitlement for VGK, XLC, XLK, XLV and XLY in progress.

|

|

|

|

|

|

backspace66

|

Jun 23 2020, 01:34 PM Jun 23 2020, 01:34 PM

|

|

QUOTE(honsiong @ Jun 23 2020, 01:27 PM) Waiting for dividend tax reimbursements. 04 Oct for 2018, 17 Jun for 2019, not sure when will they do tax refund this year. Wow, back to oct 2018? I believe this is since the inception of SA Malaysia right? Curious to know how much of the 30% WHT we can actually get back. |

|

|

|

|

|

backspace66

|

Jun 23 2020, 01:39 PM Jun 23 2020, 01:39 PM

|

|

QUOTE(zhuanko @ Jun 23 2020, 01:32 PM) I noticed some of my friends on USD denomination is performing quite well and mine is - with GBP denomination. We have the same risk and same amount, and invested on the same week. So folks, anyone can shed some lights on GBP performance vs USD performance if you know any? I know this is for long term but generally market is quite OK this week, I was expecting + for GBP but it isn't. Can you share what is currently listed under asset allocation for GBP denomination account? Only way to know is to see the ETF assigned under your portfolio based on risk selected. This post has been edited by backspace66: Jun 23 2020, 01:40 PM |

|

|

|

|

|

backspace66

|

Jun 23 2020, 01:52 PM Jun 23 2020, 01:52 PM

|

|

QUOTE(honsiong @ Jun 23 2020, 01:49 PM) No, 2017 was the starting of stashaway singapore, I worked in SG. Yes, 30% withholding taxes on bonds that is, not equities. Thanks man, so no way to get back the WHT for equities. What a bummer |

|

|

|

|

|

backspace66

|

Jun 23 2020, 02:03 PM Jun 23 2020, 02:03 PM

|

|

QUOTE(encikbuta @ Jun 23 2020, 01:55 PM) haha was about to say the same as well! my holdings are almost full on equities as far as i can remember. no goodies for us  Must be on equities for the riskier profile. Nevermind, still capital appreciation is what i am gunning for and this is just extra, but still would be nice if can get some back. Haha. |

|

|

|

|

|

backspace66

|

Jun 24 2020, 01:41 PM Jun 24 2020, 01:41 PM

|

|

If anyone still using the previous version portfolio for 36% risk, some info for you guys. SA finally buy XLE after more than a week of tranferring fresh fund. I know it doesnt matter much though given the small weightage.

|

|

|

|

|

|

backspace66

|

Jun 25 2020, 08:03 AM Jun 25 2020, 08:03 AM

|

|

QUOTE(responsible poster @ Jun 25 2020, 12:21 AM) just deposited. still got 2-3 days til my funds appear pls pls pls ride out this wave Did you link your bank account to SA? If you did, then from my experience, the bulk of the fund will be invested in the next working day. |

|

|

|

|

|

backspace66

|

Jun 25 2020, 11:33 AM Jun 25 2020, 11:33 AM

|

|

Firstly if anyone trying to get in during the dip. It would be good if one compares the amount to be put in relative to the total investment, if it is just 1-5% of the investment amount , it might not even worth the extra effort. It is just a slight dip and if combined with negligible (in term of percentage) of fund being transferred, it might not even be worth your time and effort.

|

|

|

|

|

|

backspace66

|

Jun 25 2020, 11:35 AM Jun 25 2020, 11:35 AM

|

|

QUOTE(xcxa23 @ Jun 25 2020, 11:29 AM) kinda inaccurate statement [attachmentid=10522917] if you bought the UT on 5th of june as per 24th jun nav, you are incurring losses That is distribution of dividend. It is a money market fund afterall with monthly distribution. |

|

|

|

|

|

backspace66

|

Jun 28 2020, 06:12 PM Jun 28 2020, 06:12 PM

|

|

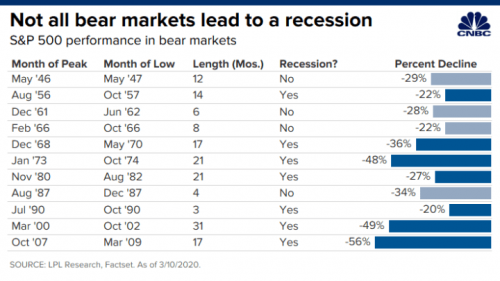

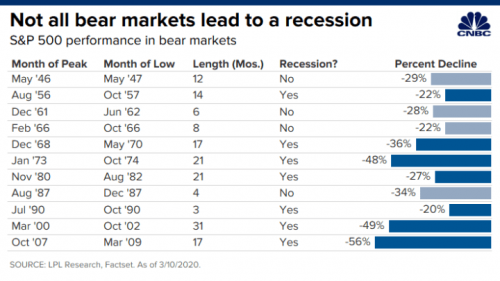

QUOTE(cyanbleu @ Jun 28 2020, 04:58 PM) I'd like to think no investments are risk free.. with the exception of FD. They mentioned volatility, but with no clear elaboration. According to the introductory post, I understand the higher the risk profile, the higher the projected returns. And you were right, these 'expected returns' are definitely higher than FD rates (even ASB for that matter). However, in the unfortunate event that the markets go downhill, what kinds of losses am I looking at if I set my risk profile to be, say, 20%? The website says if your profile is set at 20% there's a 1% chance you have 20% losses, which sounds pretty alarming.. Let me know if I misunderstood incorrectly.. Am i correct to believe that you never invested in equity or stock market before, you can actually lose all your money if the company goes bankrupt and delisted. Of course that is by using cash account and not even talking about margin account yet, but that is irrelevant in this context. As you know most of the portfolio with the higher risk is tied to equity and as you can see from the table below studying past bear market or recession, the drop is extensive for the broad market like s&p 500, the effect on individual etf could be even greater for example the small cap etf or lesser for example etf tied to healthcare.  This post has been edited by backspace66: Jun 28 2020, 07:18 PM This post has been edited by backspace66: Jun 28 2020, 07:18 PM |

|

|

|

|

|

backspace66

|

Jun 28 2020, 06:17 PM Jun 28 2020, 06:17 PM

|

|

Most FD is protected by PIDM though, at least up to 250k per bank.

|

|

|

|

|

|

backspace66

|

Jul 1 2020, 05:19 AM Jul 1 2020, 05:19 AM

|

|

SA is also getting inconsistent and slow in time to deposit compared to my previous experience. Although cant fault them they did say 2-3 business days and anything faster is just your lucky day.

|

|

|

|

|

|

backspace66

|

Jul 4 2020, 04:25 PM Jul 4 2020, 04:25 PM

|

|

If you are bumi and have access to ASB , I really don't recommend to put emergency fund in stashaway. Unless you set aside a portion for emergency fund in ASB, the balance then could be invested. The emergency fund is up to individual, but for me it has always been at least 2 years of comittment and expenses. Any additional fund on top this will be invested somewhere else.

Reasoning is if you deposit let say 200k in ASB, you will still be able to withdraw at least 200k in the foreseeable future if needed.

|

|

|

|

|

|

backspace66

|

Jul 6 2020, 12:30 PM Jul 6 2020, 12:30 PM

|

|

QUOTE(stormseeker92 @ Jul 5 2020, 08:38 PM) Nah. even with the cases in US still sky high, I think Feds has interfere enough. Already few weeks without any policy bazookas, and business started to open again. Payroll report also increased significantly. I think it'll just go upwards from now on. (Unless the Swine Flu hits like Covid-19 2.0) Just kinda sad cuz we have both equities and gold in the portfolios, but when one appreciates, the other depreciates. Like tug of war. I agree with this, but i understand why they combined IJR especially with gold etf, they want to limit the downside in case of adverse event. But the bad thing is they also limit the upside but as a new company they might not be able survive the bad publicity of giving a really bad return if that happens. They did say for a given risk percentage there is 1 % chance of losing more than that in any given year, but still it could put off people from investing. It is really a good thing in my opinion for never accepting the auto optimization which lead to me having 80++ % in US equity based on the previous iteration. Just to be clear i also have small percentage in the new iteration with KWEB ,gold,reit. |

|

|

|

|

|

backspace66

|

Jul 6 2020, 03:50 PM Jul 6 2020, 03:50 PM

|

|

QUOTE(joshtlk1 @ Jul 6 2020, 01:01 PM) So you have 2 different portfolio with same risk index? One with optimization and one without? Yes, that is correct. I have 2 different portfolio at 36% risk and both without optmization. I have clarified with SA regarding this, they do not have a feature for optimization based on per portfolio basis, it is more towards per user basis. The way i navigate through this is by rejecting optmisation whenever new iteration comes and then create a second portfolio. This new portfolio is with the new iteration. If i changed my mind later on, i can just transfer manually between the older iteration and the newer iteration. The older portfolio still exist if you reject the optimisation. This post has been edited by backspace66: Jul 6 2020, 03:51 PM |

|

|

|

|

Jun 17 2020, 05:06 PM

Jun 17 2020, 05:06 PM

Quote

Quote

0.4188sec

0.4188sec

0.18

0.18

7 queries

7 queries

GZIP Disabled

GZIP Disabled