Im puzzled with the low returns by @dopp. Must be currency.

This post has been edited by lee82gx: Dec 11 2020, 08:12 PM

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Dec 11 2020, 08:04 PM Dec 11 2020, 08:04 PM

Return to original view | Post

#101

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

|

|

|

Dec 11 2020, 08:30 PM Dec 11 2020, 08:30 PM

Return to original view | Post

#102

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

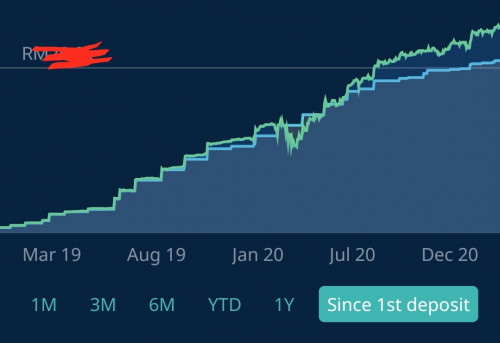

Usd returns are definitely looking better than rm

|

|

|

Dec 12 2020, 01:22 PM Dec 12 2020, 01:22 PM

Return to original view | IPv6 | Post

#103

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(WHITE APPLE @ Dec 12 2020, 12:48 PM) Planning to withdraw FD to deposit into Simple™ in lump sum, and then DCA from Simple™ to investment portfolio weekly/monthly. Any thoughts? How can we do that? withdraw from Simple™ to bank account then DCA from bank account OR we can straight DCA from Simple™? When u withdraw from fd, you also loose ur interest no?Just check the Simple™ FAQs, the Dividends is calculated on daily basis and are paid out monthly. If i want to withdraw before the pay out date (i assume it is once a month?), will i lose the dividends? Honestly I just dump it into simple and dca. You are withdraw the full amount from simple to your portfolios? |

|

|

Dec 14 2020, 12:11 PM Dec 14 2020, 12:11 PM

Return to original view | Post

#104

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(WHITE APPLE @ Dec 13 2020, 06:10 PM) I'm planning to switch my FD to Simple after maturity date. Reasons being are because Simple has no lock in period and the 2.4% returns is not that bad compare to FD. This is exactly what I do. To be honest, I have barely a few k here or there in FI / FD at any one time. I don't sweat the interest lost from a month or two and just dump it into the Simple and let it deduct away. It is more to restrict my own poor discipline in spending money needlessly if it is cash in my savings account. Come to the end you are talking about a few ringgit...Consider the big picture of a life time of returns from your portfolio....No I'm planning to DCA small amount weekly/bi-weekly from Simple to investment portfolio. WhitE LighteR liked this post

|

|

|

Dec 14 2020, 06:08 PM Dec 14 2020, 06:08 PM

Return to original view | IPv6 | Post

#105

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

In other words not yet reach sizable sum.

|

|

|

Dec 17 2020, 12:24 PM Dec 17 2020, 12:24 PM

Return to original view | Post

#106

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

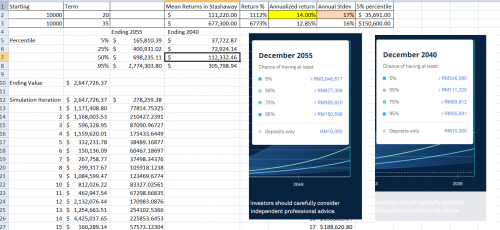

Hi everyone,

I have some data and maybe it is useless maybe it is useful. I am trying to compare Stashaway to my own DIY portfolio, with respect to risk and returns. For example if you look at Risk Index 36%, you are told there is a 1% chance of losing 36% of your investment in a year. The projected returns can be simulated in the website. By right based on the 2 statements you can derive the mean and also standard deviation based on a normal distribution. However I found that it is not matching. So, I ran some Monte Carlo analysis and reverse engineer the Standard deviation, here are the results:  With a 1000 run Monte Carlo, I manage to get close to the projected returns in Stashaway. The matching return and Standard deviation is : 14% and 17% If you use this info to calculate a sharpe ratio with a risk free return rate of 2%, then the Sharpe Ratio is 0.71 You can now use this to compare against other funds. To me, my take away is if they maintain this in real life (you have to calculate your own std dev based on your own returns based on your DCA and cash flow) then it is actually not too shabby if it is maintained over a long period. I've yet to calculate the sharpe ratio of the actual historical performance, maybe I should. But I believe it is far exceed 1.0 for the past 2 years. |

|

|

|

|

|

Dec 17 2020, 02:43 PM Dec 17 2020, 02:43 PM

Return to original view | Post

#107

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(idyllrain @ Dec 17 2020, 02:31 PM) Well, you could obtain the expected returns from the code that generates those projection graphs. I'm always amazed by skills of others. thanks.Notes for readers

I checked the 36% RI, you numbers are better match than mine. Which sadly makes the risk sharpe ratio even lower. This post has been edited by lee82gx: Dec 17 2020, 03:25 PM |

|

|

Dec 20 2020, 11:32 PM Dec 20 2020, 11:32 PM

Return to original view | Post

#108

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Vint @ Dec 20 2020, 09:11 PM) This guy is making a mountain out of molehill. I invested my first myr into StashAway knowingly that the dividends will be gone down the drain due to withholdgin tax.Fees also mentioned up front will be charged what. He should have mentioned the stability or viability of StashAway which until today cannot ascertain. What I don’t see is actually how less educated investors can easily invest their money profitably into the US or broader based international markets. After all one of the tag lines StashAway is promoting is lesser fees compared to actively managed funds, and to a certain extent the fees are indeed lower. Next thing this guy does not mention about Forex risk is that it really works both ways and sometimes we enjoy the benefit of lower RM to MYR too in our portfolio. I remember some times nett loss in USd and nett gain in MYR. One more thing is that, does withdrawing really come up with a substantial loss in forex after we have been quoted for the portfolio value daily? I’m curious, as I have never sold or liquidated anything yet. Anyhow I have bought us shares since 2006, back when usd to myr is less than 4, maybe 3.8 or less. What I find is that in the long run as long as the company and share you buy is good and increasing in value, currency losses is something you have to just suck it up. This post has been edited by lee82gx: Dec 20 2020, 11:39 PM |

|

|

Dec 21 2020, 10:52 AM Dec 21 2020, 10:52 AM

Return to original view | Post

#109

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(tehoice @ Dec 21 2020, 10:16 AM) I think that one should have diversified investments, it won't hurt to have both mutual funds and robo-investment. anyway, i think robo investing is way to go and my robo investment will definitely outgrow my mutual funds There is no trick, first step is always to diligently track your portfolio, do your homework and bring out the steel balls. If it works out, hey, more moolah, if not then at least you have your robo doing well. WhitE LighteR, Quazacolt, and 1 other liked this post

|

|

|

Dec 21 2020, 11:14 AM Dec 21 2020, 11:14 AM

Return to original view | Post

#110

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(encikbuta @ Dec 21 2020, 10:55 AM) Yea, i read his earlier blog post titled "Stashaway Malaysia Review: 23 Secrets Exposéd" where he is rightfully telling us to be careful when investing into StashAway. I thought it was a good reminder to not just shift into the 6th gear with RoboAdvisors. But this latest video outright just tries to belittle StashAway with misinformation. Uncool. That said though, it does seem like his "23 Secrets" article have been edited to bash StashAway too. I didn't remember it being so one-sided when I first read it a few months back. I also was drafting a series of rebuttals but here in Malaysia we will just call it waste of breath / air. i thought of it but it just may get deleted and i'll get pissy. I'll just leave it here in Lowyat where it's safe yea, i think mutual funds, index funds, individual stocks, bonds, real estate, ASB, FD, money markets, etc all have its place in our portfolio. i just take issue when anyone says one is ABSOLUTELY 100% better than the other. What is the point in educating a sheep / cattle falling off the cliff? If this fella got a 15% return with 20% risk method with a lower fee consistently, by all means sell it and I may even invest.... WhitE LighteR, Quazacolt, and 1 other liked this post

|

|

|

Dec 21 2020, 11:20 AM Dec 21 2020, 11:20 AM

Return to original view | Post

#111

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(tehoice @ Dec 21 2020, 11:17 AM) that's why we should always view things with an open eyes, move a step back and take a holistic approach in perspective. completely agree.can't help it, he's getting hurt from this robo advisory thing and this will not improve unless they re-invent themselves. again to me, robo-investing is a way to go in the future, whether you like it or not, it will form part of many people's portfolio going forward. Like it or not, AI = automation and it will cost human jobs. It is already doing so in so many applications. A smart person will take note and profit. Talk is cheap, he needs to show some better examples. Not cherry pick worst case vs best case. DragonReine liked this post

|

|

|

Dec 21 2020, 01:05 PM Dec 21 2020, 01:05 PM

Return to original view | Post

#112

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(polarzbearz @ Dec 21 2020, 12:13 PM) I used to enjoy some of his contents but the latest one I really cannot While watching it, I immediately thought, forumers like you can easily do a better analysis. Imagine, this is actually my first time watching his channel and I'm unlikely to come back for more.On one hand he's been nitpicking about the underlying assets of StashAway blah blah blah - those, while legit, but also applies to mutual funds equally. Among many other things DragonReine, goliath, and 3 others liked this post

|

|

|

Dec 21 2020, 04:50 PM Dec 21 2020, 04:50 PM

Return to original view | Post

#113

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(honsiong @ Dec 21 2020, 04:44 PM) Alright I dropped a comment on his video: well i didnt even bother to dislike it. Perhaps savvy investors can tell the difference in a few minutes."I am sorry if StashAway is hurting your rice bowl leading to you making this salty video. Press F for our brudder here." Let's see if he deletes my comment, because I don't believe there is a 24% dislike ratio and 0 comments criticising his points. If he is censoring critical comments, then he knows he is wrong. |

|

|

|

|

|

Dec 21 2020, 10:31 PM Dec 21 2020, 10:31 PM

Return to original view | Post

#114

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(polarzbearz @ Dec 21 2020, 06:54 PM) I always avoided conflicts esp. on others video but I decided to leave my comment this time around I try another constructive way of criticizing, which is to ask him for any better alternative. Maybe its pay per entry but I'm hoping to be either educated or entertained.To satisfy my inner rage » Click to show Spoiler - click again to hide... « Definitely keeping me interested instead of the boring DCA and swatting flies. I don't remember such excitement other than the super mega ultra bank emptying fiasco. |

|

|

Dec 25 2020, 01:20 PM Dec 25 2020, 01:20 PM

Return to original view | Post

#115

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Ziet Inv @ Dec 24 2020, 12:02 PM) Judging from his content, replies, and the drama caused, he seems to at his wits end. Burnnnnnnn......As someone that is featured in his video (lol!) as one of the "under-informed content creator", here's what I would like to chip in: 1. If he holds his license and experience that high, he should be educating instead of bashing. Nearly every recent videos that he made is bashing on content creators - why the hate lol? 2. If he thinks content creators only promote referral links for self-benefit, why put your contact details for your paid consultancy? "My RM 2,000/day consultancy is better than their BS!" 3. Its fucking 2020/2021. If you are gonna put up any content on YouTube, feel free to do so with your whiteboard + marker + static slides + not grooming yourself + your face taking up 70% of the screen. Really? At least groom yourself or get a cheap mic to not torture the 9K subscribers (or not) that you have. How ignorant can you be to think that your license triumph over everyone else's form and substance? What a donkey Anyway as expected he didn’t back to me. Save from directly investing overseas, there is no better way to do it in Malaysia ATM. honsiong liked this post

|

|

|

Dec 26 2020, 12:47 PM Dec 26 2020, 12:47 PM

Return to original view | IPv6 | Post

#116

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Oklahoma @ Dec 26 2020, 12:39 PM) Ok apologies. Anyhow how's your experience with stashaway? I put 36% risk, so far so good. As of today no one has lost money through stashaway due to fraud or deceit or anything illegal.I placed all my hard earned money in stashaway, is it wise? Your investments are held in trust by a trustee. If stashaway goes bankrupt you need to go through this trustee (Pacific trustees) to reclaim your possessions. Perhaps you will be forced to liquidate at that point. Is it wise to put ALL your money in any single investment? Stashaway thinks so but perhaps you need to think and decide for yourself. I don't. |

|

|

Dec 26 2020, 12:51 PM Dec 26 2020, 12:51 PM

Return to original view | IPv6 | Post

#117

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(47100 @ Dec 26 2020, 12:45 PM) That is plain wrong. brokenbomb, TaiGoh, and 2 others liked this post

|

|

|

Dec 27 2020, 07:34 PM Dec 27 2020, 07:34 PM

Return to original view | Post

#118

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(ali00 @ Dec 27 2020, 06:50 PM) Did you do a lump sum or dca? Either way 1 year is too short and if you had significant sums invest before covid, we are just in the beginning of a recovery. Ie breakeven is already a great thing.Please, 5% roi in year one is nothing to be scoffed at for the worst pandemic worldwide to ever hit planet earth. If you had maintained invest 4k over a year through a dca, rm200 returns over 4k of principal sounds ok. If I had to guess its definitely above 8% p.a. Again, nothing to be scoffed at. I think you should learn what is annuity, cagr, and compound interest. Considering covid this year is good and you still should focus on the coming 10 and above. Some funds would still be in the red considering the annual fees you have to pay to enter. (Non stashaway) |

|

|

Dec 28 2020, 12:28 PM Dec 28 2020, 12:28 PM

Return to original view | IPv6 | Post

#119

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(Vint @ Dec 28 2020, 11:59 AM) hi sifu, want to ask opinion, my money was invested in 36% risk The money should be invested at least 3 to 5 years. If you withdraw now, just assume it did nothing. Or lost a few percent. You should grateful that this is not public mutual....When is the best time to partially withdraw from my portfolio with maximum earning ? as of now, i had 600+ interest earned over 2 weeks, but last updated was 24th Dec. if i were to withdraw partly now, i think the earning was still not updated, and im not sure on which day even SA will start the process of exchange, selling, and deposit into my account anyone had experience? Even if you trigger the sale today, the actual liquidation of all your assets will take time and it is based on a price in the future that no one can tell. Expect 1 week + before it finally comes back to you in myr in your bank account. |

|

|

Dec 29 2020, 01:28 PM Dec 29 2020, 01:28 PM

Return to original view | Post

#120

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

Kweb has drop quite a bit, and that is the reason most portfolios having it cannot fly higher even though sp500 is having record gains. Anyhow not to fret, this is all part of the plan. Its rare and unsustainable have all funds all up all the time. honsiong liked this post

|

| Change to: |  0.3498sec 0.3498sec

0.27 0.27

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 05:14 PM |