Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

xcxa23

|

Jun 28 2020, 06:58 PM Jun 28 2020, 06:58 PM

|

|

QUOTE(cyanbleu @ Jun 28 2020, 05:06 PM) Isn't SA Simple 2.4% flat rate? According to the current FD rates list, most are still higher than this.. only exception is SASimple allows withdrawal anytime with prorates. That's what I understood from the website at least.. While we're on this, anyone knows averaging how long it takes to withdraw my investments in SA? Any difference in time taken between simple and profile? I believe their website mentioned projected 2.4% Which means it may go higher or lower than 2.4% |

|

|

|

|

|

xcxa23

|

Jun 29 2020, 11:58 AM Jun 29 2020, 11:58 AM

|

|

QUOTE(iamshf @ Jun 28 2020, 11:07 PM) Anyone is Shopee voucher before? Not clear about clause 1, it means limited to 3 redemption per stashaway account? thanks for sharing! my monthly fee more than rm15  |

|

|

|

|

|

xcxa23

|

Jun 29 2020, 01:26 PM Jun 29 2020, 01:26 PM

|

|

QUOTE(ironman16 @ Jun 29 2020, 12:25 PM)  big fish (should b white jaws)  Big fish no care rm15 fee lo.. haha |

|

|

|

|

|

xcxa23

|

Jun 30 2020, 03:51 PM Jun 30 2020, 03:51 PM

|

|

QUOTE(MNet @ Jun 30 2020, 01:29 PM) very troubleshome they should use different reference number for easier agreed since there's some of us do not wish to participate in their simple their system as of now, are treating like we having two portfolio and required to allocate money manually troublesome  |

|

|

|

|

|

xcxa23

|

Jun 30 2020, 03:53 PM Jun 30 2020, 03:53 PM

|

|

QUOTE(Barricade @ Jun 30 2020, 03:31 PM) Damn slow SA withdraw funds. Submit on 22nd until now haven't withdraw yet. My profit dropped almost 30% from 22nd until now. Contacted SA they say due to insufficient withdrawal from DRB portfolios, hence it did not meet the minimum amount to send out from broker Saxo for GBP. What the hell.... seriously?? can share the screenshot? but not surprising one of the downside of ''group'' investment |

|

|

|

|

|

xcxa23

|

Jul 1 2020, 11:47 AM Jul 1 2020, 11:47 AM

|

|

QUOTE(zstan @ Jul 1 2020, 10:26 AM) your calculation is wrong eh. if you didn't withdraw your principle your interests will be compounded daily. so assuming 2.03% p.a. effective interest rate is 3.7. much higher than FD since FD is only compounded annually. if not mistaken, read it somewhere it is calculated daily but credit monthly.. may i know from where you get the statement/fact compounded daily?? |

|

|

|

|

|

xcxa23

|

Jul 1 2020, 02:21 PM Jul 1 2020, 02:21 PM

|

|

QUOTE(zstan @ Jul 1 2020, 12:18 PM) calculated daily means compounded daily no? from my understanding compounded daily means today's interest calculation will be capital + yesterday interest earned but if calculated daily, credit monthly means for the whole month, the interest calculated based on the capital on 1st of the month. and the next month interest calculation will be inclusive of previous month interest earned + capital (this method is pretty wide use for high yield saving acc) if its compounded daily, i would assume SA will include in their selling point. it is a huge selling point! This post has been edited by xcxa23: Jul 1 2020, 02:23 PM |

|

|

|

|

|

xcxa23

|

Jul 1 2020, 02:21 PM Jul 1 2020, 02:21 PM

|

|

double post  This post has been edited by xcxa23: Jul 1 2020, 02:21 PM This post has been edited by xcxa23: Jul 1 2020, 02:21 PM |

|

|

|

|

|

xcxa23

|

Jul 5 2020, 09:12 PM Jul 5 2020, 09:12 PM

|

|

QUOTE(stormseeker92 @ Jul 5 2020, 08:38 PM) Nah. even with the cases in US still sky high, I think Feds has interfere enough. Already few weeks without any policy bazookas, and business started to open again. Payroll report also increased significantly. I think it'll just go upwards from now on. (Unless the Swine Flu hits like Covid-19 2.0) Just kinda sad cuz we have both equities and gold in the portfolios, but when one appreciates, the other depreciates. Like tug of war. well, potus have been quiet for almost a month imo, he will be tweeting anytime soon |

|

|

|

|

|

xcxa23

|

Jul 7 2020, 11:20 AM Jul 7 2020, 11:20 AM

|

|

QUOTE(joshtlk1 @ Jul 7 2020, 10:01 AM) KWEB goes up so fast, even with weekly DCA, its been weeks now, that SA did not buy into KWEB in my portfolio because it has to compensate other ETFs and distribute my DCA money to other ETFs. lol! Not sure if I like it or not another way to increase your exposure/allocation to a particular sector/country/section is thru unit trust |

|

|

|

|

|

xcxa23

|

Jul 8 2020, 10:13 AM Jul 8 2020, 10:13 AM

|

|

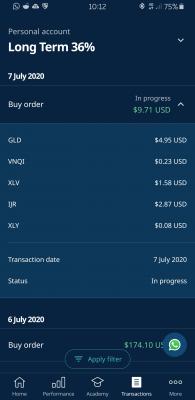

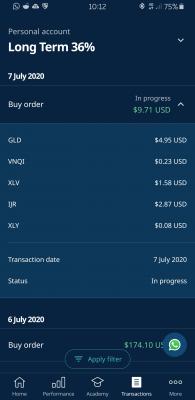

QUOTE(GrumpyNooby @ Jul 8 2020, 07:32 AM) Sales order executed for KWEB Mine got buy order

|

|

|

|

|

|

xcxa23

|

Jul 8 2020, 10:31 AM Jul 8 2020, 10:31 AM

|

|

QUOTE(woonsc @ Jul 8 2020, 10:21 AM) I no see KWEB in your buy :confused: Weightage reach I guess

|

|

|

|

|

|

xcxa23

|

Jul 12 2020, 06:23 PM Jul 12 2020, 06:23 PM

|

|

QUOTE(Xenopher @ Jul 12 2020, 06:11 PM) Want to ask some opinion here. I plan to move some fund into SA, is it better to DCA over a few weeks/months or just put them in lump sum? personally DCA, once a week, once two week, once a month. your pick depending on how you view the market |

|

|

|

|

|

xcxa23

|

Jul 27 2020, 06:13 PM Jul 27 2020, 06:13 PM

|

|

QUOTE(honsiong @ Jul 27 2020, 03:17 PM) I dont think Smartly went bankrupt, they just decide to shut their business down coz cannot fight anymore. StashAway, Syfe, EndowUs are still pretty strong in Singapore I guess. Endowus allow ppl to invest with CPF OA account, StashAway takes SRS, Syfe... I dunno lah their reviews damn a lot. I hope StashAway MY will join EPF i-invest also.doubt it since epf only allow their member to invest in what epf thinks is ''safe'' apparently epf does not invest in etf |

|

|

|

|

|

xcxa23

|

Jul 27 2020, 08:52 PM Jul 27 2020, 08:52 PM

|

|

thats why never auto debit/recurring payment

hardworking abit la... if want weekly/monthly/bi-weekly DCA, do it manually

still its scary to think that system can just keep on auto debit/recurring without additional authorisation from account holder

|

|

|

|

|

|

xcxa23

|

Jul 27 2020, 09:05 PM Jul 27 2020, 09:05 PM

|

|

QUOTE(yklooi @ Jul 27 2020, 08:56 PM) i had auto debit payment for my Streamyx a/c, Tenaga, waterbill, astro, credit card and loan repayment....should i be scared?  btw, do you have any of this on Auto debit too? nope  i have my trustee calendar, note alert and email notification well, if you are scared perhaps you can tied the auto debit/recurring payment with a dummy/not main bank account? calculate your monthly expenses, give it some overhead and let it do the payment. this probably will be my route if i ever subscribe to auto payment. This post has been edited by xcxa23: Jul 27 2020, 09:05 PM |

|

|

|

|

|

xcxa23

|

Jul 28 2020, 08:40 AM Jul 28 2020, 08:40 AM

|

|

From my pov

You give consent to your bank to initiate auto payment/recurring payment as per your instruction, say once a month.

By right the auto payment should have completed as per standing instruction but the bank does not stop or rather still authorized for more auto payment

Imo, bank should be much more secure and strict security procedure, for this case only allow auto payment as per standing instruction regardless of how many times samy "request" for the payment.

Apparently this unlimited auto debit happen across variety of banks, imo is huge security flaw/breach.

|

|

|

|

|

|

xcxa23

|

Jul 28 2020, 08:49 AM Jul 28 2020, 08:49 AM

|

|

QUOTE(victorian @ Jul 28 2020, 08:44 AM) Nope once you give consent to the bank when setting up auto debit, SAMY can deduct as they wish. Ever tried putting in lump sum using direct debit? Because auto debit is already set up, no further verification is required. Wow.. did not know about that. Those setting up/giving consent for auto debit must have high trust towards the company. Nope. I did not set up any auto payment |

|

|

|

|

|

xcxa23

|

Jul 28 2020, 08:58 AM Jul 28 2020, 08:58 AM

|

|

QUOTE(yklooi @ Jul 28 2020, 08:52 AM) Just recalled, the repeats of auto debits happens with my insurance premium some yrs ago... It happens during the merging of their system with the one that they had taken over... My insurance policy were with the one they had taken over. 2x deductions from my credit card... Noticed the error, upon reviewing the cc statement, informed the insurance company, they refunded it. Nothing more Hence my pov The "flaw" in auto debit. Anyhow, it's good that rectify early. But man, 27x is ridiculous. Imagine if the account is main account, samy "unlimited" request wipe out entire account and your auto payment for loan/mortgage/cc have due on that same day. |

|

|

|

|

|

xcxa23

|

Jul 28 2020, 11:46 AM Jul 28 2020, 11:46 AM

|

|

QUOTE(ericlaiys @ Jul 28 2020, 11:40 AM) joke of a day. which investment give daily interest? some high yield saving acc calculated daily credit monthly |

|

|

|

|

Jun 28 2020, 06:58 PM

Jun 28 2020, 06:58 PM

Quote

Quote

0.3514sec

0.3514sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled