QUOTE(littlegamer @ Jan 7 2021, 11:32 AM)

Hi, recently I bump into fsmone(I'm a slow poke I know), I notice there do have similar etf and more can be bought there.

My question is how is the fee compare SA VS fsmone.

Given the advantage fsmone I'm free to choose even higher risk etf. I mainly now now have issue with gld. Personally I dislike gld as it is a form or currency hedge and not a way to grow.

GLD 20% it is for protection and insured against currency fluctuations due to USD and RM conversion hence it is a logical play by StashAway to protect your account

GLD was always and never has been use a hedge more for insured and protect against fluctuations and inflations in FX movements

If you worried just go try 30 and 36% then you will see the difference

QUOTE(1234kingbling @ Jan 7 2021, 06:59 PM)

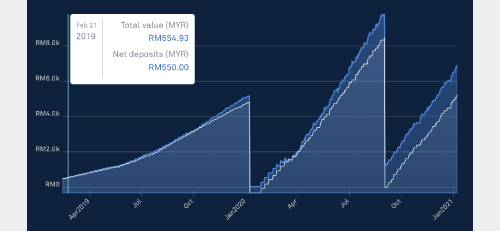

Hi there, im fairly new to SA and was wondering if RM1000 is enough to start a general investment portfolio with 30% risk? Since it converts to USD, not sure if the amount may be too little? Starting off small to get familiar with things before i add more capital. Thanks alot.

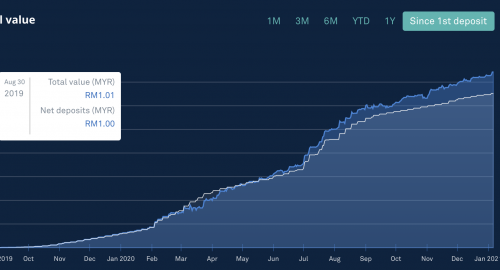

RM10 is the minimum but however it will eat up your cents because of USD rounding conversion

Try to start with RM500 and then go aggressively once you comfortable with it

Jan 6 2021, 02:33 PM

Jan 6 2021, 02:33 PM

Quote

Quote

0.0503sec

0.0503sec

0.87

0.87

6 queries

6 queries

GZIP Disabled

GZIP Disabled