Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

ironman16

|

Jan 20 2021, 03:34 PM Jan 20 2021, 03:34 PM

|

|

QUOTE(xander83 @ Jan 20 2021, 03:21 PM) How do you DCA daily? GLD basically at 20% high risk allocation just a hedge to Equities in order to support any rebound in sight when the correction happens based on ERAA strategy GLD rises means that value of the money decreases and inflation is happening soon but for near term unlikely for now due to damp growth situation because unlikely to rise within 2% in US until 2022 which curtailed by unlikely higher taxes due to US Midterm which likely to see some Biden’s policies being smothered Don’t worry too much about 36% for those invested early this year during the 1st week as already more than 2% this month only beating FD this year without doing anything and take profit at the right time when the ringgit is weaker Still got 11 more months to go if anything shows 36% risks will be likely at 16% gain for this year and on bullish market will hit 24% or more  Monthly 😁 |

|

|

|

|

|

hiyyl

|

Jan 20 2021, 03:37 PM Jan 20 2021, 03:37 PM

|

|

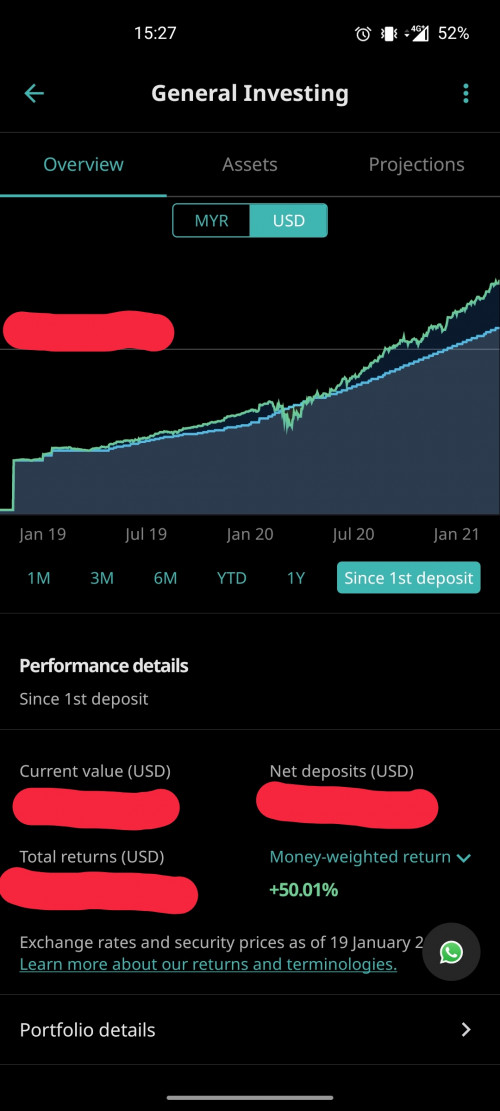

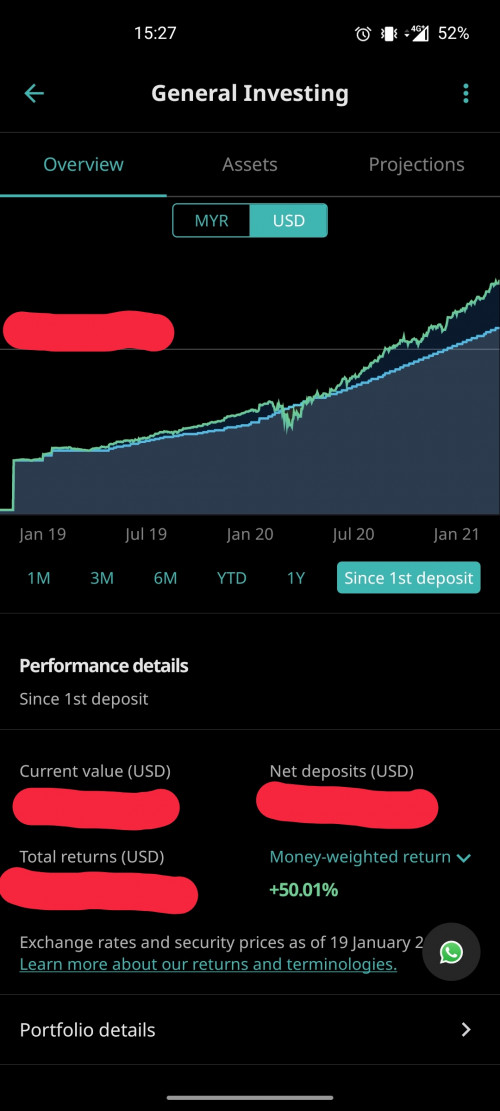

Some sharing... Started exactly 2yrs ago, miss out some weekly transfer in the beginning but manage to DCA every week after that. RI@30%  |

