QUOTE(tsutsugami86 @ Dec 29 2020, 01:40 PM)

The KWEB still quite high compare to the price i invested on May 2020, that time KWEB only around USD 50 - 55. These few month keep buy at high price

Nothing wrong with that at all. Long may it continue!Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Dec 29 2020, 10:33 PM Dec 29 2020, 10:33 PM

Return to original view | Post

#121

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

|

|

|

Jan 5 2021, 10:27 AM Jan 5 2021, 10:27 AM

Return to original view | Post

#122

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

So, now, all support Gold pulak?

US market seems cooling off a bit, which is not a bad thing if you have AAXJ, KWEB, GLD. Wish you all happy and a calm investing year ahead. With no Trump I'm wondering what the markets will react to ? Boris already almost complete the Brexit, left Covid? |

|

|

Jan 6 2021, 07:50 PM Jan 6 2021, 07:50 PM

Return to original view | Post

#123

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

I have 3 portfolios.

36 RI (50%) this one was from early 2019 26 RI (10%) this one started when SA reoptimized and removed SP500 from 36% RI, but now this one also no more SPY 14 RI (40%) this one started in mid 2019 At one point the 14% portfolio outperform the others but now its dropping a lot the returns. Must be bonds and ISD dropping. |

|

|

Jan 7 2021, 11:46 AM Jan 7 2021, 11:46 AM

Return to original view | Post

#124

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(littlegamer @ Jan 7 2021, 11:32 AM) Hi, recently I bump into fsmone(I'm a slow poke I know), I notice there do have similar etf and more can be bought there. You need to study further. There is no etf in fsm.My question is how is the fee compare SA VS fsmone. Given the advantage fsmone I'm free to choose even higher risk etf. I mainly now now have issue with gld. Personally I dislike gld as it is a form or currency hedge and not a way to grow. There is very little overlap of assets between fsm (active managed, trust funds) and stashaway (robo, passive funds). |

|

|

Jan 10 2021, 03:43 PM Jan 10 2021, 03:43 PM

Return to original view | Post

#125

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(AnasM @ Jan 10 2021, 02:54 PM) there have been great discussion over Monthly DCA vs Weekly DCA. Congrats for satisfying the inner nerd amongst us. Since you didn't share the full results I infer (rather I'm pretty sure) that the lump sum investment wins once you reach a certain amount of time, for example once you reach average returns, but still having random / normally distributed returns daily.(If you agree with me, please save and share this post to anyone asking whether they should monthly DCA or weekly DCA.) I have decided to create a simulation using Excel with the following configuration: - Annual investment: $12000 - Investment Period: 10 years (01 Jan 2021 to 31 Dec 2030) - The daily unit price changes: Random between 5% to -4.7% Based on the above, Monthly DCA amount: $12000 / 12mth = $1000 4x DCA per mth amount: $12000 / 12mth / 4 deposits = $250 Weekly DCA amount: $12000 / (365.25 days / 7 days) = $230.136986 Annually DCA amount: $12000 == For monthly Investment, I plotted a table, to compare the returns if I invest in every 1st of the month, 2nd of the month, 3rd of the month, ... , all the way to 28 of the month. - 1st of every month - 2nd of every month - 3rd of every month - .. - 28th of every month (I didn't go up to 29, 30 and 31 of every month, because not every month also have the date. And I think 28 days is more than enough for this experiment) Then review the investment return by calculating the unit obtains x the unit price as of 31 Dec 2030. So, I have 28 results for me to compare what is the different if I invest in any day of the month == For 4x DCA per mth, I chosen the following combination dates: - 1, 8, 15, 22 - 2, 9, 16, 23 - 3, 10, 17, 24 - 4, 11, 18, 25 - 5, 12, 19, 26 - 6, 13, 20, 27 - 7, 14, 21, 28 So, I have 7 set of results to compare. == For weekly is easy, I simulate if I deposit on every: - Sunday - Monday - Tuesday - ... - Saturday I also have 7 set of results to compare == For Annually, I didn't want to create 365 sets of result, so I only invested on every 1st of each month - 1st Jan - 1st Feb - 1st Mar - ... - 1st Dec So, I have 12 returns to compare == BONUS!! I also simulated daily DCA! Yes, daily! Daily DCA amount: $12000 / 365.25 days = $32.85421 ======================== P/S and conclusions: - of course, this is just a simple simulation, it does not take in all variables in the real life stock market - The results are also predictable and expected: -- Since I have fixed observation date (31 Dec 2030), the earlier I invest will get more time for the power of compounding -- weekly DCA does not guarantee better returns. It is only means your DCA is more average than monthly DCA. -- the daily DCA returns is lower than average of other DCA frequency due to the same reason, many of the deposits doesn't have enough time for the power of compounding -- conclusion, it doesn't really matter if we are DCA daily, weekly or monthly. -- The more frequent you deposit, doesn't guarantee the better returns; it is means your dollar cost averaging is more averaging than others. -- for investment in stashaway, time in market is better than time the market. So, just monthly/weekly/daily DCA as you wish. DCA only helps in short / medium term if you happen to have reached an abnormally low peak at the particular moment in time. But once you reach average returns on a normal distribution, you will lose as you did not invest earlier. QUOTE(scriptkiddie44 @ Jan 10 2021, 03:21 PM) Wanna ask, any one has an idea how StashAway calculated the returns? My returns is ridiculously high, but the return on the capital it's not what shown in the return % regardless time-weighted / money-weighted. If you can refer above post, it is likely because you invested very recently at a low point.  In FB Stashaway there is apparently an ongoing competition to post DCA vs lump sum and DCA frequency. At first I replied to many but I end up feeling I'm spoon feeding babies who refuse their milk, ie trolls. If you guys google, this question has already been analysed ad nauseum, lump sum is usually better. Just dump it and be done. I actually have a DCA monthly and have a few months worth of DCA in standby that I like to use for timing the market. Though it never hits the right time, as the Simple is just too damn freaking slow. Nevertheless the amount i have invested is already >95% of my cash in Simple. The reason I have not fully invested all my cash, is because sometimes they serve as my emergency money. In this sense, one can consider as fully invested / lump summed. Higgsboson8888, pinksapphire, and 1 other liked this post

|

|

|

Jan 10 2021, 03:58 PM Jan 10 2021, 03:58 PM

Return to original view | Post

#126

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

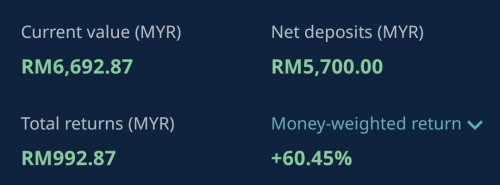

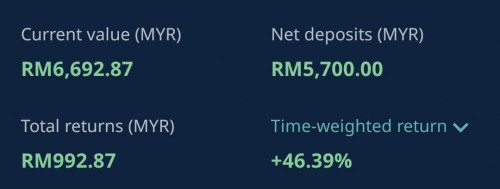

QUOTE(scriptkiddie44 @ Jan 10 2021, 03:47 PM) My portfolio started since 1st Jan 2019, and have been DCA every month (usually 1st week of every month), never stopped since then. https://www.investopedia.com/terms/m/money-...hted-return.aspThere is no lump sum involved, but I do increase my DCA amount in 2nd year. Still, the % doesnt make sense. The return calculated using pure math is only around 15% Just curious how's the calculation actually computed. I have similar method as you, DCA regularly with increase in 2020. I have 50+% MWRR and 40% TWRR, and even more if I use USD calculation. I find it hard to comprehend and use. So I use XIRR instead (which funnily Stashaway like to report anyway in their brag sheets). |

|

|

|

|

|

Jan 11 2021, 08:00 PM Jan 11 2021, 08:00 PM

Return to original view | Post

#127

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Jan 11 2021, 09:30 PM Jan 11 2021, 09:30 PM

Return to original view | Post

#128

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

Haha....over analysing things already. In the grand scheme of things this is just a drop in a bucket. Still got 10 more years for me.

|

|

|

Jan 11 2021, 09:42 PM Jan 11 2021, 09:42 PM

Return to original view | Post

#129

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(ironman16 @ Jan 11 2021, 09:35 PM) this is the purpose of auto-robo ma......biar aje......see too much very tired......better do others thing...... Remember a time when this forum was like krikkk krikkk to the sound of crickets....one day zero post also got. Now market up, suddenly day traders also appear out of nowhere.kasi itu forum hangat ma......if no debat, boring la..... |

|

|

Jan 13 2021, 10:54 AM Jan 13 2021, 10:54 AM

Return to original view | Post

#130

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(GrumpyNooby @ Jan 12 2021, 07:20 PM) QUOTE(GrumpyNooby @ Jan 12 2021, 09:00 PM) QUOTE(xander83 @ Jan 12 2021, 09:11 PM) Which Risk index portfolio is this? I'm kinda surprised because I have only ever have 1 single sell order due to re-optimization and that was in 36 RI when they dumped IVV / US core and move to AAXJ/KWEB/GLD.Interestingly it did not really work:

|

|

|

Jan 14 2021, 06:37 PM Jan 14 2021, 06:37 PM

Return to original view | Post

#131

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(lovingforyou @ Jan 14 2021, 01:29 PM) With amount i'm comfortable probably RM600 monthly, which will seperated weekly RM150.00 Izzit too small for me to start with Beside of setting schedule one time deposit in SA app (each setup take me 30 seconds), any other recommended convenience way? It doesn't cost me "more" that if i doing weekly dca comparing to monthly dca right? Worried if there is any "hidden charge" like i have to pay sales charge per deposit or etc Btw i'm aware that there is account management fee subject to 1.5% or etc So i have to put some 'referral code' into somewhere, where can i do this, i saw in previous post that had to contact CS to manually submit the 'free management fee' code You can see a projection in 20yrs how much the portfolio will grow to with the percentile prediction, which, by then you ask yourself will you be comfortable with it? Will you regret after 20 yrs down the road that the ending amount could've been enough to retire/buy a house/finance your kid's education if only you invested more if you can? Those kind of questions.. Generally, if you are saving / investing more than 30% of your take home pay, you can maintain your quality of life after retirement. If you want more then you have to look for alpha. |

|

|

Jan 15 2021, 02:28 PM Jan 15 2021, 02:28 PM

Return to original view | Post

#132

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

I am not a proponent of crypto. Will not until one legitimate government accepts it as legal tender. As such. By advising folks to keep less than 5% allocation at all times, I think they are telling you to play far far. DragonReine liked this post

|

|

|

Jan 15 2021, 08:30 PM Jan 15 2021, 08:30 PM

Return to original view | Post

#133

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

Buying crypto, at the best is like buying currency. Which already is something I'm not going to dabble also.

Imagine Stashaway suddenly offer USD / GBP / Forex "investing". I'm also first to run away. |

|

|

|

|

|

Jan 15 2021, 08:41 PM Jan 15 2021, 08:41 PM

Return to original view | Post

#134

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(stormseeker92 @ Jan 15 2021, 08:36 PM) If your 5% makes 100% in a year, then it only gives you 5% out of the overall portfolio. But if you lose most of it, say left only 1.5% of the portfolio, you will lose 3.5% per annum, and it sours the overall portfolio.Looking at this, I'd rather they do a currency hedging. lolwei liked this post

|

|

|

Jan 19 2021, 10:26 PM Jan 19 2021, 10:26 PM

Return to original view | Post

#135

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

lump sum always wins in bull market and in long term as well.

But keeping some cash for dips is a good strategy too....so maybe 90/10? In a way if you have fully invested, ie near to 90% of your investible monies, you think you are dca'ing when your monthly income is deducted and kept away. But as matter of fact it is lump sum. |

|

|

Jan 20 2021, 02:54 PM Jan 20 2021, 02:54 PM

Return to original view | IPv6 | Post

#136

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Jan 20 2021, 03:38 PM Jan 20 2021, 03:38 PM

Return to original view | Post

#137

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(stormseeker92 @ Jan 20 2021, 03:06 PM) Joking only sorry. If im not mistaken it's well know that if Gold rises stocks value goes down (correct me if I am wrong). Oh. It was not clear you were joking. Lol. But agree on your points above. As a 20% allocation, not a bad move at all. Some people don't buy but if it works then why not. Just that GLD is a cushion for us if stock prices goes down, and in a way it also limit maximum potential of profit. Having GLD is not a bad thing actually, just sharing my opinion. It doesn't break the fundamental of dont buy what you don't know. It is literally chunks of metal. |

|

|

Jan 20 2021, 11:21 PM Jan 20 2021, 11:21 PM

Return to original view | IPv6 | Post

#138

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(svchia78 @ Jan 20 2021, 08:11 PM) Does anyone feel that the stock market is getting too hot and too fast after a major crash like that back in March 2020? Or was March 2020 just a "correction"? https://www.cnbc.com/2021/01/17/the-wealthy...least-near.htmlMost are back to pre-Covid levels and still going up. What goes up must come down. It can't be up all the time, every time. Quazacolt and WhitE LighteR liked this post

|

|

|

Jan 21 2021, 12:30 PM Jan 21 2021, 12:30 PM

Return to original view | Post

#139

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(stormseeker92 @ Jan 21 2021, 11:55 AM) no worries, with any additional fresh funds, they will auto rebalance to other assets, so your exposure no matter how high and or how low is always follow broad market.In other words, DCA on lol |

|

|

Jan 24 2021, 05:00 PM Jan 24 2021, 05:00 PM

Return to original view | Post

#140

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(ang1222 @ Jan 24 2021, 04:55 PM) Do you guy normally use Jompay or auto debit ? after years of doing this, absolutely no difference.Or actually make no difference as long as we look at whole pic which is dca over 2-3 years. Direct debit had the fiasco 1 time of error in the system causing multiple direct debit until your saving account zero. Since then I didn't reestablish direct debit but use the slowest method - Stashaway simple instead. |

| Change to: |  0.4277sec 0.4277sec

0.61 0.61

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 02:50 PM |