QUOTE(Daniel Joseph @ Feb 3 2021, 11:32 PM)

Malaysian will use MYR as base currency. Simple will invest into Eastspring Investment Islamic Income Fund.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Feb 3 2021, 11:40 PM Feb 3 2021, 11:40 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

|

|

|

Feb 5 2021, 12:42 PM Feb 5 2021, 12:42 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Jitty @ Feb 5 2021, 11:01 AM) i tot t20 cannot take isinar? strictly speaking i-sinar no income limit (T20 can apply if lost all or 30% of income from Covid-19 period, based on EPF data or appeal with supporting documents)i applied isinar, BPN, BSN, BPH or whatever. end up all fail and tidak lulus. i called them and ask why, they say I am T20. but I know I am not T20. however this report is based on a poll, not an actual study of withdrawals self declared T20 can report whatever they want to the poll, they may not actually have withdrawn anything MUM liked this post

|

|

|

Feb 6 2021, 10:00 AM Feb 6 2021, 10:00 AM

Return to original view | Post

#23

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Hoshiyuu @ Feb 6 2021, 09:15 AM) Haha, unfortunately from what I have been reading, the freedom and ease SA provided for managing it also seems to let people change portfolio every other week and stop depositing when there is a dip then regret and top-up after when it's up... no wonder cannot reach projected gains. These are the people who never read or learn the very basics of investing to begin with and overestimate their risk appetite This is the main weakness of robo advisor in that unlike dealing with a financial advisor who helps you plan to invest, robo advisor is reliant on your self-declaration and your own management. It's easy to use, but some people shouldn't be given easy mode to start off (personally I underestimated my risk appetite and invested too safely for first few months oops, now that I switch to higher risk I'm happier to watch the ups and downs happen) thecurious liked this post

|

|

|

Feb 6 2021, 10:39 PM Feb 6 2021, 10:39 PM

Return to original view | IPv6 | Post

#24

|

Senior Member

2,610 posts Joined: Aug 2011 |

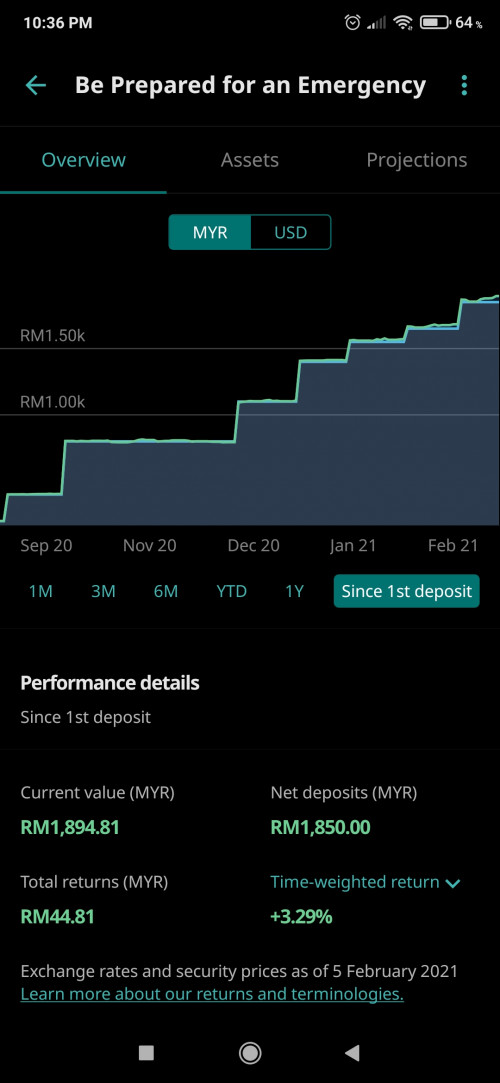

16% risk portfolio since September 2020 (will be withdrawing this after two years so I'm not using higher risk) Not bad performance for MYR. Pity because of strengthening MYR, my actual profit is low This post has been edited by DragonReine: Feb 6 2021, 10:40 PM Quazacolt liked this post

|

|

|

Feb 9 2021, 09:18 AM Feb 9 2021, 09:18 AM

Return to original view | IPv6 | Post

#25

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(AthrunIJ @ Feb 9 2021, 09:09 AM) Interesting. Our Saturdays is Friday (business day) in US because of time difference, while Simple is Malaysian based so Mondays are same as ours.Stash away is literally working close to 24/7 based on my experience. SA simple will buy the etf on Monday. SA will buy USA etf etc on Saturday too. Sunday is basically off and Public Holidays too. Because the asset classes are diverse (mix of US and East Asian ETFs for higher risk) SA can buy etf effectively 6 days a week |

|

|

Feb 9 2021, 12:55 PM Feb 9 2021, 12:55 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Daniel Joseph @ Feb 9 2021, 12:25 PM) Direct Debit less hassle. First time will take longer to approve (T+5 from my experience) but after that only T+1 to show up in StashAway. Note that I'm not including time to convert currency and buy units.JomPay if you want automated recurring deposit you need to setup through your bank account. Personally I use JomPay recurring payment to satisfy my conditional high interest savings account bonuses Daniel Joseph liked this post

|

|

|

|

|

|

Feb 9 2021, 02:27 PM Feb 9 2021, 02:27 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

2,610 posts Joined: Aug 2011 |

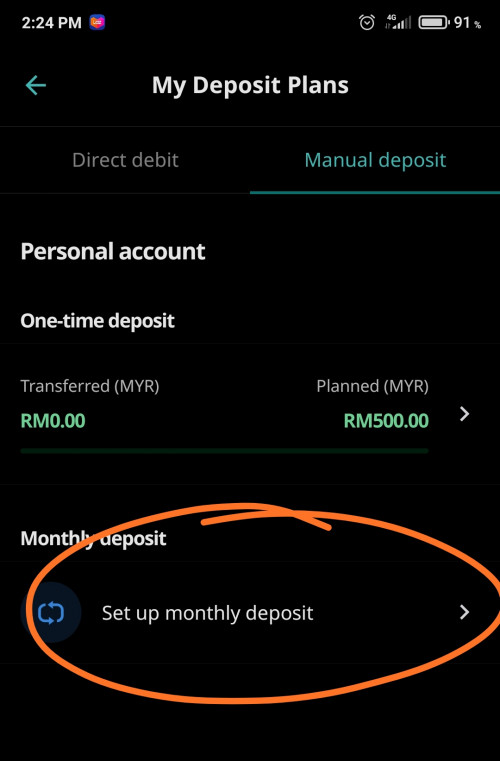

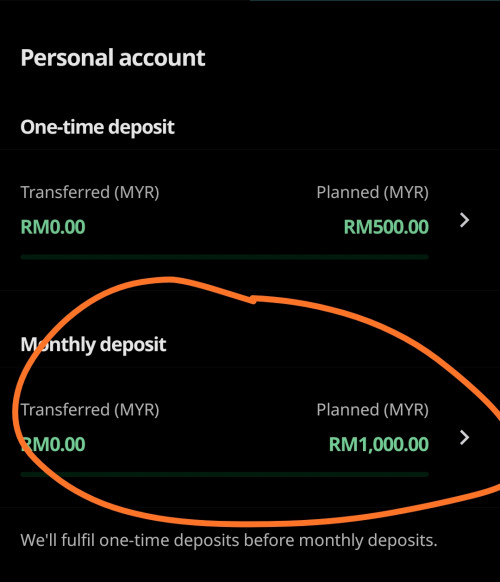

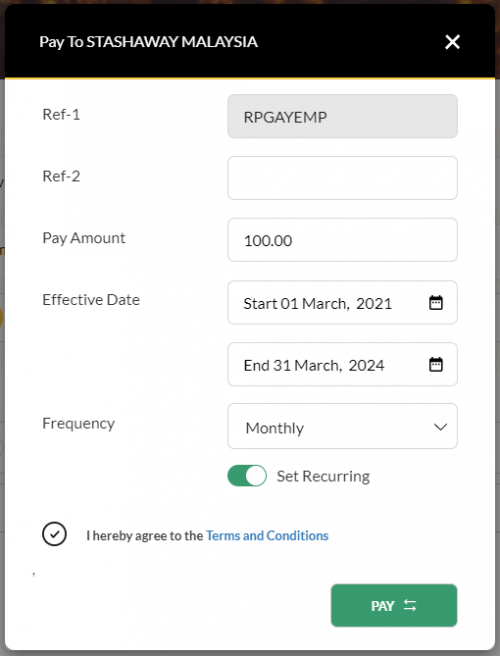

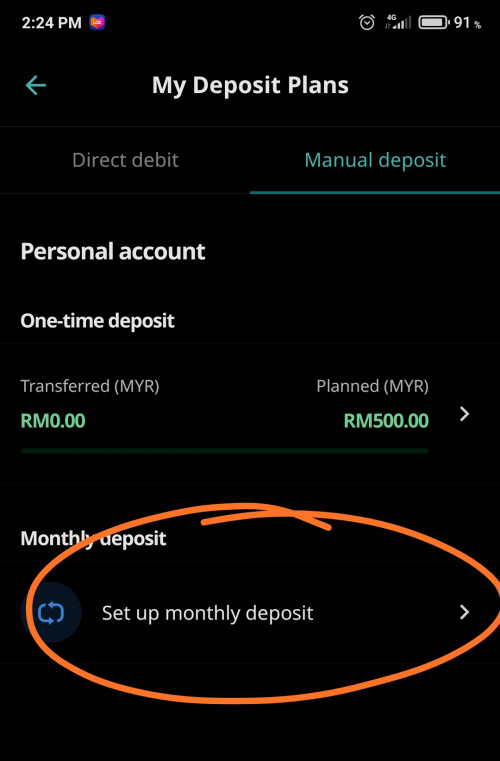

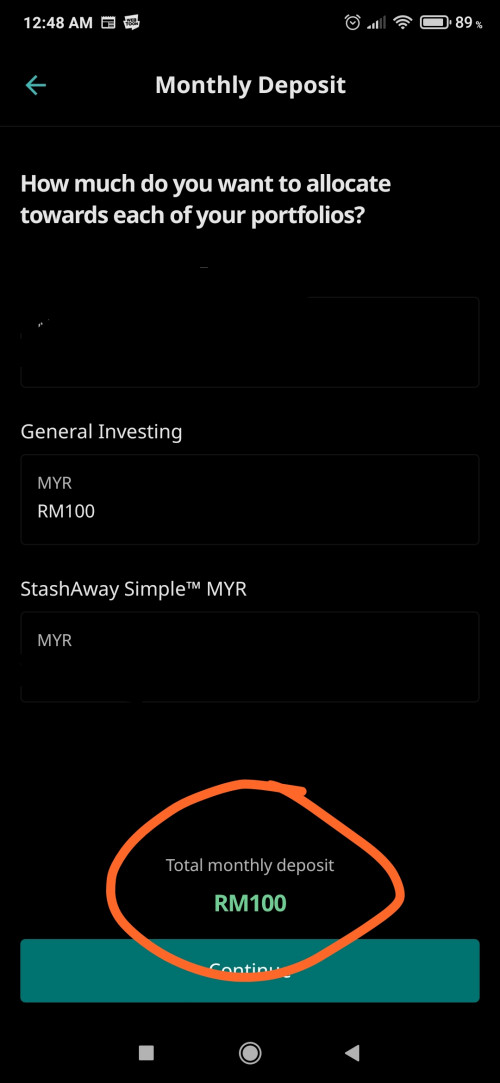

QUOTE(thecurious @ Feb 9 2021, 12:57 PM) Just wondering did you ever forget to initiate a manual deposit in stashaway since you have recurring transfer from your bank? The "manual deposits" tab allow you to setup monthly deposits in a way. See pics:Wondering if the stashaway team is able to track automatically even if didn't initiate if you are a frequent depositor lol   The monthly deposit "transferred" will reset to 0 at the start of each calendar month. You just have to get bank to setup recurring Jompay payments. |

