Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

honsiong

|

Mar 31 2019, 04:27 PM Mar 31 2019, 04:27 PM

|

|

QUOTE(vanitas @ Mar 31 2019, 04:21 PM) A bit off topic from this thread, still believing crypto is the future or sell them all already? Targeting Bitcoin 100K by 2022-2024 QUOTE(Krv23490 @ Mar 31 2019, 04:21 PM) What app is it, sounds like a better idea, feeds my ADHD. |

|

|

|

|

|

Krv23490

|

Mar 31 2019, 04:30 PM Mar 31 2019, 04:30 PM

|

|

QUOTE(honsiong @ Mar 31 2019, 04:27 PM) Targeting Bitcoin 100K by 2022-2024 What app is it, sounds like a better idea, feeds my ADHD. CNBC , so far i cant find any other app which doesn't have intrusive ads with real time updates |

|

|

|

|

|

TS[Ancient]-XinG-

|

Mar 31 2019, 04:40 PM Mar 31 2019, 04:40 PM

|

|

QUOTE(honsiong @ Mar 31 2019, 04:03 PM) I survived crypto bear and -23% in StashAway, looking forward to recession ady! What you think the trigger point will be? If its really hitting, all the EQ no doubt will burned 99 QUOTE(Krv23490 @ Mar 31 2019, 04:21 PM) nice app! have you tried investing? but it require us to register and a lot of ads. |

|

|

|

|

|

Krv23490

|

Mar 31 2019, 04:43 PM Mar 31 2019, 04:43 PM

|

|

QUOTE(Ancient-XinG- @ Mar 31 2019, 04:40 PM) What you think the trigger point will be? If its really hitting, all the EQ no doubt will burned 99 nice app! have you tried investing? but it require us to register and a lot of ads. I tried investing ! But I only use it rarely to check for futures. Shortly after I registered, someone from investing actually called me, now i mostly use the website on incognito mode on PC. CNBC is enough for me |

|

|

|

|

|

TS[Ancient]-XinG-

|

Mar 31 2019, 04:47 PM Mar 31 2019, 04:47 PM

|

|

QUOTE(Krv23490 @ Mar 31 2019, 04:43 PM) I tried investing ! But I only use it rarely to check for futures. Shortly after I registered, someone from investing actually called me, now i mostly use the website on incognito mode on PC. CNBC is enough for me wtf? Call you about what ? damn lucky I yet to register. I also use it to watch futures. |

|

|

|

|

|

Krv23490

|

Mar 31 2019, 04:58 PM Mar 31 2019, 04:58 PM

|

|

QUOTE(Ancient-XinG- @ Mar 31 2019, 04:47 PM) wtf? Call you about what ? damn lucky I yet to register. I also use it to watch futures. I hung up when he said. Hi I am xxxx from investing.com LOL . It was one of the apps where you had to enter the verification code if not mistaken |

|

|

|

|

|

Kaka23

|

Mar 31 2019, 04:58 PM Mar 31 2019, 04:58 PM

|

|

Can register join savings account in SA?

|

|

|

|

|

|

roarus

|

Mar 31 2019, 05:21 PM Mar 31 2019, 05:21 PM

|

|

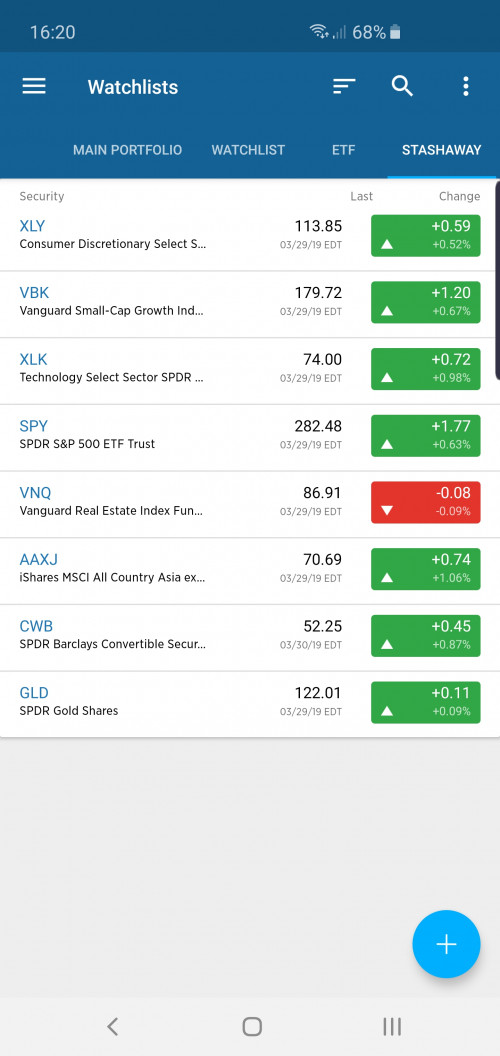

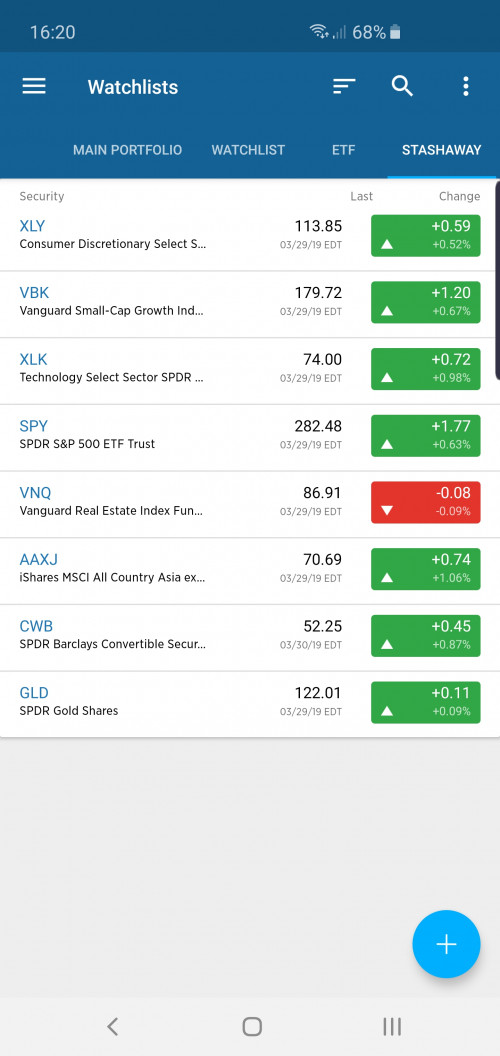

QUOTE(preducer @ Mar 31 2019, 03:39 PM) For those on highest risk profile, what is the reasoning for chosing such risk? High risk high return? https://www.stashaway.my/r/debunking-high-risk-high-returnFor me, other than it being a side project for fun - I prefer to manage my protective/fixed income porfolio separately as I have personal mandate on allocation % and not having foreign currency risk. QUOTE(Krv23490 @ Mar 31 2019, 04:30 PM) CNBC , so far i cant find any other app which doesn't have intrusive ads with real time updates I use Bloomberg app, it allows for multiple watchlists and holding of fractional units » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

tadashi987

|

Mar 31 2019, 05:59 PM Mar 31 2019, 05:59 PM

|

|

QUOTE(roarus @ Mar 31 2019, 10:10 AM) Nah, it's my fun side experiment for 1 year together with Funding Societies. Do remember StashAway charges by the value of asset under management (AUM), even though you can escape 6 months using referral code. so so far, SA or Funding Society return better? |

|

|

|

|

|

preducer

|

Mar 31 2019, 06:42 PM Mar 31 2019, 06:42 PM

|

|

QUOTE(tadashi987 @ Mar 31 2019, 05:59 PM) so so far, SA or Funding Society return better? If there's no default then definitely FS, getting roughly 11% p.a |

|

|

|

|

|

tadashi987

|

Mar 31 2019, 07:00 PM Mar 31 2019, 07:00 PM

|

|

QUOTE(preducer @ Mar 31 2019, 06:42 PM) If there's no default then definitely FS, getting roughly 11% p.a u using funding society also? |

|

|

|

|

|

SUSDavid83

|

Mar 31 2019, 07:08 PM Mar 31 2019, 07:08 PM

|

|

By the way, what is FS?

