QUOTE(cytyler @ Mar 10 2021, 06:47 PM)

whats actually stashaway simple ?

and the one-time-deposit plan means that i can invest in any time i want , but the fund will be allocated to different investments ?

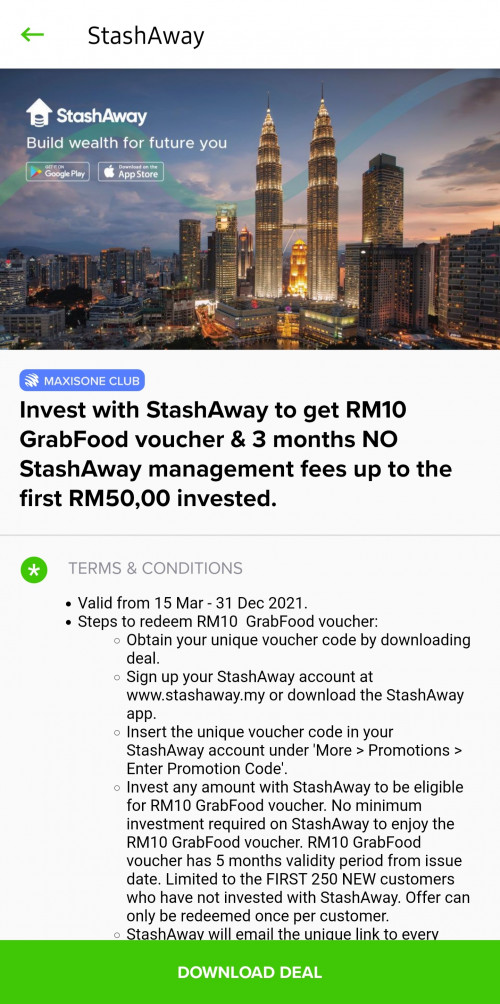

StashAway Simple is a Money Market Fund, basically a form of unit trust that invests in "safe" places like fixed deposits. It's a way of reaping the benefits of fixed deposit safety (unlikely to lose money) without being tied down to the long tenure of fixed deposits.

Yes, the allocation will be depending on what you choose to allocate when you setup the instruction to do a deposit.

QUOTE(cytyler @ Mar 10 2021, 06:49 PM)

as a newbie how much deposit should i start with ? and which % plan is more suitable ?

(making assumption here that you're very new to investing)

Ask yourself these questions first:

1) Do you have a healthy amount of emergency fund saved? By emergency fund it means at least 3 months worth of money needed to cover basic expenses (rent, loans, bills like electricity and phone, food, petrol/traveling costs). If you have zero emergency funds please don't invest yet, or only put money into StashAway Simple.

2) If you already have emergency fund saved, then allocate a set amount from your monthly budget based on how much you'd like to continue to put into emergency funds (3 months is an okay cushion, but having 6 or 12 months is better in worst case when you suddenly lose job and can't get new one so easily) and then put any excess into investments. DO NOT TAKE LOAN TO TRY AND INVEST. The wise long term strategy is only invest what you can afford. No investment in the world will be able to easily cover personal loan/credit card debt interest rates

unless you damn lucky.

3) StashAway will quiz you when you first set up account about your wealth+liabilities and your earnings+spending habits before giving you available risk profiles. Depending on your answers they might lock you out of high risk.

4) Risk is a very personal question and depends both on your personality and on how long you able to wait before investing. Are you willing to wait for decades before cashing in? Then you can weather the volatility of high risk, but remember high risk not guaranteed will give high returns. If volatility makes you panic and regret in investing, then you cannot take too high risk even if you're able to wait long term.

