QUOTE(polarzbearz @ Feb 17 2021, 06:36 PM)

How is monthly fixed contributions not a DCA? What you described is also exactly DCA since it also involves periodically investing a set amount of money regardless of the market price of the securities being purchased

IMO it's not accurate when it comes to the psychology behind the investment strategy of DCA.

Monthly contribution from income or earnings from that month is actually a form of lump sum, but because it's steady contribution at fixed periods, its considered averaging (you don't time the market, but contribute regularly without caring the performance of the unit on the particular day you invest). However because it's money you don't have on hand until you get your income, it's not fitting with the strategy of DCA.

I'll try to illustrate what I mean by this.

Investor A earns monthly RM2k. Every month when he received income, he sets aside RM200 to invest on the 1st day of next month. The RM200 isn't deducted from existing savings or sums of money he might be keeping, so it's lump sum.

Investor B received RM6k in the form of a commission bonus. Because she feels that she'd rather put the money all to work at once, she invests the full sum of RM6k immediately. This is the lump sum strategy that most people are familiar with.

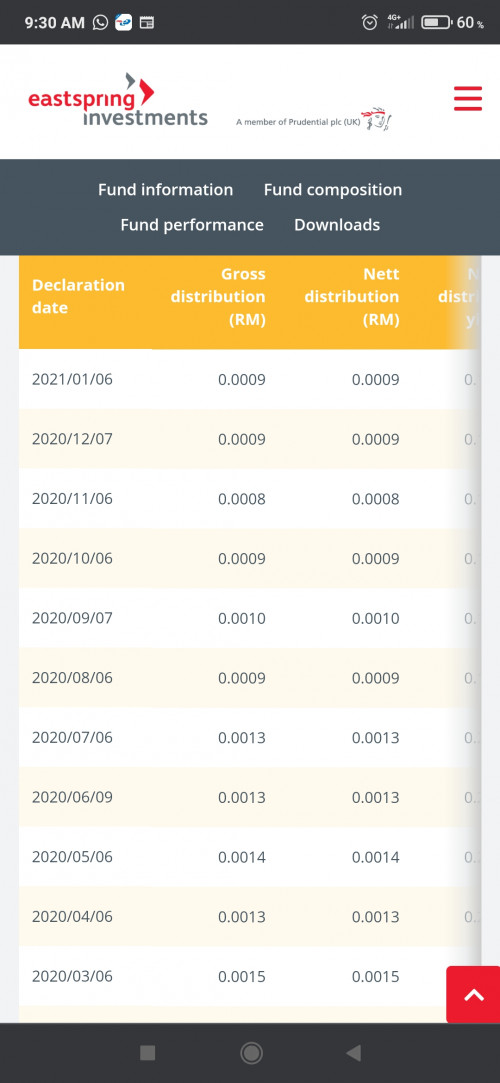

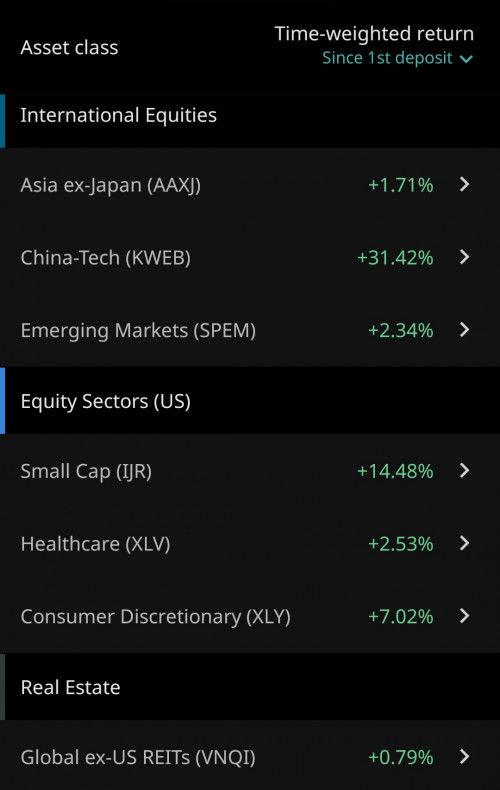

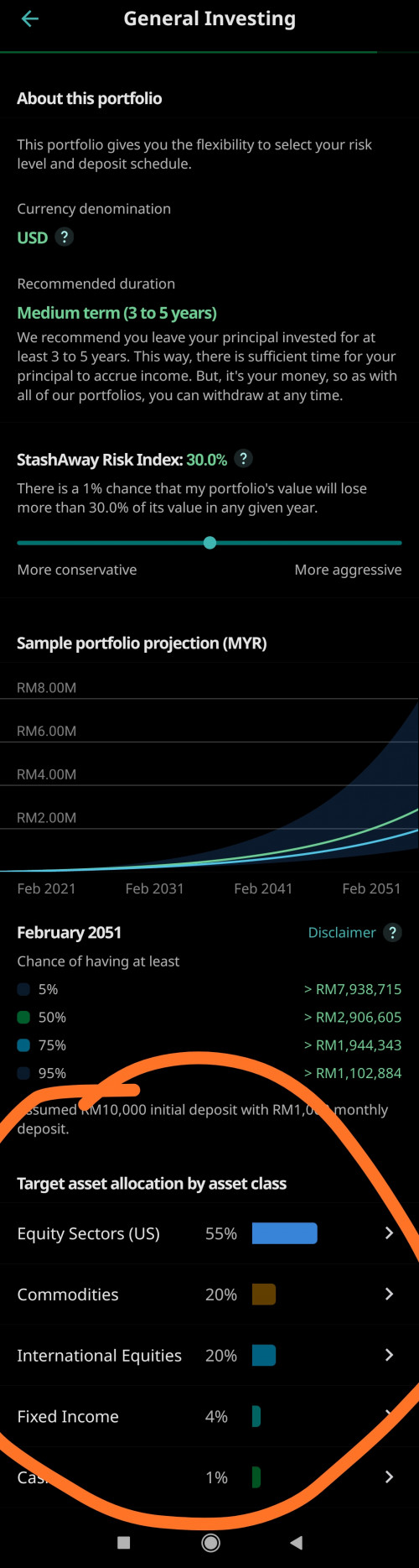

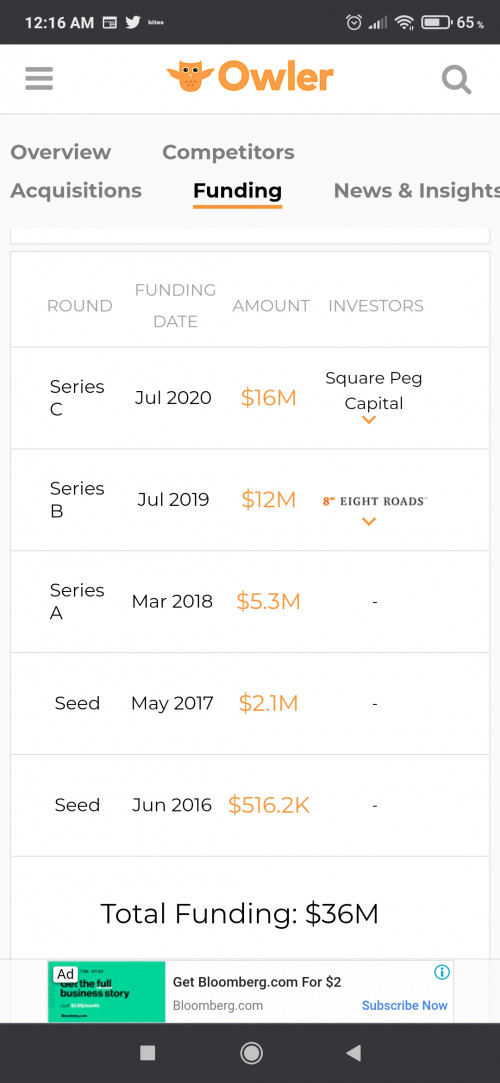

Investor C also received RM6k bonus. However because she doesn't feel comfortable with the idea of investing the entire amount in one go, she puts the RM6k in Simple which is low risk to earn dividends, and sets up a monthly deduction of RM200 to deduct from Simple into her investment portfolio, periodically topping up Simple when she gets bonuses or extra money. This is "true" strategy of DCA, where the investor slowly deducts from a pool of money that they planned to invest because they don't trust the strategy and risk of lump sum investment.

===

of course this is all semantics, in reality it's a psychological and financial safeguard to prevent yourself from investing at a bad time and/or panicking when your investments have a bad time

Monthly income contribution or monthly deduction from savings pool, both work to make you invest regularly and to average out your investments so losses are minimised and it doesn't go beyond your risk appetite.

Just invest smartly and within your means, and within your comfort zone

This post has been edited by DragonReine: Feb 17 2021, 07:15 PM

This post has been edited by DragonReine: Feb 17 2021, 07:15 PM

Feb 17 2021, 09:00 AM

Feb 17 2021, 09:00 AM

Quote

Quote

0.0386sec

0.0386sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled