QUOTE(AnasM @ Feb 7 2021, 09:41 AM)

Its still there for me.

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Feb 7 2021, 11:07 AM Feb 7 2021, 11:07 AM

Return to original view | Post

#161

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

|

|

|

Feb 7 2021, 11:33 PM Feb 7 2021, 11:33 PM

Return to original view | Post

#162

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(hedfi @ Feb 7 2021, 11:24 PM) and there are etfs that purposely shorts certain classes of assets / stocks.Needless to say, these etfs being open ended, the short interest can also exceed the number of stock on offer. such is the greatest casino in the world. |

|

|

Feb 9 2021, 01:44 PM Feb 9 2021, 01:44 PM

Return to original view | Post

#163

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(AthrunIJ @ Feb 9 2021, 09:09 AM) Interesting. are you sure bro?Stash away is literally working close to 24/7 based on my experience. SA simple will buy the etf on Monday. SA will buy USA etf etc on Saturday too. Sunday is basically off and Public Holidays too. US market is confirmed close on Saturday and sunday. WHat is the price they buy on Saturday? |

|

|

Feb 10 2021, 10:26 AM Feb 10 2021, 10:26 AM

Return to original view | Post

#164

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

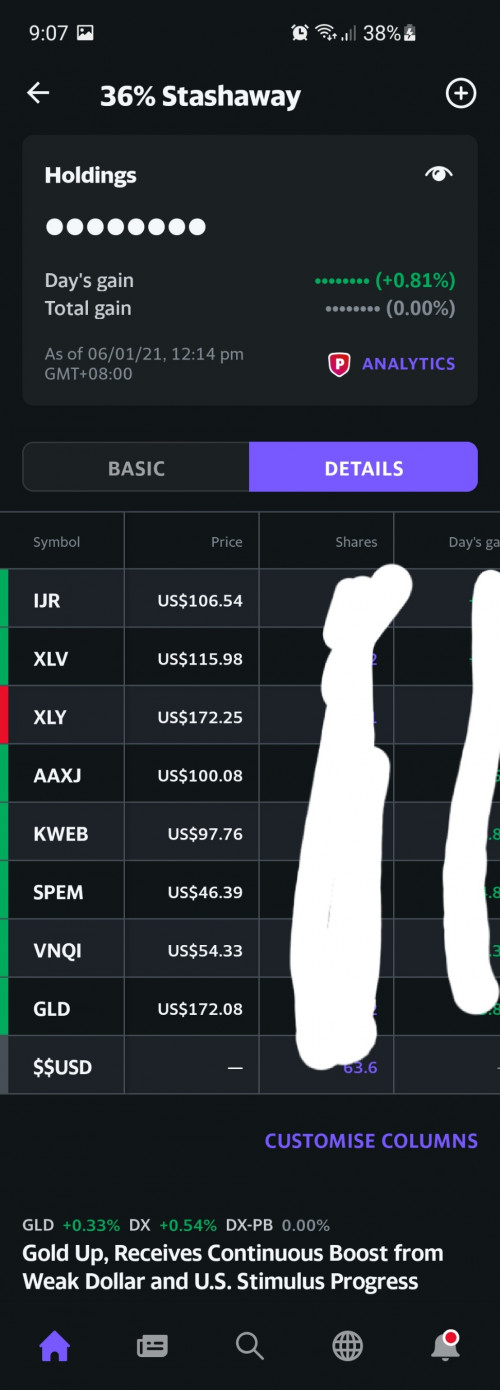

QUOTE(halotaikor. @ Feb 10 2021, 06:34 AM) Err, no it has not grown faster than ark for the past 1 year or even the past 1,3,6 months.But if you think it will in the future then only time will tell. By the way tsla being in sp500 if it crash, your SA may also be affected due to xly contain a lot of it. cucumber liked this post

|

|

|

Feb 10 2021, 11:36 AM Feb 10 2021, 11:36 AM

Return to original view | IPv6 | Post

#165

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(halotaikor. @ Feb 10 2021, 11:19 AM) better not say, coz tesla fanboys will get angry. Tesla has made many millionaires recently so to expect fan boys is normal.tesla dont have fundamentals. its stock price now is merely based on speculation and hype. i think elon musk buying btc is just a publicity stunt to divert people from tesla's balance sheet problem. Somehow, your case is not entirely without merit. Its only whether you end up winning or losing. And ark (Cathy wood) has hardly put a foot wrong this few months. Lastly don't forget that ark funds are actively managed so they CAN sell or reduce their exposure to any stock if they are not convinced. |