|

|

|

|

|

lee82gx

|

Jan 20 2021, 03:38 PM Jan 20 2021, 03:38 PM

|

|

QUOTE(stormseeker92 @ Jan 20 2021, 03:06 PM) Joking only sorry. If im not mistaken it's well know that if Gold rises stocks value goes down (correct me if I am wrong). Just that GLD is a cushion for us if stock prices goes down, and in a way it also limit maximum potential of profit. Having GLD is not a bad thing actually, just sharing my opinion. Oh. It was not clear you were joking. Lol. But agree on your points above. As a 20% allocation, not a bad move at all. Some people don't buy but if it works then why not. It doesn't break the fundamental of dont buy what you don't know. It is literally chunks of metal. |

|

|

|

|

|

halotaikor.

|

Jan 20 2021, 04:34 PM Jan 20 2021, 04:34 PM

|

Getting Started

|

a quick question.

how much stashaway charge everytime we topup ?

is higher topup amount means lower charge?

thanks in advance.

|

|

|

|

|

|

honsiong

|

Jan 20 2021, 04:44 PM Jan 20 2021, 04:44 PM

|

|

QUOTE(halotaikor. @ Jan 20 2021, 04:34 PM) a quick question. how much stashaway charge everytime we topup ? is higher topup amount means lower charge? thanks in advance. 0.1% per deposit, 0.1% per withdrawal, no discount. ---  Stay invested fellas. |

|

|

|

|

|

SUSxander83

|

Jan 20 2021, 07:13 PM Jan 20 2021, 07:13 PM

|

|

QUOTE(honsiong @ Jan 20 2021, 04:44 PM) 0.1% per deposit, 0.1% per withdrawal, no discount. ---  Stay invested fellas. What risk index? |

|

|

|

|

|

svchia78

|

Jan 20 2021, 08:11 PM Jan 20 2021, 08:11 PM

|

|

Does anyone feel that the stock market is getting too hot and too fast after a major crash like that back in March 2020? Or was March 2020 just a "correction"?

Most are back to pre-Covid levels and still going up.

|

|

|

|

|

|

honsiong

|

Jan 20 2021, 08:18 PM Jan 20 2021, 08:18 PM

|

|

QUOTE(xander83 @ Jan 20 2021, 07:13 PM) Go between 18% 36% 18% 36% |

|

|

|

|

|

SUSxander83

|

Jan 20 2021, 08:33 PM Jan 20 2021, 08:33 PM

|

|

QUOTE(honsiong @ Jan 20 2021, 08:18 PM) Go between 18% 36% 18% 36% If 36% consistent maybe hit 100% easily  |

|

|

|

|

|

GrumpyNooby

|

Jan 20 2021, 08:34 PM Jan 20 2021, 08:34 PM

|

|

So DCA can guarantee to hit 100%? No wonder so many in here defended the beauty of DCA!  |

|

|

|

|

|

SUSxander83

|

Jan 20 2021, 08:36 PM Jan 20 2021, 08:36 PM

|

|

QUOTE(svchia78 @ Jan 20 2021, 08:11 PM) Does anyone feel that the stock market is getting too hot and too fast after a major crash like that back in March 2020? Or was March 2020 just a "correction"? Most are back to pre-Covid levels and still going up. Yes and correction is going happen soon albeit a minor this time Will be bumpy for those who can’t stand the ride hence if you worried just take profit on your profit and leave your base investments untouched and then wait till minor dips which likely to be early March to re enter the market  |

|

|

|

|

|

SUSxander83

|

Jan 20 2021, 08:41 PM Jan 20 2021, 08:41 PM

|

|

QUOTE(GrumpyNooby @ Jan 20 2021, 08:34 PM) So DCA can guarantee to hit 100%? No wonder so many in here defended the beauty of DCA!  If DCA small amounts of less than USD100 then the beauty will work well For those who DCA USD1000 will suffer due to FX conversion together with unit price purchase easily RM30 to RM50 subject FX rates Both strategy have its good and bad but overall DCA it is good for mass market for minor savings  |

|

|

|

|

|

honsiong

|

Jan 20 2021, 08:45 PM Jan 20 2021, 08:45 PM

|

|

QUOTE(GrumpyNooby @ Jan 20 2021, 08:34 PM) So DCA can guarantee to hit 100%? No wonder so many in here defended the beauty of DCA!  No guarantee, but you will blame yourself less for whatever happens. Takdir allah. |

|

|

|

|

|

Oklahoma

|

Jan 20 2021, 09:06 PM Jan 20 2021, 09:06 PM

|

|

Guys need your help.

What does SA means by time-weighted return / money weighted return?

Which of these 2 metrics calculate my annualized return? And if not, how do I see my annualized return? Im quite confused with how SA reports its return.

Because my time weighted and money weighted is currently at 30% and 28% atm. I think this is not annualized because its ridiculously high...

This post has been edited by Oklahoma: Jan 20 2021, 09:07 PM

|

|

|

|

|

|

honsiong

|

Jan 20 2021, 09:10 PM Jan 20 2021, 09:10 PM

|

|

QUOTE(Oklahoma @ Jan 20 2021, 09:06 PM) Guys need your help. What does SA means by time-weighted return / money weighted return? Which of these 2 metrics calculate my annualized return? And if not, how do I see my annualized return? Im quite confused with how SA reports its return. Because my time weighted and money weighted is currently at 30% and 28% atm. I think this is not annualized because its ridiculously high... They are high coz we did too well in 2020. |

|

|

|

|

|

GrumpyNooby

|

Jan 20 2021, 09:11 PM Jan 20 2021, 09:11 PM

|

|

QUOTE(honsiong @ Jan 20 2021, 09:10 PM) They are high coz we did too well in 2020. Too high till you're not able to fall asleep recently especially on Asian Tuesday right?  |

|

|

|

|

|

SUSxander83

|

Jan 20 2021, 09:12 PM Jan 20 2021, 09:12 PM

|

|

QUOTE(Oklahoma @ Jan 20 2021, 09:06 PM) Guys need your help. What does SA means by time-weighted return / money weighted return? Which of these 2 metrics calculate my annualized return? And if not, how do I see my annualized return? Im quite confused with how SA reports its return. Because my time weighted and money weighted is currently at 30% and 28% atm. I think this is not annualized because its ridiculously high... Under performance change the time to either 12 month or YTD to see the difference because currently is cumulative since day 1 deposit |

|

|

|

|

|

Oklahoma

|

Jan 20 2021, 09:14 PM Jan 20 2021, 09:14 PM

|

|

QUOTE(honsiong @ Jan 20 2021, 09:10 PM) They are high coz we did too well in 2020. still i dont believe its annualized? I deposited since Aug 2019. So its roughly 1.5 years. So meaning from the time I deposit (Aug 2019) until now, the return is 30%? The returns are unheard of! |

|

|

|

|

|

honsiong

|

Jan 20 2021, 09:18 PM Jan 20 2021, 09:18 PM

|

|

QUOTE(Oklahoma @ Jan 20 2021, 09:14 PM) still i dont believe its annualized? I deposited since Aug 2019. So its roughly 1.5 years. So meaning from the time I deposit (Aug 2019) until now, the return is 30%? The returns are unheard of! Been using it since 2017, StashAway returns spike after their updates, yea its pretty crazy. |

|

|

|

|

|

Oklahoma

|

Jan 20 2021, 09:20 PM Jan 20 2021, 09:20 PM

|

|

QUOTE(xander83 @ Jan 20 2021, 09:12 PM) Under performance change the time to either 12 month or YTD to see the difference because currently is cumulative since day 1 deposit I tried it, by changing view to YTD or 6 months; But the time-weighted and money-weighted doesn't change. It's still at 30%. How I wish SA has this feature to change the return based on the time period. This post has been edited by Oklahoma: Jan 20 2021, 09:21 PM |

|

|

|

|

Jan 20 2021, 03:34 PM

Jan 20 2021, 03:34 PM

Quote

Quote

0.0255sec

0.0255sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled