Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

abcn1n

|

Apr 10 2020, 09:07 PM Apr 10 2020, 09:07 PM

|

|

QUOTE(mister 288 @ Apr 10 2020, 08:59 PM) you mean you cannot directly transfer funds between 2 different investment portfolios ? you can only withdraw from portfolio 1 into your bank account, then transfer from your bank account into portfolio 2 ? I am talking about opt in for reoptimisation. Not talking about transfer between funds |

|

|

|

|

|

abcn1n

|

Apr 12 2020, 08:12 PM Apr 12 2020, 08:12 PM

|

|

QUOTE(stormseeker92 @ Apr 12 2020, 05:29 PM) Well you invest what you can afford to lose. Meaning what you invest, better off assuming everything lost already, that how i create piece of mind. But if you dump RM100k during the stock crash right now, man you're gonna be filthy rich when it goes back up in 1 or 2 years. I'd definitely pump in more if I have extra If really guarantee can be rich in 1-2 years by dumping RM100k now, I will dump it.  But...nobody have a crystal ball. Can get much worse. Anyway, just joking only |

|

|

|

|

|

abcn1n

|

Apr 13 2020, 01:05 AM Apr 13 2020, 01:05 AM

|

|

QUOTE(stormseeker92 @ Apr 12 2020, 08:38 PM) Over the past 20 30 years the stock market always recovered and achieved new highs regardless of how long it took (1/2/3 years).  You must be dumping a lot of $ in the stock market then  |

|

|

|

|

|

abcn1n

|

Apr 13 2020, 02:20 PM Apr 13 2020, 02:20 PM

|

|

QUOTE(stormseeker92 @ Apr 13 2020, 01:50 PM) How I wish I can invest a lot. LOL Btw S&P Futures opened in Red. so might see some dip today Just invest what you can then. All the best in your investments |

|

|

|

|

|

abcn1n

|

Apr 18 2020, 12:37 PM Apr 18 2020, 12:37 PM

|

|

My stashaway still negative when it comes to USD. Sigh!

|

|

|

|

|

|

abcn1n

|

Apr 18 2020, 03:22 PM Apr 18 2020, 03:22 PM

|

|

QUOTE(GrumpyNooby @ Apr 18 2020, 01:33 PM) Yes, in term of USD, TWR is still negative. Both my TWR and MWR still negative for USD risk 8% |

|

|

|

|

|

abcn1n

|

Apr 19 2020, 04:20 PM Apr 19 2020, 04:20 PM

|

|

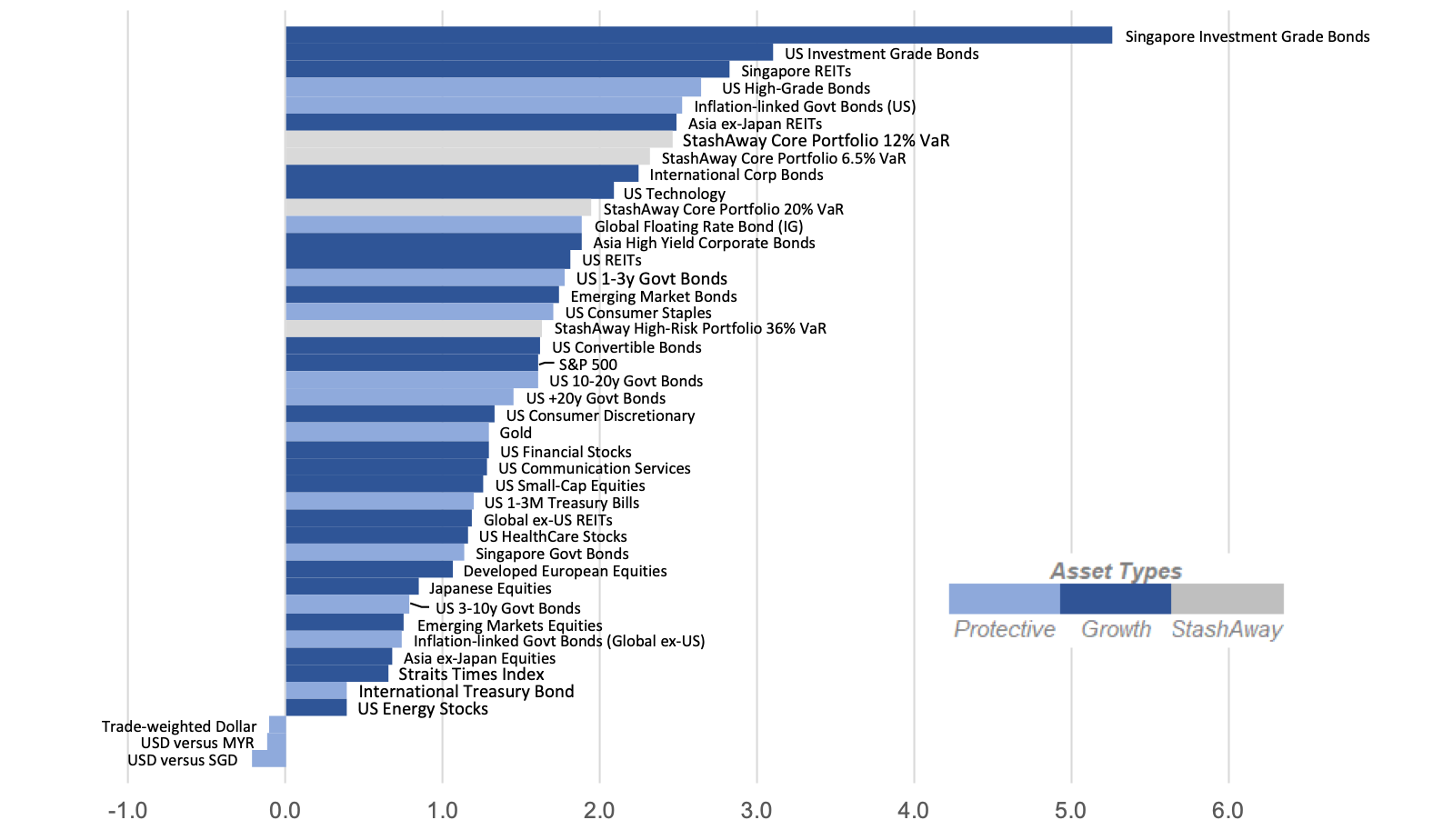

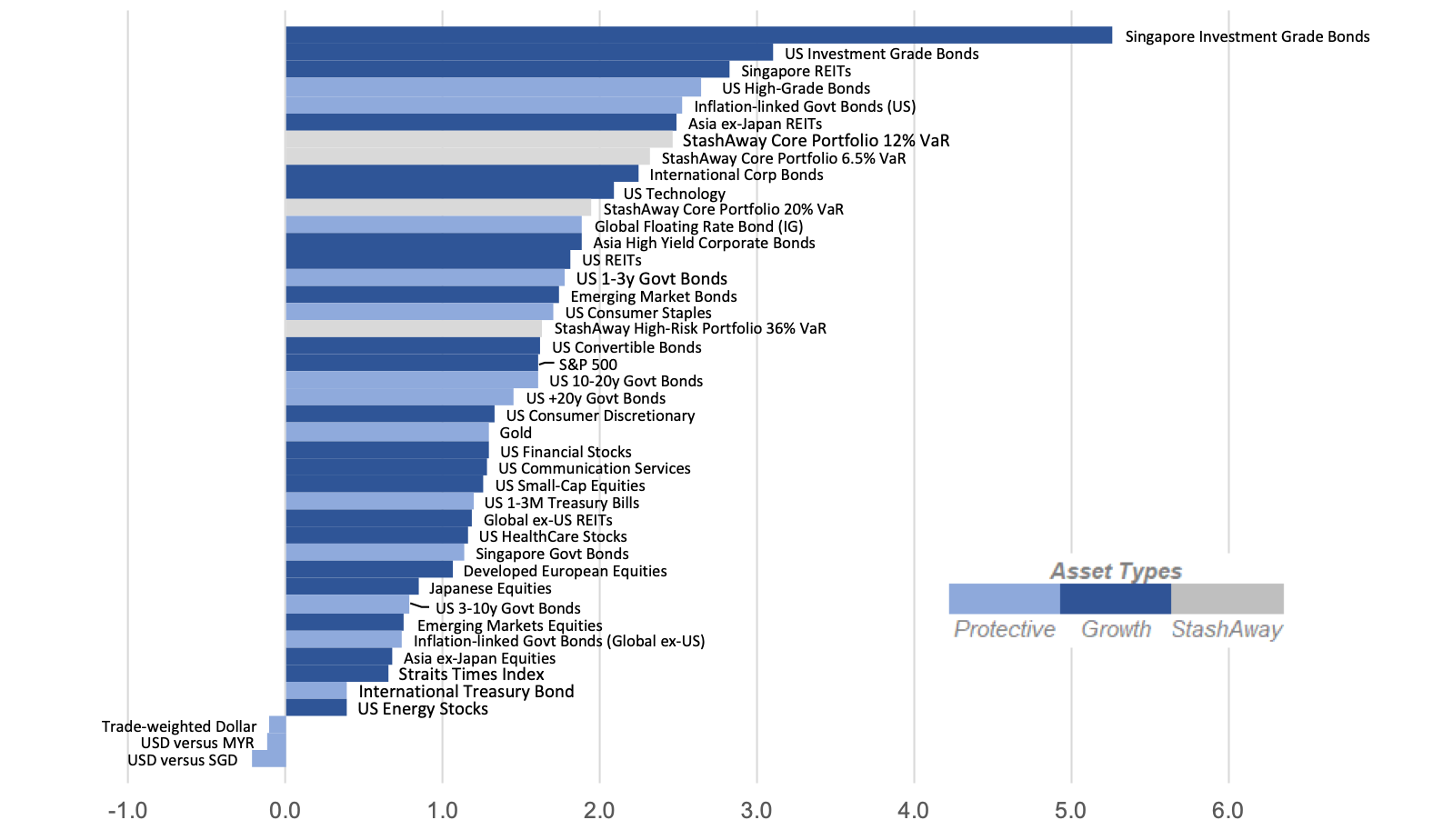

QUOTE(Ancient-XinG- @ Apr 19 2020, 04:12 PM) I got 8 18 36 8 and 36 is top performance. At max performance since last drop. Gained back all lost ad. At ++ 18 is the worst. Only able to gained all lost but not gain yet. As 8% compare to Ambond, opus touch, nomura. 8% already back to +10. While local fi just started to breakeven SAMY is usd some more If compare myr to myr SAMY 8 ad +16% as today LOL I have 8 and 30. My 30 is better than 8. When the economy better, I will likely shift 8 to 36 QUOTE(honsiong @ Apr 19 2020, 02:11 PM) See https://www.stashaway.sg/r/looking-ahead-at...-investor-guide 36% isn't always worth choosing, I think the 10%-20% var range makes more sense. Thanks for the above. So what's your rationale for having SGD vs MYR portfolio? This post has been edited by abcn1n: Apr 19 2020, 04:21 PM |

|

|

|

|

|

abcn1n

|

Apr 19 2020, 10:56 PM Apr 19 2020, 10:56 PM

|

|

QUOTE(honsiong @ Apr 19 2020, 08:13 PM) I dont understand. They are the same. You are depositing in SGD and if you withdraw $ from SA, you will be paid in SGD right? Why did you choose SGD instead of RM, that's my question. Is there any advantage? This post has been edited by abcn1n: Apr 19 2020, 10:57 PM |

|

|

|

|

|

abcn1n

|

Apr 20 2020, 12:29 AM Apr 20 2020, 12:29 AM

|

|

QUOTE(honsiong @ Apr 19 2020, 11:26 PM) I work in Singapore and they launched there long time ago. Oh, I see. Thanks |