|

|

Feb 9 2021, 04:33 PM Feb 9 2021, 04:33 PM

Return to original view | IPv6 | Post

#28

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Daniel Joseph @ Feb 9 2021, 04:22 PM) So you just set the date of recurring deposit using Jompay right? Correct, note that each bank has their own way of setting up such payments so you may have to investigate your online banking portal.Let’s say every 1st of month. Set it and every 1st of month, the set amount will be deducted from the bank account. Correct? example: Public Bank consolidates all such recurring payments into E-Standing Instruction (E-SI) under theit Account tab, OCBC you can instruct recurring payment through their "Pay Bills" section (in fact while paying JomPay through OCBC you can put in instruction to pay monthly) Daniel Joseph liked this post

|

|

|

Feb 11 2021, 07:36 PM Feb 11 2021, 07:36 PM

Return to original view | IPv6 | Post

#29

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Oklahoma @ Feb 11 2021, 05:31 PM) No credit cards. Only JomPay and bank account direct debit. Banks and Securities Commission won't allow credit cards because they don't want people to use debts to fund investment.This post has been edited by DragonReine: Feb 11 2021, 07:51 PM |

|

|

Feb 14 2021, 12:51 AM Feb 14 2021, 12:51 AM

Return to original view | IPv6 | Post

#30

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Daniel Joseph @ Feb 13 2021, 06:55 PM)  Hi, I want to do a double confirm before I proceed. If I want to do a recurring manual deposit via jompay, did I do the correct way? Does this setting will deduct a RM100 every month for 3 years? This is maybank website fyi. Is that all? Do I need to set anything in the app? Pic below for reference:  From there, allocate the money into your portfolios, but MOST IMPORTANT is make sure your Total monthly deposit is the same as your Jompay instructions:  after that you click Continue to go through authorisation steps, then shud be ok This post has been edited by DragonReine: Feb 14 2021, 12:52 AM Daniel Joseph liked this post

|

|

|

Feb 14 2021, 09:46 AM Feb 14 2021, 09:46 AM

Return to original view | IPv6 | Post

#31

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Takudan @ Feb 14 2021, 03:04 AM) Hello, did I just get conveniently excluded from the statistics with my -0.56% TWR/MWR? The bar graphs is actually in their "Our Returns in 2020" articleThanks. I do have some long term investment on stocks outside SA, so increasing risk index to focus on equities feels like I'm putting too many eggs into the same basket... or am I wrong to think so? I'm not saying I have eyes on all kinds of industries/sectors, but I'm thinking a market crash would affect every stock out there. Honestly I was expecting it to perform better than FD or heck, my saving account lol, but I can't bring myself to top up to a portfolio that tells me -0.56% TWR, meanwhile my manual investment is going strong at 15%+ It's hard to think that it was a bad peak when the market right now is better than in Aug 2020. So was I really just unlucky with the AI/whoever working on my account? I'm trying hard to convince myself about SA haha  You can check the article yourself. https://www.stashaway.my/r/our-returns-2020 The bar graph depicts their return over 2020 which as you've seen and others have mentioned, bond-heavy portfolios don't do well when market is in recovery (Covid-19, US elections etc.) However if you look at the article and check benchmarks for returns since inception, the only one that underperforms is the 6.5% index (which is honestly not much higher risk than EPF or ASB lol) I would say that you should read/listen to their commentary videos to get a sense of their direction with their investing + understand why certain elements of your portfolio might be outperform/underperform compared to your expectations, then decide if SA fits your risk appetite and your confidence in which market performs well. I think your case is simply a combination of chosing bond heavy portfolio just when bonds turn bearish + investing when MYR value was low compared to current MYR value. Just for reference, my 16% portfolio that I opened in May 2020 is hovering around +8% MWR now after staying red for Q4 of 2020 due to MYR strengthening against USD. This post has been edited by DragonReine: Feb 14 2021, 09:50 AM |

|

|

Feb 16 2021, 10:09 AM Feb 16 2021, 10:09 AM

Return to original view | IPv6 | Post

#32

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(kiba84 @ Feb 16 2021, 05:43 AM) Hi all, I just started with SA. After the assessment, it shows me 6.5% risk and when I check here, we have so many people with 36% risk assessment. When I check to change the risk, for some reason it only allowing up to 22%. What is the best way to do this? I'm looking for a long term investment. So is it better to stick with 6.5% as the automated risk says and create a new portfolio for 22%? Any advise? Not sure how to get 36% portfolio thou. Usually they put you max 22% due to several factors from your assessment answers, including but not limited to:1) low monthly income 2) high liabilities/debt-service-ratio 3) job is deemed high risk/unstable/low to no income (like student or an entry level job like clerk/waitstaff or gig work) 4) no prior investment experience 5) low to zero savings 6) age (if you're older they might not give high risk initially even if you list yourself as aggressive because your age means not many years left to retirement where you can weather volatility) basically its SA's way of protecting you and your finances. A human financial advisor would similarly tell you to take lower risk if you fall into too many of the above criteria, because it's not wise to invest if you're deep in debt with little income etc. Don't feel bad about limited to 22%, in fact 22% risk portfolio is not bad performance at all, if you look in their performance since inception the annualised return is same to 36% because of some crashes in equities a few times in the last few years.  36% portfolio is for us who can afford to stomach the volatile and are willing to risk the losses to get (maybe) high returns as above have said, you can watch the videos on Personal Finance basics and Investing basics to educate yourself, then contact StashAway customer service via their WhatsApp to help unlock 36% But don't be super WAHHH AMAZING about other LYN members' gains. SA's algorithm recommending low risk for you is not without reason. This post has been edited by DragonReine: Feb 16 2021, 10:25 AM |

|

|

Feb 16 2021, 10:44 AM Feb 16 2021, 10:44 AM

Return to original view | IPv6 | Post

#33

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(kiba84 @ Feb 16 2021, 10:32 AM) Thank you all for the advice! I'm pretty new to SA as well as to investment. I guess I will educate myself more on this before deciding to change the risk portfolio. At least I understand a lil bit more why it as design as such now. Appreciate all your inputs! :thumbsup: Good luck! My personal advise since you're new is take your time and give yourself at least a year of being exposed to investing to understand your emotional response to investment volatilities before you revisit your portfolios to decide if high risk is worth it for you.Because when new to investing sometimes we don't realise that high risk isn't just higher volatility, but also a high chance of making losses, especially if the investor is the type to panic easily when see negative returns or if don't give portfolio enough time to recover. Even then the returns may not perform to expectations. So taking higher risk is not only accepting volatility, but also accepting losses and lower returns if timing is bad. |

|

|

|

|

|

Feb 16 2021, 02:49 PM Feb 16 2021, 02:49 PM

Return to original view | IPv6 | Post

#34

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(prophetjul @ Feb 16 2021, 01:34 PM) They compare their portfolios performance to the performance of other unit trust funds from other companies and/or their own test portfolios that they've judged to be of similar risk and portfolio composition type.This post has been edited by DragonReine: Feb 16 2021, 02:52 PM |

|

|

Feb 16 2021, 05:46 PM Feb 16 2021, 05:46 PM

Return to original view | IPv6 | Post

#35

|

Senior Member

2,610 posts Joined: Aug 2011 |

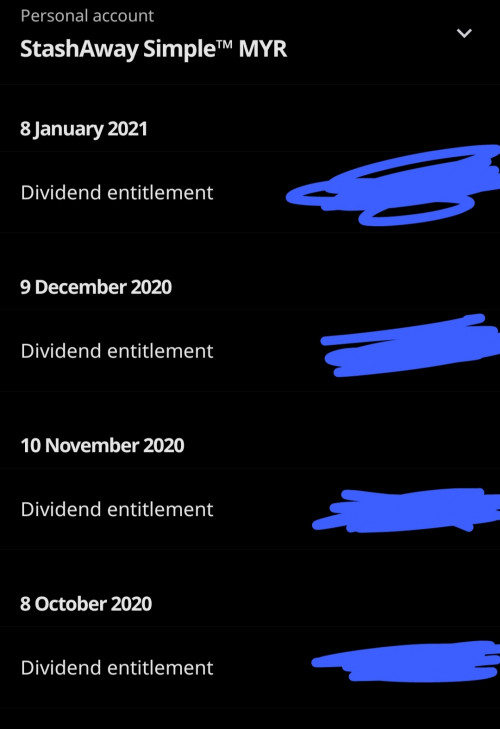

QUOTE(AthrunIJ @ Feb 16 2021, 05:38 PM) Kinda odd that the SA simple doesn't show the interest or dividend accrue in the transaction page? Need to tap Account Transactions > choose "StashAway Simple™ MYR" to see dividendsOr I am missing something? 🤔🤨 the account transactions general page only shows the movement of money between your bank account to your portfolios, transfer of money between portfolio, and the status of whether money have been redeemed/invested. similarly with Simple, any rebalancing, unit buy/sells, and dividend payouts for bonds within investment portfolios won't show in account transactions, if you want to see details you need to look up the portfolios the same way as above |

|

|

Feb 16 2021, 08:47 PM Feb 16 2021, 08:47 PM

Return to original view | IPv6 | Post

#36

|

Senior Member

2,610 posts Joined: Aug 2011 |

https://www.stashaway.my/r/market-commentar...-your-portfolio

late share because CNY hectic but looks like SA unlikely to invest in crypto, it's also a good vid that explains why they're skeptical of it |

|

|

Feb 17 2021, 12:01 AM Feb 17 2021, 12:01 AM

Return to original view | IPv6 | Post

#37

|

Senior Member

2,610 posts Joined: Aug 2011 |

KWEB's returns are just absurd. Not complaining

|

|

|

Feb 17 2021, 12:25 AM Feb 17 2021, 12:25 AM

Return to original view | IPv6 | Post

#38

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Feb 17 2021, 02:08 AM Feb 17 2021, 02:08 AM

Return to original view | Post

#39

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(timeekit @ Feb 17 2021, 12:44 AM) slightly off topic but since we are talking about KWEB. anyone knows any similar funds we can buy from FSM Malaysia ? FSMOne to my knowledge does not have ETFs (passively managed), only mutual funds (actively managed) https://www.investopedia.com/articles/inves...utual-funds.aspBecause of the different nature between ETF and mutual funds, there are very little asset overlap between available funds on FSMOne with KWEB. The closest equivalent would be funds that includes investments in China/Far East region. For the most part they have rocketed up like KWEB because of China's bull run market. This post has been edited by DragonReine: Feb 17 2021, 02:11 AM |

|

|

Feb 17 2021, 08:37 AM Feb 17 2021, 08:37 AM

Return to original view | IPv6 | Post

#40

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(AthrunIJ @ Feb 17 2021, 07:53 AM) I did but no update regarding dividends or interest paid shown under transaction - > SA Simple MYR but the SA simple page did show a few ringgit appreciation or earned. 🤔 odd 🤔 check with SA help? mine looks like this (filtered to show dividend entitlement entries) |

| Change to: |  0.0463sec 0.0463sec

0.27 0.27

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 26th November 2025 - 12:04 AM |