QUOTE(encikbuta @ Jun 15 2020, 08:17 AM)

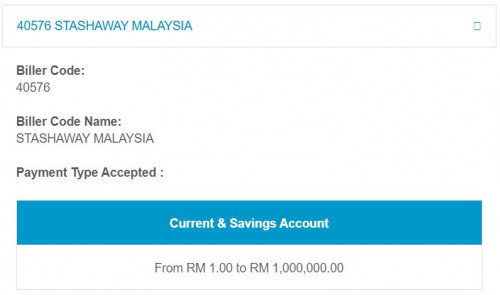

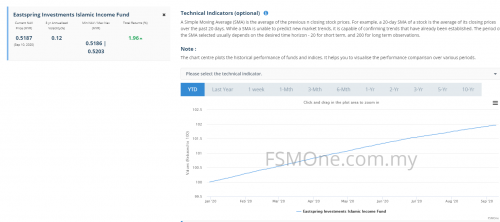

Same here! I park my funds in RHB Cash Management (in FSM) which gives similar returns. So unless, parking my funds in StashAway Simple means i can 'immediate' top up my regular StashAway funds from there, no point having 2 parking accounts.

but still, StashAway Simple is a good avenue if one is looking for something better than FD.

If you park funds in RHB cash management (in FSM), will have to wait a few days before you can use the $ to buy funds in FSM right? Its because of this, that my remaining $ in FSM is not in RHB cash management, but then I can use the $ immediately to buy FSM funds.but still, StashAway Simple is a good avenue if one is looking for something better than FD.

QUOTE(encikbuta @ Jun 16 2020, 10:00 PM)

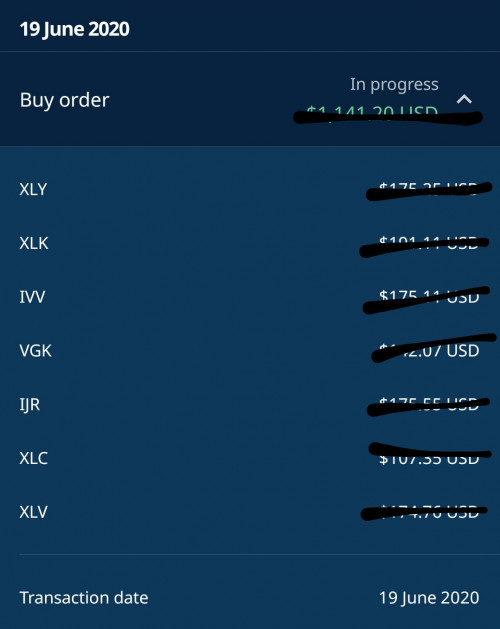

Invested since July 2019 in 36% highest risk portfolio:

TWR: 5.7%

MWR: 27.3%

ROI: 7.6%

The MWR quite inflated coz starting from Feb 2020, I decided to quit P2P Lending and gradually transfer all the repayments to StashAway. Ngam ngam market crashed. So you can say I 'accidentally' timed the market.

Where you see the ROI?TWR: 5.7%

MWR: 27.3%

ROI: 7.6%

The MWR quite inflated coz starting from Feb 2020, I decided to quit P2P Lending and gradually transfer all the repayments to StashAway. Ngam ngam market crashed. So you can say I 'accidentally' timed the market.

QUOTE(GrumpyNooby @ Jun 16 2020, 04:35 PM)

Thanks

Jun 16 2020, 11:23 PM

Jun 16 2020, 11:23 PM

Quote

Quote

0.4224sec

0.4224sec

0.38

0.38

7 queries

7 queries

GZIP Disabled

GZIP Disabled