Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

joshtlk1

|

May 28 2020, 11:07 AM May 28 2020, 11:07 AM

|

Getting Started

|

QUOTE(zerolord @ May 28 2020, 11:05 AM) I'm cashing out my 36% portfolio, and dumping the money into something else... Don't really like the 25% RMB and 20% Gold after the re-op. Woah, bold move? Is there other portfolio in your Stashaway? Or that is everything? |

|

|

|

|

|

joshtlk1

|

Jun 1 2020, 01:54 PM Jun 1 2020, 01:54 PM

|

Getting Started

|

QUOTE(dinkelberg @ Jun 1 2020, 01:52 PM) Just checked out Raiz. Their most aggressive portfolio is 80% ASN Equity 3 Fund and 20% ASN Sara 1 Fund. Where did you get the information? |

|

|

|

|

|

joshtlk1

|

Jun 3 2020, 04:53 PM Jun 3 2020, 04:53 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ Jun 3 2020, 04:42 PM) SAMY is gearing up for Simple. Apart from the hint that tadashi987 had shared. Another hint is in the monthly statement: March 2020 statement:  May 2020 statement:  show that too! Won't see much benefit being that there are savings accounts in MY that offer around 3% plus interest. On another note, do most people here invest in both Wahed and SA too? |

|

|

|

|

|

joshtlk1

|

Jun 10 2020, 09:49 PM Jun 10 2020, 09:49 PM

|

Getting Started

|

QUOTE(stormseeker92 @ Jun 10 2020, 07:52 PM) I started on 19 Feb (just before market crash. still hurt about that LOL). For March I deposit once per month, starting from April I deposit minimum RM250 weekly until now. Returns so far (profit / total deposit) is 8%  Good so far for SA. I have 2 portfolio, 36 and 22%. Combined now I am +7%, invested since beginning of the year and weekly DCA |

|

|

|

|

|

joshtlk1

|

Jun 11 2020, 04:58 PM Jun 11 2020, 04:58 PM

|

Getting Started

|

QUOTE(honsiong @ Jun 11 2020, 03:55 PM) DCA means no more no less, just consistent. lol true. I have been DCA-ing a large amount every week. I am a little nervous about the way the market is going. In a sense, I have trained myself to think that when the market goes down its good, because I can buy stocks at a cheaper value. But now that the market is inflated, and detached from the real economy. I am thinking of cutting back the amount per DCA, but still continuing DCA. What is everyone doing with Stashaway currently? |

|

|

|

|

|

joshtlk1

|

Jun 12 2020, 02:41 PM Jun 12 2020, 02:41 PM

|

Getting Started

|

QUOTE(Oklahoma @ Jun 12 2020, 02:38 PM) This is my first time switching to 36%. Previously was 30% all these while for 1+ years. Then today I woke up few hundreds gone just like that Then read the news its second wave of dumping by us investors again  Its hard seeing your portfolio down by so much. But the key is the train your brain to think that it is a good thing, because if your method is DCA. You know that your next few DCA is going to be of a higher value. My SA portfolio drop from +7% 3 days ago, to now +1.5%  |

|

|

|

|

|

joshtlk1

|

Jun 12 2020, 02:46 PM Jun 12 2020, 02:46 PM

|

Getting Started

|

QUOTE(zstan @ Jun 12 2020, 02:44 PM) mine dropped 8% but no feel already. instead i dumped in more money  haha! I am trying to get to the point of 'no feel'. Trying super hard! lol |

|

|

|

|

|

joshtlk1

|

Jun 15 2020, 10:48 AM Jun 15 2020, 10:48 AM

|

Getting Started

|

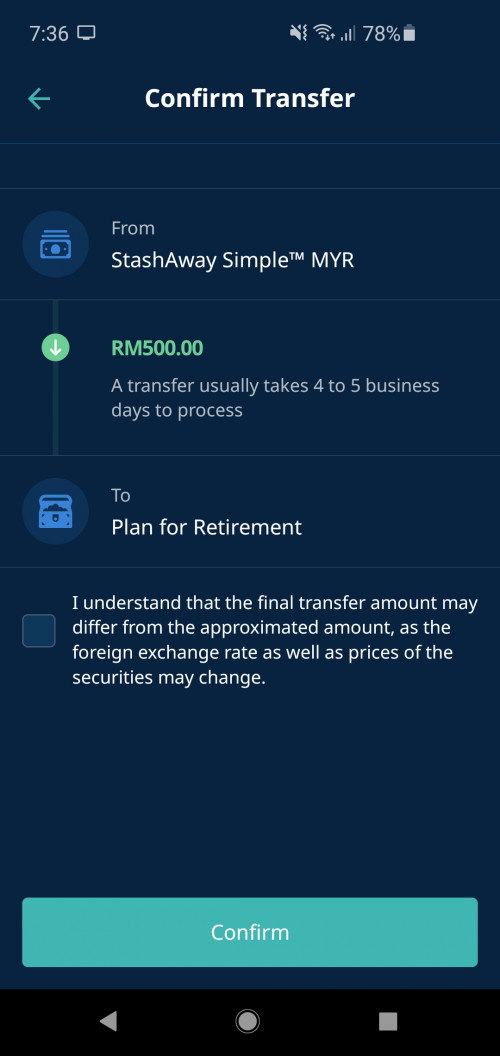

QUOTE(Eurobeater @ Jun 15 2020, 10:30 AM) It seems cheaper to buy into the fund via SA. The annual expense ratio in the app is 0.165%, after rebates. Anyway, just put in RM 500 to see how much I can make in a month and see how fast the withdrawal might take Same. I some money in it to test out the feature. Also, Stashaway should design something like Simple, but shorten their processing time when transferring to investment portfolio. It seems like this is one of the most common pain points among forumers here. |

|

|

|

|

|

joshtlk1

|

Jun 15 2020, 11:29 AM Jun 15 2020, 11:29 AM

|

Getting Started

|

QUOTE(lee82gx @ Jun 15 2020, 11:14 AM) I gave them a call regarding the Simple. My question was can I setup a monthly or regular deduction from the Simple into my Investment portfolios. Answer was YES. However I don't see this option when messing around, trying to create a new regular deposit into my existing investment portfolios. To me its quite a hassle if I need to manually, individually create a 1 time transfer for each investment portfolio by transfer from the Simple to the investment.... Perhaps its because I have no balance inside yet...so like you guys I put in a small amount to test it out. Did they say it would be faster processing time for Simple to Investment? |

|

|

|

|

|

joshtlk1

|

Jun 16 2020, 07:52 PM Jun 16 2020, 07:52 PM

|

Getting Started

|

QUOTE(responsible poster @ Jun 16 2020, 05:53 PM) anyone here keep any records of investment return over time? 6mth/1year Invested with StashAway since October 2019 with 36% and 22% portfolio. So far combining both, about +4.4% MWR. |

|

|

|

|

|

joshtlk1

|

Jun 16 2020, 08:36 PM Jun 16 2020, 08:36 PM

|

Getting Started

|

QUOTE(encikbuta @ Jun 16 2020, 02:27 PM) the summary of the last few days: - "omg, second wave virus" - sell EVERYTHING - "ei, USA gomen will print money" - buy EVERYTHING Haha! Now buyyyyyyyyyyy! It's going higher and higher! Dow is soaring! |

|

|

|

|

|

joshtlk1

|

Jun 17 2020, 11:20 AM Jun 17 2020, 11:20 AM

|

Getting Started

|

Anyone here knows how dividend's are taxed for Stashaway? In funds like VNQI where the dividend amount is pretty high 9%. Are the dividends subjected to 30% tax upfront?

|

|

|

|

|

|

joshtlk1

|

Jun 17 2020, 07:35 PM Jun 17 2020, 07:35 PM

|

Getting Started

|

Just saw from stashaway simple that we can set a reccuring transfer from simple into our investment profolio.

|

|

|

|

|

|

joshtlk1

|

Jun 18 2020, 04:54 PM Jun 18 2020, 04:54 PM

|

Getting Started

|

QUOTE(Super_Spammer @ Jun 18 2020, 04:52 PM) Anyone able to open the SA app at the moment, seems to be down. Only can access thru the web for now. Not sure the rest. Works fine for me. On app. |

|

|

|

|

|

joshtlk1

|

Jun 19 2020, 03:31 PM Jun 19 2020, 03:31 PM

|

Getting Started

|

Why are people here so religious about the term 'DCA'. We all know what DCA is, and we all understand what forumers are trying to say when they say they will continue to 'DCA' even though we think its not DCA. Give it a break guys.

Anyway, my portfolio didn't change much from yesterday to today. Will measure the performance of Wahed and SA at the end of the year

|

|

|

|

|

|

joshtlk1

|

Jun 19 2020, 05:08 PM Jun 19 2020, 05:08 PM

|

Getting Started

|

QUOTE(honsiong @ Jun 19 2020, 03:57 PM) Commenting "I will keep DCA-ing" while timing the market at the same time is not strictly DCA anymore. With roboadvisors you are really supposed to let go of the steering and trust the investment team to have done their homework for you - hence the 0.8% p.a. you pay for. I still DCA to my existing goals, same amount every week, but I time the market on the side with the money I put in StashAway Simple for fun. But if you ever withdraw from the goals with explicit intent to time the market, that's not DCA anymore. So if you DCA more than usually is it considered as DCA? Say I add 500 every month, now I decided to add 100 every month, and then next year I add 200 every month instead. Lol... So is that still dca? |

|

|

|

|

|

joshtlk1

|

Jun 24 2020, 10:23 PM Jun 24 2020, 10:23 PM

|

Getting Started

|

QUOTE(stormseeker92 @ Jun 24 2020, 10:01 PM) Anyone has any comment if I use SA Simple MY to put some small amount of money is worth it or not? Plus I read the interest is calculated daily, so the interest might probably too small a return for low amount of cash stored. Yup I have a 0.04% increased so far. Haha! Still testing it out, just putting it in there to see how it will perform. |

|

|

|

|

|

joshtlk1

|

Jun 25 2020, 04:30 PM Jun 25 2020, 04:30 PM

|

Getting Started

|

QUOTE(footie_ft @ Jun 25 2020, 04:05 PM) Find back old post... Someone bought twice and it didn't work the second time. They put the code in the thread in case anyone can use it.... Not sure if it still valid anymore but you can try... I am one of them that bought twice and shared it out... Lol Yup you can only use it once. So use it wisely! haha |

|

|

|

|

|

joshtlk1

|

Jun 25 2020, 09:16 PM Jun 25 2020, 09:16 PM

|

Getting Started

|

QUOTE(Josephtky725 @ Jun 25 2020, 08:23 PM) Anyone know how SA work during the investment? Lets say if I invest 10k then they just pick the asset and invest till we withdraw or they will buy and sell during the investment period? If you just put 10k and leave it in there and not touch it anymore. They will reallocate your investment based on the target. So if example for GLD, if your GLD has increased more than its target of 20% to 25% of your portfolio. They will sell 5% of GLD and reallocate accordingly. |

|

|

|

|

May 28 2020, 11:07 AM

May 28 2020, 11:07 AM

Quote

Quote

0.4233sec

0.4233sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled