QUOTE(JJ93 @ Jun 8 2021, 09:52 AM)

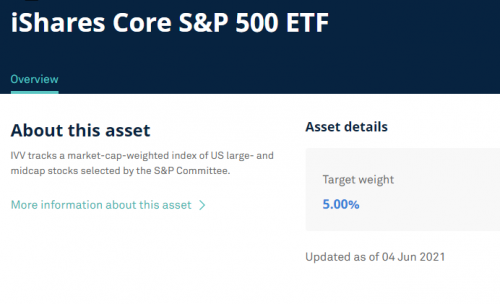

Not just you. If I check SRI 30% that's the current target weight for IVV:

Note that IVV is under their "International Equities" in asset class.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jun 8 2021, 01:30 PM Jun 8 2021, 01:30 PM

Return to original view | Post

#261

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

|

|

|

Jun 8 2021, 02:51 PM Jun 8 2021, 02:51 PM

Return to original view | Post

#262

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(honsiong @ Jun 8 2021, 01:43 PM) VCA is bullshit. How do you even measure value in the first place? Agree with this, especially if you're a newbie investor.If the stock market keeps going up steadily for years and years without dips and corrections, will you keep reducing investments? Also Stashaway is diversified portfolio by default, deposit - investment flow takes days, whatever VCA, timing the market can trip you up. Just DCA, aim to invest the same RM every week/month, then live your life. Delete Stashaway app if that helps you. There's no optimal VCA in StashAway because 1) There's always a processing time of at least 2 days between deposit and the actual buy order executing, so depositing that day NEVER GUARANTEES that you will invest in a "low" time, as buy order could just as easily happen to execute on a high day. 2) diversified portfolios, so overall highs and lows are not drastic enough to justify the waiting for high/low to happen, especially due to the processing time of #1. It also means highs and lows tend to happen gradually, so it's hard to predict when is the absolute low and when is the absolute high. 3) forex risk, as we're converting from MYR to USD (or GBP if you're assigned a profile under GBP due to domestic ringgit borrowing), so even if the stocks is on low, MYR might be weak on the day you're converting so you have less USD to buy with. The only viable strategies in SA are DCA or just lump sum investing regardless of timing. Lump sum works in your favour in the very long term (many years) most of the time, but it can be uncomfortable to see the ups and downs especially if you're bad luck and invest during a high. Again, StashAway's portfolio by its nature will not climb high or drop low drastically, most of the time the value is in single digit % or decimal points of a % of earn/loss. Exceptions are during major events like recent pandemic crash and crackdown of China tech, none of which are predictable. StashAway should be treated like EPF/SSPN/ASB/regular mutual funds: put in what you're comfortable putting in, and forget about it until it's time to withdraw. This post has been edited by DragonReine: Jun 8 2021, 02:52 PM |

|

|

Jun 10 2021, 09:40 AM Jun 10 2021, 09:40 AM

Return to original view | Post

#263

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(akhito @ Jun 10 2021, 07:07 AM) Stashaway do not have nomination feature like epf. So in time of untimely demise, the family will have to claim through will and lawyer? StashAway is like most private investment vehicles (stocks, mutual funds etc.) in that you cannot nominate directly the way you can do with EPF which is government incentive and meant to be a retirement fund (exception is PRS funds which are also government incentive, just that it's managed by private investment fund houses)You need to specify in your will/wasiat about any investments and assets you own. Otherwise StashAway is unable to release money to your beneficiary: https://www.stashaway.my/faq/900001773963-w...er-passes-away/ |

|

|

Jun 10 2021, 09:47 AM Jun 10 2021, 09:47 AM

Return to original view | Post

#264

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(prophetjul @ Jun 10 2021, 08:48 AM) i have a question: Potentially, but some problems:IF the portfolio allocations of SA is fixed anyway and there is no AI involved, one can easily use the same portfolio and buy in directly into the ETFs yourself and save the SA charges? 1) Cannot buy fractional shares the way that StashAway can, so it gets very expensive very quickly unless you're loaded. 2) It's very tricky and expensive to balance and manage weights for so many different ETFs on your own, unless you're experienced, as you're juggling easily more than 7 ETFs 3) Exchange rates for currency and other potential fees might not work in your favor, which may negate any gains you get from not needing to pay fees to SAMY 4) SAMY reoptimises their portfolio every now and then which increases the cost and hassle because you'd need to buy+sell the relevant ETFs Self buy ETF is probably only good for lump sum strategy with large capital, but loses out on flexibility of reoptimising. If you want similar diversification but DIY it's better to follow Bogleheads' strategy of 2-4 fund portfolios. This post has been edited by DragonReine: Jun 10 2021, 09:49 AM |

