Hi guys, stashaway country manager interview on this youtube channel

https://www.youtube.com/watch?v=2u8qE_eTWOY

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Apr 21 2020, 09:20 PM Apr 21 2020, 09:20 PM

Return to original view | Post

#1

|

Junior Member

161 posts Joined: Apr 2020 |

Hi guys, stashaway country manager interview on this youtube channel

https://www.youtube.com/watch?v=2u8qE_eTWOY |

|

|

|

|

|

Apr 21 2020, 09:59 PM Apr 21 2020, 09:59 PM

Return to original view | Post

#2

|

Junior Member

161 posts Joined: Apr 2020 |

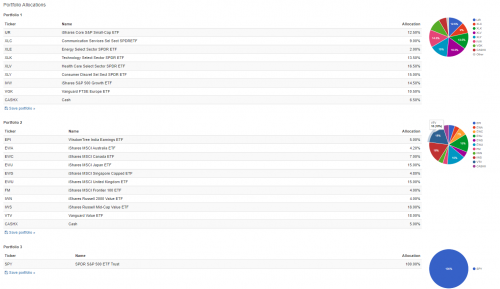

https://pictr.com/images/2020/04/21/52lUX8.md.png

https://pictr.com/images/2020/04/21/52lNdX.md.png Stashaway Country Manager's portfolio |

|

|

Apr 22 2020, 04:50 PM Apr 22 2020, 04:50 PM

Return to original view | Post

#3

|

Junior Member

161 posts Joined: Apr 2020 |

QUOTE(taiping... @ Apr 22 2020, 04:27 PM) This disaster on economy is worldwide, everyone will sink together. Won’t impact as much cause everyone sink. Correct me if wrong not entirely true. If you are comparing everyone investing in equities, it might be true. But maybe for people investing in commodities like gold, or Bitcion as a hatch, those two might go in opposite direction compare to equates. Historically commodities does have a opposite correlation with the equity market. As for Bitcion, people are saying it's a hatch against the dollar of this world due to heavy stimulus packages and inflation rising, which result in weakening of the dollar. Just my twice cents 🤔😁 |

|

|

May 1 2020, 01:27 PM May 1 2020, 01:27 PM

Return to original view | Post

#4

|

Junior Member

161 posts Joined: Apr 2020 |

Hey guys, I have promo code for StashAway that I bought from Boost and realized I can't use it anymore since I have already used it once. Whoever is the lucky person to use it let me know.

BOOST-2RRH3LYSV |

|

|

May 1 2020, 01:50 PM May 1 2020, 01:50 PM

Return to original view | Post

#5

|

Junior Member

161 posts Joined: Apr 2020 |

|

|

|

May 1 2020, 02:18 PM May 1 2020, 02:18 PM

Return to original view | Post

#6

|

Junior Member

161 posts Joined: Apr 2020 |

|

|

|

|

|

|

May 2 2020, 07:10 PM May 2 2020, 07:10 PM

Return to original view | Post

#7

|

Junior Member

161 posts Joined: Apr 2020 |

QUOTE(honsiong @ May 2 2020, 06:51 PM) I tend to have a different opinion. As many billionaire and millionaire investors would say, one thing that they regret not doing, is that they wished they have invested while they were younger. This includes Mark Cuban and so on. The power of compound interest adds up, when you are so young, assuming you are still in university, that's the best time to invest eventho your savings might not be a lot. But that RM100 that you invested at 20 yrs old, will be worth RM10, 000 when you are 65. And if you invested at 30 yrs old, with the same RM100, when you are 65 yes old, your RM100 invested will be worth a lot less than RM10k, at least a few magnitudes lower. |

|

|

May 2 2020, 08:34 PM May 2 2020, 08:34 PM

Return to original view | Post

#8

|

Junior Member

161 posts Joined: Apr 2020 |

QUOTE(honsiong @ May 2 2020, 08:21 PM) Don't disagree for the sake of disagreeing. That fella asked should they use StashAway when they do not have income just yet. LOL maybe you should read the question properly. Looks like you've made some painful but useful mistakes.Use that pocket money to buy ebooks or MOOC to upskill, go travel a bit, boost your motivation and morale for the rest of your life. So fast grind retirement saving for what LMAO. Cmon, uni students, you have better use for those monies than to put inside robo advisor. Maybe buy bitcoin and learn some painful lessons on investing, which can cost you more if you make those mistakes later in life. Anyway his/her question is 'can' you register for StashAway without an income. Not 'should' they use stashaway without an income. |

|

|

May 3 2020, 01:28 PM May 3 2020, 01:28 PM

Return to original view | Post

#9

|

Junior Member

161 posts Joined: Apr 2020 |

|

|

|

May 3 2020, 10:17 PM May 3 2020, 10:17 PM

Return to original view | Post

#10

|

Junior Member

161 posts Joined: Apr 2020 |

QUOTE(zacknistelrooy @ May 3 2020, 10:04 PM) Stashaway 36% vs MYTHEO vs SPY Performance in USD for anyone interested Are you invested into both platform? If so what are your thoughts. Looks like mytheo portfolio is more country diversify. Monthly Return  Returns have been in line with S&P 500 for Stashaway at least |

|

|

May 4 2020, 01:38 AM May 4 2020, 01:38 AM

Return to original view | Post

#11

|

Junior Member

161 posts Joined: Apr 2020 |

[quote=zacknistelrooy,May 3 2020, 11:38 PM]

I only have a bit in StashAway as I invest directly but double check their performance for my friends who are invested in these platforms. Yes it is more diversified geographically but requires both value to outperform and the dollar to go down. I will use Australia as an example of the importance of the movement of the dollar. The ASX 200 actually hit an all time high in February but the Australian ETF was still down nearly 30% from the all time high mainly due to the deprecation of the Australian dollar. https://www.portfoliovisualizer.com/ That's interesting. What kind of direct investment are you heavily invested in? Are they mainly bursa malaysia stocks? Wanted to pick your brain cause it seems like you know a variety of stuff. |

|

|

May 6 2020, 04:49 PM May 6 2020, 04:49 PM

Return to original view | Post

#12

|

Junior Member

161 posts Joined: Apr 2020 |

How are your portfolio's so far?

Mine 36% risk is - 2.11%TWR 22% risk is - 5.78% TWR |

|

|

May 14 2020, 08:07 AM May 14 2020, 08:07 AM

Return to original view | Post

#13

|

Junior Member

161 posts Joined: Apr 2020 |

|

|

|

|

|

|

May 14 2020, 09:52 AM May 14 2020, 09:52 AM

Return to original view | Post

#14

|

Junior Member

161 posts Joined: Apr 2020 |

QUOTE(tadashi987 @ May 14 2020, 09:41 AM) I tend to be favorable for the change. Looks like Asia will perform better in this economic downturn. Also because US equities are also close to all times high, where China and Asia are still far off. The only thing I was a little disappointed as they took XLK(US Tech) entirely out of the 36% portfolio. Meaning no more investment in Google, Facebook, Microsoft, and so on. I would have loved to keep that in. |

|

|

May 14 2020, 07:10 PM May 14 2020, 07:10 PM

Return to original view | Post

#15

|

||||||||||||||

Junior Member

161 posts Joined: Apr 2020 |

QUOTE(GrumpyNooby @ May 14 2020, 06:27 PM) Below is under SELL order tonight for my 36% portfolio: Hmm I'm just calculating what is your overall sto k portfolio and converting it back to usd? 😂 Sorry missed the point there.

It's 60% of my today's portfolio valuation. |

||||||||||||||

|

|

May 14 2020, 08:59 PM May 14 2020, 08:59 PM

Return to original view | Post

#16

|

Junior Member

161 posts Joined: Apr 2020 |

I think these few days will be interesting to see after optimization how each of our portfolio's are doing. I'm already down MWR wise before the optimization. If after optimization I can break even within a couple weeks. I'm already happy. What about you guys?

|

|

|

May 15 2020, 02:02 PM May 15 2020, 02:02 PM

Return to original view | Post

#17

|

Junior Member

161 posts Joined: Apr 2020 |

I am wondering when they are going to buy all the other ETFs that they have added.

One idea that I wish SA has done is to not sell everything all at once when re-optimized. But sell at stages, similar to DCA, over a span of 1 or 2 months. That way if there are any losses, it will be minimized. |

|

|

May 22 2020, 06:31 PM May 22 2020, 06:31 PM

Return to original view | Post

#18

|

Junior Member

161 posts Joined: Apr 2020 |

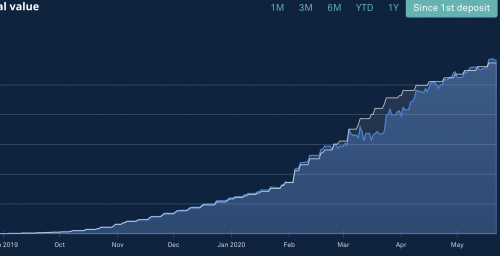

QUOTE(donhay @ May 22 2020, 05:01 PM) Have been investing in SA for a year. I consistently put in money every week. Its part of my diversification. I can't seem to see the Y-axis? haha..My Risk Profile is a 18% from the start, didn't change. Can say I am satisfy so far, didn't have to study or anything MYR MWR +7.12% TWR +9.72% USD MWR -1.31% TWR +4.11%  I did the same as you with a 36% and 22% portfolio since Aug 2019, and Jan 2020 for the 22% portfolio. So far here are my numbers  36% Portfolio MYR MWR +1.52% TWR +0.40% USD MWR -5.79% TWR -1.11% 22% Portfolio MYR MWR +5.91% TWR -2.97% USD MWR +1.77% TWR -7.97% |

|

|

May 27 2020, 09:18 PM May 27 2020, 09:18 PM

Return to original view | Post

#19

|

Junior Member

161 posts Joined: Apr 2020 |

The other time just last month it was 63k, now 70k? Looks like he is heavily investing?

Still very doubtful of 20% gold in the portfolio. But will continue to DCA for the next 6 months |

|

|

May 27 2020, 10:21 PM May 27 2020, 10:21 PM

Return to original view | Post

#20

|

Junior Member

161 posts Joined: Apr 2020 |

QUOTE(rocketm @ May 27 2020, 10:03 PM) Hi all, Hi I can't speak much about Wahed, as I just started a few weeks ago, and until now my money is still not invested.Are you happy with the performance of your portfolio so far? I am a Wahed user. I have attended few webinar organised by SA. From the webinar, it looks like SA is managing their business better (just my opinion). May I know considering the same risk level, which platform is better (if you have invest on both SA and Wahed). Another thing is how do you know the platform has optimize your portfolio? If they did, do we always see positive in our account? SA generally has better more ETFs under their belt, hence making it also better IMO. The last re-optimization, SA notify us on the platform itself. Whether it is positive or negative really depends on how long you have been invested with them. Current it is too soon to say if its was a good decision or not. The only way to really tell is to benchmark prior ETFs that SA invested in, and compare it to ETFs that they are investing now, maybe after a year? Providing they do not re-optimized again haha! |

| Change to: |  0.4727sec 0.4727sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 03:35 AM |