|

|

|

|

|

abcn1n

|

Apr 22 2020, 12:50 AM Apr 22 2020, 12:50 AM

|

|

QUOTE(Drian @ Apr 21 2020, 09:14 PM) Does anyone have any breakdown on the portfolio for Stashaway lowest risk settings? I'm planning to use Stashaway lowest risk settings sort of like an FD in USD, assuming Stashaway puts the money in US Bonds. Wouldn't US bonds interest be low? Not sure what's the duration of the bond but interest rate in Malaysia would certainly be higher than USA. Plus the loss in exchange rate from converting MYR to USD when depositing and vice versa when withdrawing will kill one's profits |

|

|

|

|

|

abcn1n

|

May 4 2020, 10:08 PM May 4 2020, 10:08 PM

|

|

QUOTE(stormseeker92 @ May 4 2020, 10:03 PM) I split 2 times a week now.  2 x a week or 2x a month? 2 x a week is like overkill This post has been edited by abcn1n: May 4 2020, 10:09 PM |

|

|

|

|

|

abcn1n

|

May 4 2020, 10:11 PM May 4 2020, 10:11 PM

|

|

QUOTE(stormseeker92 @ May 4 2020, 10:10 PM) 2x a week. Still better than the daily DCA dude. HAHAHA Wah, really so often. Well, if you can afford the $, then 2x a week is really good. This will ensure you do not miss the delicious price drop if it happens |

