QUOTE(magicnox @ Jan 22 2021, 03:08 PM)

Hi everyone, I'm pretty new to SA but I've been following this thread for awhile.

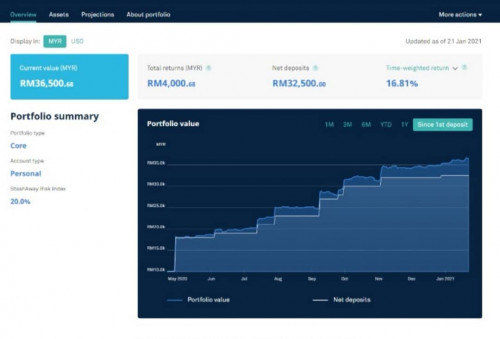

I'm 25 years old, after 1 year+ of working, I'm able to save up to 5 figures till date (I'm able to save up to 50/60% of my salary monthly).

I'm considering keeping them in SA simple (I read that it's better than keeping it in FD (?) compared to just keeping in my bank account) & also start investing in SA. I do not have an FD account yet, hence I'm torn with either keeping my savings in SA simple or a high-yield savings account (still surveying that atm)

The recommended risk by the system for SA is not more than 18% for my first portfolio. I put it at 10% for now and have not made my first deposit yet.

If anyone has tips/suggestions on how I should go about it, feel free to share.

Thank you

i cut short bcoz many times been mention:

Save at least 3 months to 6 month salary (more accurate is perbelanjaan) as Emergency fund (unless u said my mom/dad is my emergency fund

)

- may b 1 month in eFD (2 month oso can, up to u, important is easy to redeem, i choose eFD bcoz on the spot can get my money if i redeem through apps)

- balance 50% in money market fund (SAMY Simple) + 50% in Bond Fund

Extra money baru start invest, u wan in UT/SAMY/WAHED/MyTHeo/AKru/FSM/eunitrust/.............up to u

seen u still young, why dont just go with 2 portfolio, one is Risk 10% as u wish, one is 36% risk to test water

monthly dca without stop, after 1 or 2 year baru decide....

This post has been edited by ironman16: Jan 22 2021, 03:22 PM

This post has been edited by ironman16: Jan 22 2021, 03:22 PM

Jan 22 2021, 02:00 PM

Jan 22 2021, 02:00 PM

Quote

Quote

0.0212sec

0.0212sec

0.59

0.59

6 queries

6 queries

GZIP Disabled

GZIP Disabled