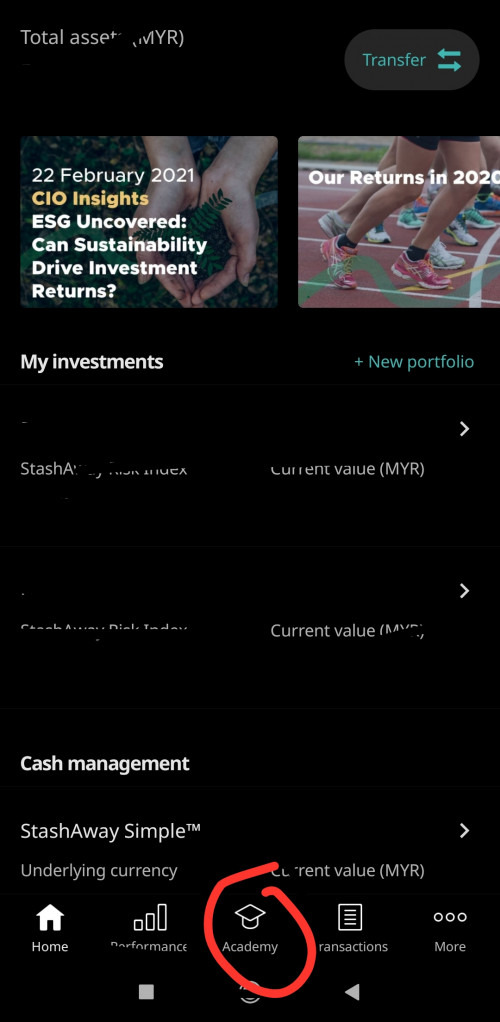

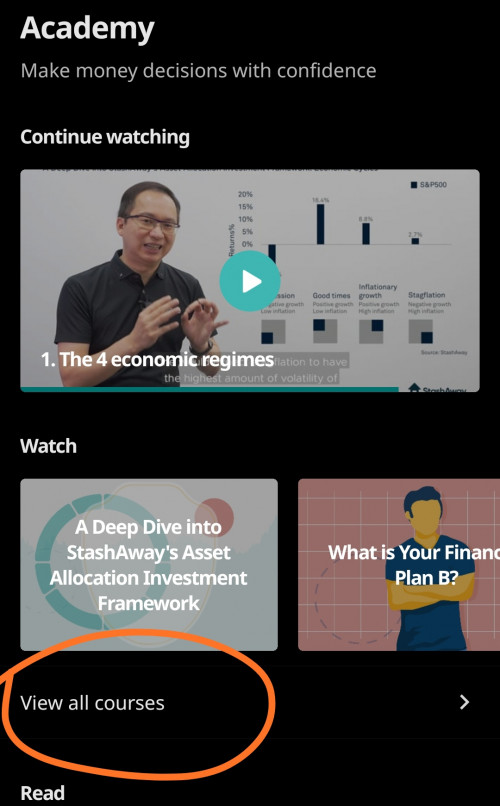

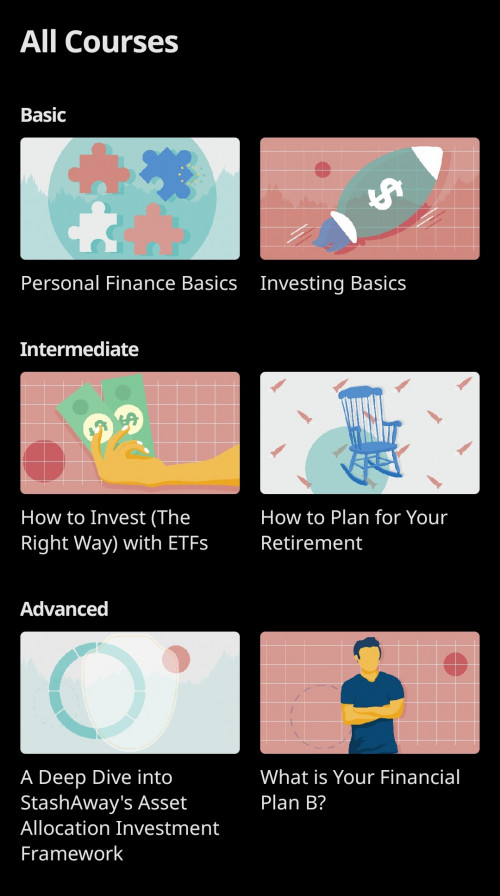

I suggest you check back my post here and watch the SA academy videos first before deciding:

https://forum.lowyat.net/index.php?showtopi...ost&p=100187434This post has been edited by DragonReine: Mar 10 2021, 07:36 PM

Mar 2 2021, 04:54 PM

Mar 2 2021, 04:54 PM

Quote

Quote

0.0547sec

0.0547sec

0.95

0.95

7 queries

7 queries

GZIP Disabled

GZIP Disabled