|

|

|

|

|

abcn1n

|

May 14 2020, 05:30 PM May 14 2020, 05:30 PM

|

|

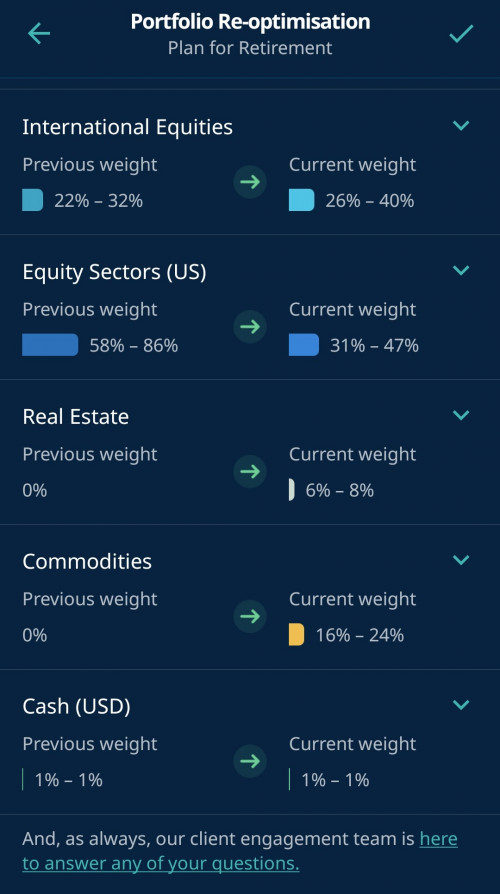

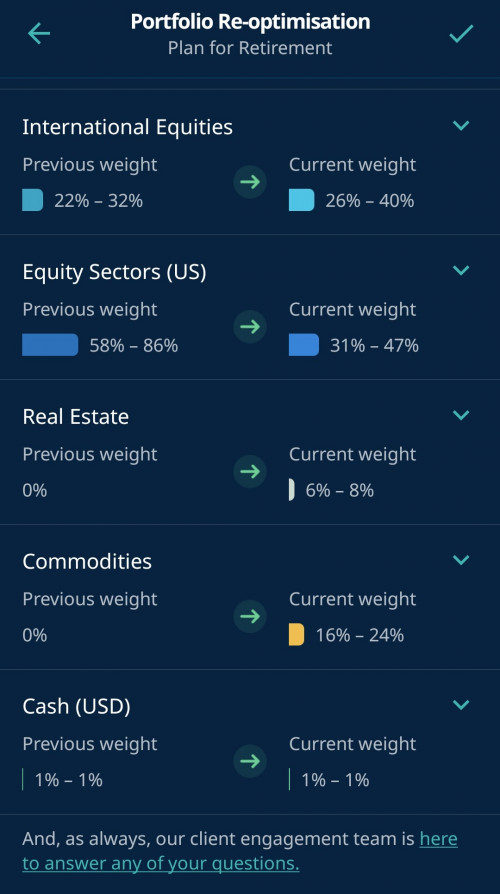

Guess we are forced to reoptimize. I actually turned it off but then they sent me an email asking me to turn it on. Really not happy about this. Was planning to add some $ soon but after this, will hold it off for the time being. QUOTE(joshtlk1 @ May 14 2020, 08:07 AM)  Pretty big moves on 36% portfolio. QUOTE(honsiong @ May 14 2020, 08:48 AM) You can only delay, weeks later they gonna move everyone to new portfolios coz its expensive to trade for that few remainders. They just want you to acknowledge there are going to be changes. |

|

|

|

|

|

abcn1n

|

May 19 2020, 12:08 AM May 19 2020, 12:08 AM

|

|

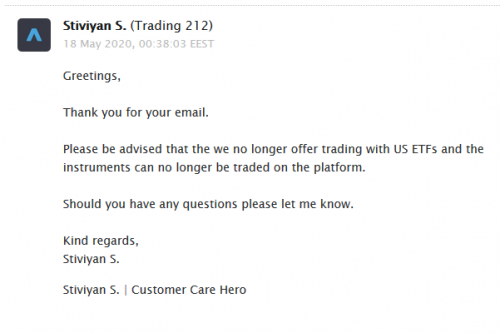

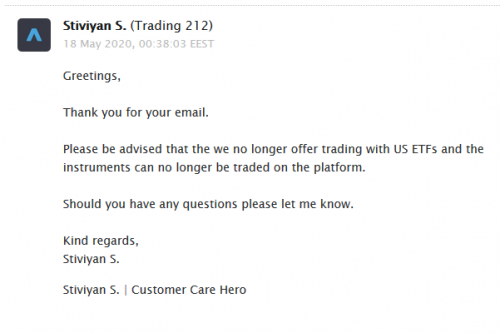

QUOTE(red streak @ May 18 2020, 08:10 PM) If you want more exposure to US equities, you'd be better off picking everything but 36%. Apparently high risk doesn't mean shit anymore  Try creating a new portfolio, play around with the slider bar and you'll see what I mean. Off topic but I messed around with Trading212 and apparently they removed US ETFs from their platform. Not sure when that happened but it's no longer a good alternative if you want to invest more in the US market. QUOTE(red streak @ May 18 2020, 10:16 PM) That's what their support told me when I asked why I could only see US ETFs on CFD and not Invest. The weird thing is I can still view and buy US ETFs like XLE on CFD so I have no idea what's happening. Maybe he just meant Invest can't buy US ETFs? Honestly their support is kinda dogshit. Ask a couple of things and they only answer one thing and it's not even the complete answer.  Weirdest thing is when I lookup XLE on their main page it does show up in Invest, but not when I try to trade it.   So Trading212 is ruled out now as no more US ETFs. Thanks for info |

|

|

|

|

|

abcn1n

|

May 19 2020, 08:08 PM May 19 2020, 08:08 PM

|

|

QUOTE(red streak @ May 19 2020, 07:50 PM) Regulated by the UK's FCA. Legit but kinda weird how CFD can play with ETFs but not the cash money account.  At least you can still buy fractional shares of companies. You can still buy them on CFD. Not really something I want to mess with though  Have never touched CFD and don't intend to do so as don't know how to play it |

|

|

|

|

|

abcn1n

|

May 22 2020, 08:45 PM May 22 2020, 08:45 PM

|

|

QUOTE(GrumpyNooby @ May 22 2020, 09:13 AM) Fund must reach their trust account at Citibank by 10am. IBG GIRO is not instant and has to be executed according to IBG schedule by Paynet. QUOTE(GrumpyNooby @ May 22 2020, 11:06 AM) As per IBG schedule, after 11am, money will reach recipient after 8pm. QUOTE(GrumpyNooby @ May 22 2020, 09:10 AM) If the currency conversion completed by this evening, it'll be invested by tonight. QUOTE(zstan @ May 22 2020, 09:48 AM) used jompay at night. next morning received notification money in already. Now I know why it takes so much longer for my funds to get invested. Need to use jompay instead of IBG Giro fom now on |

|

|

|

|

|

abcn1n

|

May 22 2020, 10:10 PM May 22 2020, 10:10 PM

|

|

QUOTE(red streak @ May 22 2020, 10:03 PM) I've always had my buy orders completed within 2 days by using Jompay unless it's a holiday weekend. Deposit clears Thursday, everything is bought by Friday. I see. Thanks |

|

|

|

|

|

abcn1n

|

Jun 14 2020, 01:54 AM Jun 14 2020, 01:54 AM

|

|

QUOTE(backspace66 @ Jun 13 2020, 03:59 PM) If u want exposure and performance similar to s&p 500, u can consider HLAL etf provided by Wahid. 65% invested there if you take the most aggresive portfolio. The disadvantage is that it is not exactly based on s&p 500 but instead a selected component of it. Other disadvantage is exposure to MYETF-MMID (20%) where the index it is based on basically sucks. HLAL etf also do not have any exposure to financial institution and almost non existant exposure to telecommunication Sorry--OT a bit. I really don't understand why Wahid doesn't have a portfolio that can exclude MYETF-MMID. I'm sure if they do that, they will have more customers and more $ going into them. Maybe if enough of us make noise they will do that. One of the attractions of Wahid is that we can buy in smaller amounts each time which allow us to do more frequent DCA. So although we can buy HLAL directly, many will still choose to do it through Wahid due to the above reason. Ever since SA reoptimize to having very little exposure to USA markets, Wahid has become more attractive This post has been edited by abcn1n: Jun 14 2020, 01:57 AM |

|

|

|

|

|

abcn1n

|

Jun 14 2020, 12:50 PM Jun 14 2020, 12:50 PM

|

|

QUOTE(backspace66 @ Jun 14 2020, 10:48 AM) I have contacted their customet service, they do not even have any plan to exit myetf-mmid. If they have a really small exposure less than 10% , i would actually be fine with that. Other problem is the I-VCAP being unreliable and might close down anytime in the future. As for stash away, if i am not mistaken, if you are invested few months ago before the reoptimization, you can reject the reoptimisation Nah, you can't reject reoptimisation from what I heard although in the email , SA do put it very nicely as if you can QUOTE(pigscanfly @ Jun 14 2020, 11:17 AM) Agreed. I'm not a big fan of MyETF-MMID either. Apparently MyETF-MMID is allocated 20% of portfolio (very aggressive) for investors in Malaysia. For US Wahed investors, 95% of portfolio (very aggressive) is allocated into Wahed FTSE USA Shariah ETF. Makes me think, maybe Wahed invests in Malaysia a fair bit due to agreement with Malaysia to support the local stock market and maybe get some incentive for doing so. Otherwise, they are really dumb if they have never thought of creating a portfolio that excludes Malaysia market  |

|

|

|

|

|

abcn1n

|

Jun 15 2020, 12:56 AM Jun 15 2020, 12:56 AM

|

|

QUOTE(Barricade @ Jun 15 2020, 12:00 AM) StashAway simple is launched. Check your app. 2.4% pa Cool. Projected 2.4% pa QUOTE(honsiong @ Jun 15 2020, 12:50 AM) Yes, the long withdrawal time will make you not impulse purchase shit. See a stock at a discount? You can only get back the money 3 days later, which give you buffer time to think properly. Ohh, I thought that if I park $ in SA simple, then when I want to transfer the $ to my portfolio, it will be as fast as doing it as per jompay. I guess not then. Bubble burst |

|

|

|

|

Apr 10 2020, 09:07 PM

Apr 10 2020, 09:07 PM

Quote

Quote

0.8065sec

0.8065sec

0.23

0.23

7 queries

7 queries

GZIP Disabled

GZIP Disabled