|

|

Jun 10 2021, 10:04 AM Jun 10 2021, 10:04 AM

Return to original view | Post

#265

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(prophetjul @ Jun 10 2021, 09:56 AM) Some good pints here. 👍🏻 Good points, but I do consider that if a person has the financial capability and the knowledge+confidence required to attempt or seriously consider DIY, they're already not suited for SA and not SA's (and most robo advisors) target audience, which are investors with low investing capital and who don't have the time/capability/confidence to DIY invest and manage their own portfolio.I will be the devil's advocate. So not saying you are wrong. 1)We can buy fractional or rather small units shares of US based ETFs easily. You can buy ONE share. Of course there is minimum brokerage fees. Yes. Some of these ETFs may be beyond the reach of many for DCA strategy. 2)SA does not do rebalancing so often. So not a real issue. 3) SA wins on forex i think. 4) Re optimising is quite rare AFAIK? Same as rebalancing. i do have my porftfolio of dividend yielding stocks. Only about 15 to 20 at a time. SA to me is autopilot investing, which comes with its own pros (low barrier to entry, little need to manage and track portfolio) and cons (no control, paying fees accumulates), so it depends on the investor's needs and investing strategy whether SA or DIY it's better. This post has been edited by DragonReine: Jun 10 2021, 10:11 AM |

|

|

Jun 10 2021, 01:07 PM Jun 10 2021, 01:07 PM

Return to original view | Post

#266

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(S_SienZ @ Jun 10 2021, 12:58 PM) Hey guys, is it normal for your initial investment to take a long time to process? Scheduled a deposit on 4 June 2021, until now still "Processing" and not showing up in portfolio. Bank already confirmed the transfer. Yes, on top of 2-3 business days to process funds there's another 2-3 business days to open nominee account. Since it's your first investment, they must open up nominee account for you before they consider it "received" in their app. 5 - 6 June: Weekend, no processing 7 June: Holiday, no processing. This post has been edited by DragonReine: Jun 10 2021, 01:08 PM |

|

|

|

|

|

Jun 10 2021, 11:51 PM Jun 10 2021, 11:51 PM

Return to original view | IPv6 | Post

#267

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(nicemamak @ Jun 10 2021, 09:37 PM) Depends on the ETFs in the portfolio, some ETFs give monthly (bonds and fixed income ETFs), some give "incidental" which is once a year.As for how much, I'll give perspective: BNDX (fixed income) is around USD 57 per unit currently, their monthly dividends on average is USD 0.03 (3 cents) per unit. EMB (government bonds) is around USD 112 per unit, their monthly dividends is on average around USD 0.24 (24 cents) per unit. Summary? Don't rely on dividends in SA, if you want growth it'll usually be capital gains based (unit prices rising), not dividends. Even the lower risk portfolio gains are mostly from unit prices rising but slowly. You want dividend based investment better to invest in EPF/ASB/SSPN. |

|

|

Jun 17 2021, 12:11 AM Jun 17 2021, 12:11 AM

Return to original view | IPv6 | Post

#268

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(GymBoi @ Jun 16 2021, 11:47 PM) icic ok thanks sifu! sry got another question i still dont quite understand. So i'm just planning to be lazy and just DCA weekly all the way. So what I need to do is. 1) Set your jompay instruction1) Make standing instructions from my bank to JOMPAY weekly (Example rm100 per week) 2) In the app, need to set manual recurring deposit (only monthly available) as rm400? I only have 1 portfolio, 3) so the app manual deposit actually for what? Just for reference? They will buy order for me weekly as I deposit right? 4) I will probably set everything up to run like 6 months, don't plan to touch anything. But let say 3 months later i get some bonus or what, feel like want to deposit more? example 200 for that ONE week only, what to do? Need cancel 1 & 2, do 1 time deposit, then set up 1 and 2 again? 2) Go to "Manual Deposit" and your manual monthly deposit in StashAway as EXACT AMOUNT of your instruction. example: it each jompay is RM100 per week, set monthly deposit as RM100. No worries about "going over" StashAway will simply follow your instructions on how to handle your deposit based on your instruction. 3) Manual one-time deposit is for people who do lump sum. 4) No need, just create a one-time deposit for the extra amount and deposit the extra. StashAway executes one-time deposits first before they execute monthly order. Ref-1 (for Jompay) will always remain the same for each account so you can even just use the saved "Favourite bill" in your banking site/app. This post has been edited by DragonReine: Jun 17 2021, 12:14 AM |

|

|

Jun 17 2021, 08:40 AM Jun 17 2021, 08:40 AM

Return to original view | Post

#269

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Kadaj @ Jun 17 2021, 08:22 AM) Not just stocks and bonds fell but also gold. Depends lor, if you're doing this for long term (as you should) then take the fall as a windfall and shoot a few extra bullets.What else to invest in the near future since everything going to fall? :confused: Markets taking a hit is to be expected with the past trend of prices stabilizing and inflation risk. Once economy reopens in full it'll go up again. Just part of the market cycle. |

|

|

Jun 18 2021, 11:22 AM Jun 18 2021, 11:22 AM

Return to original view | Post

#270

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(Medufsaid @ Jun 18 2021, 09:42 AM) if you can actively manage your SA, switch into 6% SA during bear market and switch back to 36% during bull market NOOOO don't do this.When you switch SRI, StashAway will sell off the units in the sectors that aren't relevant to the new SRI (read: convert into cash) to buy units in relevant sectors, which means REALISING YOUR LOSSES. Do this constantly and you'll LOSE money from all the buy/sell orders happening and increase chances of buying high/selling low because of SA's delay. You want to time market, go trade in stocks. Not StashAway. Quazacolt, Daenthylin, and 1 other liked this post

|

|

|

Jun 20 2021, 01:02 AM Jun 20 2021, 01:02 AM

Return to original view | IPv6 | Post

#271

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(guest54321 @ Jun 19 2021, 10:08 PM) Been depositing 1k every month. How come my total returns still stagnant at rm500-rm800 monthly? Risk appetite set to 22% US market stagnant + if you'd started after May 2020, MYR continuously strengthen against USD so it flattened out any gains in USD. Remember that StashAway carries some forex risk so if MYR gets stronger, gains might end up lesser. guest54321 and honsiong liked this post

|

|

|

Jun 21 2021, 01:21 PM Jun 21 2021, 01:21 PM

Return to original view | Post

#272

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Jun 21 2021, 06:26 PM Jun 21 2021, 06:26 PM

Return to original view | Post

#273

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(MUM @ Jun 21 2021, 06:09 PM) This drop is across entire markets, not just StashAway 😂 RM200+ to -RM51 is a very tiny movement relative to current drop with gold sell-off and inflation fears + investors reacting to potential Fed Reserve policy changes. |

|

|

|

|

|

Jun 21 2021, 07:21 PM Jun 21 2021, 07:21 PM

Return to original view | Post

#274

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(MUM @ Jun 21 2021, 06:39 PM) gains vs volatility strategy SA's strategy is not "high gains as possible during bull market" but "as little loss as possible during bear market" so don't expect zoom up like investing in ARKK or similar. |

|

|

Jun 25 2021, 08:58 AM Jun 25 2021, 08:58 AM

Return to original view | Post

#275

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(ky33li @ Jun 25 2021, 07:18 AM) actually stashaway performance is not as good as s&p 500 this year. Last year is different all stocks unit trusts ETF had goos returns why would you even compare YTD performance 😂 it's not a comparable benchmark for diversified portfolio like SA wongmunkeong liked this post

|

|

|

Jun 25 2021, 10:10 AM Jun 25 2021, 10:10 AM

Return to original view | Post

#276

|

Senior Member

2,610 posts Joined: Aug 2011 |

|

|

|

Jun 25 2021, 10:20 AM Jun 25 2021, 10:20 AM

Return to original view | Post

#277

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(prophetjul @ Jun 25 2021, 10:15 AM) That probably explains why those who bought before the gold surge in 19/20 is still in the green. The ones who buy higher SRI near KWEB surge (in late 2020 to earl 2021) also ended up red by now 😂 my SRI 16% still holding quite steady even though i bought after the gold reallocation, mostly propped up by the good performance of IJR and XLV under US Equities sector.Heavier weightage holding up the portfolios.  This post has been edited by DragonReine: Jun 25 2021, 10:22 AM |

|

|

Jun 25 2021, 11:14 AM Jun 25 2021, 11:14 AM

Return to original view | Post

#278

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(prophetjul @ Jun 25 2021, 10:48 AM) i bought in end Feb into 22% portfolio this year. DCA every 2 weeks. It is pretty flat. Still greeen. Just about. same with my 36% 😂 the MYR-USD exchange rate post March 2020 really worked against USD-based investments deposited during that time even while stock markets rocket up hahaha |

|

|

Jun 26 2021, 12:36 PM Jun 26 2021, 12:36 PM

Return to original view | IPv6 | Post

#279

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(JeffreyYap @ Jun 26 2021, 12:02 PM) Thanks. Because my MYR gain + RM500, but usd negative -200, huge difference.. just curious why they show both myr and usd.. confusing. StashAway's ETFs are traded in USD, so USD is the value of the actual funds itself.However, MYR is what you deposit with and what you get when you withdraw, so MYR is the actual money you get. |

|

|

Jun 26 2021, 10:52 PM Jun 26 2021, 10:52 PM

Return to original view | IPv6 | Post

#280

|

Senior Member

2,610 posts Joined: Aug 2011 |

QUOTE(NGV22 @ Jun 26 2021, 04:23 PM) Money that you deposit AFTER input the code. Means if you already have money in SA before put promo code, that money won't get 100% off from fees, but monies after redeemed code will get the 100% off. NGV22 liked this post

|

| Change to: |  0.1262sec 0.1262sec

1.38 1.38

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 09:52 PM |