|

|

|

|

|

|

Krv23490

|

Mar 31 2019, 07:21 PM Mar 31 2019, 07:21 PM

|

|

QUOTE(David83 @ Mar 31 2019, 07:08 PM) Funding Societies is the 1st P2P financing platform for SMEs in Malaysia. We enable SMEs to secure business financing from retail and institutional investors. Copy and paste haha Since we are on the topic, abit hard to compare P2P and ETF investing. Risk is so much different |

|

|

|

|

|

preducer

|

Mar 31 2019, 07:29 PM Mar 31 2019, 07:29 PM

|

|

QUOTE(tadashi987 @ Mar 31 2019, 07:00 PM) u using funding society also? Yup just started actually, aldy allocated all my funds in notes. Now waiting for repayments to come in monthly |

|

|

|

|

|

TS[Ancient]-XinG-

|

Mar 31 2019, 07:31 PM Mar 31 2019, 07:31 PM

|

|

QUOTE(preducer @ Mar 31 2019, 07:29 PM) Yup just started actually, aldy allocated all my funds in notes. Now waiting for repayments to come in monthly Use auto invest. No doubt p2p at least 10% pa. But the risk is super high. So far mine is at 23.6% pa. But but already 3 default. Lost over 600 MYR. Even the interest earn yet to cover. |

|

|

|

|

|

preducer

|

Mar 31 2019, 07:34 PM Mar 31 2019, 07:34 PM

|

|

QUOTE(Ancient-XinG- @ Mar 31 2019, 07:31 PM) Use auto invest. No doubt p2p at least 10% pa. But the risk is super high. So far mine is at 23.6% pa. But but already 3 default. Lost over 600 MYR. Even the interest earn yet to cover. Thats why i don't invest in high int notes |

|

|

|

|

|

honsiong

|

Mar 31 2019, 07:43 PM Mar 31 2019, 07:43 PM

|

|

Pulled 50% of my initial deposit out from FS. P2P is too high risk, it takes few weeks of due diligence fuck ups to wipe out ur capital, no matter how good their past performance is.

StashAway investing in ETFs feel much safer. Unless WW3 breaks out.

|

|

|

|

|

|

SUSDavid83

|

Mar 31 2019, 07:44 PM Mar 31 2019, 07:44 PM

|

|

QUOTE(honsiong @ Mar 31 2019, 07:43 PM) Pulled 50% of my initial deposit out from FS. P2P is too high risk, it takes few weeks of due diligence fuck ups to wipe out ur capital, no matter how good their past performance is. StashAway investing in ETFs feel much safer. Unless WW3 breaks out. ETFs risk should be low. |

|

|

|

|

|

roarus

|

Mar 31 2019, 09:40 PM Mar 31 2019, 09:40 PM

|

|

QUOTE(tadashi987 @ Mar 31 2019, 05:59 PM) so so far, SA or Funding Society return better? Both started beginning of this year: FS - capital SGD$500, projected annualized return 13.19%, nett return so far SGD$3.02 after fees and tax. But this month 4 of 23 notes missed payment, 2 of 4 missed ones didn't respond when contacted by FS and awaiting lawyer letter. SA - unrealized gains is higher at the moment, FS need time for notes to complete. This post has been edited by roarus: Mar 31 2019, 09:41 PM |

|

|

|

|

|

Krv23490

|

Mar 31 2019, 10:00 PM Mar 31 2019, 10:00 PM

|

|

QUOTE(roarus @ Mar 31 2019, 09:40 PM) Both started beginning of this year: FS - capital SGD$500, projected annualized return 13.19%, nett return so far SGD$3.02 after fees and tax. But this month 4 of 23 notes missed payment, 2 of 4 missed ones didn't respond when contacted by FS and awaiting lawyer letter. SA - unrealized gains is higher at the moment, FS need time for notes to complete. How much capital at risk for the 4 notes which have missed payments ? |

|

|

|

|

Mar 31 2019, 04:27 PM

Mar 31 2019, 04:27 PM

Quote

Quote

0.0155sec

0.0155sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled