QUOTE(stormseeker92 @ Mar 4 2021, 01:32 PM)

Historically, election year sell off continues until mid of march But this year special abit with covid

Also

pay attention to powell tonight, or izit tomorrow.

Should be related to the yield

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Mar 4 2021, 01:37 PM Mar 4 2021, 01:37 PM

Return to original view | IPv6 | Post

#201

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

|

|

|

Mar 11 2021, 08:44 AM Mar 11 2021, 08:44 AM

Return to original view | IPv6 | Post

#202

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

Mar 11 2021, 11:27 AM Mar 11 2021, 11:27 AM

Return to original view | IPv6 | Post

#203

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(honsiong @ Mar 11 2021, 11:08 AM) Sorry I use stashaway singapore. You are using robo advisor so you can't time the market with this tool, if you care about timing please consider opening CIMB Singapore + Tiger Brokers. x faham QUOTE(honsiong @ Mar 11 2021, 02:06 AM) Deposited and executed on Monday night. if sold IJR on tuesday, then the selling price most likely 110Rebalancing mechanism sold IJR on Tuesday. Now stocks are in the red and they buying them again. and buy on wed, then the buying price most likely 112 so SA are sell high and buy higher? |

|

|

Mar 12 2021, 01:50 PM Mar 12 2021, 01:50 PM

Return to original view | IPv6 | Post

#204

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(pinksapphire @ Mar 12 2021, 01:28 PM) Sorry, can I ask, I kept hearing that tech correction is over? Meaning buying spree is done with and now should be expecting the rise? Is this correct? To be honest, no one indicator will give you 100% accuracyJust for knowledge, nothing else. Based on TA at Nasdaq, it close above resistance and awaiting confirmation of continuation of uptrend which is a bounce and close above the resistance. pinksapphire liked this post

|

|

|

Jun 18 2021, 05:47 PM Jun 18 2021, 05:47 PM

Return to original view | IPv6 | Post

#205

|

Senior Member

2,649 posts Joined: Nov 2010 |

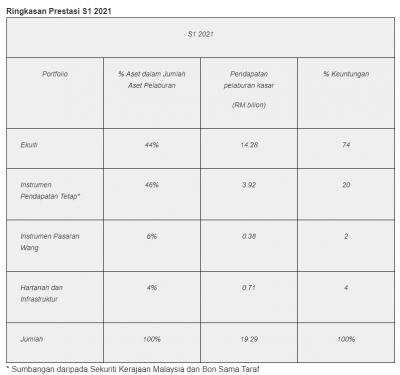

QUOTE(honsiong @ Jun 18 2021, 01:33 PM) EPF has 51% bond, 3% cash/mm, 40%+ equities and real estate. not quite accurateFrom here you just need to make sure you are above 16% var should outperform EPF already.

https://www.kwsp.gov.my/ms/-/epf-records-he...ome-for-q1-2021 thediablo liked this post

|

|

|

Jul 12 2021, 10:58 AM Jul 12 2021, 10:58 AM

Return to original view | IPv6 | Post

#206

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(squarepilot @ Jul 10 2021, 12:45 PM) Since MIDF already launch fuss free trading on NYSE and US market, If one were to mimic SA holdings, might as well just keep in SAwhat will be the plus point of investment in SA vs DIY of index fund investing in MIDF? Midf fees, usd 5 or 0.04% per trade whichever higher (waive as of now) This alone enough to significantly affect your return assuming you DCA frequently On top of annual fee of your total Investment amount. |

|

|

|

|

|

Jul 21 2021, 01:46 PM Jul 21 2021, 01:46 PM

Return to original view | IPv6 | Post

#207

|

Senior Member

2,649 posts Joined: Nov 2010 |

Interesting

Adding xle, xlp and ewa in 36% |

|

|

Jul 21 2021, 04:05 PM Jul 21 2021, 04:05 PM

Return to original view | IPv6 | Post

#208

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Oklahoma @ Jul 21 2021, 03:15 PM) GUYS stashaway just did a big re-optimized today...my highest risks (36%), they sold off some equities and bought US high grade bonds and REITs Seems like 36% getting pretty defensiveAny comments? Adding consumer staple, utilities, bonds and gold (reduced from 20%) To be honest, pretty surprise they added Australia etf. This post has been edited by xcxa23: Jul 21 2021, 04:06 PM Oklahoma liked this post

|

|

|

Jul 21 2021, 04:28 PM Jul 21 2021, 04:28 PM

Return to original view | IPv6 | Post

#209

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Oklahoma @ Jul 21 2021, 04:14 PM) freddy posted an article explaining it. because australia is a commodities exporting country Hmm but Australia not even top 5 of commodities countrieshttps://www.stashaway.my/r/economy-inflatio...ReoptimisationA "Maintained (or increased) exposure to China Tech China’s economy is growing again. And, it has a 5-year tech timeline that includes the development of semiconductors, servers, cloud computing, and 5G networks. This long-term view makes China’s recent antitrust measures a mere blip on the country’s clear trajectory to becoming a global tech superpower. Over the next decade, China will continue to invest heavily in technological innovations. Our investment algorithm is designed to invest in asset classes with substantial growth potential over the medium and long term, and so most of our portfolios’ allocation to China Tech has stayed the same or has even increased. If China Tech underperforms in the short term, investors should see being able to invest at low prices as an opportunity. Broader protection against inflation We’ve maintained our portfolios’ previous level of protection against the dilution of fiat money with Gold. But now, we’ve also broadened our inflation-protection assets beyond just Gold. Specifically, we’ve increased our allocation to assets that can both seize the growth opportunities in the new economic regime and maintain inflation protection. For US assets, we’re making new equity allocations to Consumer Staples and Energy. We’re also making new allocations to US REITs. Internationally, we slightly increased our allocations to Emerging Market bonds, and made new equity allocations to commodity-exporting countries, such as Australia. To minimise the dilutive impact on fixed income-like assets in our lowest-risk portfolios, our system has focused on enhancing inflation protection for these lower-risk portfolios. " https://trendeconomy.com/data/commodity_h2/TOTAL Oh well, who am I to question SA robo. Interesting to see how well with the Australia etf perform |

|

|

Jul 21 2021, 06:52 PM Jul 21 2021, 06:52 PM

Return to original view | IPv6 | Post

#210

|

Senior Member

2,649 posts Joined: Nov 2010 |

just login to SA and looked in the sell history 36% RI sold price in 2020 xlk 91.3 xlv 98.49 xle 35.79 ivv 281.79 vgk 43.95 xlc 49.74 current price xlk 150 xlv 128 xle 47.5 (they are adding this back) ivv 432 vgk 65.8 xlc 80.5

This post has been edited by xcxa23: Jul 21 2021, 06:57 PM jacksonpang liked this post

|

|

|

Jul 22 2021, 09:00 AM Jul 22 2021, 09:00 AM

Return to original view | IPv6 | Post

#211

|

Senior Member

2,649 posts Joined: Nov 2010 |

|

|

|

Jul 22 2021, 09:28 AM Jul 22 2021, 09:28 AM

Return to original view | IPv6 | Post

#212

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(zstan @ Jul 22 2021, 09:09 AM) HahaWaiting for SA to plot it, to show user how well ther robo AI perform with their each optimization. If it's good, damn SA user base gonna grow exponentially QUOTE(AthrunIJ @ Jul 22 2021, 09:17 AM) O well. Gotta believe in SA for now. Until better opportunities to buy oversea stocks at a relative cheaper price. Actually, there's many fintech, heck even some bank overseas allow Malaysian to open account with them. I'm using those to directly buy US stock and etfRecently there's one local institution finally support this, MIDF Tho the fees are on hefty side but pros are they are locally regulates. This post has been edited by xcxa23: Jul 22 2021, 09:29 AM |

|

|

Jul 22 2021, 10:43 AM Jul 22 2021, 10:43 AM

Return to original view | IPv6 | Post

#213

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(zstan @ Jul 22 2021, 10:31 AM) if SA plot it later you say it's misleading pula Lol.. dude hold your horses and chill..SA comparison chart with their SRI and you don't see me said it's misleading This thread is pretty toxic Members question about SA decision and gotten respond like if you don't trust SA, do it yourself Quazacolt, jacksonpang, and 2 others liked this post

|

|

|

|

|

|

Jul 22 2021, 11:14 AM Jul 22 2021, 11:14 AM

Return to original view | IPv6 | Post

#214

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(zstan @ Jul 22 2021, 11:12 AM) where's the toxicity? Good for you then 😉This post has been edited by xcxa23: Jul 22 2021, 11:15 AM Quazacolt liked this post

|

|

|

Jul 22 2021, 02:24 PM Jul 22 2021, 02:24 PM

Return to original view | IPv6 | Post

#215

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(littlegamer @ Jul 22 2021, 01:52 PM) Not a very informative input. 14months isn't a long time. Keeping them accountable abit too much, I mean invest does not mean will only profit.I'm not here to bash SA decision, but asking the question why. Why those new allocation. Although SA is set and forget, still have to know the reason behind it. I don't think answer like ' our AI and algorithm did their things''. I'm not sure why everyone is so defensive of SA instead of being neutral just keeping them accountable. But I do agree with asking questions. All of us started as newbies and by asking question only we may learn something. But some ppl here are so quick to defensive. This post has been edited by xcxa23: Jul 22 2021, 02:25 PM |

|

|

Jul 23 2021, 10:43 AM Jul 23 2021, 10:43 AM

Return to original view | IPv6 | Post

#216

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(adele123 @ Jul 23 2021, 09:27 AM) Forum is for exchanging ideas and opinion and also information. If indeed you feel strongly about what you do, then more reason for you to feel strongly about sharing what you believe too, correct? Instead of shunning and attacking when others opinion do not align with yours. Agreed.People here just want to make money and understand where their money goes. Anyhow, nowadays info pretty much available and easily accessible. Plus covid accelerated companies online support So any doubt or info required, just straight email or socmed ask. |

|

|

Jul 27 2021, 08:47 AM Jul 27 2021, 08:47 AM

Return to original view | IPv6 | Post

#217

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(AthrunIJ @ Jul 27 2021, 07:40 AM) Based on my understanding thru the news I gathered,Only those that threaten china "wellfare" Recent crackdown on education, it's due to some sort of ill practice of $TAL that try to harm china wellfare. Western/international news did not report much about it My Chinese are not good so I had to ask friend translate for me There's few core focuses/goal that china trying to achieve, one of it is education and apparently $TAL business model hinder china goal. Hence the crackdown. Previously was DiDi and that was due to concern of china user data being used by "unauthorized" party. As for ANT, this one is pretty complicated. Sorta like shadow banking but the ease of loaning is much more easier and ANT are not subjected to financial rules and regulations. It's not like china going on rampage just for the sake of it. China main goal has and always will be china 1st. Any action that threaten that will not be tolerate. Just like any country should do, country and citizen is the main priority. |

|

|

Jul 27 2021, 10:19 AM Jul 27 2021, 10:19 AM

Return to original view | IPv6 | Post

#218

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(ben3003 @ Jul 27 2021, 09:12 AM) yeah seems like it. the best way is to list in HK for now. see how many company listed US kena hantam by China locally. They wan total control of their organization. Cos in china all ur wealth is Emperor Xi and his gang control punya. But mostly kena big tech company. small start up still okay-ish. If you worry about China stock delisted or wan US only stock, can try wahed.It seems like now is still catching dropping knife style. imagine if those delist, KWEB will delist too? stashaway should give us some answer on this. their reoptimizing is piss poor. They have portfolio 97.5% US 2.5% cash allocation With their own hlal etf. Consist only US stock. Can PM me for more 🤭 |

|

|

Jul 27 2021, 10:25 AM Jul 27 2021, 10:25 AM

Return to original view | IPv6 | Post

#219

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(lee82gx @ Jul 27 2021, 10:13 AM) That is in other words communism. One can not imagine every single US VIE listing doing something wrong in the eyes of the CCCP all within 1 year. And it is the opposite of capitalism. If so, one should not participate in a communist scheme assuming it will turn out capitalist. You can't expect the US adopt communism citing china rapid growthNor You expect China opting for democracy for US domination Those investing in those countries must understand the risk involved. If can't/refuse to understand the core concepts that the country adopt, might as well switch it off for piece of mind. |

|

|

Jul 27 2021, 10:30 AM Jul 27 2021, 10:30 AM

Return to original view | IPv6 | Post

#220

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(zstan @ Jul 27 2021, 10:22 AM) Yup, I think it's 30%++ and largest holding definitely apple.If not mistaken, 2nd largest is healthcare, 20%++ Those worry about China stock delisted, worry it will affect their portfolio, or want US only exposure, can try wahed. |

| Change to: |  0.0716sec 0.0716sec

0.33 0.33

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 03:38 AM |