QUOTE(littlegamer @ Aug 11 2021, 09:10 AM)

But when SA themselves do reopt, is essentially the same thing. Everyone here just seem to agree with it and ok with the lost.

Did you actually check the units sold during reopt? It's not "sell all units of all the ETFs equally", it takes into consideration weight of the sectors. Unlike user changing SRI, where the weights change and thus affects buy order, SA doesn't always change the weight of certain sectors during reopt.

I don't know about others, but when SA put in the sell order, almost all the units sold were units that were solidly profiting previously in my account and had been in the green for some time. They simply realised the profits and reinvested in other ETFs units.

KWEB had zero sold order, so no realised losses at all. They've also maintained the target weight of KWEB across all portfolios, so they essentially left it alone.

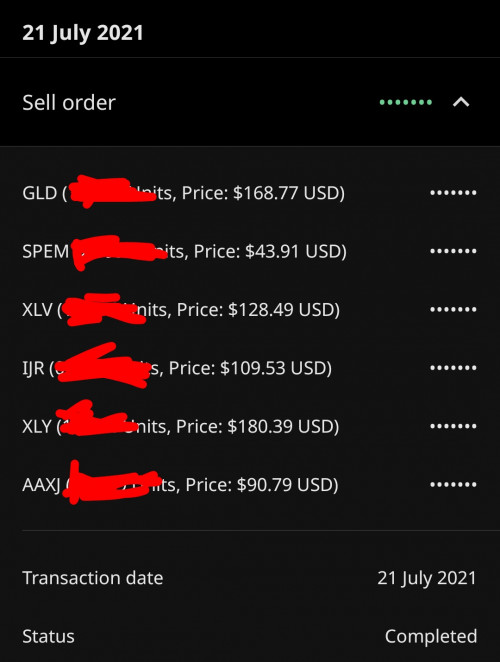

This is a snapshot for my 36% SRI sell order during the reopt, no KWEB realised losses.

Aug 12 2021, 01:52 PM

Aug 12 2021, 01:52 PM

Quote

Quote

0.4325sec

0.4325sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled