QUOTE(statikinetic @ Jan 24 2021, 09:04 PM)

Yup.I try to put as much as I can into my Simple, sometimes I just treat it as a savings account.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jan 24 2021, 09:09 PM Jan 24 2021, 09:09 PM

Return to original view | Post

#141

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

|

|

|

Jan 25 2021, 10:13 AM Jan 25 2021, 10:13 AM

Return to original view | Post

#142

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(yklooi @ Jan 25 2021, 10:03 AM) Unlikely that M'sia alone can make 1bil USD from us poorfags in this time. Besides, they would have announced an even bigger number for their total if it was SAMY > 1 bil. |

|

|

Jan 25 2021, 10:40 AM Jan 25 2021, 10:40 AM

Return to original view | Post

#143

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Jan 25 2021, 12:06 PM Jan 25 2021, 12:06 PM

Return to original view | Post

#144

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(yklooi @ Jan 25 2021, 11:17 AM) on a side note...just for comparison purposes... affin hwang may have some funds by themselves that exceed 1Bill USD.Affin Hwang asset mgt in Malaysia manages over RM60 billion (as at 30 June 2020) in assets for retail and professional clients. I suppose one must start somewhere. Besides, I think both systems can co-exist for the short and medium term. After that, you may see M&A's. |

|

|

Jan 26 2021, 12:04 AM Jan 26 2021, 12:04 AM

Return to original view | Post

#145

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(CaptainGrindy @ Jan 25 2021, 11:17 PM) omg, kweb is on fire, again... how am i suppose to top up again with the price keep rallying. scare the hell out of me Um, if u enter now, almost none of it would be kweb by way of active rebalancing. honsiong liked this post

|

|

|

Jan 26 2021, 08:09 AM Jan 26 2021, 08:09 AM

Return to original view | Post

#146

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

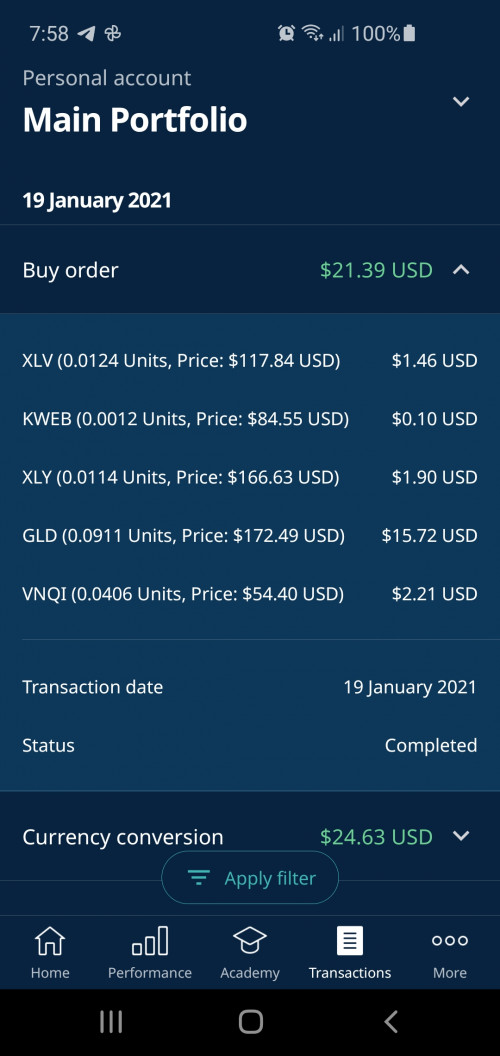

QUOTE(CaptainGrindy @ Jan 26 2021, 01:31 AM) sry, was trying to say all etf in my portfolio keep rising and is at all time high, especially KWEB. IJR also. this month alone, portfolio gain 4-5%. You still end up buying lots of GLD and VNQI. I hope you won't ask why not buying the ijr and kweb or aaxj etc which are so hot instead.But if you are really trying to ask if you should or should not buy during the peaks, then this question has been discussed ad nauseum. In a bull market, the risk of not entering and losing opportunity is higher than making a loss. Think of it this way: your portfolio already invested should be many many times more than your planned dca this month. So why worry about the small amount buying ath, suffering correction but not worry about your big pool also suffering the correction? If thats the case why not sell the whole portfolio now? Thats because you believe deep down it will rise, eventually. So if indeed that is true, why not keep investing / invested? BTW I am only sharing my useless 2c. Don't listen to it.  This post has been edited by lee82gx: Jan 26 2021, 08:10 AM TaiGoh liked this post

|

|

|

|

|

|

Jan 26 2021, 12:52 PM Jan 26 2021, 12:52 PM

Return to original view | Post

#147

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

right now, the among shares, UT, and stashaway, I honestly think SA is the safest instrument in such a hot market.

But, that does not mean I am literally stashing all my cash here. I just think that the methodology proposed is safe - when all are greedy be careful. |

|

|

Jan 27 2021, 11:10 PM Jan 27 2021, 11:10 PM

Return to original view | Post

#148

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

one thing i realise recently is that market open hours are damned volatile, either up or down. Quazacolt liked this post

|

|

|

Jan 28 2021, 01:05 PM Jan 28 2021, 01:05 PM

Return to original view | IPv6 | Post

#149

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Jan 31 2021, 02:53 PM Jan 31 2021, 02:53 PM

Return to original view | IPv6 | Post

#150

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Jan 31 2021, 09:16 PM Jan 31 2021, 09:16 PM

Return to original view | Post

#151

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(backspace66 @ Jan 31 2021, 08:15 PM) Not wrong if you believe in AAPL, i believe in it too, but is it ok for you to be significantly exposed to just AAPL rather than choosing ETF which cover a basket of stock? If you dca msft from before dotcom bubble I don't even doubt to check that by now you will already have been very well rewarded. I believe in Maybank, BIMB and Tenaga but i dont unnecessarily DCA and increase my exposure to this company Since u mention Bursa, now lets talk about nasdaq listed cisco,it never recover to its previous peak even after more than 20 years. Even microsoft took more than 10 years to recover and exceed it previous peak during the dotcom buble. In fact perhaps only yahoo is one of the tech companies until today not returning a strong growth from the 2000s till now. But im not checking and I might well be mistaken. As Jack Bogle says, over time stocks tend to rise. (The inverse implied is that some stocks will just tank and kaput). But we digress. And again and again, this has been discussed and discussed every page. Just enter, if you have big amount (to you) then just spread it out over 3 amounts in 3 months. The longer you wait the higher the risk of opportunity lost. |

|

|

Jan 31 2021, 10:26 PM Jan 31 2021, 10:26 PM

Return to original view | Post

#152

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(backspace66 @ Jan 31 2021, 09:27 PM) Sure ,this is all about "what if". We can also make a scenario of people starting to invest during the bubble or at the peak or even when it come crashing down. It is all " what if" and all these is just looking back at the data. Key takeaway is never to invest in a company blindly and follow the principle of DCA blindly. One of the keys to investing is not just dca blindly. One must always know what one is buying. So, this also means to regularly check the pulse of the company you are investing in. Dont get me wrong i believe in DCA for etf and unit trust and of course not all etf and not all UTF. Even ETF and UTF, as you say does not guarantee a return if DCA blindly. BUT I recall my friend a PB Mutual agent (at the time, now no more) that guaranteed me if I DCA I was guaranteed to make a return. Alas, if I did, and I checked, that I did, today it would have given me slightly less than 8% per annum. But, I would have had to hold on for around 13 years IIRC, not to mention stagnate for more than 6 years. In that time, I exited, pivoted and changed don't know how many bloody portfolios until today. In this manner, Stashaway is recommended because they try to take care for you. The reoptimization actions already occurred several times over this few years, removal of SPY, XLK (dumb dumb move lol) and added some KWEB (hooray), GLD and some others I cannot recall. They are only locked by the mandate of making return at the risk levels you choose and last I checked they give pretty good sharpe ratios. Not like some dungu UTF that will stick to a certain region, certain type of stock etc. The quote that Buffet famously says, active management will usually loose to passive indexing applies. Therefore I reiterate, that among Stocks, UTF and ETF, Stashaway is actually very balanced in risk vs reward. SithBuster liked this post

|

|

|

Jan 31 2021, 11:09 PM Jan 31 2021, 11:09 PM

Return to original view | Post

#153

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

|

|

|

Feb 1 2021, 10:35 AM Feb 1 2021, 10:35 AM

Return to original view | Post

#154

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Feb 1 2021, 10:48 AM Feb 1 2021, 10:48 AM

Return to original view | Post

#155

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(tehoice @ Feb 1 2021, 10:37 AM) For me, if other investments work out eventually it will outpace stashaway, and that must be a good news. Remember, Stashaway is not much more better than SP500.its reward vs risk appetite. |

|

|

Feb 2 2021, 01:42 PM Feb 2 2021, 01:42 PM

Return to original view | Post

#156

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(liwei92 @ Feb 2 2021, 11:43 AM) Hi sorry I am new here. So for this, i will only know the actual returns and i pull everything out from SA? My apologies for newbie questions. buying and selling unit trust and equity based assets do not generate returns like interest. That term is used for loans / liability / deposits. So, yes, when you decided to sell, you calculate the amount you have put in (tally up vs time) and the selling price and calculate the returns / gains. That is when you realise the gains or losses.In between, some of the assets you own will generate returns in cash and will be given back to you in your total holdings, reinvested (in the case of Stashaway non-simple). At anytime in between, it can be negative (worth less than you paid for) or worth a lot more than what you sell it for eventually. You will know the actual returns at any time of the day, if you decide to sell then it is more or less at that price (+ daily actual fluctuations, + exchange rate charges). It is almost 99% accurate. Quazacolt liked this post

|

|

|

Feb 2 2021, 06:31 PM Feb 2 2021, 06:31 PM

Return to original view | Post

#157

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

I know that money put in last weekend is already invested fully. So the prices reflect last night.

|

|

|

Feb 6 2021, 03:02 PM Feb 6 2021, 03:02 PM

Return to original view | Post

#158

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(honsiong @ Feb 6 2021, 02:53 PM) In that manner you are actually lump sum. Dca is actually those who are sitting on a pile of cash, actually choosing to slowly invest over time. By the time you are dca'ing every month out of your regular income, that is actually lump sum. |

|

|

Feb 6 2021, 05:37 PM Feb 6 2021, 05:37 PM

Return to original view | Post

#159

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Pewufod @ Feb 6 2021, 05:00 PM) hahahaha so if technicality matters its not a technicality. it is the truth, if you have 100k cash marked for investment, sitting on it and spreading it out over 100 months, it is by definition "averaging"my RM1000 per month "lumpsum" is not the same as your RM1000 per month "DCA" because your available cash is RM100k ? Sure, 1000 per month of your regular income also achieves the same effect regardless of whether you had 100k in your Savings or not, but in reality we are trying to talk about 100k, not the 1000. The longer you drag it out in a bull market the less harder it will work for you. |

|

|

Feb 6 2021, 05:41 PM Feb 6 2021, 05:41 PM

Return to original view | Post

#160

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

| Change to: |  0.1038sec 0.1038sec

0.77 0.77

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 10:56 PM |