|

|

Feb 10 2021, 04:05 PM Feb 10 2021, 04:05 PM

Return to original view | Post

#166

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

|

|

|

Feb 10 2021, 09:12 PM Feb 10 2021, 09:12 PM

Return to original view | Post

#167

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

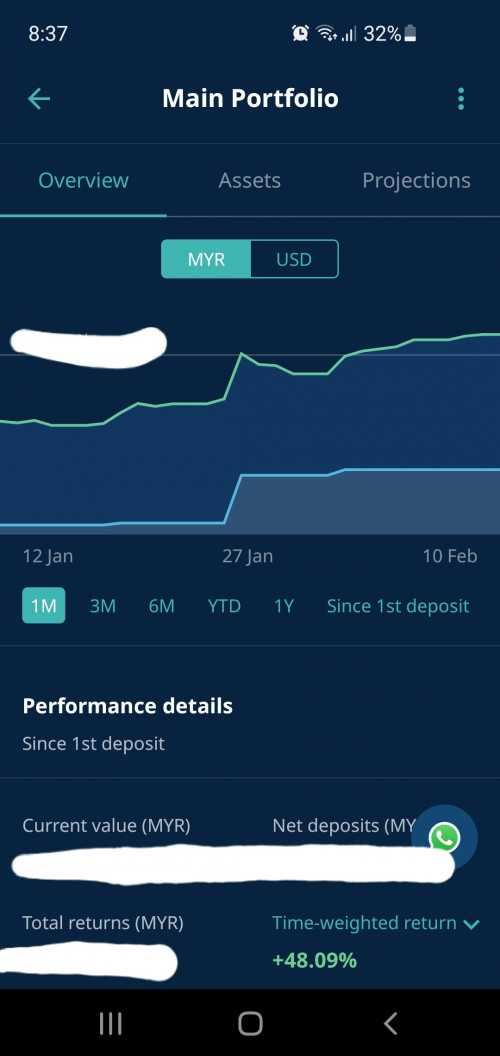

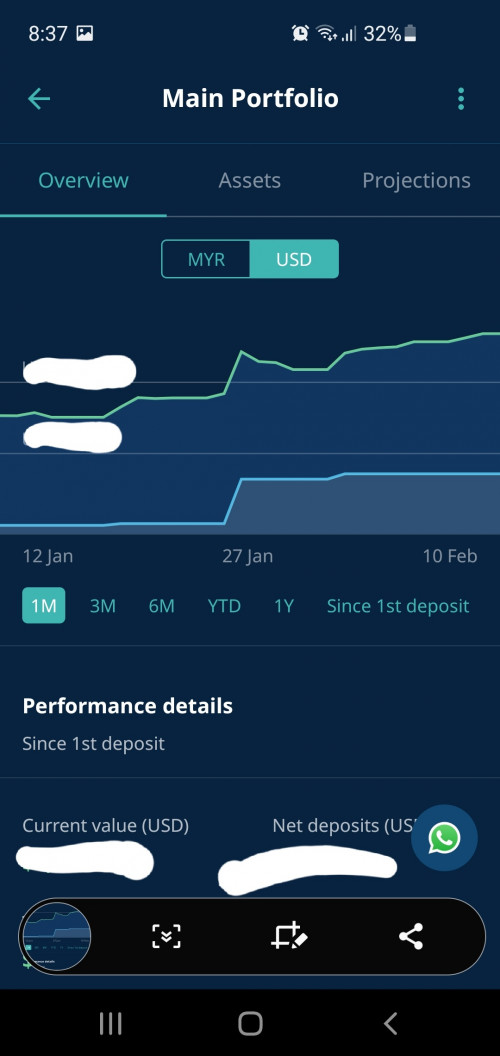

QUOTE(blibala @ Feb 10 2021, 05:59 PM) I have 22% and 36% since last year and just started to add 3k in 30%. 2 months ago. Possible myr to usd fluctuations. But let me save you some headache in this (which works for me).This morning value reduced about 5% compared to yesterday. At 2pm it increased and updated as usual but still in negative zone. If coompare with yesterday currency rate i think fluctuation less than 1% right? 1. Track in USD. 2. Track with Yahoo finance app (you need to key in each particular asset and your quantities). You don't need to keep this very very up to date but I update once a month when I done my fresh new investment.    rc2x and Life_House liked this post

|

|

|

Feb 10 2021, 10:13 PM Feb 10 2021, 10:13 PM

Return to original view | Post

#168

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(foong pooi sing @ Feb 10 2021, 09:40 PM) Fyi, Tesla's bitcoin investments is classified as assets in its company's accounting treatment/annual report. Whether this fits into your definition of "asset" is up to you Think of it in another way, if Tesla winds up you are entitled to some Bitcoin as a share holder. I’m no fan of Bitcoin, I also don’t like it at all, but i also don’t like certain chairs, tables, and stationery that Elon buys. |

|

|

Feb 10 2021, 11:05 PM Feb 10 2021, 11:05 PM

Return to original view | Post

#169

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(xander83 @ Feb 10 2021, 10:28 PM) Every FX loss is only up to 1% on volatile exchange including 0.1% spot rate Highly likely is due to the assets or etfs drop in value by the time they were sold. Fx is 1%, no doubt. Which is why, kids, please stay invested and only sell when you can beat daily fluctuations. This is not a trading platform. Even if it is, I wouldn’t advise FX on small or too frequent transactions.Even on 10k deposit the most you can lose up it is up to rm100 so don’t exaggerate because your calculation is way by 10x on 5% loss which will never on FX even on black swan event |

|

|

Feb 11 2021, 12:16 AM Feb 11 2021, 12:16 AM

Return to original view | Post

#170

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(necrox77 @ Feb 11 2021, 12:01 AM) why suddenly my porfolio sold my KWEB etf?? is this auto rebalance program algorithm by taking out 50% of profit here and buy other cheaper asset? no. are you changing risk level or withdrawing something?in progress selling 49.67 usd kweb etf from 108.60 usd profit? from that stock. need to check what etf next will buy.. anyone else kena? |

|

|

Feb 11 2021, 09:19 AM Feb 11 2021, 09:19 AM

Return to original view | Post

#171

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(necrox77 @ Feb 11 2021, 06:05 AM) I didnt withdraw or change portfolio risk. my last deposit is Jan 26. I have 36, 26, 14% risk index since early 2019. I have reoptimization ON. It has never sold anything except during the reoptimization once when changing from spy, XLK etc to now KWEB, xly, XLV. Which is 1 time.If it buy same KWEB etf at higher price really facepalm.. need t wait and see. If it buy GLD etf or Bond etf, I also face palm because lesser profit there and only waiting for the small dividend.... Also i off the optimization still do rebalance.. please do share info ya. In my mind if you constantly invest fresh money it should not come to the point of needing to sell anything to maintain your balance. In any case is your portfolio now properly balanced? If yes just relax. If your are not happy, kweb is ~USD100 per unit, you can buy directly...as much as you want....if you want to ride the China bull there are also many other ways than StashAway. If you think something really wrong, just share us the transaction records via print screen. Or you can contact their customer service. TaiGoh and polarzbearz liked this post

|

|

|

Feb 11 2021, 05:21 PM Feb 11 2021, 05:21 PM

Return to original view | Post

#172

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(xander83 @ Feb 11 2021, 02:37 AM) Withdraw in small amounts is better to take profit than lump sum because FX rate calculations where more gains are to be seen than losses dude, one day i will understand you but as of now, I totally don't...can you share an example calculation or transaction?No offense just trying to learn. |

|

|

Feb 11 2021, 08:18 PM Feb 11 2021, 08:18 PM

Return to original view | Post

#173

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(xander83 @ Feb 11 2021, 06:04 PM) You can go try withdraw small amounts of less than RM1 then you know how much the difference. I been putting in lump sum in xxxx and withdraw daily in small amounts of less than RM1 when the MYRUSD price alert trigger on my dashboard My question is whether you have calculated whether you make more by not withdrawing at all, or at the a later time.You wouldn’t understand unless you have trade FX derived FI and MMF, FX and ETF directly hence you wouldn’t understand when to take profit at the right time |

