QUOTE(Syracuse @ Nov 23 2021, 08:13 PM)

I've just started investing on Stashaway since one week ago (risk index 14%), but it's pretty disheartening to see my funds continuously drop for the whole week with no signs of bouncing back to the positives.

I initially planned to use Stashaway as a invest-and-forget investment vehicle for the next 3-5 years, but the current trend makes me wonder whether my funds will disappear after 3-5 years. Perhaps I've just entered the market at the worst possible timing?

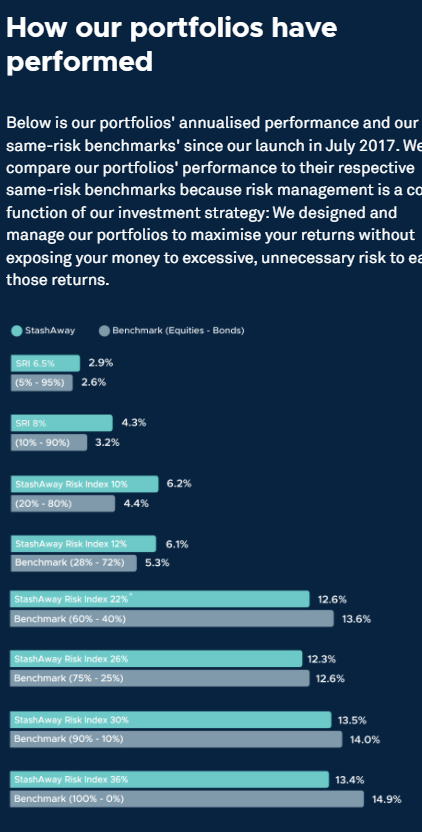

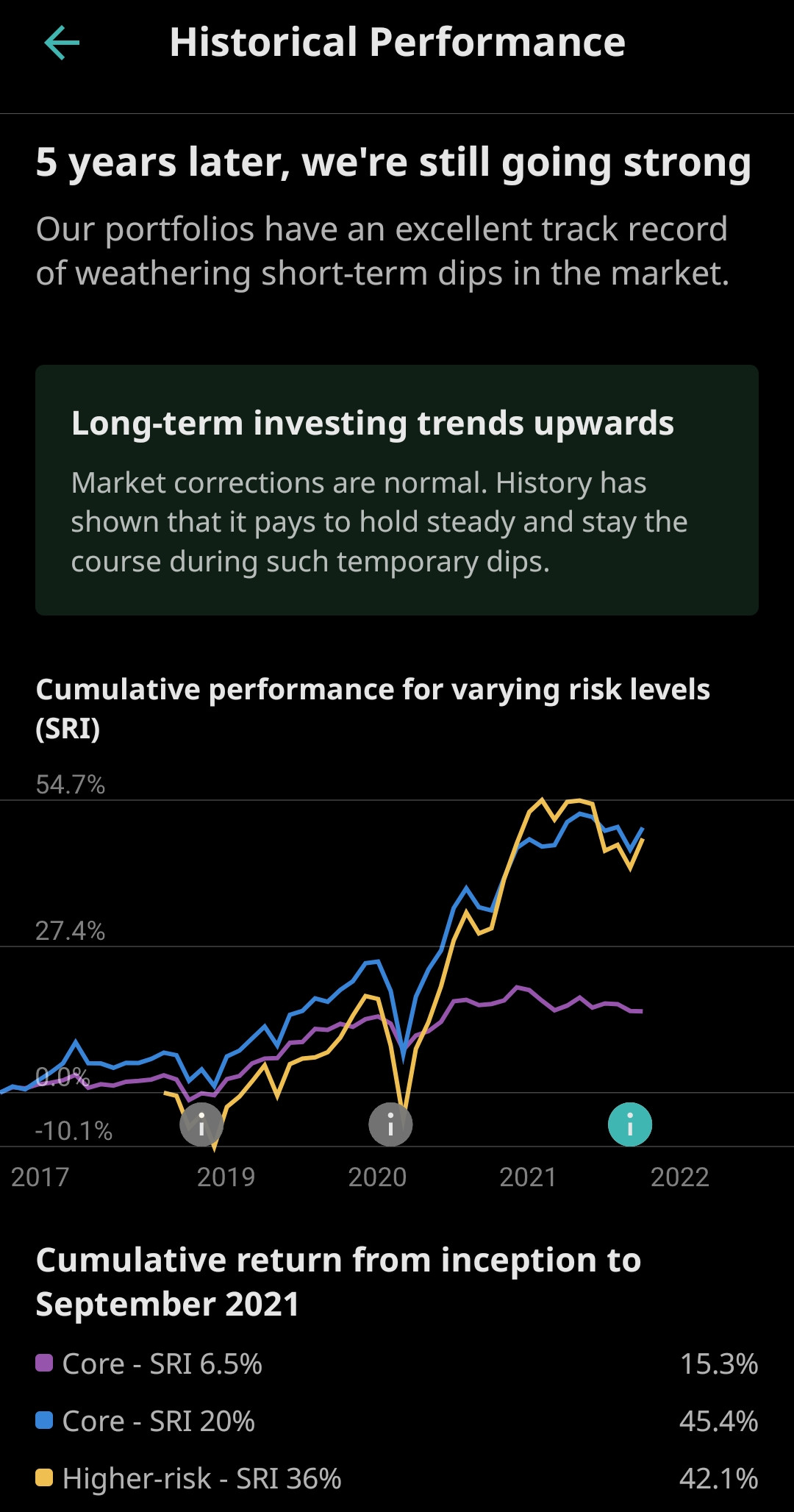

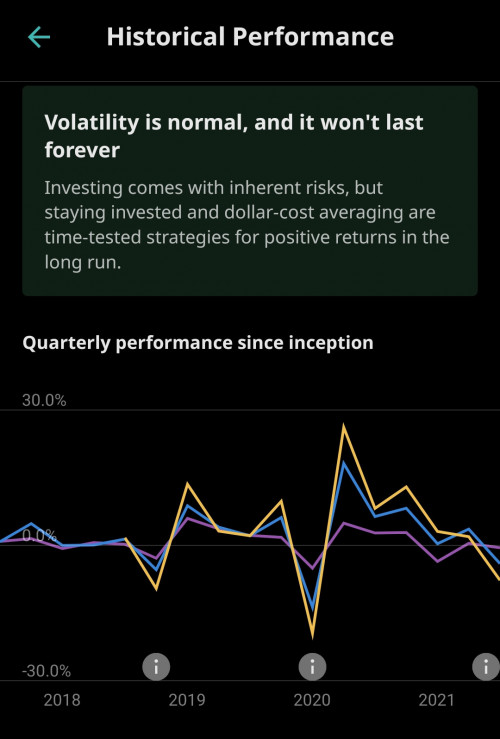

StashAway is functionally investing in a broad portfolio of a broad portfolio of stocks + bonds, which means there is going to be volatility where there's ups and downs.I initially planned to use Stashaway as a invest-and-forget investment vehicle for the next 3-5 years, but the current trend makes me wonder whether my funds will disappear after 3-5 years. Perhaps I've just entered the market at the worst possible timing?

starting off negative is not unusual

remember that this is NOT ASB/EPF/FD, you will see ups and downs

I'll share a snapshot of my account below of the past 3 months which is a combination of all my portfolios to show you the possible volatility.

investing in StashAway means you're prepared to accept this kind of ups and downs.

FYI my 16% SRI has since Sep 2020 given me 3% MWR as of todate, even though I put a large amount at the "all time high" (read: expensive units) right before the market crash in April-May

Nov 24 2021, 08:42 AM

Nov 24 2021, 08:42 AM

Quote

Quote

0.0598sec

0.0598sec

0.45

0.45

7 queries

7 queries

GZIP Disabled

GZIP Disabled