QUOTE(BboyDora @ May 21 2020, 10:13 AM)

It's a platform investing into ETFs and there's annual management fee billed monthly.This post has been edited by GrumpyNooby: May 21 2020, 10:15 AM

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

May 21 2020, 10:14 AM May 21 2020, 10:14 AM

Return to original view | Post

#241

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

May 21 2020, 11:53 AM May 21 2020, 11:53 AM

Return to original view | Post

#242

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tehoice @ May 21 2020, 11:44 AM) Yeah, noted on that too, why i say so initially is because The US exposure is rather disappointing. before re-optimisation 36% risk index has more US equities 18% risk index has lower US equities exposure Now after re-optimisation is the other way round. Where as, the 36% risk index has more exposure in the East part of the world instead. Thanks for the information mate. hmmm, at 30% risk index, they starting to have some exposure in bonds already. The fast growth ETF has been dropped out which is XLK. Now, they only invests into IJR, XLV and XLY for US region. This post has been edited by GrumpyNooby: May 21 2020, 11:53 AM |

|

|

May 21 2020, 02:02 PM May 21 2020, 02:02 PM

Return to original view | Post

#243

|

All Stars

12,387 posts Joined: Feb 2020 |

After waited for close to 3 months, portfolio of 36% back into green region in term of USD. Fuh!

|

|

|

May 21 2020, 05:09 PM May 21 2020, 05:09 PM

Return to original view | IPv6 | Post

#244

|

All Stars

12,387 posts Joined: Feb 2020 |

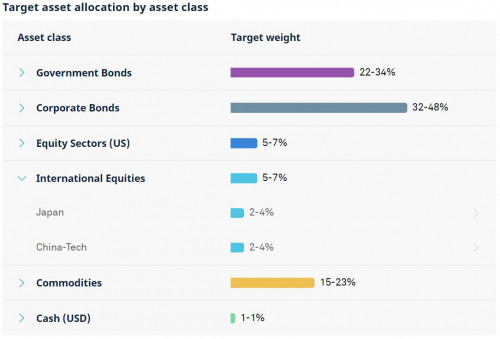

Just discovered that their 6.5% and 8% portfolio has exposure to Japanese equity.

|

|

|

May 21 2020, 05:34 PM May 21 2020, 05:34 PM

Return to original view | IPv6 | Post

#245

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tadashi987 @ May 21 2020, 05:30 PM) iShares MSCI Japan ETF (EWJ)https://www.etf.com/EWJ Risk rating: 6.5  Risk rating: 8  At 10%, it is no longer there. This post has been edited by GrumpyNooby: May 21 2020, 05:44 PM |

|

|

May 21 2020, 05:55 PM May 21 2020, 05:55 PM

Return to original view | IPv6 | Post

#246

|

All Stars

12,387 posts Joined: Feb 2020 |

Will this has impact on KWEB?

Senate passes bill to delist Chinese firms from exchanges https://www.thestar.com.my/business/busines...-from-exchanges |

|

|

|

|

|

May 21 2020, 08:44 PM May 21 2020, 08:44 PM

Return to original view | IPv6 | Post

#247

|

All Stars

12,387 posts Joined: Feb 2020 |

Baidu considers leaving the Nasdaq to boost its valuation: Sources

https://www.channelnewsasia.com/news/busine...uation-12757260 |

|

|

May 22 2020, 09:10 AM May 22 2020, 09:10 AM

Return to original view | Post

#248

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 22 2020, 09:13 AM May 22 2020, 09:13 AM

Return to original view | Post

#249

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(fjoru103 @ May 22 2020, 09:13 AM) Fund must reach their trust account at Citibank by 10am.IBG GIRO is not instant and has to be executed according to IBG schedule by Paynet. This post has been edited by GrumpyNooby: May 22 2020, 09:15 AM |

|

|

May 22 2020, 09:31 AM May 22 2020, 09:31 AM

Return to original view | Post

#250

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 22 2020, 11:06 AM May 22 2020, 11:06 AM

Return to original view | Post

#251

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 22 2020, 11:11 AM May 22 2020, 11:11 AM

Return to original view | Post

#252

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 22 2020, 11:16 AM May 22 2020, 11:16 AM

Return to original view | Post

#253

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

May 22 2020, 01:02 PM May 22 2020, 01:02 PM

Return to original view | Post

#254

|

All Stars

12,387 posts Joined: Feb 2020 |

Do take note that 36% today's portfolio is not similar to 36% portfolio few months ago even including last year.

|

|

|

May 24 2020, 09:50 AM May 24 2020, 09:50 AM

Return to original view | IPv6 | Post

#255

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 25 2020, 07:06 AM May 25 2020, 07:06 AM

Return to original view | IPv6 | Post

#256

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(mr_tuzki @ May 25 2020, 02:01 AM) Yes, but there's also VCA (value cost averaging) which makes more sense. Say you're DCA-ing RM100/week. When there's a crash/dip, put more in, say RM200/300 and skip the next few weeks. Gets more bang for your buck. Don't have to follow DCA so rigidly. Wednesday will receive your money and do currency conversion.Btw, if i lump sum in now, since Monday & Tues is public holiday here, when would be the currency exchange & ETF purchase in SA? Thursday? Thursday will perform BUY order and complete it. |

|

|

May 25 2020, 09:30 AM May 25 2020, 09:30 AM

Return to original view | IPv6 | Post

#257

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 25 2020, 10:28 AM May 25 2020, 10:28 AM

Return to original view | IPv6 | Post

#258

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(stormseeker92 @ May 25 2020, 10:24 AM) I wish too. Can you send them emails to force them to improve their lead time? Shoot them to ensure that all deposit, conversion & buy order can be completed within a day and effects can be seen tomorrow around lunch time. |

|

|

May 25 2020, 10:51 AM May 25 2020, 10:51 AM

Return to original view | IPv6 | Post

#259

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

May 26 2020, 12:01 PM May 26 2020, 12:01 PM

Return to original view | IPv6 | Post

#260

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(iamwilliamcwl @ May 26 2020, 11:56 AM) What is the difference between Stashaway and Public Mutual? Stashaway: platform to buy ETFs; cannot select which ETF to be included into portfolio; only can adjust risk %Looking for advise which platform is better to grow our money Public Mutual: platform to buy unit trusts/mutual funds (mainly exclusive to the funds under its own management); can freely choose which fund to buy according to your preference. |

| Change to: |  0.0443sec 0.0443sec

0.27 0.27

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 09:33 PM |