|

|

|

|

|

Feb 12 2021, 03:35 PM Feb 12 2021, 03:35 PM

Return to original view | Post

#174

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(honsiong @ Feb 12 2021, 01:34 PM) I think it boils down to how cheap it is for us living in Malaysia to trade ETFs. Even with commission free trades which are common nowadays, it is hard to replicate the StashAway portfolio when the capital is low, because most brokers do not offer free fractional share Trades.Currently we need to open brokerage account abroad, then wire the money over, which can hurt our return without investing huge amount one shot. If a broker accepts MYR deposits, and give us USD 1.99 commission to trade ETF, I can see stashaway to be much less appealing here. I have SGD bank account and Tiger Brokers account, I buy some ETFs there, but I still maintain regular deposits into StashAway because I am not confident my ETF allocations can outperform StashAway in long run. Buying own ETFs is fun, but stashaway is at least professional managed, very happy with their performance since 2017. In other words agree with you wholly. I’d go as far as saying I’m willingly agree to being charged 1% per annum for small trades, fractional shares, from MYR. How much principal per year I will let them charge is another matter...I’m now at 5 digits, I don’t think it will cross to 6 digits anytime soon. Quazacolt liked this post

|

|

|

Feb 13 2021, 03:09 PM Feb 13 2021, 03:09 PM

Return to original view | Post

#175

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(highflier @ Feb 13 2021, 01:04 PM) Notice that last night a small portion of KWEB was being sold and I understand that because it has exceeded the target weight too much. I know I just said that my portfolios have never sold but I did a recheck and also my 14% portfolio has sold some KWEB to buy various other funds.My portfolio is 16%, and the target weight for KWEB is 8%, before yesterday the actual weight was 9+% What concern me is that I have set to transfer money from Simple to this portfolio on weekly basis, running for months already, and the amount is almost same with the KWEB portion that was being sold last night. Actually based on previous records, this week investment should be done on Thursday or Friday, but i think because of holiday, it didn't kick in. If that happens, I think the platform won't sell the KWEB that much. And now I believe high chances that in coming weeks I will buy KWEB again, in higher price, due to the weekly deposit. Instead of using Simple, perhaps I should just manual transfer money to the portfolio. In this case you still can't escape the automated algorithm, just ride along. If KWEB does indeed rise more, actually you won't be losing that much, as I believe (not calculated) that your current allocation / holding will still appreciate over this period of time. The whole point of this auto pilot is for auto re-balancing, and you are paying for it...might as well let it do its thing. PCMasterRace and Quazacolt liked this post

|

|

|

Feb 13 2021, 09:45 PM Feb 13 2021, 09:45 PM

Return to original view | Post

#176

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

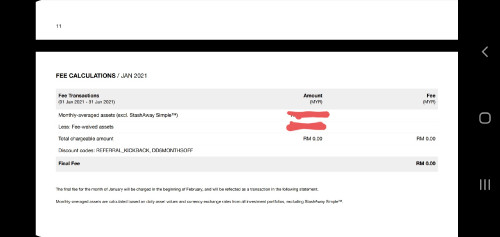

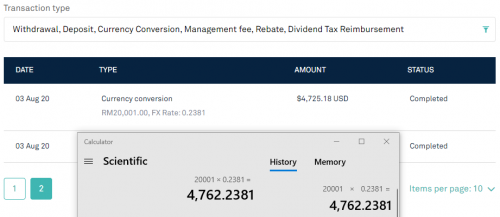

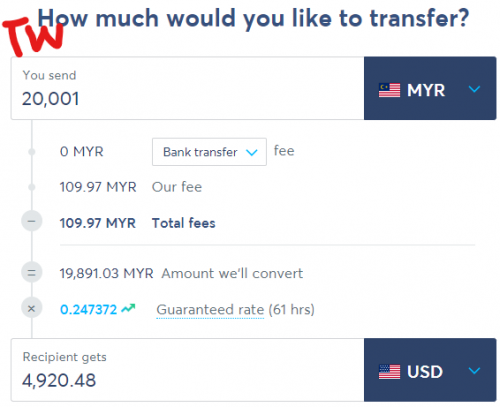

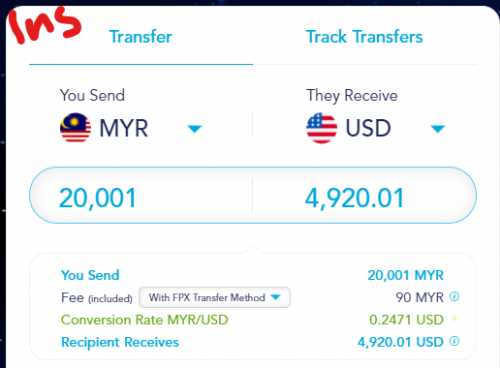

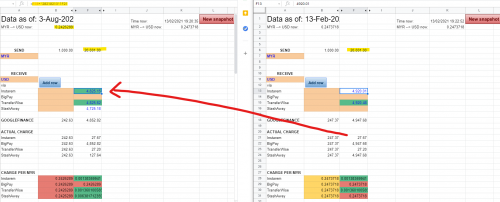

QUOTE(Takudan @ Feb 13 2021, 07:38 PM) Hi all, Question about SA's conversion rate - I don't like what I'm seeing but I might be wrong in this. Here's a snapshot of my SA transaction history:  The transfer fee was USD37.0581, considering SA's exchange rate displayed there, there was a hidden processing fee of 37.0581 USD. Now to reverse engineer to find out what was the MYR>USD rate on 3 Aug 2020: Today (13 Feb), 1MYR = 0.2473718USD On 3 Aug, 1MYR = 0.2473718 - 0.0047429 = 0.2426289   But of course, I have no way to reverse engineer fintech's or bank's offers so I went to Instarem and TransferWise to check the rates, and plotted them onto my own transfer rate calculator (Special thanks to a forumer who did a sheet like this himself, I made my own copy with some additional functions). Google finance is the benchmark, and the various fintechs are more realistic values: TW and Instarem:   Excel comparison:  RHS: Today's exchange. I'm taking 27.67 USD as the actual charge incurred for the exchange and put that into 3 Aug sheet (LHS). Meaning, if I did the transfer on 3 Aug instead using TransferWise, I would've receive approx 4825 USD instead. That is 100 USD spread from SA's conversion compared to other fintechs! Did I miss out something or is SA conversion rate really that bad? inb4 "Why are you trying to reverse engineer this?" I didn't know what I was doing back then, now I want to know if I should continue keeping my money in SA or take it out to invest manually. Frankly speaking, the performance has been disappointing, and I want to know why. On top of that, there's a 3+USD conversion back to RM to pay the management fee every month, so shitty conversion rate would really hurt investments in SA. OR, if anyone is going to make a deposit into SA soon, please do me a favour and compare your post-conversion amount to other fintechs? Thank you!  . According to Xe.com 3rd Aug 2020 was 0.23588 usd per myr. With 20001 myr it converts to usd 4718. I read your post and I still scratching my head why you are using today's rate and compare to 3rd Aug with 37 usd difference? |

|

|

Feb 14 2021, 09:03 AM Feb 14 2021, 09:03 AM

Return to original view | Post

#177

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Takudan @ Feb 14 2021, 03:04 AM) Hello, did I just get conveniently excluded from the statistics with my -0.56% TWR/MWR? Bonds and gold are underperforming these past few months, so to have a loss is not surprising in these “bull times” for equities, bear for bonds. Even my 14 % ri portfolio is not performing as well as the higher risk ones. BUT, during the bad times at the worst of COVID last year, i assure you it was outperforming the equity heavy portfolios, and by a strong margin. At one time the 14% risk portfolio was doing 20% return per annum. Of course I was doing DCA and this guaranteed average results. Now it is roughly 10-12% XIRR. Thanks. I do have some long term investment on stocks outside SA, so increasing risk index to focus on equities feels like I'm putting too many eggs into the same basket... or am I wrong to think so? I'm not saying I have eyes on all kinds of industries/sectors, but I'm thinking a market crash would affect every stock out there. Honestly I was expecting it to perform better than FD or heck, my saving account lol, but I can't bring myself to top up to a portfolio that tells me -0.56% TWR, meanwhile my manual investment is going strong at 15%+ It's hard to think that it was a bad peak when the market right now is better than in Aug 2020. So was I really just unlucky with the AI/whoever working on my account? I'm trying hard to convince myself about SA haha As has been discussed many many times, lump sum during down turn is going to loss out to DCA (your situation for bond heavy portfolio). The plus factor is you hardly lost any significant money during this period and I bet you are still very much in the 10% risk index performance bracket, ie 1% chance of losing 10% in a year. There is actually no guarantee that the lowest risk portfolio must make profit, it is just lower in volatility. I’d say a 0.5% loss over 6 months is damn low volatility. There are a few ways to look at this: 1. Stay invested and eventually it will rise back to close to the benchmark 9.5% p.a. 2. Invest more and it will reach 9.5% sooner 3. If you actually looking for more reward vs risk then switch to higher risk as many have recommended. Now the question that remains is what are you going to do and it is not up to others to decide or even for you to decide based on historical returns. If you think market gonna tank, suggest you top up your 10% port, if you think market going up, do the 36% instead. |

|

|

Feb 14 2021, 06:42 PM Feb 14 2021, 06:42 PM

Return to original view | Post

#178

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(cucumber @ Feb 14 2021, 03:55 PM) I agree with this thinking. Cut loss move on. Don't hang on to losers. Opportunity cost. The investor should make up his own mind, IMHO. Our advice should not be construed as a signal to buy or sell. We have all invested in this, so there is a tendency to advise the investor to go go go.Fed is about to inject another trillion dollar into the system. Market is going up. Don't allocate so much in bonds. AaronFPS, stormseeker92, and 4 others liked this post

|

|

|

Feb 16 2021, 10:50 AM Feb 16 2021, 10:50 AM

Return to original view | IPv6 | Post

#179

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(DragonReine @ Feb 16 2021, 10:09 AM) Usually they put you max 22% due to several factors from your assessment answers, including but not limited to: Another thing with those return graphs is that the annualised performance for 26 and 36% is much shorter Time period (2019) vs the 22% which is actually from 2017 or 2018. Due to this they are not apple to apple. What I can say is I'm charting roughly 24% xirr on both 36 (since March 2019) and 26 (since early 2020) with my own cash flows, but these are based on mixture of dca, and buy the dips.1) low monthly income 2) high liabilities/debt-service-ratio 3) job is deemed high risk/unstable/low to no income (like student or an entry level job like clerk/waitstaff or gig work) 4) no prior investment experience 5) low to zero savings 6) age (if you're older they might not give high risk initially even if you list yourself as aggressive because your age means not many years left to retirement where you can weather volatility) basically its SA's way of protecting you and your finances. A human financial advisor would similarly tell you to take lower risk if you fall into too many of the above criteria, because it's not wise to invest if you're deep in debt with little income etc. Don't feel bad about limited to 22%, in fact 22% risk portfolio is not bad performance at all, if you look in their performance since inception the annualised return is same to 36% because of some crashes in equities a few times in the last few years.  36% portfolio is for us who can afford to stomach the volatile and are willing to risk the losses to get (maybe) high returns as above have said, you can watch the videos on Personal Finance basics and Investing basics to educate yourself, then contact StashAway customer service via their WhatsApp to help unlock 36% But don't be super WAHHH AMAZING about other LYN members' gains. SA's algorithm recommending low risk for you is not without reason. DragonReine liked this post

|

|

|

Feb 16 2021, 01:56 PM Feb 16 2021, 01:56 PM

Return to original view | Post

#180

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(amateurinvestor @ Feb 16 2021, 12:54 PM) Hey just curious on what do you mean wed & thurs will correct itself? Is it a trend for markets to correct themselves around end of week? And is this in relation to us markets or equity markets in general? If you listen too much to experts, sooner or later they become correct. (No offense to anyone here).Coz if tats the usual trend then it makes sense to top up around end of week yes? Thanks haha 😆 KenDiriwan, TaiGoh, and 5 others liked this post

|

| Change to: |  0.0627sec 0.0627sec

0.22 0.22

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 06:24 AM |