Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

prophetjul

|

Jun 28 2021, 09:36 AM Jun 28 2021, 09:36 AM

|

|

QUOTE(Grammar Police @ Jun 28 2021, 12:23 AM) my cousin showed me his UK equivalent of stashaway ( only available for UK residents) the fees is 0.15% only stashaway fee quite high eh Eveything is chaeper in UK. Insurance, fees, etc. Malaysians are pigs for service slaughter. |

|

|

|

|

|

prophetjul

|

Jul 4 2021, 07:07 AM Jul 4 2021, 07:07 AM

|

|

QUOTE(xander83 @ Jul 3 2021, 09:00 PM) KWEB already 52 week low with a lot of funds waiting to buy in because when CCP FUD news out the buyers will swamped to buy in Don’t worry too much about KWEB because try buying CQQQ instead What is this?  BTW thanks for the education on the China ETFs.  |

|

|

|

|

|

prophetjul

|

Jul 6 2021, 09:24 PM Jul 6 2021, 09:24 PM

|

|

QUOTE(lee82gx @ Jul 6 2021, 08:54 PM) At least StashAway withdrawal works. I just withdrew 100% into cash a few weeks ago, in the high 5 figures. How long does it take from the withdrawal to your bank account ? |

|

|

|

|

|

prophetjul

|

Jul 6 2021, 10:04 PM Jul 6 2021, 10:04 PM

|

|

KWEB looks like a sick pup.

|

|

|

|

|

|

prophetjul

|

Jul 8 2021, 10:10 PM Jul 8 2021, 10:10 PM

|

|

KWEB will be on drip soon at the rate it's going.

|

|

|

|

|

|

prophetjul

|

Jul 9 2021, 09:22 AM Jul 9 2021, 09:22 AM

|

|

Down US$823 billion, China tech firm selloff may be far from over

(July 7): China’s technology giants have seen a combined US$823 billion wiped from their market value since a February peak, with Beijing’s expanding crackdown on the sector fueling investor concern that the selloff is far from over.

Authorities on Tuesday issued a sweeping warning to the nation’s biggest companies, vowing to tighten oversight of data security and overseas listings just days after Didi Global Inc’s contentious decision to go public in the US. That has put further selling pressure on China’s biggest technology names including Tencent Holdings Ltd, Alibaba Group Holding Ltd, JD.Com Inc, Baidu Inc and Meituan.

“The selling will continue in the third quarter,” said Paul Pong, managing director at Pegasus Fund Managers Ltd. He says he sold two thirds of his technology stock holdings, including in Tencent and Alibaba, in May. “The measures from authorities will keep coming.”

The losses have come from 10 firms including three US-listed names. Didi’s ADRs fell 20% stateside on Tuesday, erasing about US$15 billion of its market value.

The Hang Seng Tech Index, whose members include many of China’s biggest tech companies, fell as much as 1.9% before paring losses to 0.6% Wednesday, marking its sixth consecutive day of declines.

Tencent slid 1.9%, among the biggest decliner on the Hang Seng Index. Alibaba dropped 1.7%, while Meituan fell 1.3%.

China’s sweeping warning Tuesday followed the opening of a security review by the nation’s internet regulator last week into Didi and a demand for app stores to remove it. The move stunned investors and industry executives and has hammered the Hong Kong shares of peers such as Tencent — one of Didi’s largest backers.

Investors worry that the latest security-based probes have opened a new front in President Xi Jinping’s broader campaign against China’s internet giants that began in November with the collapse of Ant Group Co’s mega IPO and subsequent antitrust investigations into Alibaba and Meituan.

Over the weekend, China moved against two other companies that also recently listed in New York — Full Truck Alliance Co and Kanzhun Ltd

Investors are likely to take “a sell first, talk later approach” to limit policy risks in their portfolio, said Justin Tang, the head of Asian research at United First Partners in Singapore. Stock prices are likely to be driven by near-term sentiment swings as opposed to company fundamentals, Jian Shi

Cortesi, a Zurich-based fund manager at GAM Investment Management, wrote in an email.

To be sure, valuations may start to look attractive. Tencent, Alibaba and Baidu Inc — among the earliest Chinese tech companies to enter public markets and the biggest, trade at an average of 22 times forecasted earnings over the next 12 months. That compares with the 10-year average of 26 times, according to data compiled by Bloomberg.

“In case the market sentiment goes into extreme pessimism and we see the Hang Seng Tech Index down 20% from here, it could be a rare opportunity to buy some fast-growing Chinese internet companies at extremely attractive prices,” GAM’s Jian Shi said.

The Hang Seng Tech Index is down 31% from its February high. Investors in mainland China, who accounted for about a third of turnover in Tencent shares this year, turned net sellers of the stock in June.

“While the long-term future of Chinese tech remains, it will be caveat emptor for investors in the near term,” said United First’s Tang.

|

|

|

|

|

|

prophetjul

|

Jul 10 2021, 08:10 AM Jul 10 2021, 08:10 AM

|

|

Time to share:

i started investing through SA end FEb

To date in USD terms, returns is only TWR 3% and MWR 1.13%

This basically shows that in the last 5 months, the performance of SA 20% is almost 0.

The returns in MYR is wholely on the strengthening of the USD.

End.

|

|

|

|

|

|

prophetjul

|

Jul 10 2021, 09:00 AM Jul 10 2021, 09:00 AM

|

|

QUOTE(Kadaj @ Jul 10 2021, 08:41 AM)  If you invested IVV directly you already have gained 14.57% instead.  SA is not perfect. Especially when SA very insisted to invest in China, yet losing your money and you can't stop it when you seeing the ship started sinking very earlier few months ago. It's like the Titanic. My worry is the market is looking very toppish. Techincally, there seems to be a top here. Yes, This is timing the market.  |

|

|

|

|

|

prophetjul

|

Jul 10 2021, 10:00 AM Jul 10 2021, 10:00 AM

|

|

QUOTE(zstan @ Jul 10 2021, 09:52 AM) i started a new 10% account in mid February 2021 and my TWR is 3.18%, MWR +4.11% USD or MYR ? |

|

|

|

|

|

prophetjul

|

Jul 10 2021, 10:18 AM Jul 10 2021, 10:18 AM

|

|

QUOTE(owum @ Jul 10 2021, 10:17 AM) I started SA 26% in mid April'21 To date in GPB, returns is TWR 3.75% and MWR 3.17% saw higher returns when gold price rises In Sterling Pounds? Didn't realise SA is in GBP? |

|

|

|

|

|

prophetjul

|

Jul 10 2021, 01:26 PM Jul 10 2021, 01:26 PM

|

|

QUOTE(ironman16 @ Jul 10 2021, 11:56 AM) some ppl will get GBP instead of USD......may USD is high risk compare to GBP....  i did not realise SA is also denominated in GBP? i can only see USD in mine? |

|

|

|

|

|

prophetjul

|

Jul 10 2021, 02:50 PM Jul 10 2021, 02:50 PM

|

|

QUOTE(ironman16 @ Jul 10 2021, 01:52 PM) its depend on ur what they call>>> ringgit borrow ??????.............i forgot the name oledi.........i only know is ur comitment/loan/......  Don't understand this.  They don't ask about loan commitment. How would they know? |

|

|

|

|

|

prophetjul

|

Jul 10 2021, 02:54 PM Jul 10 2021, 02:54 PM

|

|

QUOTE(tehoice @ Jul 10 2021, 02:52 PM) you declared when you register for the account. Cannot remember this.  Thanks |

|

|

|

|

|

prophetjul

|

Jul 10 2021, 03:24 PM Jul 10 2021, 03:24 PM

|

|

QUOTE(ironman16 @ Jul 10 2021, 03:21 PM) Thanks, always forget the full sentence. They said is domestic ringgit borrow.... U try Google it, then u will understand. During u register accounts, stashaway ask u loan/house/dependent /........ Normally commitments high, u get GBP, low risk a bit. Else, u will get USD. Once acc approve n invest, can't change Bcoz etf is different. I do not think i was ever asked this question on my loan commitments.  |

|

|

|

|

|

prophetjul

|

Jul 13 2021, 09:17 AM Jul 13 2021, 09:17 AM

|

|

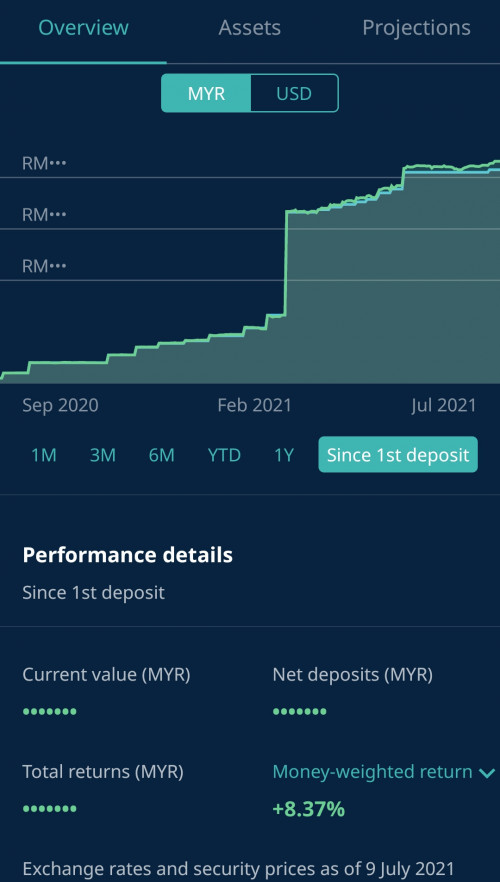

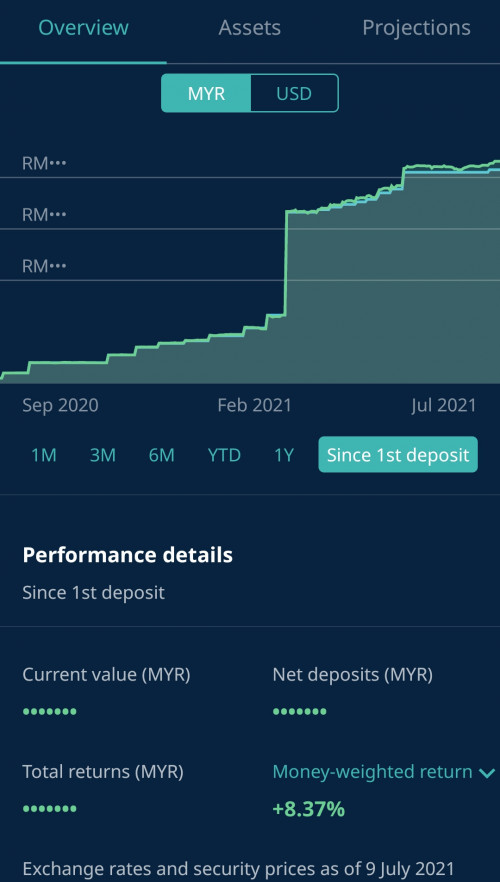

QUOTE(DragonReine @ Jul 12 2021, 11:20 AM) » Click to show Spoiler - click again to hide... « » Click to show Spoiler - click again to hide... « I agree with you 😂 especially on looking at the big picture and trusting in the growth of Chinese/Asian technology. I would like to clarify that the reason I bring up EPF is due to the "locked up" nature of EPF where majority of it cannot be withdrawn before age 55, which is a big "negative" for people who want money for luxuries and/or those who are into FIRE movement, or those where liquidity is much more important to them. Risk Free? Yes. Liquid? Not at all. And the unfortunate fact is that majority of local mutual funds offerings (the dubiously closest equivalent to SAMY available to ikan bilis investors without needing to open foreign account or deal with foreign brokers) actually do not perform as well as EPF in terms of annualised return. IMO that's the trade-off of a diversified portfolio that's liquid. I would also like to remind newbies reading this that if you started StashAway and/or investing from 2020, it's only been a year (and a very rollercoaster one at that), which is not the best time or place economy-wise to gauge the performance of an investment. Give it another couple of years before you can judge if it matches your expectations, at the same remember to be realistic. Speaking of investing since last year, here's the current results of my "medium term" portfolio since 1st opening in September 2020, for y'all to judge  Started from 12% SRI then bumped up to 16% right around the big deposit spike in February 2021 (which is not exactly great timing, but I'm more of a lump sum type than DCA). For additional reference, TWR is +5.63%   What made you pump in a big lump sum in FEb 2021? |

|

|

|

|

|

prophetjul

|

Jul 14 2021, 09:11 AM Jul 14 2021, 09:11 AM

|

|

QUOTE(timeekit @ Jul 14 2021, 08:11 AM) Anyone facing delay in funds deposit? Deposited on 9 July but till today haven't even initiated currency conversion. Kinda unusual as usually it will initiate within 1 working day.. This does not sound good. Is this a RED FLAG? |

|

|

|

|

|

prophetjul

|

Aug 9 2021, 10:12 AM Aug 9 2021, 10:12 AM

|

|

GLD down $70 in the last 2 trading days.

|

|

|

|

|

|

prophetjul

|

Aug 9 2021, 10:24 AM Aug 9 2021, 10:24 AM

|

|

QUOTE(yklooi @ Aug 9 2021, 10:17 AM) From Yr abt 20 yrs experience in gold investing, what is Yr forecast of its directions for the next 1 month? i have no short term forecast.  In the longer term, we may see the same thing happen as in 08/09 to 2011 with incessant QE. Gold has always been a hedge. Let's see. |

|

|

|

|

|

prophetjul

|

Aug 9 2021, 03:02 PM Aug 9 2021, 03:02 PM

|

|

QUOTE(zstan @ Aug 9 2021, 02:34 PM) you haven't see crash $100-200 before ah Have you?  In context, it corrected from $980 to $680 in 2008. But $100 to $200 in a $1800 gold may not be a bad thing. This post has been edited by prophetjul: Aug 9 2021, 03:04 PM |

|

|

|

|

|

prophetjul

|

Aug 19 2021, 09:37 AM Aug 19 2021, 09:37 AM

|

|

Since starting in March 2021 on 20% SA, my portfolio has finally gone into the red zone.

Looks like even the gains in Forex cannot cover the loss from the equities at this time.

|

|

|

|

|

Jun 28 2021, 09:36 AM

Jun 28 2021, 09:36 AM

Quote

Quote

0.6063sec

0.6063sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled