Continue to DCA smaller amounts?

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

Jan 22 2021, 03:41 PM Jan 22 2021, 03:41 PM

Return to original view | Post

#1

|

Junior Member

231 posts Joined: May 2006 |

|

|

|

|

|

|

Jan 22 2021, 03:52 PM Jan 22 2021, 03:52 PM

Return to original view | Post

#2

|

Junior Member

231 posts Joined: May 2006 |

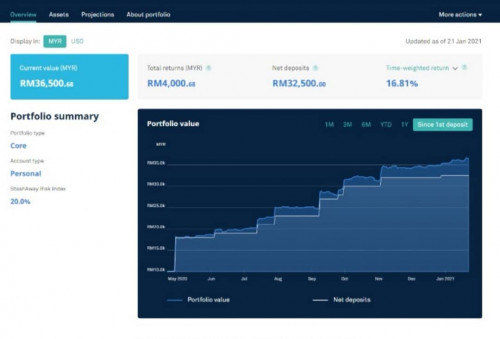

QUOTE(ironman16 @ Jan 22 2021, 03:46 PM) if u dun wan continue DCA, what is ur plan? redeem to cash? redeem to SImple? adjust ur risk? u oledi achieve ur target? thats mean u oledi save 36k n wanna buy car/ go vacation/ kahwin ? Just bought car, can't go vacation, no fiancee So no to all three hahaha |

|

|

Jan 22 2021, 04:02 PM Jan 22 2021, 04:02 PM

Return to original view | Post

#3

|

Junior Member

231 posts Joined: May 2006 |

|

|

|

Feb 1 2021, 04:24 PM Feb 1 2021, 04:24 PM

Return to original view | Post

#4

|

Junior Member

231 posts Joined: May 2006 |

QUOTE(Kagekiyo @ Feb 1 2021, 03:39 PM) Hi guys. If your risk appetite is medium to high risk, I recommend to put above 20%. Don't want to play it too safe. I play with the asset allocation slider to see the percentage of funds allocated until I'm comfortable with it. For me I chose 22%I've decided to give Stashaway a chance owing to it's wider investment portfolio as Raiz has been performing sub par (despite setting my portfolio to aggressive for the past 7+ months) since the time i started using it in July 2020 till now. Some questions: i) What is a reasonable risk setting range given today's economic climate? I have quite an appetite to take medium - high risk and my current setting is 16% ii) Since my recommended porfolio also covers US equity sectors, will it be wiser to deposit one lump sum of cash eg. RM50,000 given how 1 USD is now roughly 4.04 against MYR or will it be advisable to stagger it by depositing one time, RM10,000 followed by monthly RM3,000 contributions? Thanks! as I feel its the best risk return ratio for me. Lump sum this question is very subjective. Lump sum might suffer short term losses if market goes down. But If you're investing for medium to long term, why not? You will lose out on potential gains in the long term if you were to slowly enter the market through mthly contributions. But that's just my opinion. For me, I lump sum because I want to take on more risk and I'm investing in for the medium to long term ( 3 years and above). After lump sum my comfortable amount (after taking into account my emergency fund etc.) , I will put in mthly contributions from my mthly savings |

|

|

Feb 2 2021, 05:32 PM Feb 2 2021, 05:32 PM

Return to original view | Post

#5

|

Junior Member

231 posts Joined: May 2006 |

I tot updated ady? Mine back on the rise after the dip a few days ago hehe

|

| Change to: |  0.0416sec 0.0416sec

0.41 0.41

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 08:33 AM |