https://finance.yahoo.com/news/u-private-pa...-122514795.html

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

May 6 2020, 09:42 PM May 6 2020, 09:42 PM

Return to original view | IPv6 | Post

#201

|

All Stars

12,387 posts Joined: Feb 2020 |

Private payroll plunged to record for April 2020 but US markets in green

https://finance.yahoo.com/news/u-private-pa...-122514795.html |

|

|

|

|

|

May 7 2020, 08:34 PM May 7 2020, 08:34 PM

Return to original view | IPv6 | Post

#202

|

All Stars

12,387 posts Joined: Feb 2020 |

Jobless claims: Another 3.169 million Americans file for unemployment benefits

https://finance.yahoo.com/news/jobless-clai...-170914685.html |

|

|

May 8 2020, 08:37 PM May 8 2020, 08:37 PM

Return to original view | IPv6 | Post

#203

|

All Stars

12,387 posts Joined: Feb 2020 |

April jobs report: U.S. employers cut a record 20.5 million payrolls, unemployment rate jumps to 14.7%

https://finance.yahoo.com/news/jobs-report-...-165316546.html |

|

|

May 10 2020, 08:35 PM May 10 2020, 08:35 PM

Return to original view | IPv6 | Post

#204

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 10 2020, 09:57 PM May 10 2020, 09:57 PM

Return to original view | IPv6 | Post

#205

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(MNet @ May 10 2020, 09:53 PM) tomorow us market is open but SA MY is not open that why I asking whether the so called robo advisor will still process the deposit and etf buying Nobody will process your deposit tomorrow since banks in MY are not open.How does my money get invested from the moment I make a deposit? If your funds reach our Citibank Trust account before 10am on a business day, it will be linked to your StashAway account on the same day. You will also receive an acknowledgement email from us concurrently. The funds will usually be invested the next business day (this is because when we send funds to our broker, Saxo, it usually reaches their account the morning of the next business day) when the market opens and be reflected in your account the following business day. Please note that deposits sent from outside of Malaysia and foreign currency deposits may take longer due to extra verification required by regulations and a longer processing period respectively. https://www.stashaway.my/faq/360009405233-h...make-a-deposit/ |

|

|

May 11 2020, 03:09 PM May 11 2020, 03:09 PM

Return to original view | Post

#206

|

All Stars

12,387 posts Joined: Feb 2020 |

Both are correct from Investopedia:

What Is Interest? Interest is the charge for the privilege of borrowing money, typically expressed as annual percentage rate (APR). Interest can also refer to the amount of ownership a stockholder has in a company, usually expressed as a percentage. https://www.investopedia.com/terms/i/interest.asp |

|

|

|

|

|

May 11 2020, 04:19 PM May 11 2020, 04:19 PM

Return to original view | Post

#207

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(nbotsduo @ May 11 2020, 04:17 PM) The cut-off time is 10am as the FAQ stated.Before 10am, you'll get the acknowledgement email by the same business day. (My experience is around 5pm to 6pm). After 10am, you'll get the email by the next business day. There's also in-app notification that your fund has been received. And also when you launch the app, there's a big banner notice too. This post has been edited by GrumpyNooby: May 11 2020, 04:21 PM |

|

|

May 11 2020, 04:24 PM May 11 2020, 04:24 PM

Return to original view | Post

#208

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 12 2020, 07:26 PM May 12 2020, 07:26 PM

Return to original view | IPv6 | Post

#209

|

All Stars

12,387 posts Joined: Feb 2020 |

Fed starts buying corporate bond ETFs

May 12, 2020 3:08 AM ETBlackRock, Inc. (BLK)70 Comments It's a historic milestone for the Fed, which hasn't yet bought ETFs.The central bank's Secondary Market Corporate Credit Facility will begin purchases today of eligible exchange-traded funds invested in corporate debt, seeing the method as a fast way to direct money into the credit markets.The program, managed by BlackRock (NYSE:BLK), centers around investment grade corporate bonds, though some will be high-yield.Another Fed facility designed to buy debt directly from issuers, the Primary Market Corporate Credit Facility, is set to launch "in the near future." Source: Seeking Alpha |

|

|

May 12 2020, 07:46 PM May 12 2020, 07:46 PM

Return to original view | IPv6 | Post

#210

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 14 2020, 09:23 AM May 14 2020, 09:23 AM

Return to original view | Post

#211

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 14 2020, 09:34 AM May 14 2020, 09:34 AM

Return to original view | Post

#212

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(svchia78 @ May 14 2020, 09:30 AM) It is on, my dear!  For the international equities, they're venturing into: 1. KraneShares CSI China Internet ETF (KWEB) 2. SPDR Portfolio Emerging Markets ETF (SPEM) 3. iShares MSCI All Country Asia ex Japan ETF (AAXJ) 4. Vanguard Global ex-U.S. Real Estate ETF (VNQI) under Real Estate This post has been edited by GrumpyNooby: May 14 2020, 09:38 AM |

|

|

May 14 2020, 09:58 AM May 14 2020, 09:58 AM

Return to original view | Post

#213

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

May 14 2020, 06:27 PM May 14 2020, 06:27 PM

Return to original view | IPv6 | Post

#214

|

|||||||||||||||||||||

All Stars

12,387 posts Joined: Feb 2020 |

Below is under SELL order tonight for my 36% portfolio:

It's 60% of my today's portfolio valuation. This post has been edited by GrumpyNooby: May 14 2020, 08:29 PM |

|||||||||||||||||||||

|

|

May 14 2020, 08:54 PM May 14 2020, 08:54 PM

Return to original view | IPv6 | Post

#215

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 14 2020, 08:55 PM May 14 2020, 08:55 PM

Return to original view | IPv6 | Post

#216

|

All Stars

12,387 posts Joined: Feb 2020 |

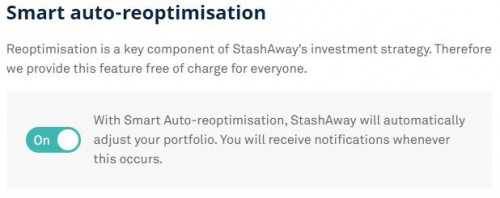

QUOTE(woonsc @ May 14 2020, 08:55 PM) Previous re-optimization exercise got ask for consent also.It just asked me to downgrade my risk rating. And I also not aware of the new re-optimization exercise until I read from here! No alert. No banner upon logging into SAMY web/app. This post has been edited by GrumpyNooby: May 14 2020, 08:58 PM |

|

|

May 15 2020, 10:01 AM May 15 2020, 10:01 AM

Return to original view | Post

#217

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(jutamind @ May 15 2020, 09:59 AM) Assuming that i dump my money in 6.5% risk index. Can i switch/sell and buy a 36% risk index from the money pool i have in 6.5% portfolio? Yes.concept is similar to money parked in money market/bond funds an switch to equity periodically Create a new portfolio with 36% risk. Then initiate a transfer between portfolio. |

|

|

May 15 2020, 03:39 PM May 15 2020, 03:39 PM

Return to original view | IPv6 | Post

#218

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 15 2020, 05:03 PM May 15 2020, 05:03 PM

Return to original view | IPv6 | Post

#219

|

All Stars

12,387 posts Joined: Feb 2020 |

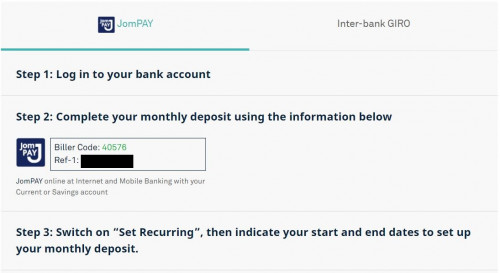

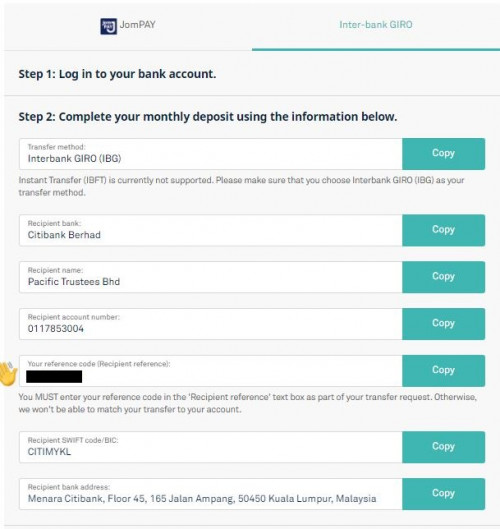

QUOTE(overclockalbert @ May 15 2020, 05:01 PM) Hi all, i am new with SA Account had open and the risk assessment i have = 22%. Can i change this %? Also, how to transfer money in? i only saw direct debit option. QUOTE(acejlsh @ May 13 2020, 09:11 PM) https://www.rhbgroup.com/others/highlights/..._may/index.html Change risk %: Edit PortfolioRHB revision. Bonus Saver Account get cut on one off basis, from 2.65% down to 1.40% Deposit: Use JomPay or IBG GIRO   This post has been edited by GrumpyNooby: May 15 2020, 06:02 PM |

|

|

May 15 2020, 05:25 PM May 15 2020, 05:25 PM

Return to original view | IPv6 | Post

#220

|

All Stars

12,387 posts Joined: Feb 2020 |

|

| Change to: |  0.4143sec 0.4143sec

0.70 0.70

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 02:56 PM |