QUOTE(zon911 @ Jun 26 2023, 01:06 PM)

https://www.kwsp.gov.my/employer/contributi...-responsibilityEPF - self contribution, need advise

EPF - self contribution, need advise

|

|

Jun 26 2023, 01:23 PM Jun 26 2023, 01:23 PM

Return to original view | Post

#21

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

|

|

|

Jun 28 2023, 10:00 AM Jun 28 2023, 10:00 AM

Return to original view | Post

#22

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(cute_boboi @ Jun 27 2023, 01:02 PM) Self contribute on Sunday night via Maybank desktop web. Self contribute on Monday morning via PBB desktop web.Monday no update in EPF Tuesday morning amount already reflected in EPF. Tuesday no update in EPF Wednesday morning amount already reflected in EPF. romuluz777 and nexona88 liked this post

|

|

|

Jun 28 2023, 01:08 PM Jun 28 2023, 01:08 PM

Return to original view | Post

#23

|

Senior Member

3,833 posts Joined: Oct 2011 |

harmonics3 liked this post

|

|

|

Jul 6 2023, 10:30 AM Jul 6 2023, 10:30 AM

Return to original view | Post

#24

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(tropik @ Jul 6 2023, 10:23 AM) If clicked on Add Contribution, keyed in the amount, selected the bank and met with FPX page not available, is this because a process has not been completed? I tried and select maybank fpx just now, it can reach the m2u page with no problem. Happened to my own account and elder's. Maybe try with another bank? |

|

|

Jul 7 2023, 11:12 AM Jul 7 2023, 11:12 AM

Return to original view | Post

#25

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(romuluz777 @ Jul 6 2023, 11:46 PM) The monthly drawdown, explained EPF, was where a portion of the member’s savings, up to a certain limit, will be converted into a monthly income and the remaining portion can be withdrawn lump-sum, is needed to prevent old-age poverty and for consumption smoothing during retirement. I think that they should also set an age limit, for example only for those 55-75 y/o. I mean if already reach 75 y/o, just allow them to withdraw all la. |

|

|

Jul 7 2023, 12:22 PM Jul 7 2023, 12:22 PM

Return to original view | Post

#26

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

|

|

|

Jul 11 2023, 09:30 PM Jul 11 2023, 09:30 PM

Return to original view | IPv6 | Post

#27

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(batman1172 @ Jul 11 2023, 08:30 PM) existing members will be able to transfer their savings from Accounts 1 and 2 to Account 3 and be able to make unconditional withdrawals QUOTE(nexona88 @ Jul 11 2023, 08:32 PM) QUOTE(Wedchar2912 @ Jul 11 2023, 08:40 PM) hear first... its really unbelievable.... truly surprising... He didn't copy the next paragraph in the article: same dividend rate but more flexibility? really got frog jumping around on the street? "As Account 3 would serve act as an emergency fund, Nurhisham said it will probably offer a lower dividend compared to the other two accounts." This post has been edited by poweredbydiscuz: Jul 11 2023, 09:32 PM nexona88 and Wedchar2912 liked this post

|

|

|

Jul 12 2023, 07:37 AM Jul 12 2023, 07:37 AM

Return to original view | IPv6 | Post

#28

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(nexona88 @ Jul 11 2023, 09:40 PM) Ahhhh... If the dividend is similar/higher than FD then it's good for some of us. Self contribute then move to account 3 to earn interest and can withdraw anytime. Also can claim tax relief (if still available that time).Lower dividend payout... But next question.... How lower compared with the existing 2 account? 😁 Those with low self control, then gg when retirement. Wedchar2912 liked this post

|

|

|

Sep 26 2023, 04:17 PM Sep 26 2023, 04:17 PM

Return to original view | Post

#29

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

Sep 26 2023, 04:46 PM Sep 26 2023, 04:46 PM

Return to original view | Post

#30

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

Sep 26 2023, 04:53 PM Sep 26 2023, 04:53 PM

Return to original view | Post

#31

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

Sep 29 2023, 11:18 AM Sep 29 2023, 11:18 AM

Return to original view | Post

#32

|

Senior Member

3,833 posts Joined: Oct 2011 |

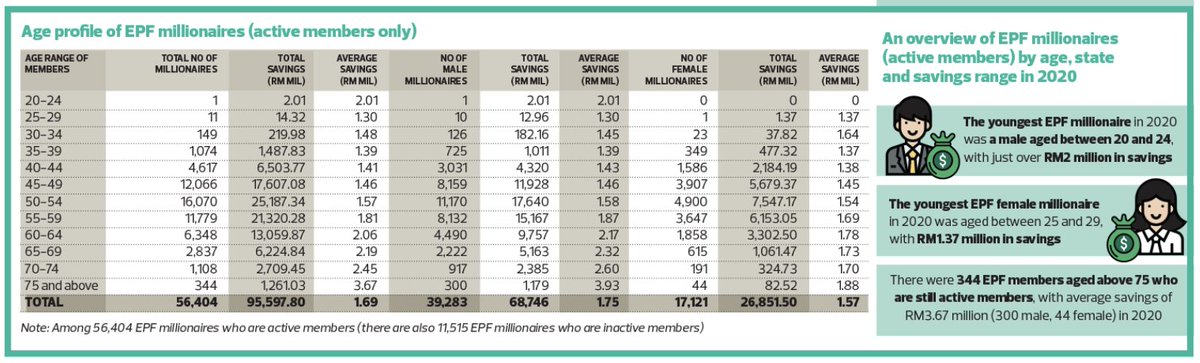

QUOTE(ronnie @ Sep 29 2023, 10:50 AM) Got a EPF member age 20-24y/o with saving of RM2.01m (as at dec 2020). His annual contributions must be high af. https://wargabiz.com.my/2023/03/01/did-you-...ale-aged-20-24/  |

|

|

Oct 18 2023, 10:56 AM Oct 18 2023, 10:56 AM

Return to original view | Post

#33

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(batman1172 @ Oct 18 2023, 10:54 AM) I got a stupid question. Yes, whole month of november + 1 day in october.If I put in 100k max contribution now (18.10.2023) and I take out 100k in 1.12.2023, will there be dividends due for november on the 100k invested? nexona88, batman1172, and 1 other liked this post

|

|

|

|

|

|

Oct 19 2023, 08:35 AM Oct 19 2023, 08:35 AM

Return to original view | Post

#34

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(TOS @ Oct 19 2023, 07:32 AM) If anyone received, you will see them post here. TOS liked this post

|

|

|

Oct 25 2023, 08:10 AM Oct 25 2023, 08:10 AM

Return to original view | Post

#35

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

Nov 23 2023, 07:38 AM Nov 23 2023, 07:38 AM

Return to original view | Post

#36

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(potatobanana @ Nov 23 2023, 12:09 AM) Hey Sifu, Would just like to confirm, 'Self-contribution' and 'i-Sarran' are two different things? Self-contribution is for all members below age of 75. i-Saraan is only for self-employed/no fixed income/gig workers below age of 60. Let's say my friend interested to put into self-contribution; Is it just another account that follows the annual EPF return rate? It will be divided 70:30 into the existing acc1 and acc2, so it has the same dividend rate. If my friend is an employee and age 58, will he be able to self-contribute? Yes. Just require some clarification since I saw some saying it is only eligible for non-employee and self-contribution is related to unit trust instead of EPF return rate. potatobanana liked this post

|

|

|

Nov 23 2023, 10:55 AM Nov 23 2023, 10:55 AM

Return to original view | Post

#37

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(killeralta @ Nov 23 2023, 10:47 AM) HI, wanted to ask you all my mom just receive a letter from EPF stating that she can no longer deposit any money into EPF account after the age of 75, and as such should stop contributing into it immediately. I thought EPF can top up until 100 years old? Self contribution only until 75. Dividend will be given until 100. |

|

|

Nov 27 2023, 12:00 PM Nov 27 2023, 12:00 PM

Return to original view | Post

#38

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(cpk @ Nov 27 2023, 11:22 AM) The monthly mandatory contribution has no limit (employer pay 13%, you pay 11% (deduct from salary)). Other than the above, you sendiri self top-up (self-contribution) is limited to 100k per year. |

|

|

Nov 30 2023, 08:17 PM Nov 30 2023, 08:17 PM

Return to original view | IPv6 | Post

#39

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

Dec 4 2023, 03:00 PM Dec 4 2023, 03:00 PM

Return to original view | Post

#40

|

Senior Member

3,833 posts Joined: Oct 2011 |

QUOTE(!@#$%^ @ Dec 4 2023, 02:40 PM) not really. for those who dun need it in the first place, why need to be troubled by paperwork to opt out? Last time MCO period EPF reduces employee contribution from 11% to 8% (or 7%?), everyone also kena doesn't matter you like it or not, unless you apply to opt out. |

| Change to: |  0.0250sec 0.0250sec

0.41 0.41

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 08:24 AM |